- While Open Interest increased, Funding Rate stalled.

- The price of the altcoin might keep swinging between $3,400 and $3,600 in the short term.

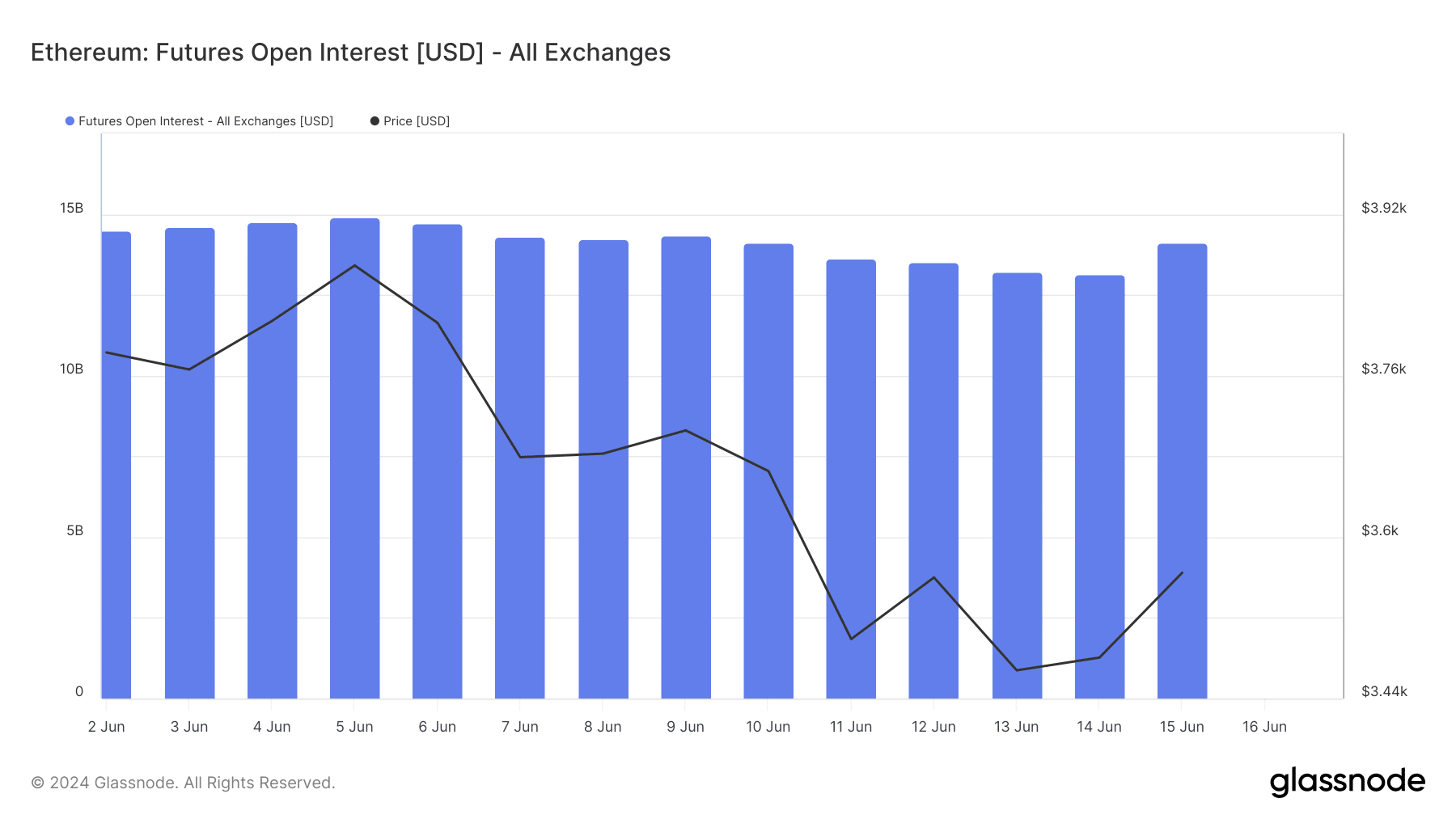

As a researcher with experience in the cryptocurrency market, I have observed that Ethereum’s [ETH] Open Interest increased significantly from $13.14 billion to $14.10 billion within a day, indicating increased speculative activity and potential price strength for the altcoin. However, the decrease in trading volume by 35.36% in the last 24 hours is a cause for concern as it might lead to a stalling of the ETH price around $3,500 to $3,600 if spot market activity continues to decline.

As an analyst, I’ve observed a noteworthy development in Ethereum‘s [ETH] Open Interest market. Yesterday, the Open Interest dipped to a value of $13.14 billion. Surprisingly, within the day, an additional billion was added, bringing the current Open Interest to a total of $14.10 billion at the time I’m writing this analysis. The data used for this observation comes from reliable sources like Glassnode.

As a market analyst, I would interpret a decrease in Open Interest (OI) as traders closing their positions on cryptocurrency futures contracts. Conversely, an increase signifies new positions being opened or existing ones being held.

Speculation is a ticket to a new high

The growing number of Ethereum contracts implies heightened speculation about the altcoin. Often, an uptick in open interest provides support for the price trend.

I, as an analyst, observe that Ethereum (ETH) has experienced a minimal price change in the past hour, with its value currently being traded around $3,563 – a 1.10% upward shift from the previous price.

By the look of things, this could be the start of a significant uptrend for the cryptocurrency.

In the past 24 hours, there was a 35.36% reduction in Ethereum’s trading volume. This decrease indicates that fewer transactions were carried out on the Ethereum spot market.

Should the decline in Ethereum’s spot market transactions persist, while the derivatives market experiences an uptick in trading activity, it is possible that Ethereum’s price may hover around the $3,500 to $3,600 range.

If the demand for purchasing an altcoin intensifies in the current market, it could potentially surge towards the $3,800 price point.

Skepticism lingers

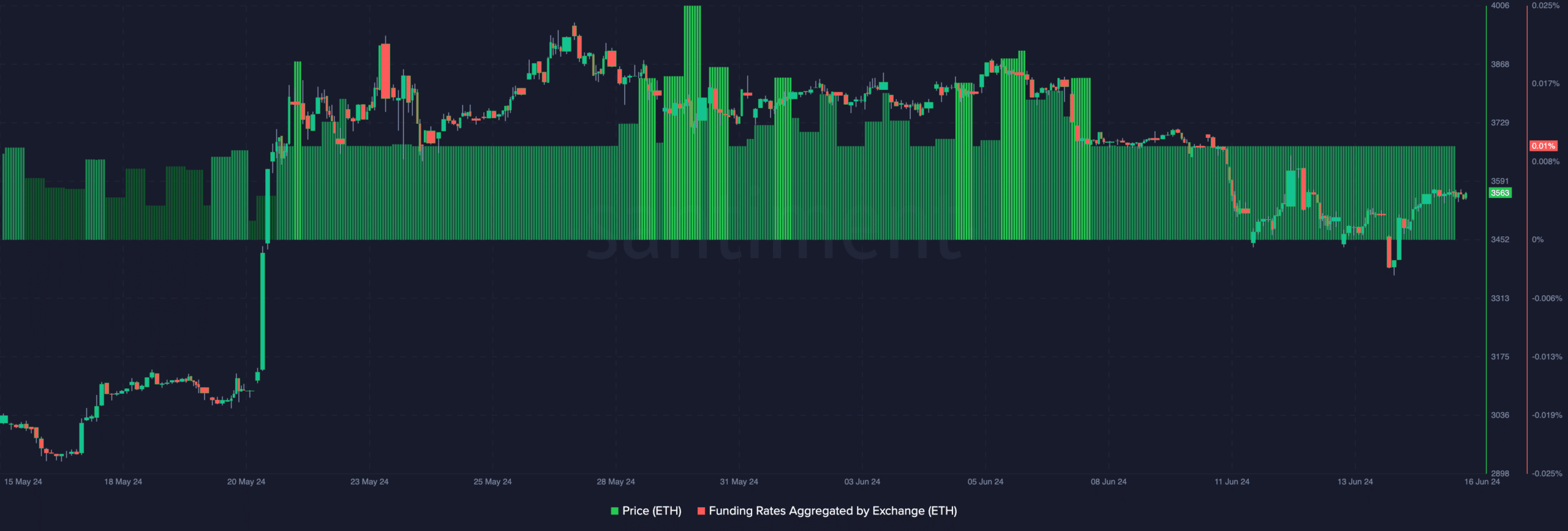

Although the overall sentiment may not be favorable, Ethereum’s funding rate has continued to hover at a standstill since the 8th of June. The funding rate represents the fee paid or received for maintaining an open position in Ethereum derivatives.

If the funding is favorable, it indicates that the contract’s price is higher than the current market price (or spot price). Consequently, those holding long positions must pay a fee to maintain their positions in such circumstances.

In contrast, when funding is negative, it signifies that short sellers are effectively subsidizing long positions. Additionally, the contract price for the cryptocurrency is below its market value.

For ETH, the low Funding Rate and high price means that spot volume might soon begin to pick up.

If this situation holds true, it’s plausible that Ethereum will experience an uptrend. However, there’s a chance its price may not reach $4,000 within the upcoming week.

Moreover, AMBCrypto analyzed the Taker Sell Ratio by dividing the sell volume by the entire perpetual swap volume.

When the ratio is below 0.5, it signifies reduced selling pressure in the market. Conversely, a ratio above 0.5 suggests that selling activity prevails in the market.

Realistic or not, here’s ETH’s market cap in BTC terms

From my research as of now, Ethereum’s Taker Buy Sell Ratio stands at 0.50 based on data from CryptoQuant. If this trend persists, it may hinder Ethereum’s efforts to reach the projected price of $4,000 that was previously suggested.

Based on historical trends, I anticipate that the value of the cryptocurrency could fluctuate between the ranges of $3,400 and $3,600 in the upcoming week.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 02:15