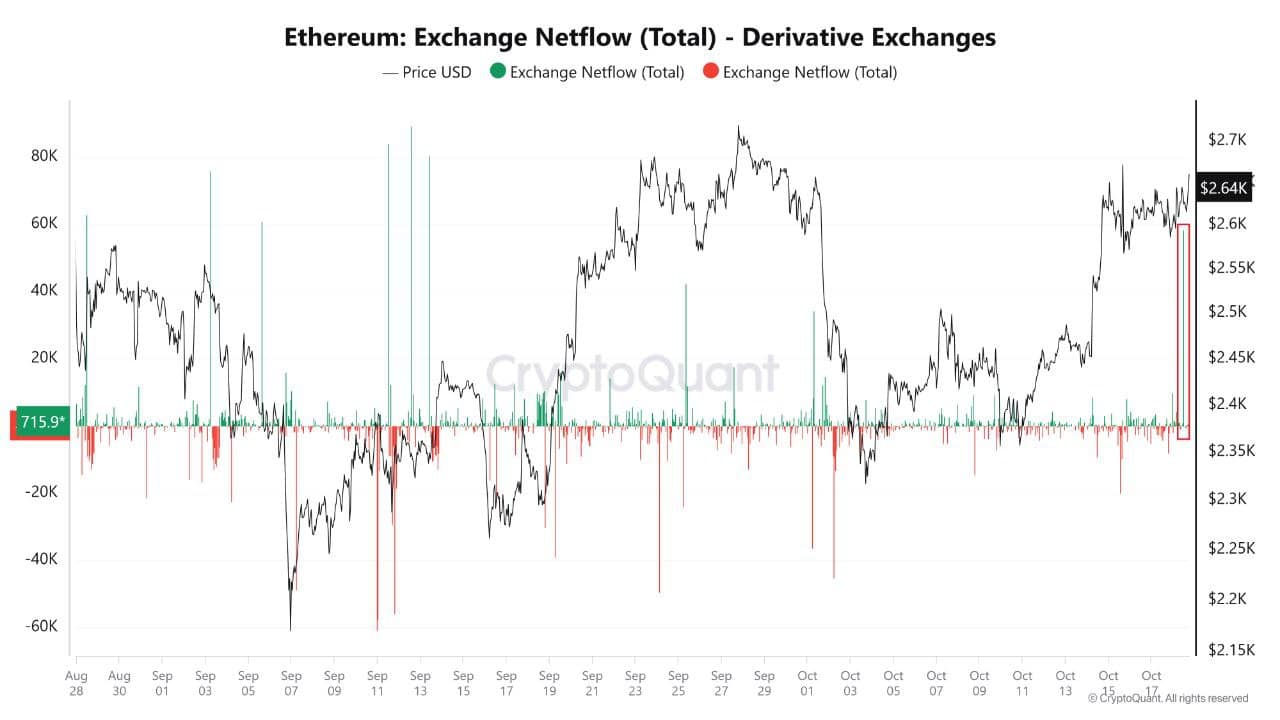

- Ethereum saw a surge in deposits over withdrawals.

- ETH’s price patterns showed a potential breakout.

As a seasoned researcher with years of experience in the crypto market, I must say that the latest trends in Ethereum [ETH] are intriguing indeed. The surge in netflows on derivative exchanges to over 50,000 ETH per day suggests that traders are gearing up for some significant price movements.

The daily inflow of Ethereum (ETH) on derivative trading platforms has exceeded 50,000 ETH, suggesting a notable increase in deposits compared to withdrawals.

This trend has traders speculating about the potential impact on ETH price movements.

An increase in deposits could indicate either upcoming selling activity or more loans being taken out to boost long-term investments, implying that market fluctuations might occur soon.

As investors look ahead, they may find themselves closely watching potential significant fluctuations in Ethereum’s value over the next few months, given the expectations of market players.

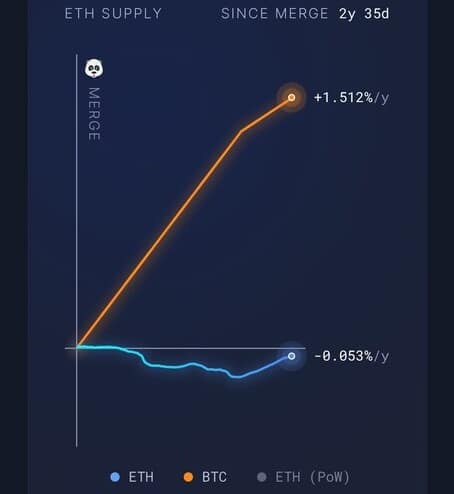

ETH price and inflation rate

Ethereum’s price action has remained in the spotlight. Over the past week, ETH has risen by 8.53%, and as of press time price stood at $2605.63.

Currently, the ETH/USDT pair is situated within an upward-sloping triangle formation, and a breakout from this structure might propel the price upwards. If the bullish trend persists, the next significant milestone for ETH could be around $2800.

On the Ethereum-Bitcoin (ETH/BTC) exchange, the price is close to a crucial support point around 0.039 on the weekly graph. Even with a predominantly bearish market outlook, this support level has remained robust, suggesting a potential rebound could occur.

Such a rebound could not only benefit ETH but also spark a broader rally in the top 100 altcoins.

Inflation remains a crucial factor in Ethereum’s overall market performance. Currently, Ethereum’s inflation rate stands at +0.31% per year, a figure lower than both Bitcoin and gold.

Ever since The Merge transformed Ethereum into a Proof-of-Stake network, approximately 135,000 Ether has been destroyed through the burn mechanism, making the supply even more scarce. This continuous burn process only serves to amplify Ethereum’s inherent deflationary nature, as an engaged crypto investor.

Although there hasn’t been much change in prices recently, the expanding user interest and inherent deflationary traits suggest a possibility of significant price rises in the future.

It’s probable that as Ethereum reduces its supply and experiences more network use, the price of Ether (ETH) could rise in the coming times.

Leading smart contract platform

The supremacy of Ethereum as the primary platform for smart contracts continues to go uncontested. Ever since its debut in 2015, Ethereum serves as the bedrock for ingenuity in the Decentralized Finance (DeFi) and Non-Fungible Token (NFT) industries.

Thanks to ETH 2.0 going live, the network has become more scalable, reliable, and energy-conserving than it’s ever been. These improvements are fueling Ethereum’s ongoing expansion within the blockchain industry.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The continuous advancement and application of Ethereum’s blockchain technology, along with its lower rates of inflation and deflation, contribute significantly to the anticipation that prices will increase.

Keeping tabs on Ethereum’s upcoming actions is crucial since it appears to be poised for robust growth in the short term. As we approach 2025, it could potentially yield substantial benefits.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-20 17:11