-

ETH showed renewed interest across the options market.

Despite short-term challenges, it suggested a bullish outlook for ETH in Q4.

As a seasoned crypto investor with a few battle scars and a heart full of hope, I find the recent developments surrounding Ethereum [ETH] quite intriguing. The surge in options activity, particularly the renewed interest in ETH contracts targeting $3k by December 27, is indeed a promising sign for Q4. However, I’ve learned over the years that the crypto market can be as unpredictable as a roller coaster ride at an amusement park.

Even though Ethereum (ETH) received approval for a U.S. spot ETF in Q2, it has trailed behind its significant counterparts like Bitcoin (BTC) and Solana (SOL). However, on September 13th, there was a noticeable surge of renewed interest in the top altcoin.

Based on information from the cryptocurrency trading firm QCP Capital situated in Singapore, there has been significant increase in demand for ETH options, particularly those with a goal of reaching $3,000 by the end of this year. A section of their recent report stated…

There’s been a surge of attention in the options market towards Ethereum (ETH), as more than 20,000 contracts aim for the $3k mark by December 27. It seems that the end-of-year forecast for ETH could turn out to be quite substantial.

ETH’s bullish revival

In essence, options data and trading volume serve as predictive tools, giving us insights into anticipated prices and the general mood or attitude of the market for the future.

It appears that the recent increase in activity in the options market, particularly the Open Interest rates, suggests optimistic forecasts and possible price growth during the fourth quarter.

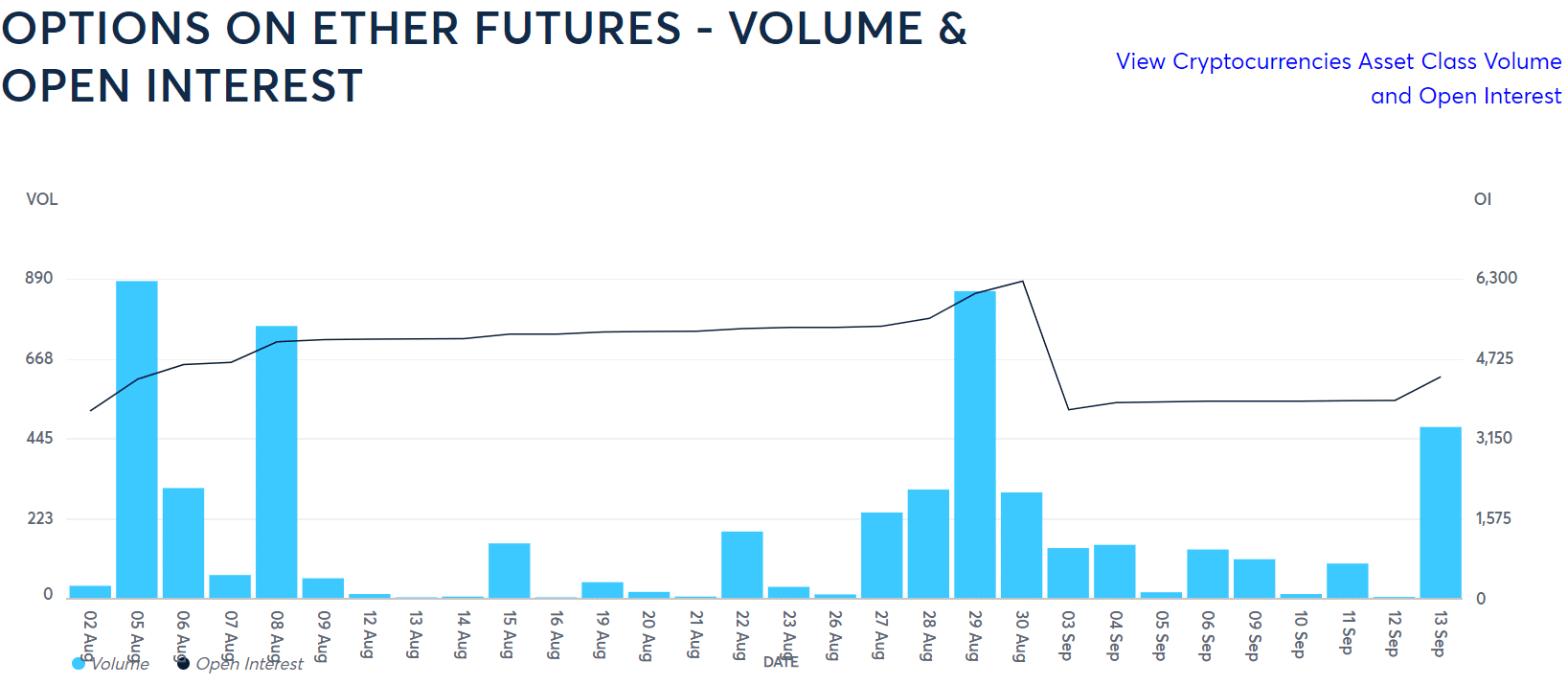

The Chicago Mercantile Exchange (CME) data confirmed QCP Capital’s outlook.

For the initial time this month, on September 13th, Ethereum (ETH) experienced a significant increase in trading volume and open interest (OI). The open interest soared to approximately $3.1 billion, while the volume almost reached $700 million. This surge indicates growing institutional investment in ETH as an altcoin.

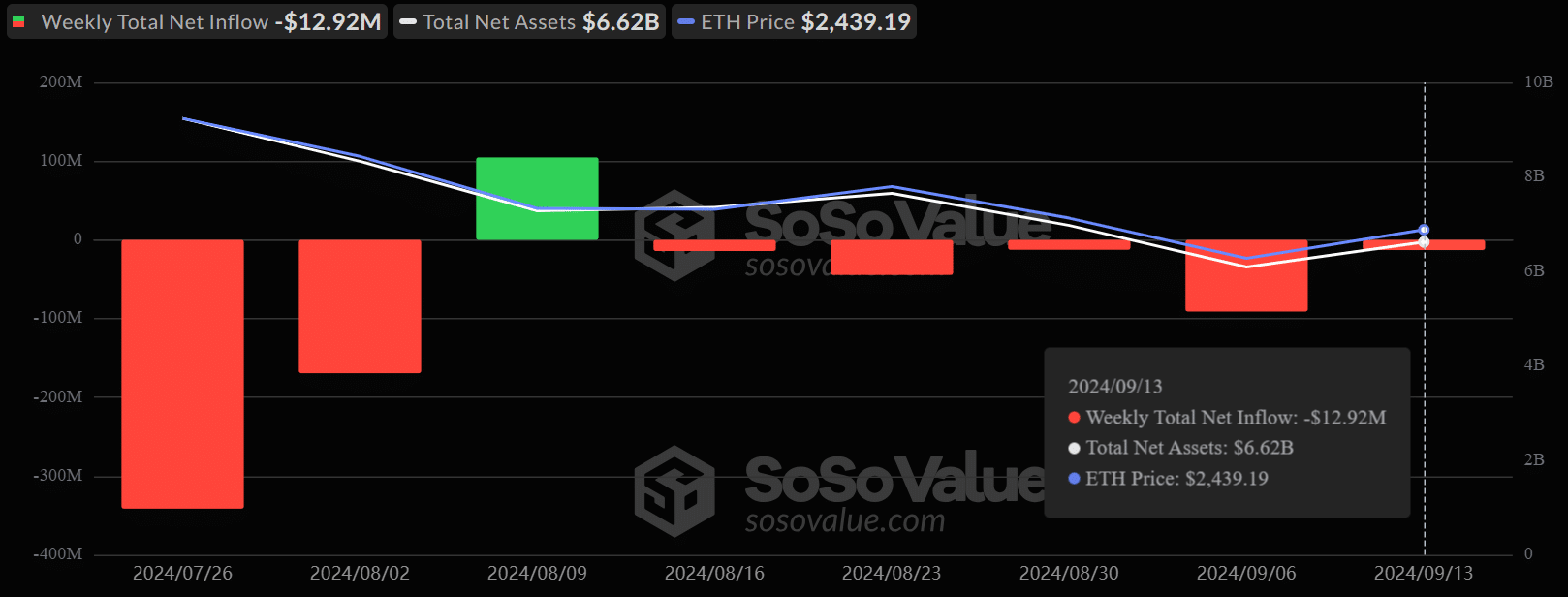

On Friday, there was limited interest from U.S. ETH ETFs in the spot market, even though options trading had risen significantly.

The products saw a cumulative $1.5 million in daily inflow, but it was net negative on the weekly count. They bled $12.92 million last week, a trend that was yet to be reversed to reinforce strong investor confidence.

However, Coinbase analyst David Duong blamed ETH’s muted price performance on the current market structure. Duong noted that crypto investors were tied to other altcoin positions, limiting capital flow to ETH.

Another possible short-term challenge to ETH’s price was a spike in exchange reserves. About 100k tokens moved to exchanges ahead of the Fed rate decision on the 18th of September.

In the meantime, ETH was valued at $2.4k at press time, up 5% in the past seven days of trading.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-16 00:07