-

ETH wants to break above resistance.

The bulls supported the coin’s uptrend with a number of markers spotted on a daily chart.

As a researcher with extensive experience in cryptocurrency analysis, I am optimistic about Ethereum’s [ETH] potential to break above the resistance level and continue its uptrend. The coin’s recent price action, as well as several technical indicators, suggest that buying pressure is stronger than selling pressure in the market.

The leading cryptocurrency Ethereum [ETH] is primed to break above the resistance line of its downward trend, implying a lessening of sell-side pressure.

The price of the coin stood at around $3,100 as of the latest update, representing a nearly 10% increase over the past week based on data from CoinMarketCap. This surge in value aligns with the broader crypto market’s upward trend during this timeframe.

Based on data from CoinGecko, the total value of all cryptocurrencies has increased by 9% over that time frame.

Will ETH make it?

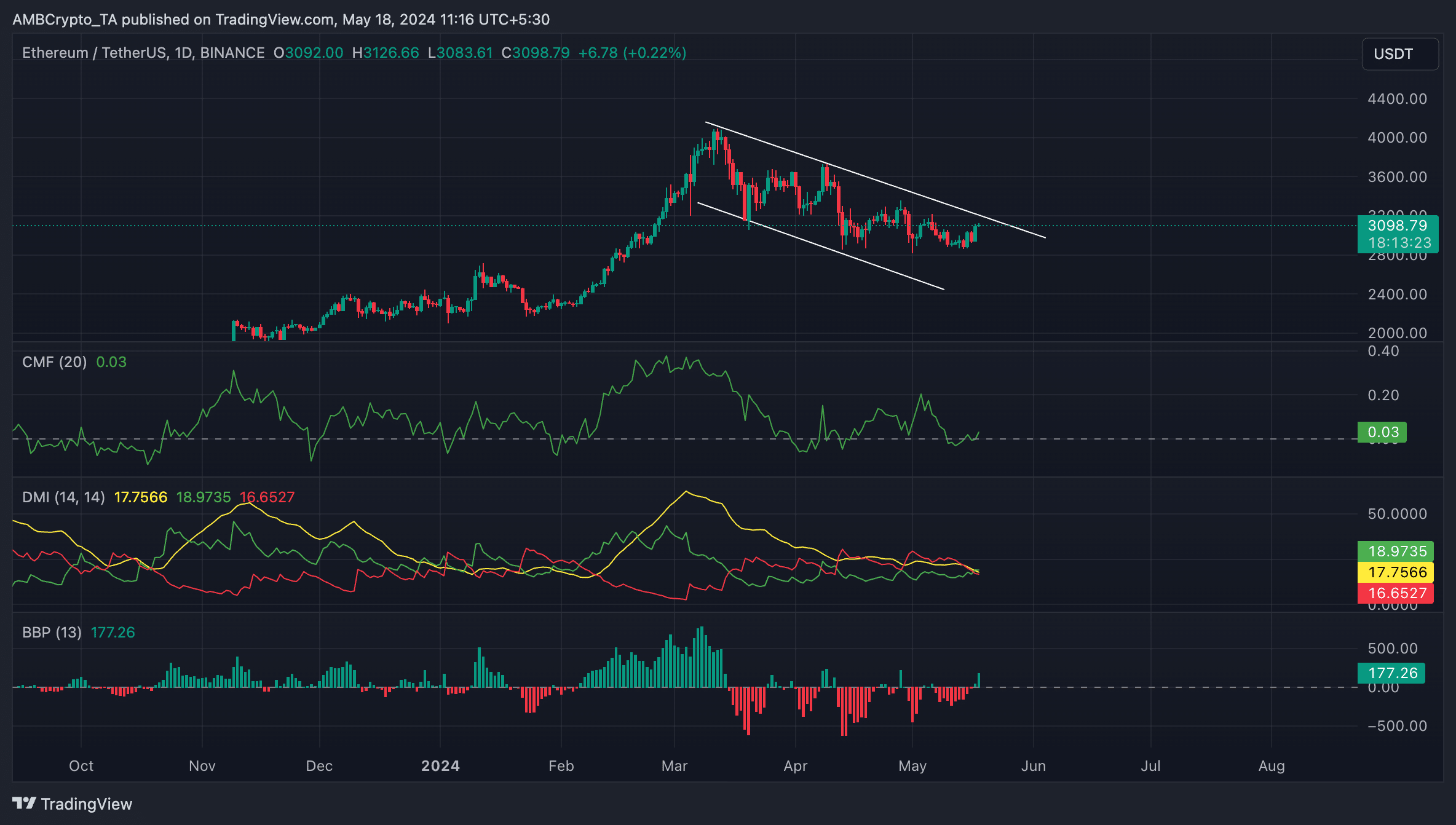

When an asset’s price keeps forming successively lower peaks and troughs, it signifies a downward trend, which can be described as a declining channel in financial markets.

Starting from the 12th of March, ETH‘s price began to slide within this channel, resulting in a 20% decrease.

As the coin approaches the top boundary of the established channel, serving as a resistance point since March, the market has experienced a significant influx of fresh liquidity.

As a crypto investor, I’ve been closely monitoring Ethereum’s (ETH) Chaikin Money Flow (CMF). Just recently, this valuable indicator crossed above the zero line, signaling that more money has been flowing into ETH than out of it. At the moment of writing, the CMF was on an uptrend. This indicator plays a crucial role in assessing the buying and selling pressure in the market, making it an essential tool for keeping track of Ethereum’s price momentum.

When an asset’s Chaikin Money Flow (CMF) increases significantly, it indicates that there is greater demand for the asset than supply in the market. This situation typically arises when the asset’s price sets new highs as a result of increased trading activity.

In the last seven days, ETH’s daily trading volume has risen by 40%, per Santiment’s data.

On May 17th, Ethereum’s bullish signal strengthened as its positive directional indicator surpassed the negative one.

Interpreting data from an asset’s Directional Movement Index (DMI) implies a bullish trend in the market.

Further, the value of the coin’s Elder-Ray Index was positive at press time.

This metric reflects the balance of power between buyers and sellers in the market. A positive reading signifies that buyer demand is more influential. In other words, the bulls are in control.

Read Ethereum’s [ETH] Price Prediction 2024-25

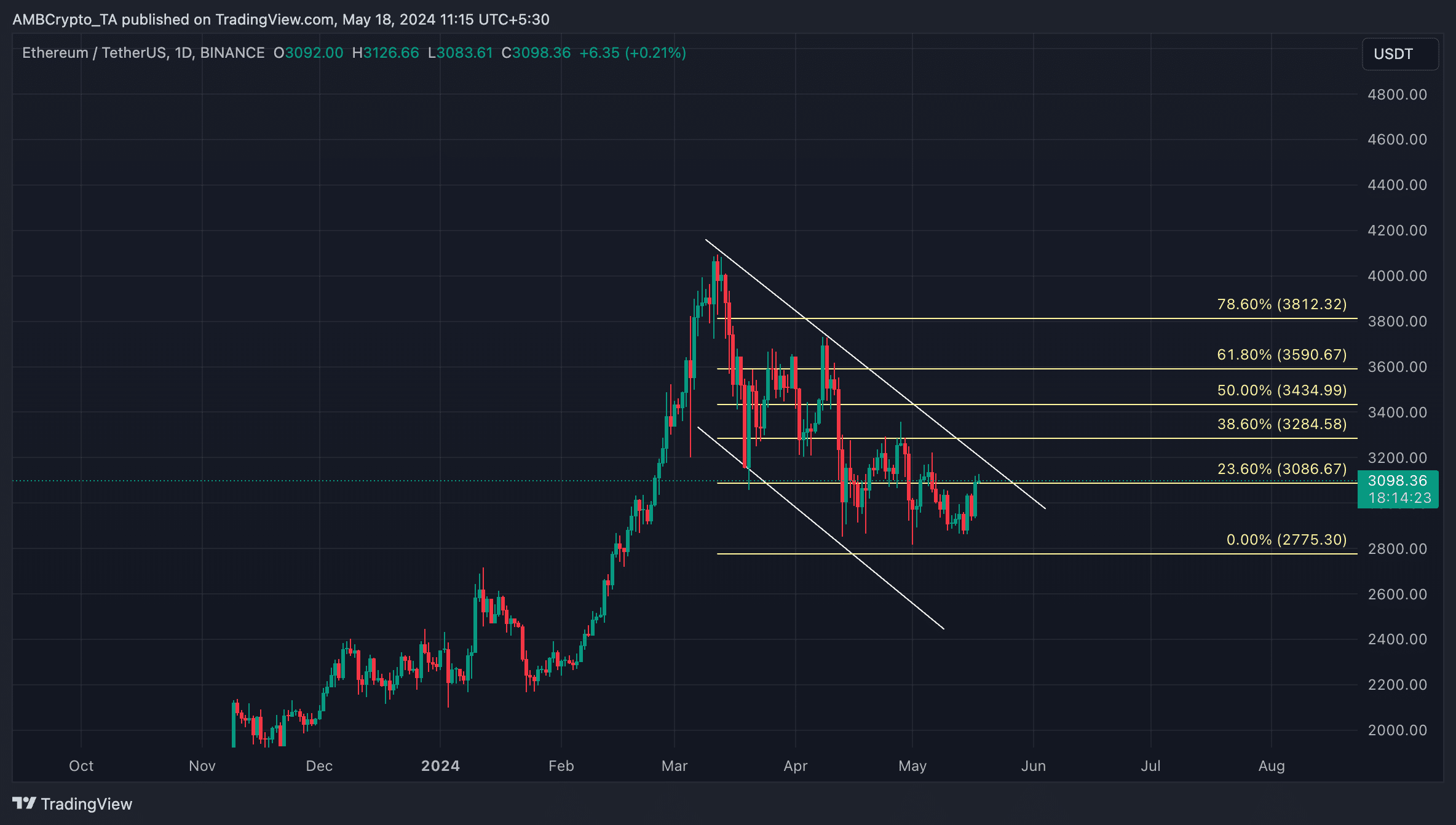

As an analyst, I would interpret this as follows: If the Ethereum bulls manage to surpass the resistance level at the upper boundary of the descending channel, the coin’s value is expected to rise and reach a new price point exceeding $3200.

If selling intensity increases and a declining trend emerges, it’s projected that the price will drop to around $2775, reaching support in the process.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-05-18 14:15