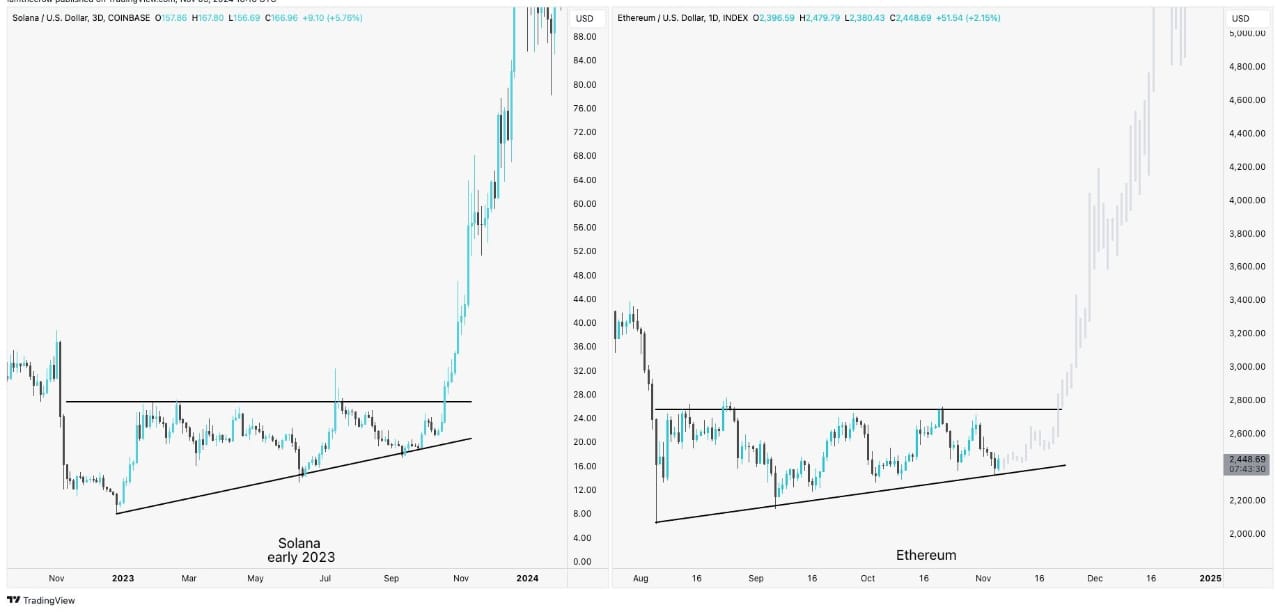

- Ethereum mirroring Solana’s exact structure, a triangle below its resistance level.

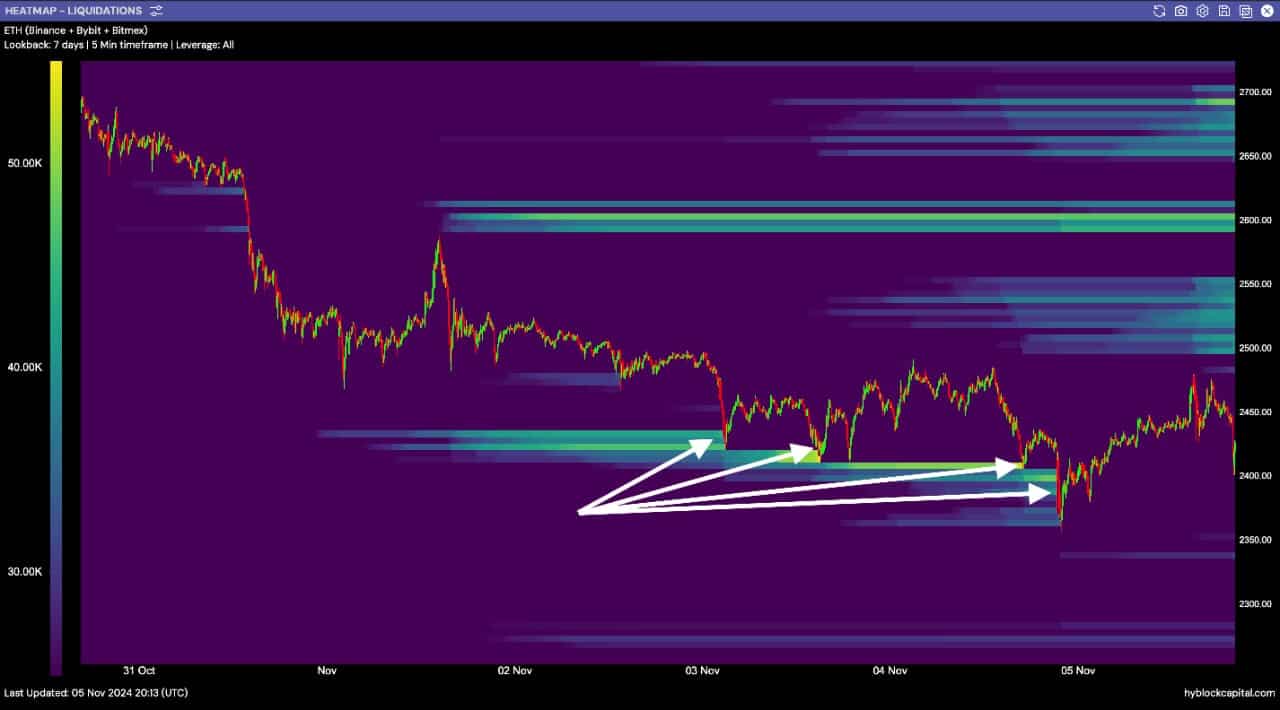

- The multiple liquidity grab that occurred on ETH could spark a rally.

As a seasoned crypto investor with a knack for deciphering market patterns and trends, I find myself intrigued by the current state of Ethereum [ETH]. The striking similarity between ETH’s recent price action and Solana [SOL]’s from earlier in 2023 is undeniable. If history repeats itself, we might be on the brink of a significant bullish breakout for ETH.

Looking at the graphs for Ethereum (ETH) and Solana (SOL), we can see a striking resemblance in their price trends during early 2023, with both showing a significant similarity in their recent market behavior.

As a researcher observing the cryptocurrency market in early 2023, I noticed that Solana had been forming an ascending triangle, a pattern indicative of consolidation. This consolidation was taking place just below a significant resistance level. Eventually, this consolidation phase ended, and Solana broke through the resistance, leading to an impressive surge of approximately 222% in its price.

Currently, as we speak, Ethereum follows a comparable pattern – it’s building an ascending triangle below its resistance line, exhibiting a similar accumulation and compression of price action.

Based on this matching trend, there’s a possibility that Ethereum might be poised for a significant upward surge similar to Solana’s, if its growth pattern continues in the same way.

In simpler terms, the ‘ascending triangle’ is a pattern frequently used by traders that indicates a possible upward movement for Ethereum (ETH). This upward movement could potentially take ETH to higher levels. However, for ETH to reach similar heights, it’s crucial that the momentum and trader activity align favorably.

If Ethereum manages to surpass its current barrier, it could potentially trigger a robust surge, aiming at comparable percentage gains. This would set the stage for Ethereum to embark on another substantial upward trajectory.

The RSI and MACD indicators suggest…

Furthermore, the relative strength index (RSI) and moving average divergence convergence (MACD) indicators on Ethereum suggest a possible market upswing.

1) The Relative Strength Index (RSI) was lingering close to a region indicating a slightly positive or bullish trend, implying that the momentum might soon tilt upward. Meanwhile, the MACD histogram displayed fewer red bars, suggesting that the bearish influence could be losing strength.

Furthermore, it seems that the MACD line is approaching a point where it crosses above the signal line, a scenario often interpreted as a positive or bullish sign.

In essence, these markers suggest that Ethereum could potentially see a rise in buying pressure if there’s an increase in key factors such as liquidity inflow and on-chain activity, aligning with typical market trends.

The impact of the liquidity grab on ETH price action

Examining the ETH liquidity map revealed a recurring pattern, suggesting another day of calculated liquidity acquisition.

The price trend repeatedly dipped to drain liquidity, forming a chain of small candlestick “tails” or “wicks.” This pattern seemed to indicate that stronger traders or market makers were forcing out less confident investors.

In simpler terms, it seems likely that Ethereum (ETH) will bounce back following this liquidity event, given that a substantial amount of liquidity is still nearby at prices higher than its current value.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a financial analyst, I find myself drawn to the increased liquidity in the Ethereum market. This liquidity seems to be acting as a powerful magnet, suggesting that Ethereum may soon move upward. If this trend continues, Ethereum could potentially reach levels where it mirrors the 222% gains seen by Solana.

As a researcher, I am positing that after the recent liquidity sweep, Ethereum (ETH) might capitalize on the restored momentum to ascend and seize nearby liquidity reserves. This could possibly instigate a bullish short-term trend.

Read More

2024-11-07 05:11