- ETH’s funding rate also increased over the past few days.

- In case of a correction, ETH might drop to $3.3k again.

As a seasoned researcher with years of experience observing and analyzing cryptocurrency markets, I have seen my fair share of market cycles. While it is undeniably exciting to witness Ethereum [ETH] reaching new heights, I can’t help but recall the old adage, “What goes up must come down.

Approaching the $3,700 level, Ethereum [ETH], known as the leader among altcoins, has achieved a significant milestone. One of its crucial derivative metrics has attained an unprecedented high. However, the question remains: Is this a bullish indication or could it potentially influence ETH’s price trend negatively?

Ethereum’s record could attract bears

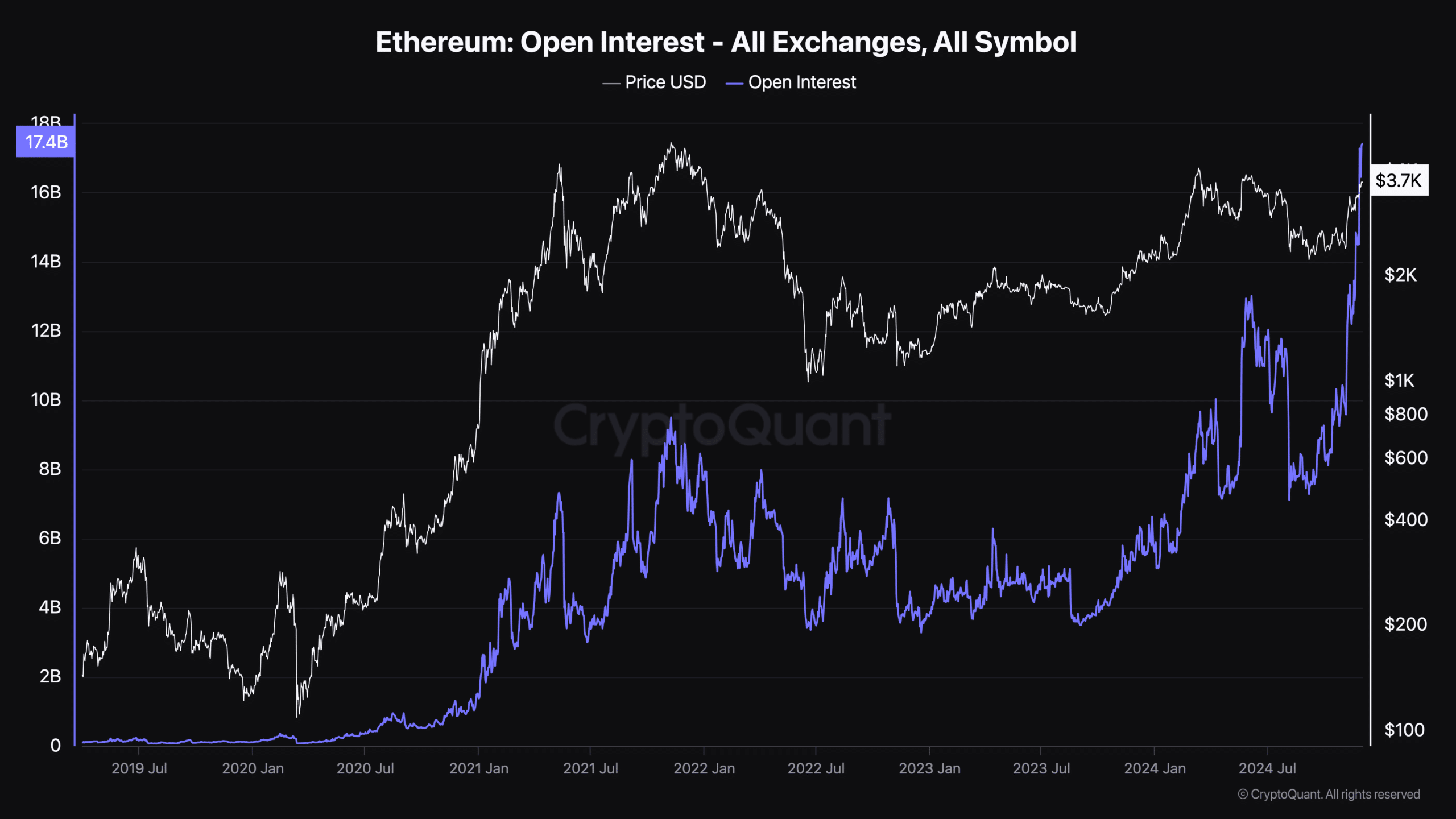

The total value of positions held by traders using Ethereum’s futures and options contracts has reached a record peak of over $17 billion. This rise in positions indicates that an increased number of traders are engaging in these contracts, potentially leading to a surge in funds flowing into the market.

Indeed, another key indicator related to derivatives, known as the funding rate, has experienced a significant increase lately. An upward trend in this metric is generally considered a positive sign, suggesting that the market is optimistic. This optimism often arises when traders are prepared to pay more in order to maintain their long positions.

Initially, it may seem like prices are continuing to climb, but upon closer examination, the opposite could be true. The graph suggests that when open interest increases significantly, a decrease in price usually follows.

These incidents occurred in November 2021 and June 2024. Both times, a surge in Open Interest (OI) seemed to indicate a peak in the market.

Will history repeat itself?

Instead of examining if ETH had reached its market peak, AMBCrypto delved into the token’s on-chain statistics for a more thorough investigation. According to our evaluation using CryptoQuant’s data, the rising trend in ETH’s exchange reserve suggests an increase in selling pressure.

Furthermore, its random fluctuations were found in the overbought region, suggesting an increase after potential sell-offs, typically leading to adjustments or price corrections.

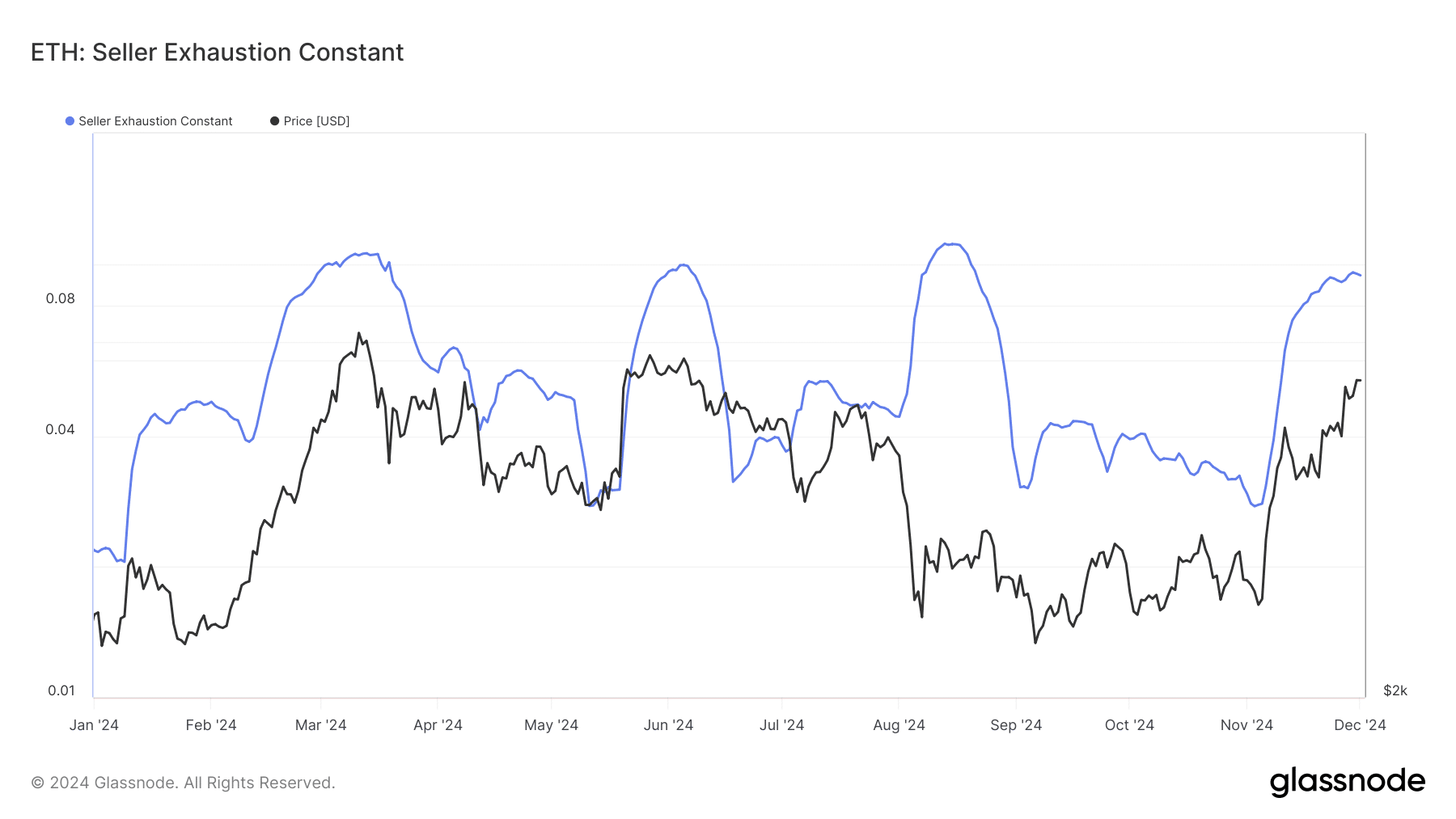

In addition to our findings, it’s worth noting that the seller exhaustion rate for ETH reached its highest point. As can be seen from the graph, when this measure peaked, the value of ETH dropped significantly within the subsequent days.

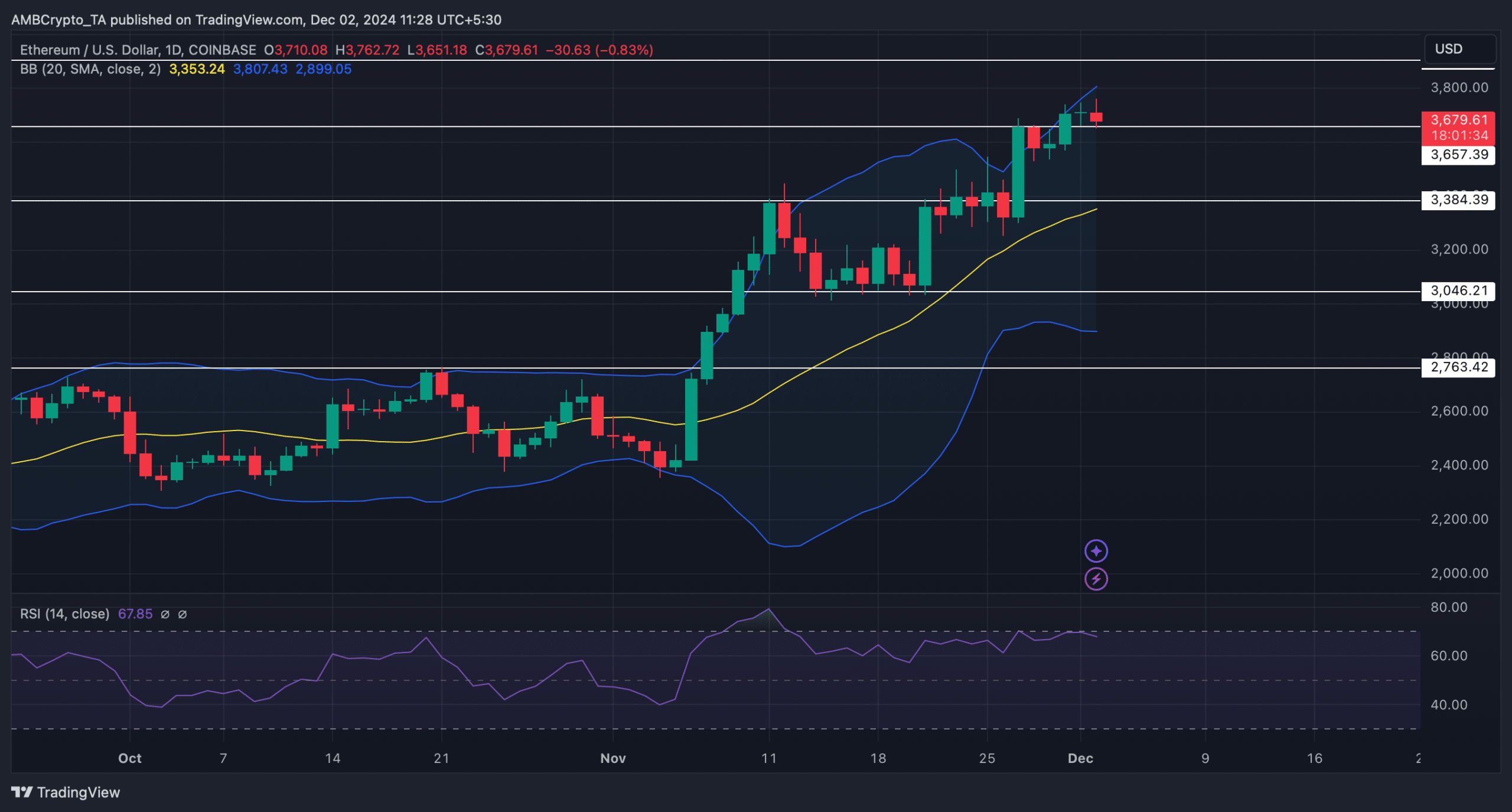

On the other hand, it’s worth mentioning that the Relative Strength Index (RSI) hadn’t reached the oversold level just yet. This implies that there could be further opportunities for purchasing, potentially allowing Ethereum to sustain its upward trend.

Currently, the leading cryptocurrency among altcoins is being tested at its support level. If the Relative Strength Index (RSI) is accurate, Ethereum may manage to pass this test and proceed on an upward trajectory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

If the significant increase in Open Interest (OI) and funding rates lead to a price fall, as has occurred historically, then Ethereum could potentially slide towards its lower level of support.

To be precise, a drop from the current price level might first push ETH down to $3.38k again.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

2024-12-02 13:43