- Ethereum traders trapped in longs as market declines.

- Ethereum shows strength in revenue and TVL dominance.

As a seasoned crypto investor with a decade of experience navigating the volatile waters of this exciting industry, I find myself standing at the crossroads of optimism and caution when it comes to Ethereum [ETH]. On one hand, I’m heartened by its resilience in generating impressive revenue and maintaining TVL dominance over competitors. On the other, the bearish signals from price action and the recent selling pressure exerted by early whales and institutional investors give me pause.

As we approach the final months of the year, it’s clear that Ethereum (ETH) remains a significant player within the crypto market. Various crucial elements are anticipated to shape its price fluctuations during this period.

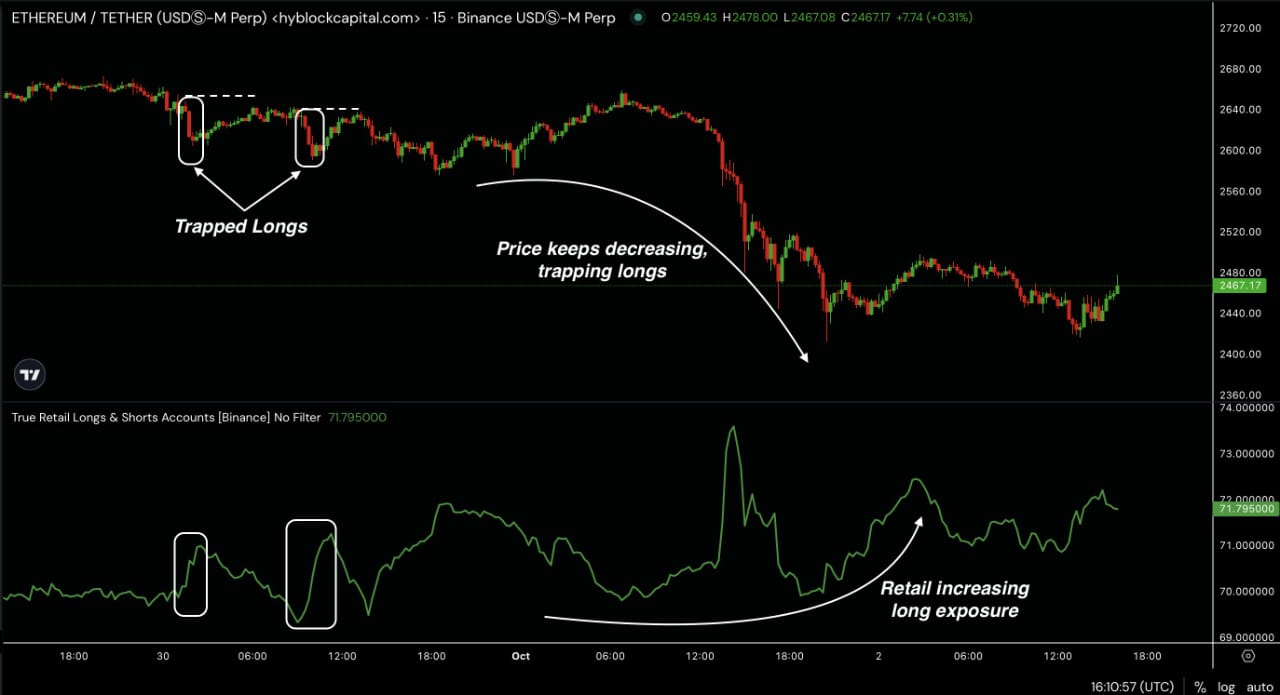

By late September, individual investors started to invest more heavily in Ethereum, aiming to profit from temporary price drops. Unfortunately, this move resulted in several of them finding themselves stuck in unprofitable trades as the value of ETH kept falling.

As recurring trends emerge, investors find themselves wary as they ponder if Ethereum’s price might keep dropping in the remaining months of the year.

ETH price action signals bearishness

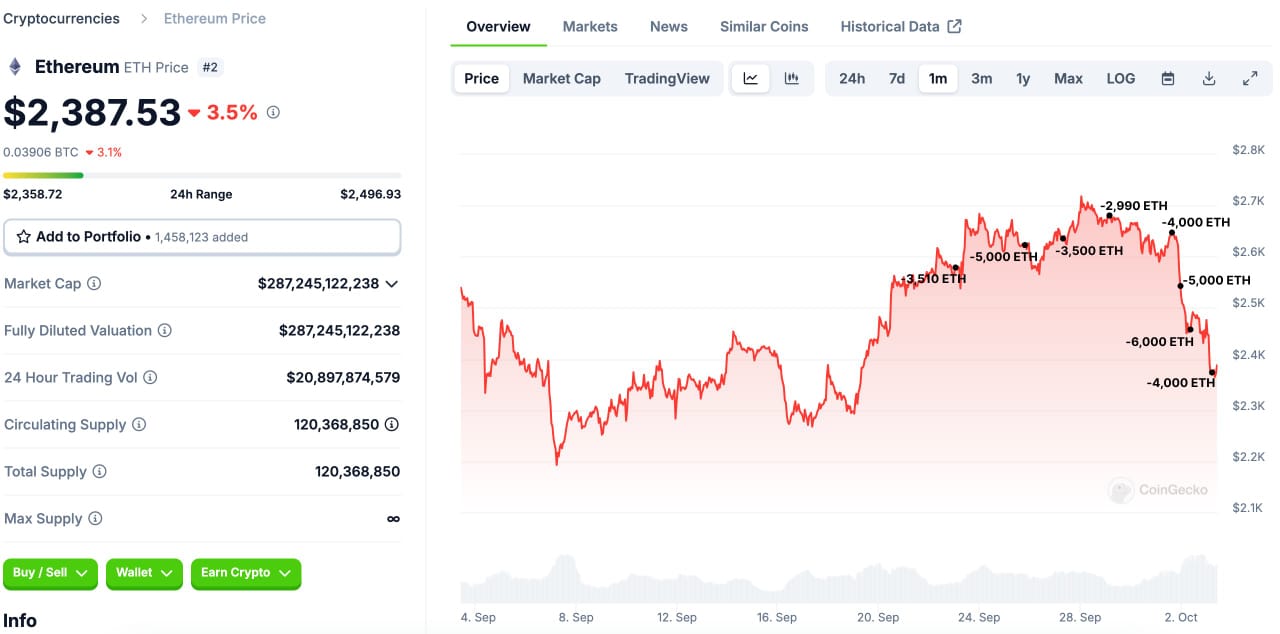

Based on Ethereum’s current price trend, it appears that the ETH/USD pair might continue to drop. On the daily chart, Ethereum is trading under all three of its Exponential Moving Averages (150, 50, and 20), suggesting a downward market movement or a bearish outlook.

The S&P 500 (SPX) index, dropping beneath its 150-day moving average (EMA), provides additional evidence supporting the pessimistic viewpoint.

Furthermore, the volume bars imply that sellers are dominating, suggesting a potential continuation of Ethereum’s downward trend, which might dishearten traders expecting a rise.

Impact of ICOs and Grayscale on ETH

The data recorded on the blockchain supports a pessimistic outlook, particularly with regards to Initial Coin Offerings (ICOs) and Grayscale’s transactions. Notably, a substantial investor in Ethereum ICOs has recently disposed of 19,000 ETH, valued at approximately $47.54 million.

At first, this contributor obtained 150,000 Ether (ETH) during the Initial Coin Offering (ICO), priced at around $46,500 per token. Currently, it is worth an astounding $358 million.

It’s worth noting that as early investors (or ‘whales’) of Ethereum start to sell their assets, this action tends to put a greater emphasis on reducing prices, given that Ethereum has generally shown a bearish trend throughout the final three months of the year following a bullish September.

Additionally, it’s been reported by Onchain Lens that two inactive Grayscale Ethereum Trust (ETF) wallets transferred approximately 5,837 Ether, equivalent to around $14.17 million, into Coinbase.

These wallets had previously held 23026 ETH, purchased at an average price of $1,593 a year ago.

The transfer of these funds, along with the wallets containing 17,189 ETH, seems to suggest that major investors are taking action which may influence the value of Ethereum.

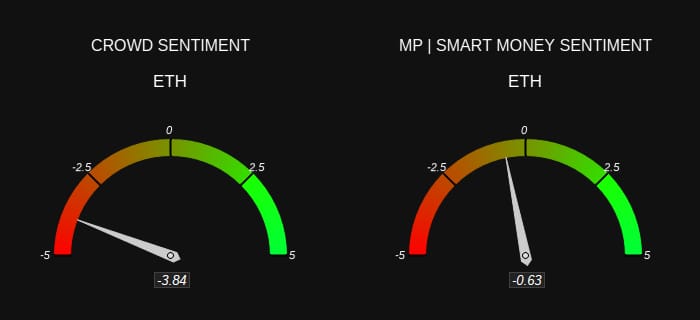

Sentiment among traders

It appears that both individual and institutional investors have developed a pessimistic outlook towards Ethereum’s value. This change in sentiment seems to be prompted by recent geopolitical occurrences, which have led to a decline in the overall cryptocurrency market.

Consequently, it’s anticipated that Ethereum (ETH) may encounter increased selling activity, potentially causing its price to drop even more during the last three months of the year.

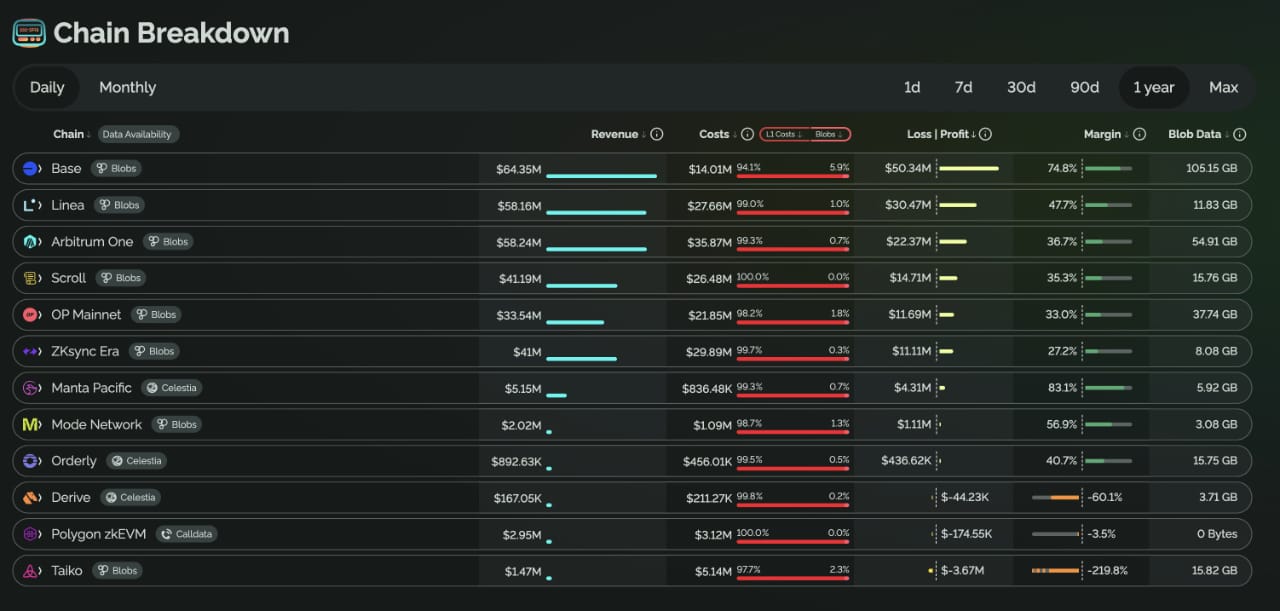

Ethereum’s revenue strength and TVL dominance

Even though Ethereum appears pessimistic in some aspects, it has demonstrated robustness in various sectors. Notably, the platform has raked in more than $140 million in total profits across nine distinct chains during the last year.

In essence, Ethereum – a network of interconnected economies using Ether (ETH) as their currency – continues to be seen as a thriving “land of opportunities.” Over time, this dynamic landscape might potentially counteract any prevailing downward tendencies.

Additionally, it’s worth noting that Ethereum maintains a significant lead in terms of Total Value Locked (TVL) compared to other Layer 1 blockchains. Its market capitalization of $48.7 billion significantly outweighs its competitors such as Solana ($5.4 billion) and Sui ($984 million).

The strong control over Total Value Locked (TVL) demonstrates that Ethereum remains at the forefront of the market, even amidst bearish trends and competition from emerging blockchain platforms.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although Ethereum seems pessimistic in the immediate future due to negative market sentiments, its robust foundations and dominant market standing could potentially lead to a recovery in the long term.

However, traders should remain cautious as market dynamics continue to evolve.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-03 17:44