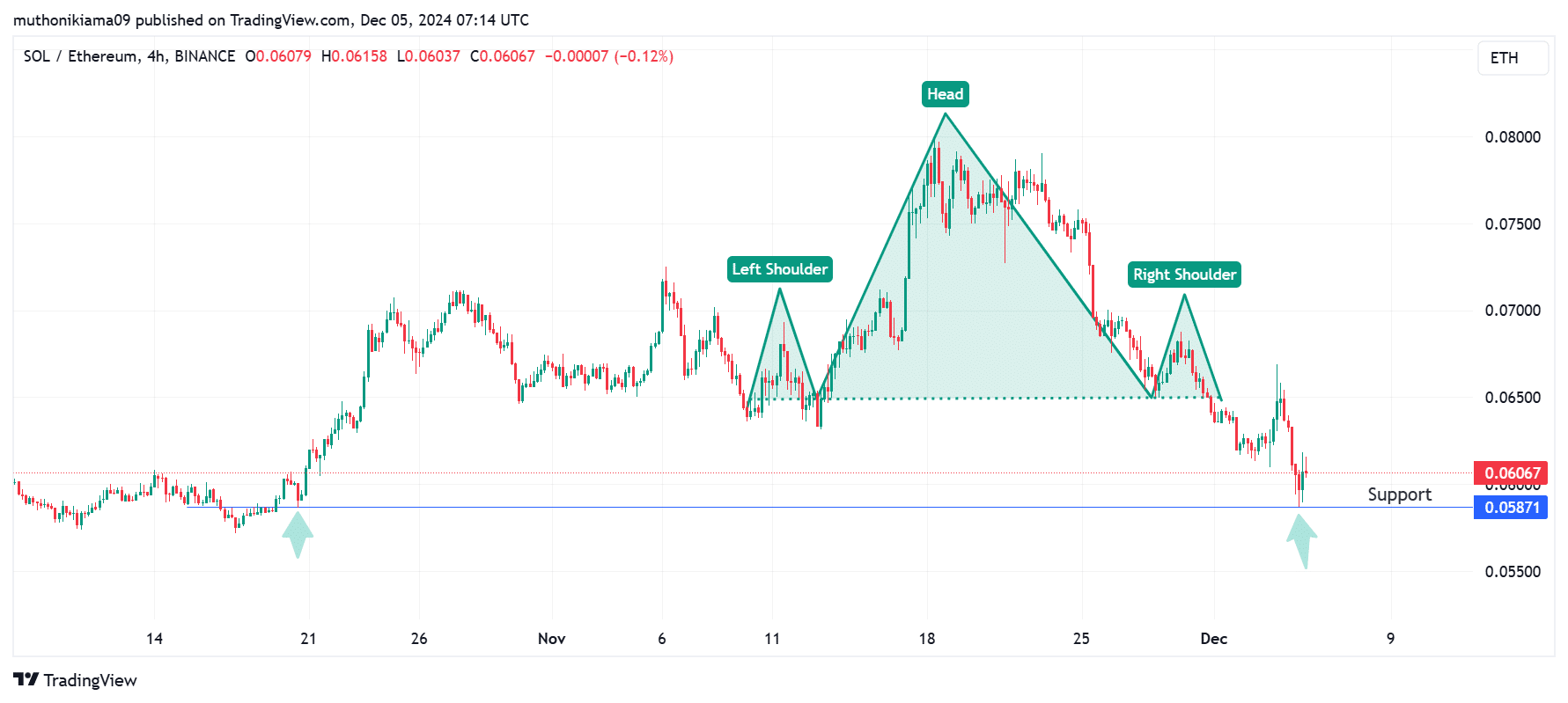

- The SOL/ETH ratio has dropped to a six-week low of 0.058 as Ethereum outperforms Solana.

- Solana has been stuck in consolidation due to a lack of fresh buying activity.

As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I find the current situation of Solana [SOL] quite intriguing. The six-week low of SOL/ETH ratio and the consolidation of SOL within a narrow range are indicative of a market that’s playing hard to get.

At the current moment, Solana [SOL] is being exchanged for approximately $233, experiencing a minor 1.5% decrease over the past day. Interestingly, it’s the sole coin among the top ten largest cryptocurrencies by market cap that has experienced a seven-day setback.

Solana’s lackluster growth hasn’t managed to follow the positive trend seen in the wider altcoin sector. Consequently, SOL has dropped to its lowest point in six weeks compared to Ethereum [ETH], the leading altcoin.

As I write this, the Solana-to-Ethereum (SOL/ETH) ratio has dipped to 0.606, having rebounded from a support level of 0.058 on the four-hour chart.

As an analyst, I’ve observed a notable decrease in performance between Ethereum and Solana, indicating that Ethereum is surpassing Solana in terms of growth. This downward trend aligns with the development of a bearish head-and-shoulders pattern.

The bearish trend has pushed SOL/ETH to a support level of 0.058. The last time SOL tested this support was in late October before starting a rally. Whether this trend will repeat depends on buying activity around Solana.

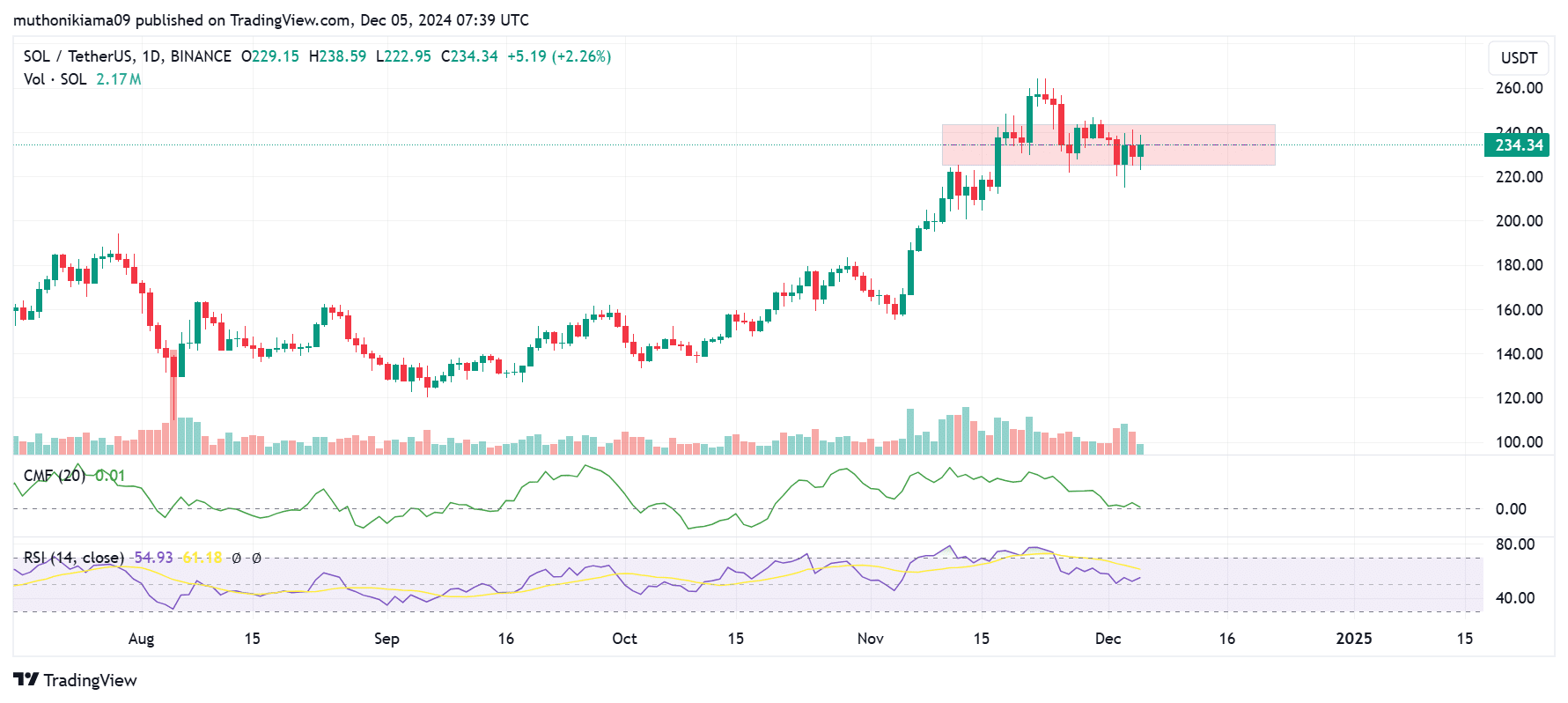

Solana price stuck in consolidation as buying pressure wanes

Over the last seven days, the price of Solana has been stabilizing within a band of roughly $225 to $243. The bar graph representing trading volume suggests that there hasn’t been much intense buying or selling recently, which might keep Solana locked within this pattern of range-bound trading.

Purchases were limited, as suggested by the decreasing Chaikin Money Flow (CMF) that’s been hitting new lows.

Concurrently, the Relative Strength Index (RSI) was showing a decline. Even though it remained above 50, this suggests an increase in selling activity while the demand for buying coins remains relatively low.

The cryptocurrency Solana might yield to bearish tendencies and undergo a drop-off as a result of persistent selling from the meme coin platform Pump.fun.

As reported by Lookonchain, Pump.fun recently moved 100,000 SOL, equivalent to approximately $23.45 million, into the Kraken exchange. Since its inception, this platform has deposited a total of around $265 million in SOL for potential selling purposes.

If the market doesn’t take up the sold Solana (SOL) coins, it might persistently lag behind Ethereum and other popular altcoins in terms of performance.

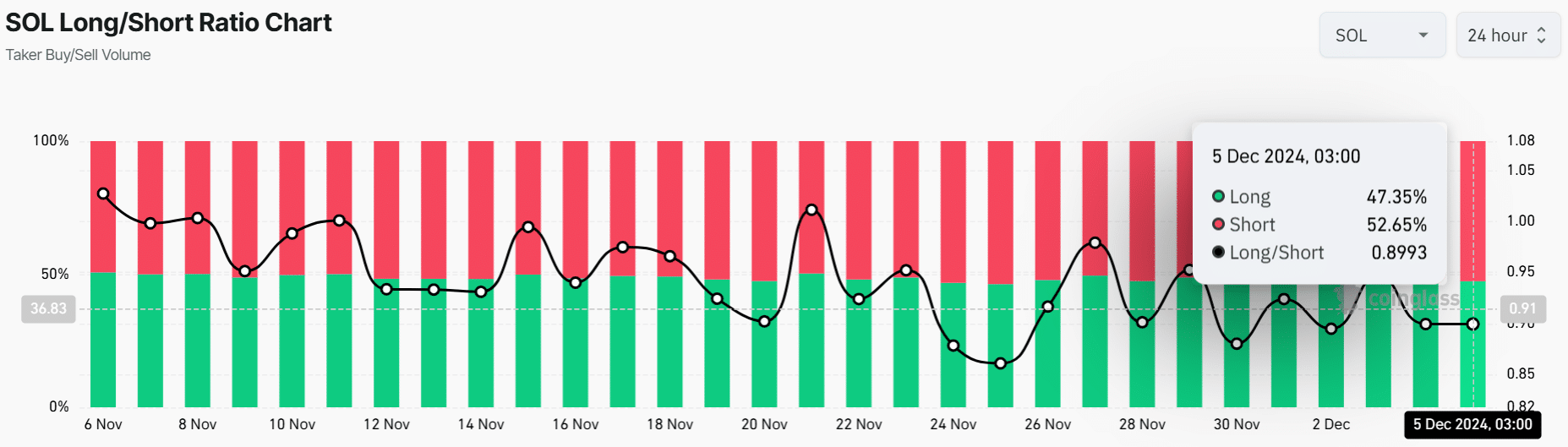

Long/Short Ratio shows a bearish sentiment

The Long/Short Ratio for Solana indicates a predominantly bearish market sentiment towards SOL, as it has fallen to approximately 0.89.

Read Solana’s [SOL] Price Prediction 2024–2025

It seems that most traders have chosen to go short on altcoins using leverage, suggesting they expect its price to drop even more.

Conversely, a surge in short positions can lead to a potential “short squeeze.” This means that rapid price rises might occur unexpectedly due to a chain reaction of forced buying from traders trying to cover their short positions. So, it’s crucial for traders to be vigilant and prepare for such instances of sudden price increases that could trigger more short liquidations and drive the price even higher.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-05 20:07