- Ethereum’s price surged by 6% from its weekly low of $3,381.

- Metrics indicate a potential price reversal.

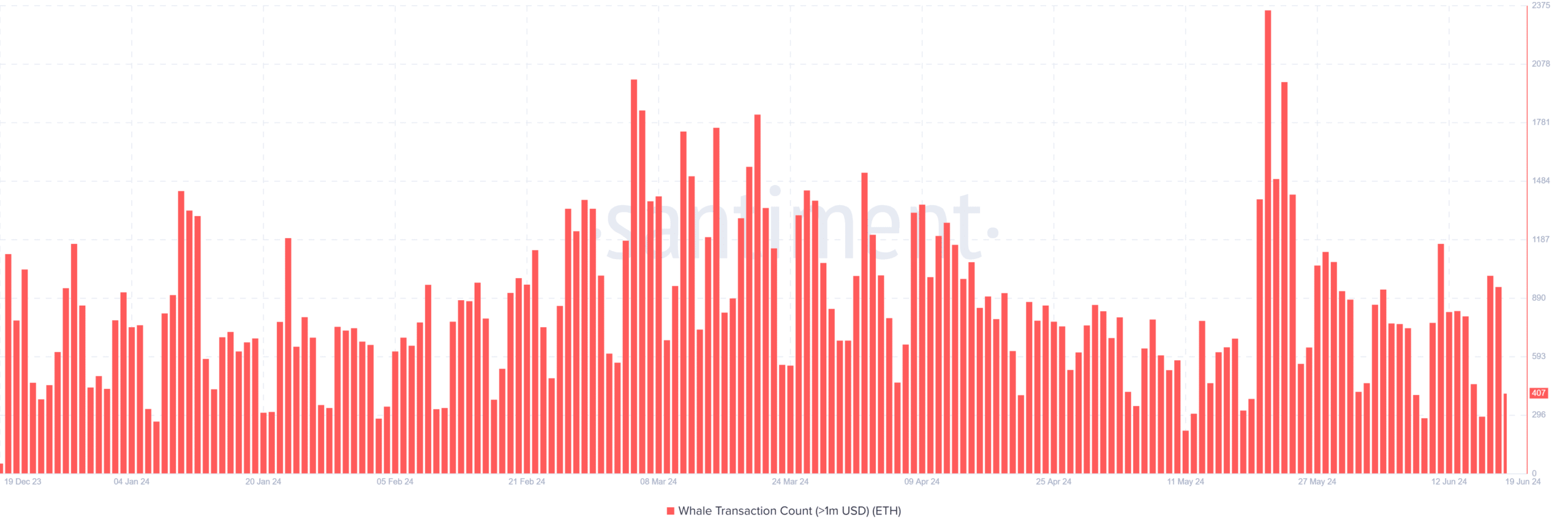

As an experienced analyst, I have closely monitored Ethereum’s [ETH] recent price action and market trends. Based on the available data and metrics, it appears that Ethereum has undergone a remarkable turnaround, with its price surging by 6% from its weekly low of $3,381. This upswing can be attributed to heightened whale activities, as indicated by Santiment’s data showing over 1400 whale transactions in the last few days.

The king of altcoins has experienced a remarkable reversal, bouncing back strongly from its weeklow of $3,381.

Based on information from leading platforms, it appears that large-scale investors, referred to as “whales,” have been active in buying large quantities of Ethereum [ETH], contributing to its recent price increase.

In the past thirty days, Ethereum’s value increased by approximately 14%. At present moment, its price is hovering around $3,527. The cryptocurrency’s trading volume for the previous 24 hours was roughly $19.5 billion, and its total market capitalization amounted to about $433 billion.

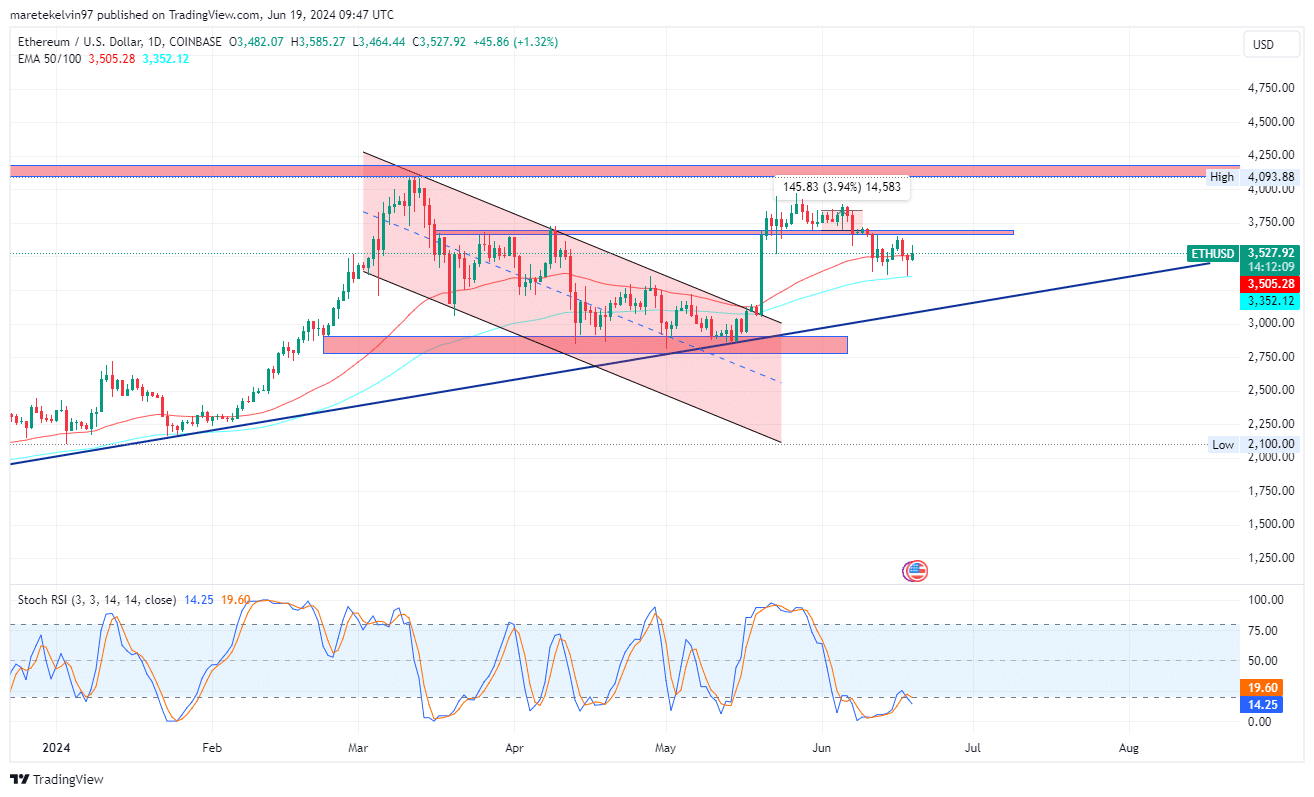

Ethereum has experienced a 6% increase in value after touching its 50-day exponential moving average’s resistance point. If bulls gain additional strength, the next significant resistance level lies around $3700.

As a researcher studying financial markets, I’ve come across the stochastic Relative Strength Index (RSI), which highlights potential overbought and oversold levels in a financial instrument’s price action. Currently, the stochastic RSI is signaling an oversold zone for the asset under analysis. This could potentially indicate a reversal to the upside, as prices may have been undervalued in the recent market conditions.

Whale transactions fuel price momentum

Based on Santiment’s findings, there has been a significant increase in whale-related Ethereum activities as of late. On the 18th of June alone, over 1400 such transactions were recorded.

The increased number of whale transactions on Ethereum network occurs in tandem with its recent price increases. This implies that investors have been buying ETH in large quantities during previous price declines.

The whales’ long positions may cause ETH to surge if the bullish pressure continues.

Liquidation heats up but Ethereum remains strong

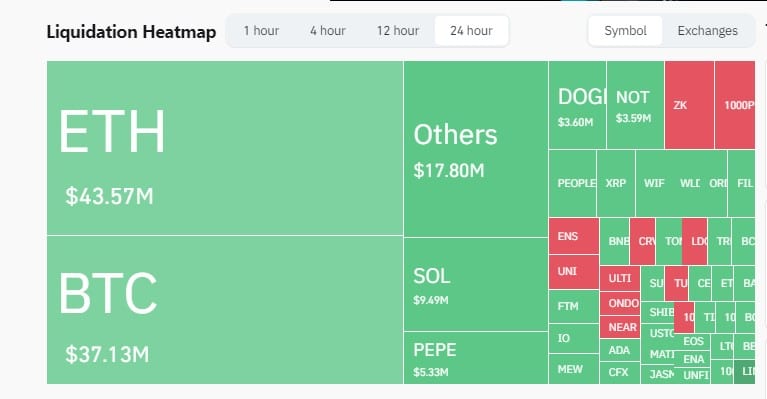

Coinglass’s liquidation heatmap data further indicates Ethereum’s resilience.

As an analyst, I’ve observed that despite the recent wave of cryptocurrency liquidations, Ethereum (ETH) whales have successfully maintained positions totaling approximately $43.57 million in Ethereum futures contracts for a long term investment perspective within the past 24 hours.

This whale’s commitments further indicate confidence among Ethereum’s long term prospects.

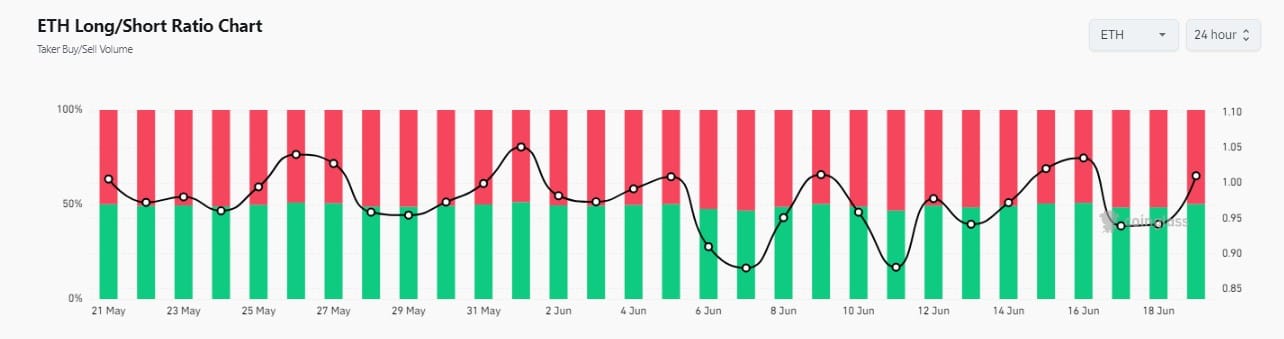

The long-to-short ratio data indicate a pause in the growth of long positions, signified by a leveled curve. Yet, a surge in this data suggests that long positions now hold significant influence over the market.

Read Ethereum’s [ETH] Price Prediction 2024-2025

What next for ETH?

Due to heightened whale involvement and investor tenacity, Ethereum’s ongoing bullish trend is expected to persist.

Long investors are currently dominating the market, implying a potential significant price increase. Yet, there’s still a chance for the bearish trend to persist further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-20 05:11