-

The ENS price action showed that bears might force another rejection.

AMBCrypto found one metric that could be key for traders to time a bullish breakout.

As a seasoned crypto investor with a keen interest in Ethereum Name Services (ENS), I’ve witnessed firsthand the price action that unfolded since early this year. The recent rally from mid-June was an exciting development, but my experience tells me that we might be approaching another resistance level that could potentially lead to rejection by bears.

The Ethereum Name Service (ENS) experienced a robust surge, which started on the 12th of June and showed no signs of slowing down as of now. Currently, ENS has increased by 9.82%, with potential for further growth.

As a crypto investor, I’m keeping a close eye on Ethereum Name Service (ENS) because it’s nearing a significant resistance level that held strong throughout the entirety of 2024. This could potentially signal a shift in market sentiment, and after three previous unsuccessful attempts to breach this barrier, I’m left wondering: will the bulls finally succeed in pushing through, or should bears get ready to capitalize on potential short opportunities?

Price action shows bulls might struggle to make new highs

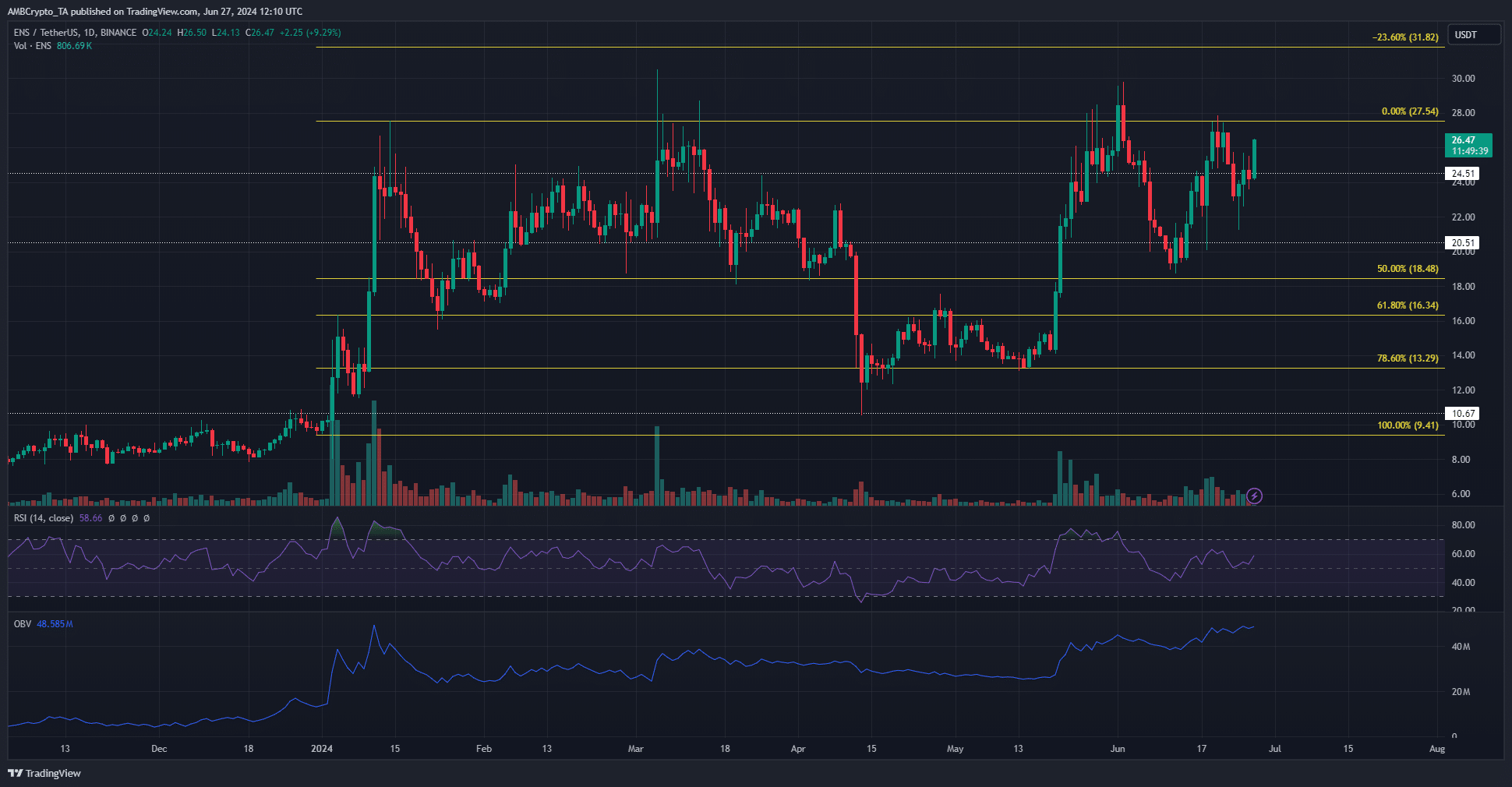

As an analyst, I’ve noticed that the $27.5-$28.5 range has functioned as a consistent resistance area throughout the year. In January, when prices attempted to rally, they were met with strong selling pressure and ultimately pulled back to the 61.8% Fibonacci retracement level at $16.34.

However, the subsequent breakout attempt in early March also met with failure.

After the price drop, ENS reached a low of $10.67. Bullish investors put up a strong defense during April and May to protect the 78.6% mark, which was at $13.29.

During this period, the oscillator indicating buying strength (OBV) has consistently risen. The persistent demand could eventually result in a significant price surge.

Network Growth was another positive sign

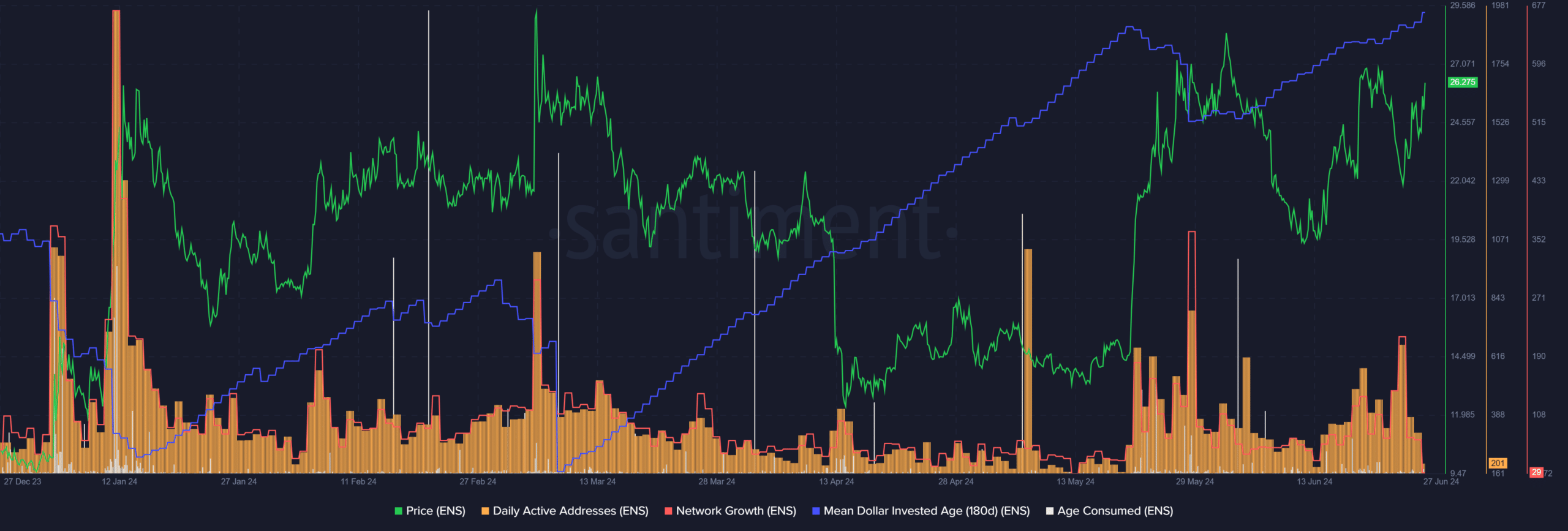

As a crypto investor, I’ve noticed an uptrend in new addresses being created on the Network since the 15th of June. Additionally, the number of daily active addresses has been increasing as well.

Together, the rising adoption might fuel demand.

The average investment age of each dollar in the network kept climbing higher, indicating that the network was growing less busy and old tokens tended to remain in the same wallets.

A drop in the MDIA metric could rejuvenate the market and spark a breakout.

Currently, investors may need to exercise caution when considering purchasing Ethereum Name Service (ENS) tokens at the current strong resistance level. On the other hand, if the $27.5 area has been breached and the MFI (Money Flow Index) metric starts to decrease, it could be an opportunity for bullish investors to consider entering the market.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-28 06:15