- Ethereum regained a bullish structure but the downtrend was still in play.

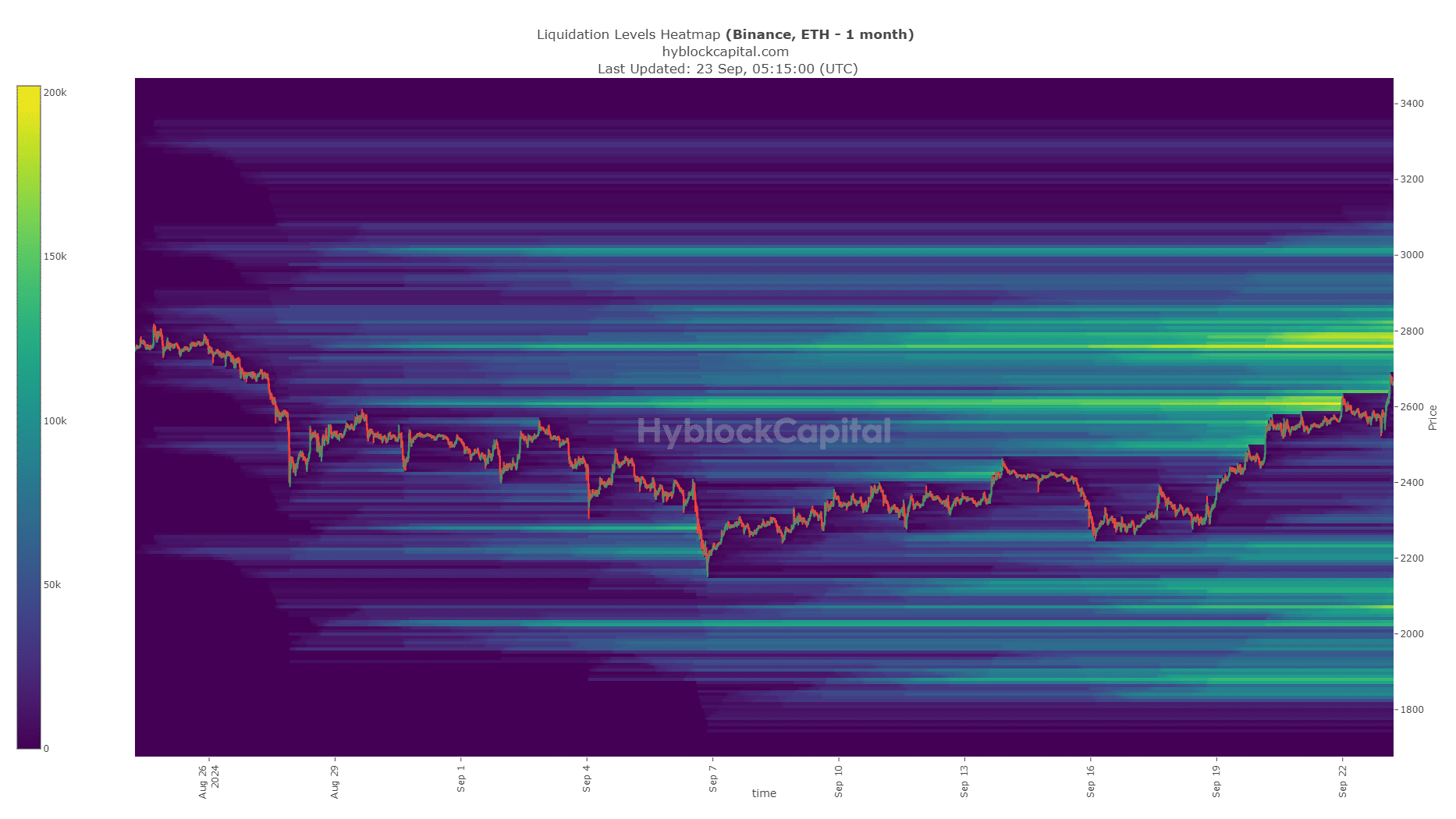

- The former support zone at $2.9k could be the next price target.

As a seasoned analyst with years of experience under my belt, I can confidently say that Ethereum [ETH] is gearing up for a potential move towards its next price target – the former support zone at $2.9k. The bullish structure is evident, but the downtrend from June remains in play.

Ethereum (ETH) hasn’t kept pace with Bitcoin (BTC)’s performance so far, but this trend might be about to change based on recent market trends, which suggest a potential turning point for ETH/BTC. Looking ahead against the US dollar, Ethereum is predicted to show significant growth in the near future.

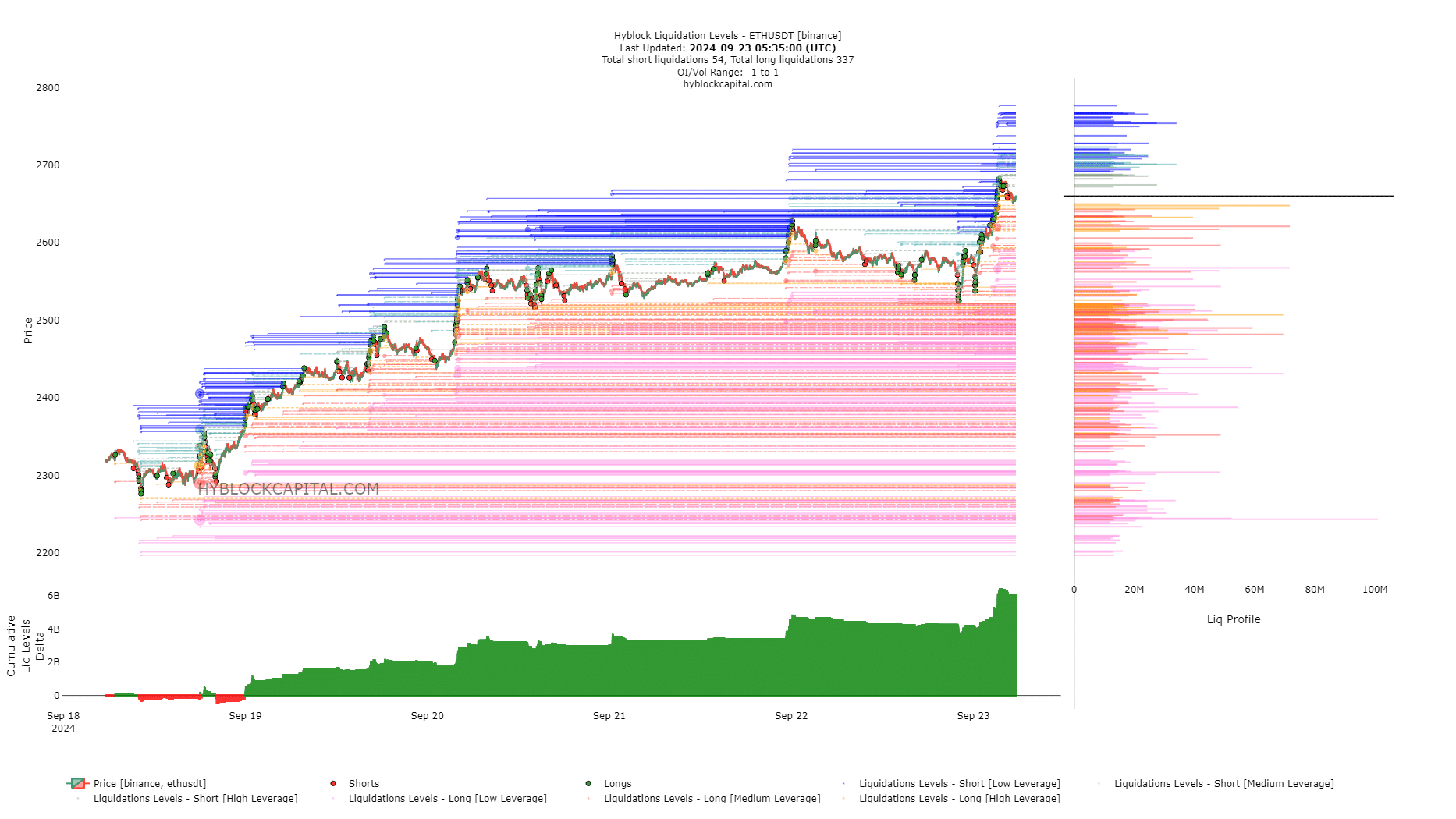

As a researcher, I’ve noticed some hints suggesting a potential 5% upward movement might occur based on the liquidation levels and price action charts I’ve been analyzing. However, should we see any advancements surpassing this threshold, it would require significant buyer intervention to maintain such growth.

Ethereum approaches a local high and pivotal resistance zone

On a day-to-day basis, the market trend appeared optimistic as the price surpassed the latest lowest peak at $2,464. Furthermore, the Relative Strength Index (RSI) was above 50, suggesting that the momentum had shifted from negative to positive.

Yet, it’s essential to clarify that just because there have been some positive price movements, it doesn’t automatically mean the trend is bullish. Instead, the trend has been bearish since June, following an unsuccessful recovery in May. The On-Balance Volume (OBV) aligns with this observation and has been declining since March, indicating weak buying pressure for the majority of that period.

At the $2.8k level, there existed an area of significant selling pressure, known as a bearish order block. Since the middle of August, this region has shown a reversal in market trend, becoming a robust area of supply due to its high point, thus indicating a strong resistance level.

It’s quite possible that Ethereum will reach this resistance level, however, whether it breaks out from there hinges on overall market mood and significant news events.

Another piece of evidence for the $2,800 target

In simpler terms, there’s a significant concentration of selling points, or “liquidation levels,” around the $2.8k area, making it an important focus for short-term traders. This week, it’s anticipated that Ethereum will pass through this region before potentially reversing its trend.

Anticipation arises as the $2.8k-$3k range has served as a crucial support or resistance point since April. This area could be densely populated with sellers, yet if Bitcoin keeps surging, the buying forces might prevail over them.

For the immediate future, significant opportunities existed for taking advantage of strong positions at approximately $2,647 and $2,621, potentially benefiting from increased market activity or a rush to buy.

Read Ethereum’s [ETH] Price Prediction 2024-25

The positive cumulative liq levels delta suggested a near-term price retracement was possible.

Over the coming days, it’s anticipated that Ethereum will experience a positive trend. It seems probable that we might see Ethereum reaching between $2,800 and $2,900. The potential for further growth will hinge upon market conditions and the robustness of buyers, which can be gauged through trading volume.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-23 20:07