-

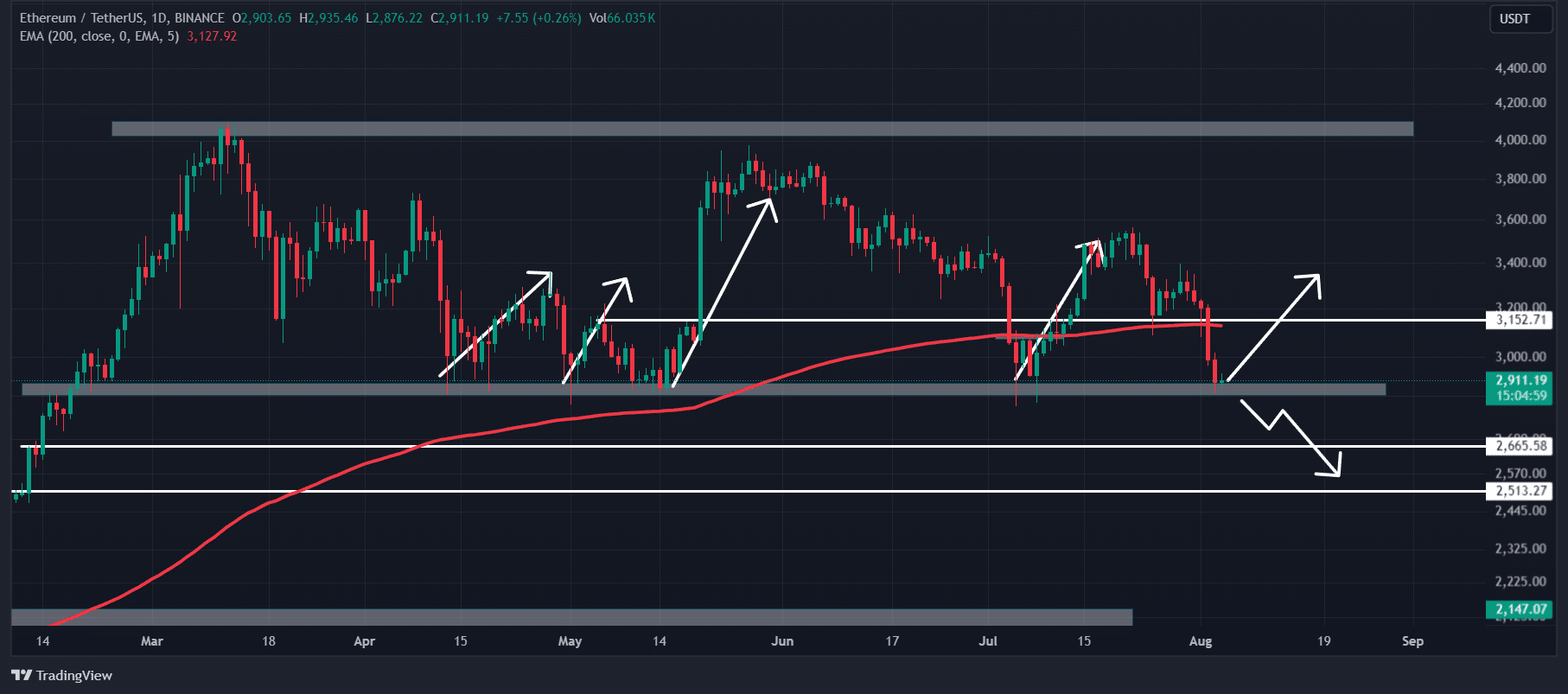

Based on historical price performance, ETH could see a 17% upside rally in the coming days.

ETH is at crucial support, if it fails to hold this level, it could fall to the $2,600 mark.

As a seasoned researcher with a decade of experience in the cryptocurrency market, I find myself intrigued by this recent accumulation of ETH by a smart trader who seems to have an uncanny knack for timing his purchases perfectly. The $19.8 million investment in two trading days amid a downturn is a bold move that speaks volumes about his confidence in Ethereum’s potential recovery.

Over the last several days, the entire cryptocurrency sector has seen a consistent drop in value. Despite this bearish trend, certain large investors (whales) and stakeholders are now considering purchasing larger quantities of Ethereum [ETH], given its substantial decrease in price.

More recently, a well-known on-chain analysis company, Lookonchain, shared information (originally on Twitter) about a skilled trader who boasts an unmatched track record of 100% success. This trader has amassed approximately 6,424 ETH, which equates to a substantial value of around $19.8 million.

Smart trader bags $19.8 million of ETH amid recent decline

As an analyst, I’ve observed that, in the wake of recent price drops, a savvy trader, as indicated by lookonchain, strategically amassed Ethereum (ETH) over two trading days. Specifically, when ETH plummeted beyond its crucial support level of $3,130 on August 2nd, this trader made a significant purchase of 4,000 ETH, which amounted to approximately $12.58 million at the time.

On the 3rd of August, as ETH continued to drop and hit its subsequent support level at $2,900, he decided to purchase an additional 2,424 ETH, which equated to approximately $7.22 million.

Since November 21, 2024, this savvy trader has executed seven transactions, consistently earning substantial profits from each one. According to Lookonchain’s records, the total profit generated by these trades surpassed $38 million.

Regardless of its significant buildup, Ethereum (ETH) kept dropping. At the current moment, it was being exchanged around $2,880, showing a decrease of 3.5% over the past 24 hours.

Using an easier and more conversational tone,

ETH’s historical price momentum and upcoming levels

Based on historical trends, when Ethereum (ETH) approached its support level around $2,900, it typically ignited a significant price surge. Yet, unlike previous instances, there seems to be widespread anticipation among traders and investors for another upward rally in the current scenario.

Starting from April 2024, the support level for ETH has been tested four times, and on every occasion, investors have seen an approximate uptrend of 15% to 17%.

Read Ethereum (ETH) Price Prediction 2024-25

If historical patterns recur, it’s likely that ETH may experience a surge of approximately 17%, potentially hitting the $3,400 milestone.

From my perspective as an analyst, should Ethereum (ETH) fail to maintain its current critical support level, there’s a significant possibility that it might plunge towards the $2,600 and even the $2,500 price points.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-04 21:11