- Ethereum surged 29% over the past week, reaching a three-month high of $3,184.

- The altcoin could be approaching its YTD high, fueling speculation of a potential Ethereum ATH.

As an analyst with over two decades of experience navigating the complex world of finance and cryptocurrencies, I have seen my fair share of market fluctuations. The recent surge in Ethereum, reaching a three-month high of $3,184, is undeniably captivating. It’s reminiscent of those rare instances when the market behaves like a wild mustang, galloping across the plains with unbridled energy and enthusiasm.

In the last seven days, Ethereum [ETH] has witnessed a significant jump, increasing by 29% to touch a three-month peak at $3,184. This powerful upward trend suggests that Ethereum is about to reach its highest point this year, sparking interest among investors and market observers.

The significant increase in Bitcoin‘s price to $89,000 has sparked more conversations about Ethereum potentially reaching a new all-time high. Is it possible that the foremost alternative coin could see even bigger increases, or is this growth merely a brief spike?

Ethereum rally driven by traders and holders

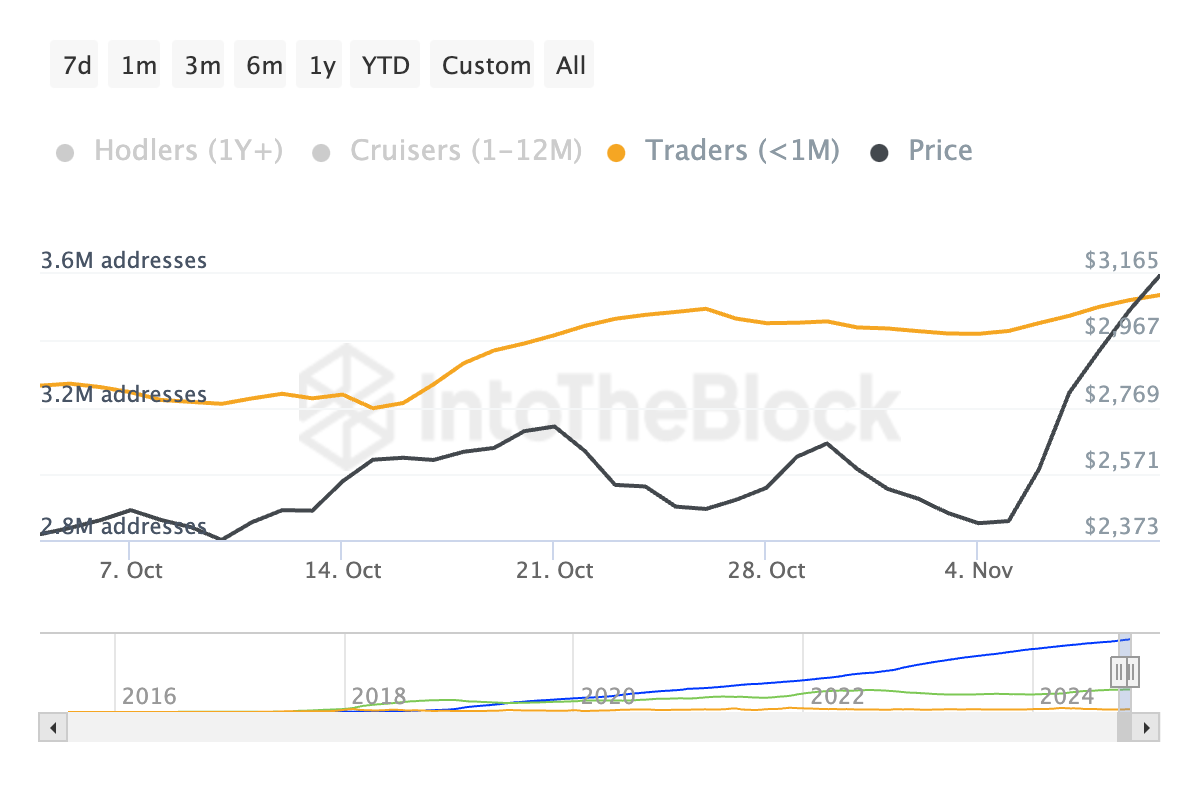

The recent surge in Ethereum can be attributed to an increase in the average duration that investors are holding onto it, pointing towards more involvement from long-term investors. This pattern indicates higher faith in the continued price growth and potentially sets a solid base for future increases.

Simultaneously increasing duration and price levels suggest a sustained rally, driven by improved market confidence and decreased resistance to sell. It’s uncertain if this trend will result in a new all-time high, but there’s definitely a surge in investor positivity.

As an analyst, I observed that the recent spike in Ethereum’s price can be attributed, in part, to a rise in short-term traders. Approximately 3.6 million wallets, which have been active for less than a month, seem to be contributing to this surge.

This surge in speculative actions indicates a possible brief market uptrend ahead, yet those holding long-term and medium-term show stability, forming a solid foundation.

Is an Ethereum ATH possible?

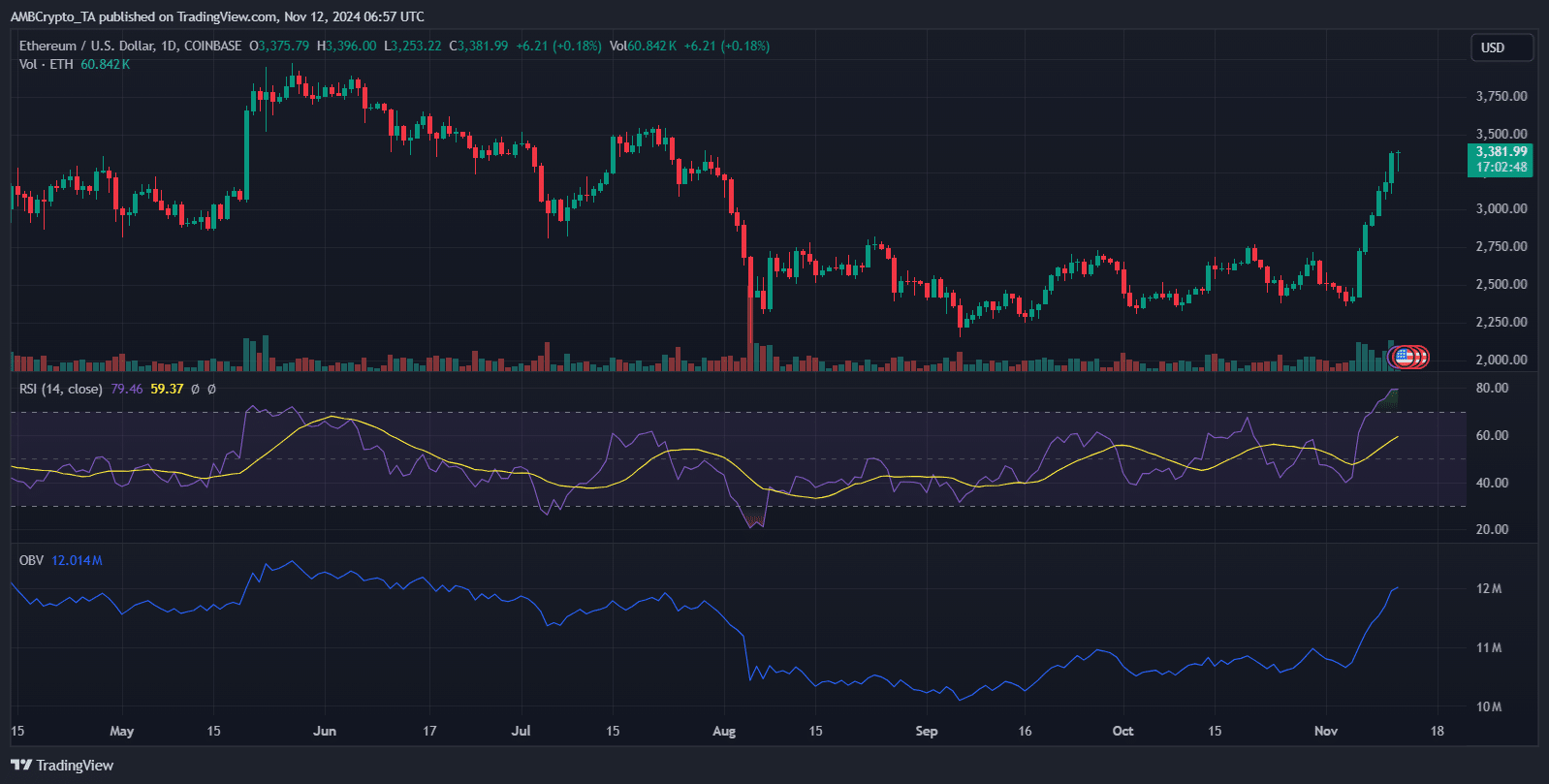

The rapid increase in Ethereum’s value has taken its Relative Strength Index (RSI) up to 77.45, signaling potential overbought conditions that could lead to a temporary downturn. However, the upward price trend is underpinned by an increasing On-Balance Volume (OBV), suggesting robust buying activity.

Should Ethereum surpass its present value of $3,348, it’s quite plausible that I might find myself witnessing a climb towards this year’s high.

Considering the high RSI indicating oversold conditions, there might be a drop back to $3,000 prior to any additional gains. It’s advisable for traders to exercise caution, keeping an eye out for price consolidation near current levels or potential retests before making an effort to reach a new all-time high (ATH).

Market sentiment and institutional involvement

As a crypto investor, I’ve been closely watching Ethereum’s impressive surge, fueled by a robust market mood and increasing institutional attention. It seems that the larger players are being magnetized towards Ethereum due to its growing significance in Decentralized Finance (DeFi) and Web3, making it an exciting prospect in my portfolio.

Institutions contribute to the fluidity and resilience of Ethereum, strengthening its future prospects by decreasing price fluctuations.

Read Ethereum Price Prediction 2024-25

Yet, if the Relative Strength Index (RSI) exceeds overbought territory, even slight shifts in market opinion – possibly resulting from economic or policy adjustments – might spark a correction.

Should institutional trust persist at its present level, Ethereum might maintain its advancements and edge closer to a fresh all-time high. The continuous backing from institutions could play a crucial role in upholding the current upward trend, potentially laying the groundwork for even higher values in the future.

Read More

2024-11-12 17:11