- If Ethereum continues to mimic the S&P 500, it could triple its value.

- Short interest persisted but the potential for ETH to rally remained evident.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed many bull runs and bear markets, and Ethereum’s current trajectory is reminiscent of some of the most promising cycles I’ve seen. If we consider ETH’s mirroring of the S&P 500 as a reliable indicator, we could be in for an exciting ride.

Ethereum (ETH) has shown similar price fluctuations to the S&P 500 index, sparking speculation that its value could significantly increase in the future. The close correlation between ETH and the S&P 500 suggests enthusiasm for an upward trend.

As an analyst, I’m observing that Ethereum (ETH) continues to trade below its all-time high achieved in November 2021. However, the current price action seems to indicate a potential surge in bullish sentiment could be imminent.

Experts suggested that a similar trend with conventional markets might indicate Ethereum’s potential for setting new records.

If ETH keeps moving along its current path, it could push the S&P500 even further upward, possibly resulting in a significant jump or breakthrough for ETH.

The possibility that ETH’s value could triple, reaching above its all-time high of $4800, depends heavily on continued market backing and comparable trends in the S&P500.

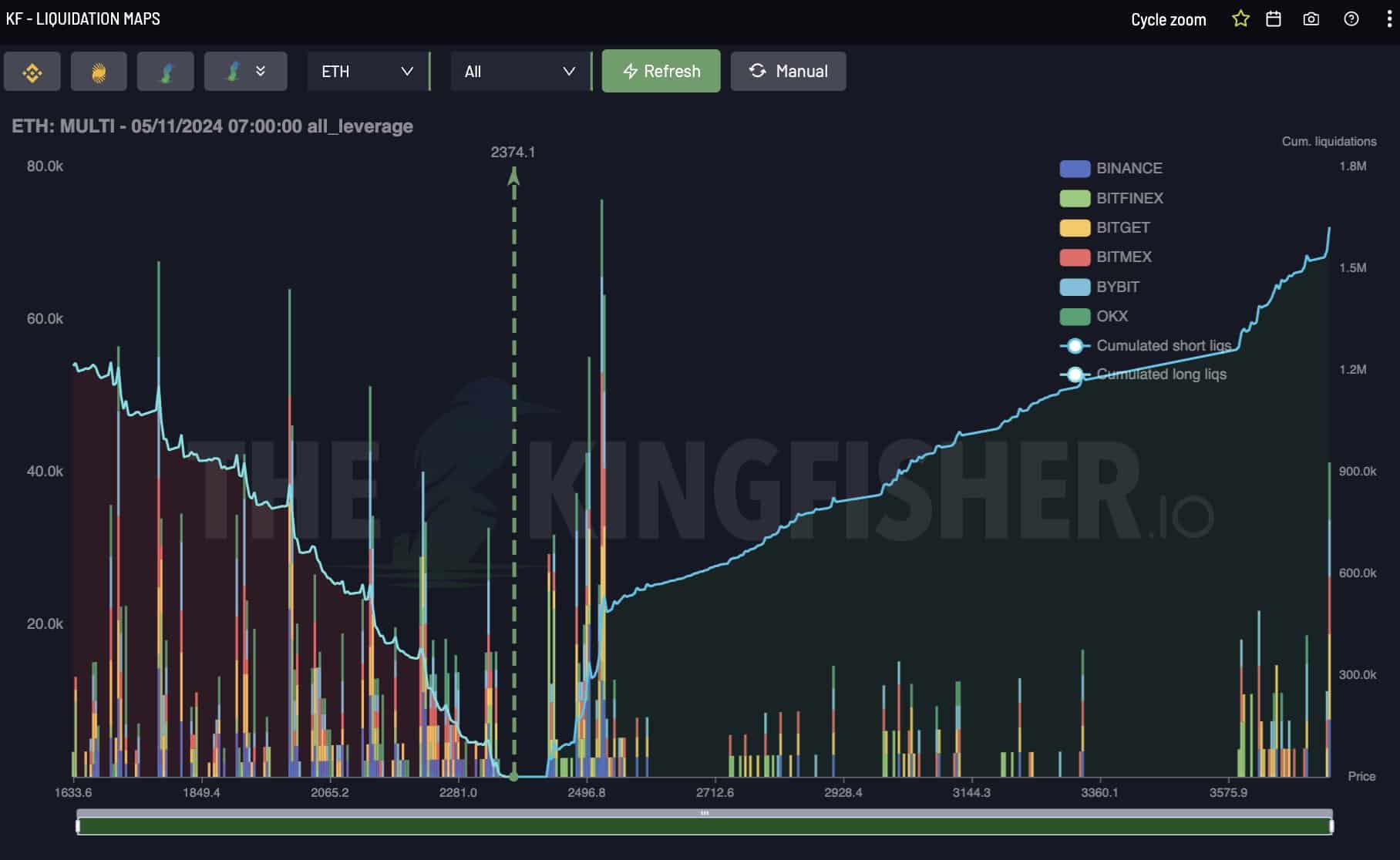

Short leveraged positions pile up ahead of possible rally

The cost of Ethereum has seen a rising number of sellers who anticipate it will drop more, but past trends indicate that Ethereum’s price tends to surge significantly once these short positions are closed out.

The increase in liquidations we’ve seen lately, clearly indicated on the liquidation chart, suggests a substantial price shift may be imminent.

As a crypto investor, I’m keeping a close watch on Ethereum. Once it builds enough steam and manages to clear those short positions, its price could skyrocket, potentially reaching unprecedented heights. I’m anticipating that when the shorts are squared away, Ethereum will soar.

Whale activity suggest ETH could hit $10K…

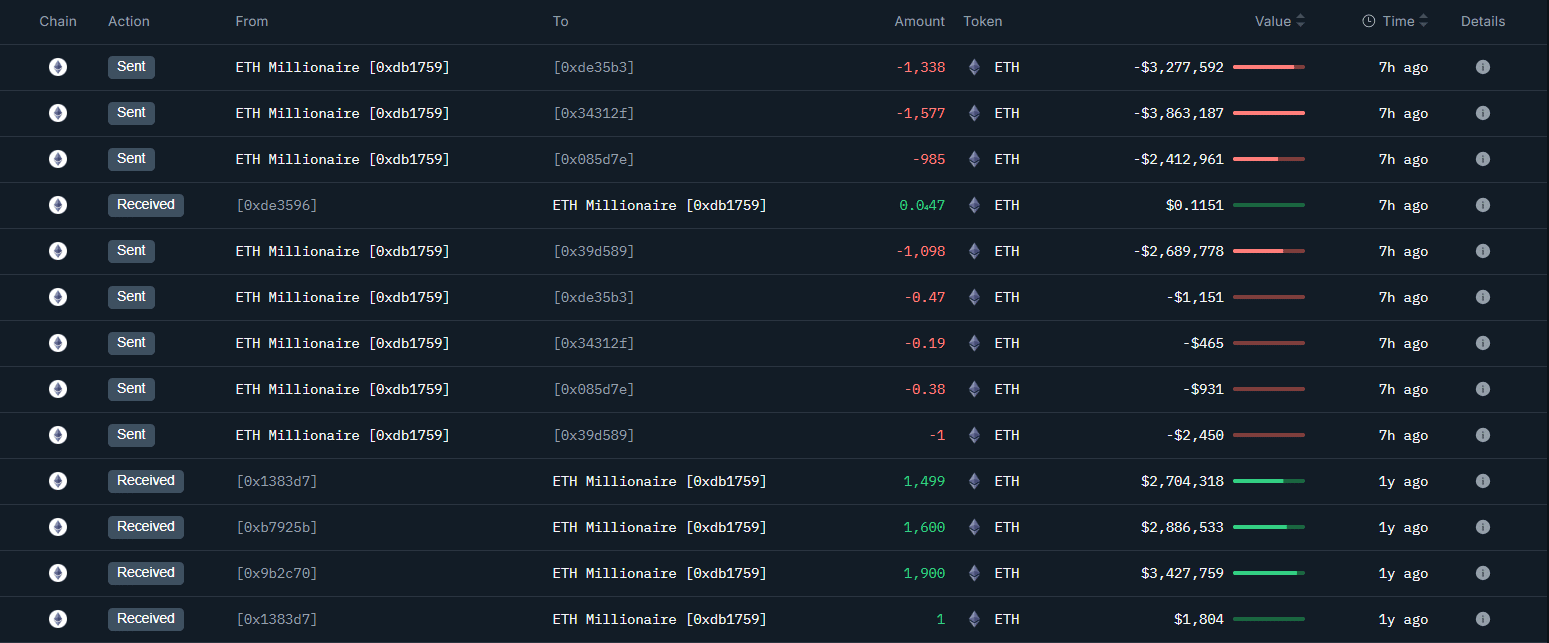

It seems that whales are confident that Ethereum could potentially rise to $10,000, as they frequently choose to cash out while steadily investing through a method known as Dollar Cost Averaging (DCA).

Lately, it’s been observed that a large investor (referred to as a ‘whale’) moved 5,000 Ether into Binance. This action resulted in a gain of approximately $3.22 million. Interestingly, exactly one year prior, the same whale took out 5,000 Ether valued at around $9.02 million from Binance.

Following a lengthy pause, I chose to reinvest my Ethereum, currently valued at approximately $12.24 million. This action generated a substantial profit exceeding $3.22 million, underscoring the faith among major investors in Ethereum’s promising future prospects.

Investor enthusiasm is growing as Ethereum’s recent market behavior and correlation with the S&P 500 suggest a potential resurgence in its bullish trend.

As Ethereum continues its progression, there’s a lot of anticipation about whether it might surpass current limits and potentially reach the significant milestone of $10,000, as Ali hypothesized in his analysis on X.

It appears that Ethereum ($ETH) is following a similar pattern as the S&P500. Some analysts believe this may represent the final drop before it significantly increases, potentially reaching a value of $10,000!

Read Ethereum’s [ETH] Price Prediction 2024–2025

The consistent appearance of whales, their buying and reselling actions, as well as their subsequent investments, suggest a strong optimism or positive outlook among them, which might significantly increase the value of Ethereum (ETH).

The achievement of such lofty goals for ETH is contingent upon the state of the overall market, the behavior of conventional financial markets, and the ongoing participation of significant players in the blockchain network.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-11-06 04:40