- Solana’s clampdown on MEV validators has attracted divergent opinions.

- Ethereum also faced criticism for its reported strict stance against memecoins.

As a crypto investor with some experience in the industry, I’ve been following the ongoing debate between Solana and Ethereum with great interest. The recent developments regarding Solana’s clampdown on MEV validators and Ethereum’s reported stance against memecoins have added fuel to the fire.

The ongoing news comparison between Solana (SOL) and Ethereum (ETH), a topic that has recently dominated crypto news, shows no signs of letting up.

During the past weekend, the contentious discussion between the top two contenders for L1 (Layer 1) blockchain alternatives reignited. Solana took action against validators employing MEV (Maximum Extraction Value), leading to renewed debate on this issue.

As a data analyst, I’ve come across information suggesting that the Solana Foundation allegedly discontinued its financial backing for validators involved in MEV (Minimum Extractable Value) extraction on their network.

A Ethereum core developer, Ryan Berckmans, dismissed the significance of the move and labeled Solana as not being a genuine base for large-scale transactions.

“In their strategy to tackle MEV issues, the team proposed withdrawing financial backing from validators who profit from MEV extraction chuckles. However, I’m not entirely convinced that Solana is a reliable platform for settlements.”

For those unfamiliar with the concept, MEVs (Minimum Exchange Value) represent methods for optimizing profits for validators. They achieve this by manipulating the sequence, omitting certain transactions, or incorporating new ones within a block.

Is Solana’s anti-MEV good or bad?

Whether the anti-MEV update is great or not is up for debate.

According to Lucas Bruder, the CEO of Solana-based MEV infrastructure provider Jito Labs, he supports the actions taken by the Solana Foundation.

The Solana Foundation acts as a validator within the network. It’s in the best interest of these validators for the Solana network to thrive. Why then would they advocate for anything that diminishes the network’s chances of success?

As a market analyst, I’d interpret the executive’s statement as follows: I believe the intention behind this action is to shield the most significant community of Solana users, primarily meme coin traders, from potential harm.

If the majority of transactions on Solana involve memecoin trading, then alienating its primary user base by misusing the blockspace could lead to their departure. Consequently, we would be left with decreased usage and potentially asking ourselves why we didn’t take more preventative measures.

Noted expert here. An intriguing perspective emerged from Solana co-founder Anatoly Yakavenko, who endorsed the anti-Minimum Ethereum Value (MEV) approach as a beneficial response to the demands of meme coin traders.

Instead of “Berckmans argued that the action was taken by Solana Foundation to shield meme coin traders for the sake of ‘competitiveness’ versus Ethereum and its Layer 2 solutions,” you could say:

As an analyst, I believe that the current narrative surrounding the SOL/ETH ratio significantly exaggerates Solana’s resilience in challenging Ethereum’s position as a major player in the blockchain landscape. This perspective stems from my assessment of Solana’s capabilities when compared to Ethereum’s L1 and our top L2 solutions.

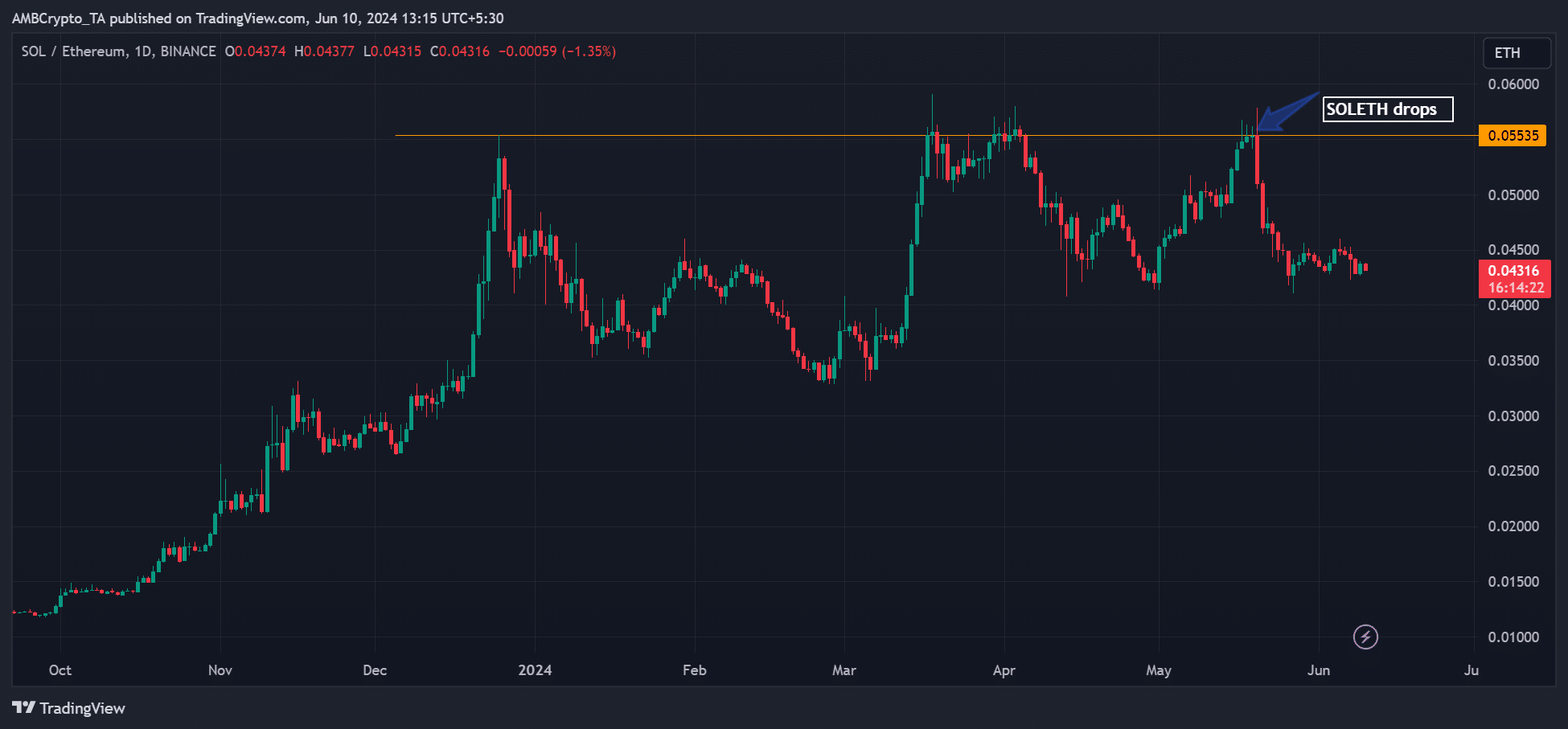

The referred-to SOL/ETH ratio illustrates how SOL’s price has compared to Ethereum’s since October 2023. This ratio has been climbing steadily until it took a small step back in the wake of May’s unexpected ETH Exchange-Traded Fund (ETF) announcement.

As a market analyst, I’ve observed that since last year, Solana (SOL) has consistently shown stronger price performance compared to Ethereum (ETH) based on chart analysis. However, it’s important to note that market trends can shift unexpectedly and this current trend could potentially reverse.

More Solana vs. Ethereum news

Last week, during a heated debate between Iggy Azalea and Vitalik Buterin over celebrity involvement in cryptocurrencies, Evgeny Gaevoy, CEO of Wintermute, voiced his concern that Ethereum (ETH) might not succeed due to the influence of its prominent figures, rather than Solana.

“If Ethereum falters in the future, it won’t be due to Solana being faster, but rather because the Ethereum establishment remains mired in a significant contradiction.”

As an analyst, I’ve observed that Gaevoy’s response was significantly influenced by Buterin and Uniswap’s founding perspective. They believe that memecoins, unlike traditional cryptocurrencies, should primarily serve societal benefits rather than just financial returns.

Solana has adopted a role as a meme coin supporter and initiator, contrasting Ethereum’s stance.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-10 13:12