-

Ethereum faces headwinds after a bearish breakout below the 5-month rectangle pattern.

ETH has held onto the crucial support at $2,611, but the short-term sentiment remained bearish.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I find myself cautiously eyeing Ethereum (ETH) after its recent bearish breakout below the five-month rectangle pattern. The positive CPI data turned out to be a sell-the-news event, causing most cryptos to dive, including ETH.

On August 14th, the favorable U.S. Consumer Price Index (CPI) report led to a “sell the news” situation, resulting in most cryptocurrencies trading at lower values.

Over the past 24 hours, the leading altcoin, Ethereum (ETH), has decreased by 4%, currently trading at $2,622 as this text is being written.

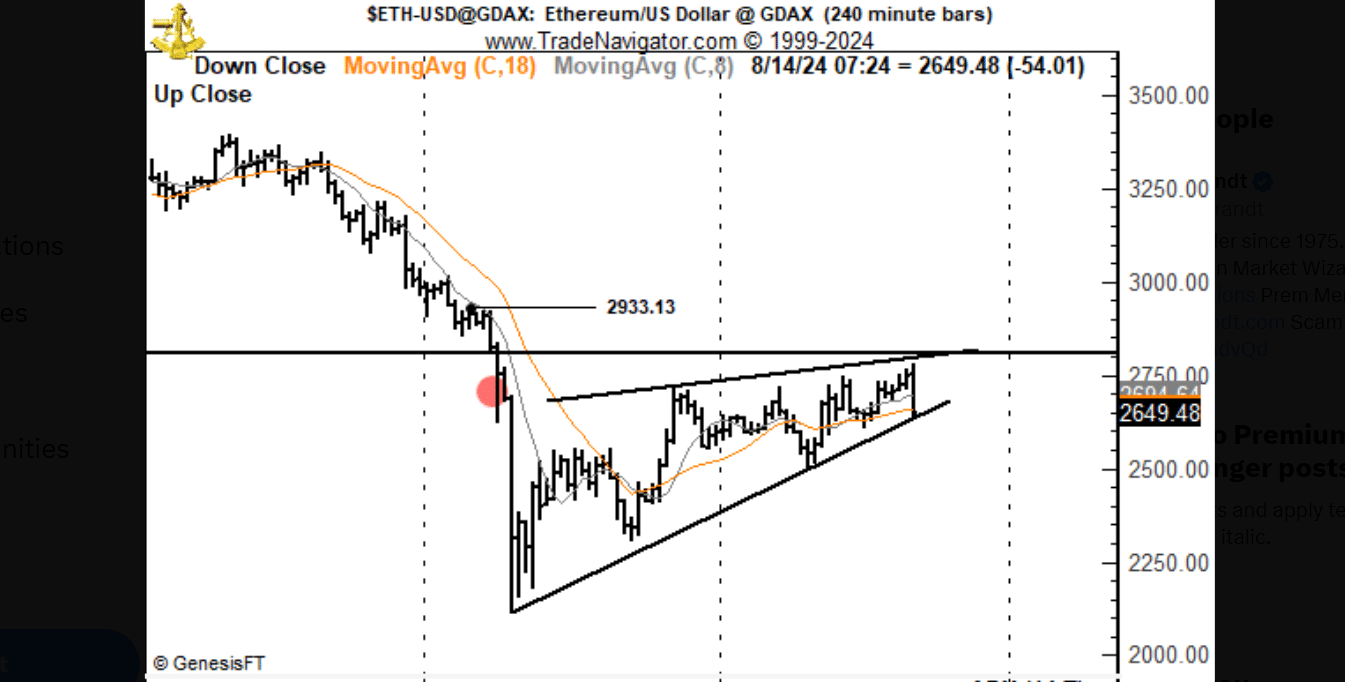

According to analyst Peter Brandt, Ethereum (ETH) might face more challenges ahead following its completion of a five-month chart formation known as a rectangle pattern on the 4th of August.

Over the past five months, I’ve observed Ethereum (ETH) trading within a relatively narrow range. However, a recent bearish trend has resulted in ETH forming a significant resistance level at approximately $2,933.

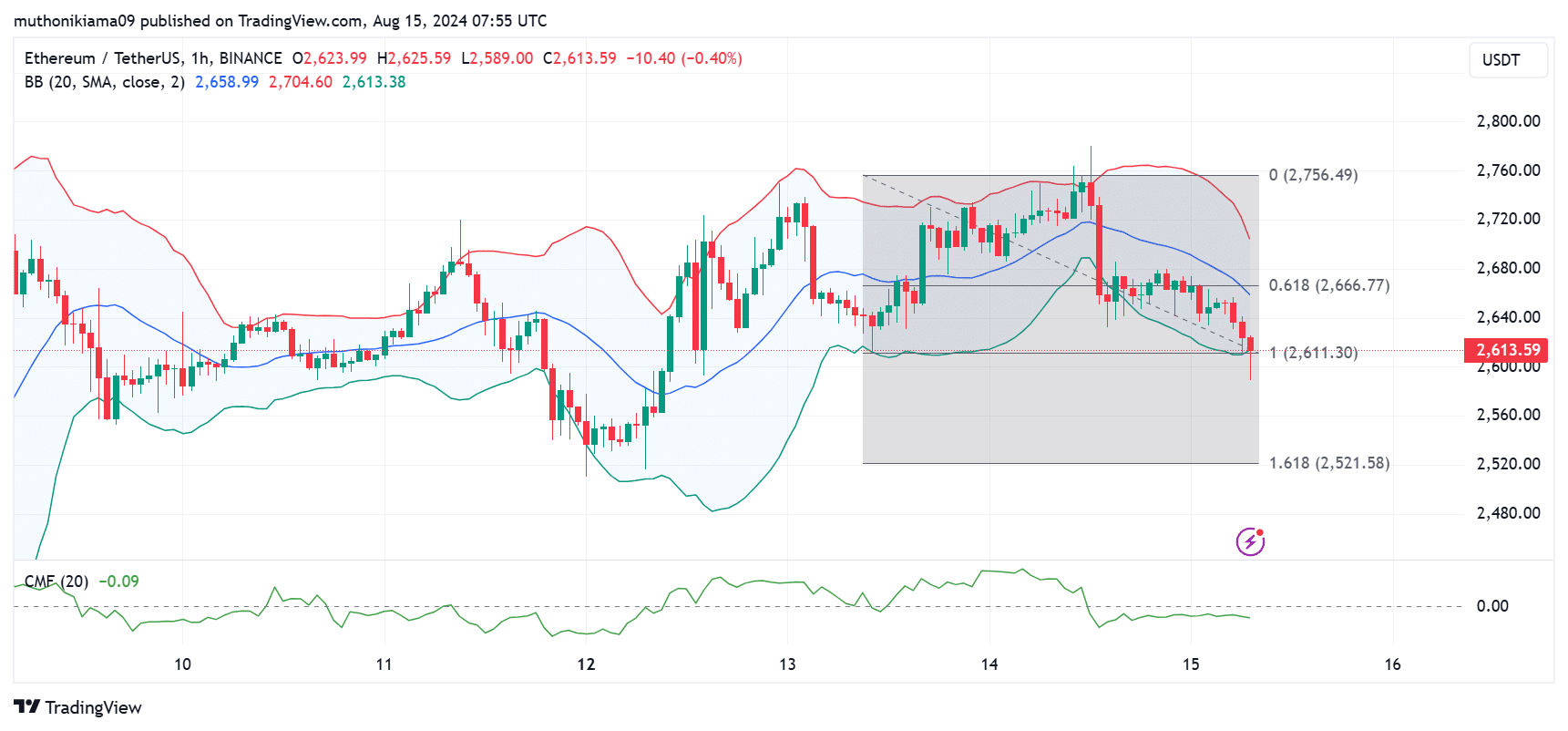

As a researcher, I observed on the 14th of August that ETH made an attempt to surmount the resistance it faced, yet fell short. Furthermore, the ascending wedge formation evident in the intraday chart hinted at waning momentum and suggested a possible bearish reversal might be imminent.

Using these pessimistic signals, Brandt forecasted a fall towards $1,652. This analyst then established a short trade aiming for this decline. It’s worth noting that his bearish hypothesis would be disproved if ETH manages to surpass $2,961.

Big drop ahead for Ethereum?

Based on the analysis of technical indicators, there seems to be a temporary bearish outlook for Ethereum. Specifically, the Chaikin Money Flow (CMF) stands at -0.09, suggesting that sellers are currently exerting more influence in the market than buyers.

The Constant Market Fund (CMF) has stayed constant, indicating a diminished level of faith in Ethereum among investors and a hesitancy on their part to create fresh buying opportunities.

Over the last day, the Bollinger bands, which indicate market volatility, have expanded significantly, suggesting an increase in volatility as the market trends downward. The price has fallen from the upper band to the lower band within this timeframe, implying a strong bearish reversal with a sharp downturn.

In simpler terms, if Ethereum doesn’t maintain its current position at around $2,611, there’s a possibility it could fall to approximately $2,521, which is a key Fibonacci support level.

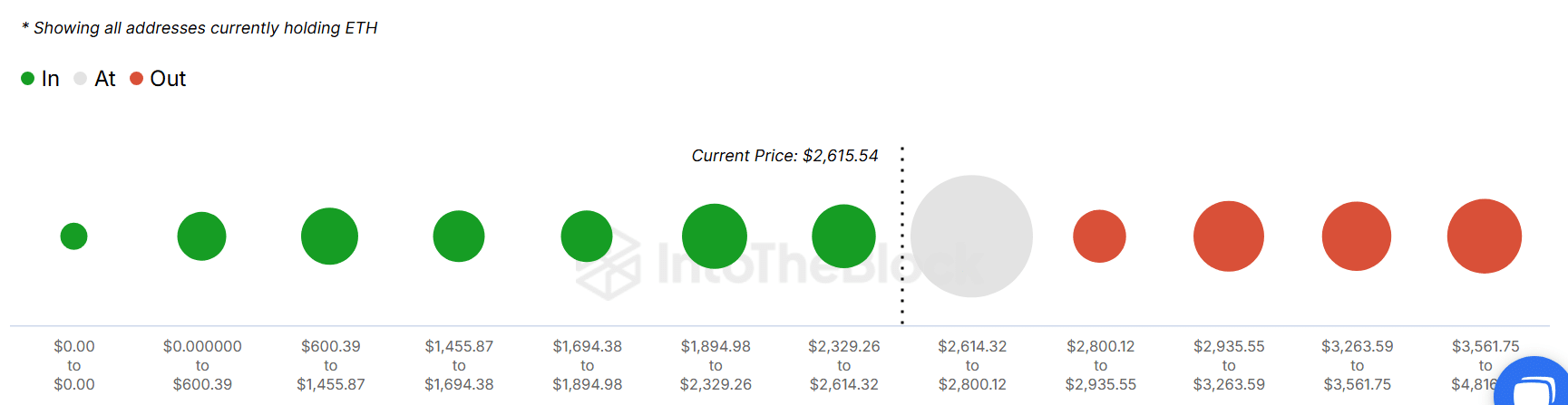

Significant levels were found between $2,614 and $2,800, as a substantial number of buyers who purchased at these prices were “Breaking Even” at the current moment.

If the price falls, it could lead to increased selling as traders look to limit their potential losses, adding more pressure on the market to drop further.

Examining the Futures market more closely, it appeared that many traders were wagering on Ethereum’s decline rather than its growth. At the current moment, the Long/Short Ratio stood at 0.90, implying a higher number of traders were opting for short positions over long ones.

A 3% decrease in Open Interest (OI) suggests that Ethereum’s futures traders might not be as optimistic regarding its price.

According to Coinglass data, the Open Interest (OI) has consistently decreased from approximately $14 billion at the start of the month down to its current level of around $10 billion.

Read More

2024-08-15 22:20