- Ethereum’s price resilience and key resistance levels suggest potential for an imminent breakout.

- Strong outflows, positive MACD, and dominant long positions indicate a supportive bullish setup.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself intrigued by Ethereum’s current trajectory. The massive outflows from exchanges and the supportive technical indicators suggest that we might be on the cusp of an imminent breakout for ETH.

Ethereum (ETH) is drawing focus yet again due to its significant daily net withdrawal of over 25 million, making it the top blockchain in terms of capital relocation. This massive movement might indicate that prominent investors are cashing out or adjusting their investments strategically.

Currently, Ethereum (ETH) is trading at $2618.54, marking a 3.32% increase at this moment in time. This upward trend leaves us wondering if these withdrawals might strengthen liquidity and potentially spark another bullish rally. Let’s delve into the technical aspects and market signals driving Ethereum’s current price movements.

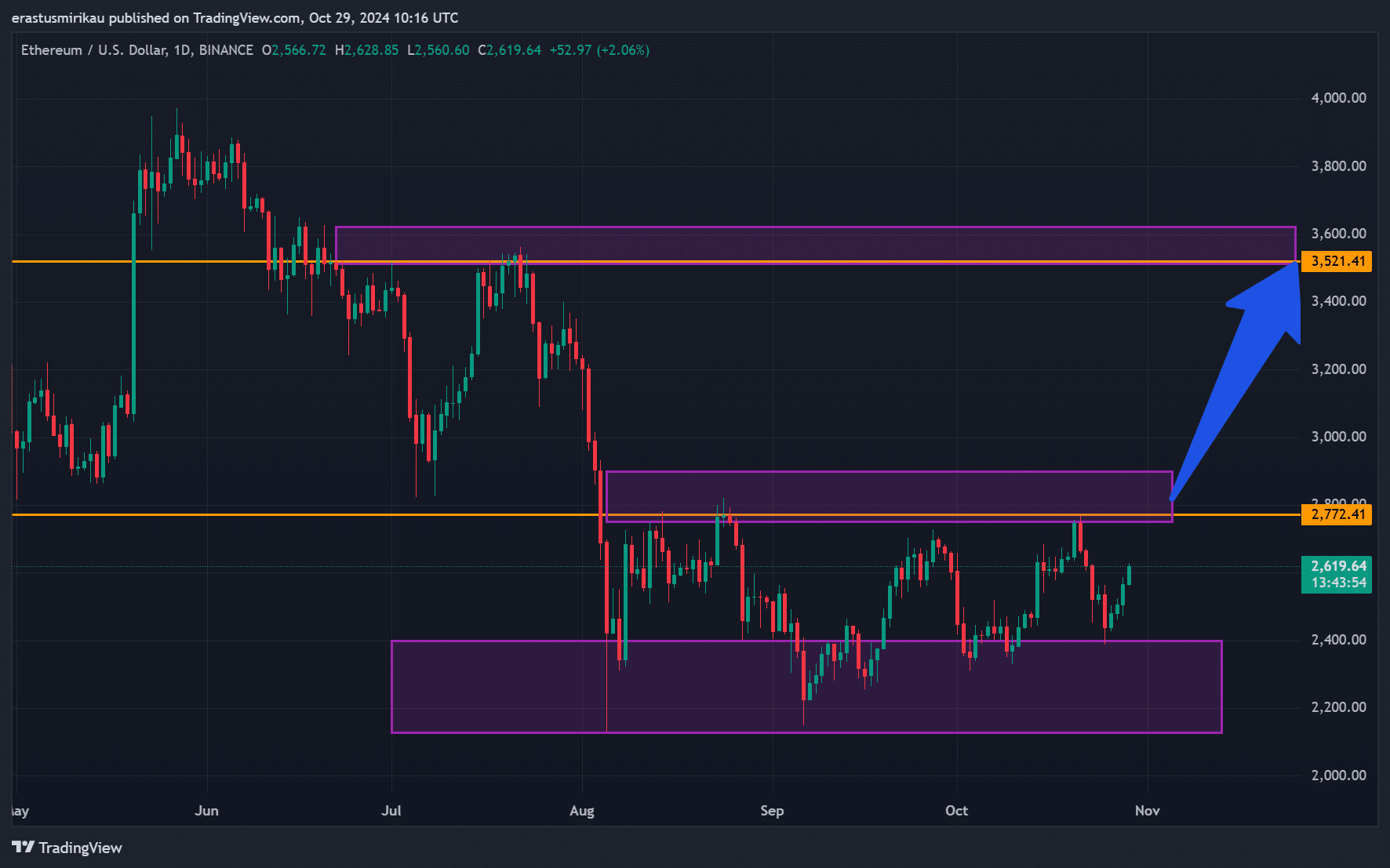

ETH price analysis: Building up to a breakout?

As a crypto investor, I’ve been closely watching Ethereum (ETH), and it seems like we might be on the brink of a significant price surge. Despite the volatility in the broader market, ETH has consistently held its ground above the psychologically significant level of $2,500, indicating potential for a breakout.

This level has proven resilient and may act as a launchpad for a stronger upward push.

Moving forward, $2,772 serves as the next potential resistance point, while $3,521.41 might act as a substantial hurdle. This hurdle could either validate or pause any ongoing bullish trend.

Should Ethereum manage to surpass these key points, it may lead to a swift upward trend. But if the resistance persists strongly, Ethereum could find itself in a period of stabilization, waiting for a significant trigger event to move forward.

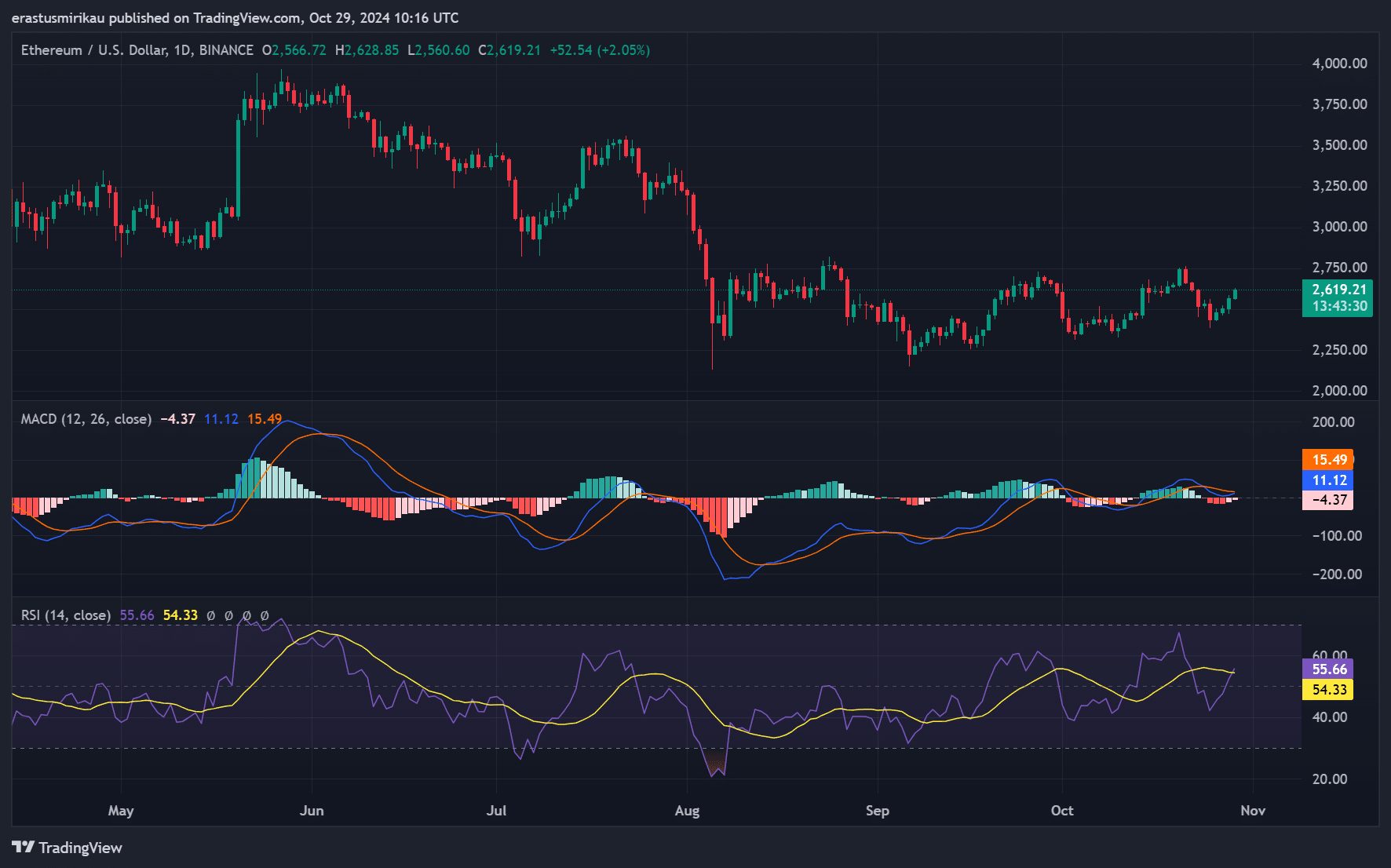

MACD and RSI indicate strengthening momentum

The technical aspects of Ethereum suggest it could be headed for an increase, supported by the Moving Average Convergence Divergence (MACD) indicator. This tool is signaling a bullish trend because the MACD line has crossed over the signal line, which historically can indicate impending positive price movements.

Furthermore, the Relative Strength Index (RSI) stands at approximately 54.33, which suggests a relatively optimistic market trend.

Consequently, Ethereum still shows potential for further price increases before reaching overbought levels, suggesting that buying activity might continue to push prices up in the short term.

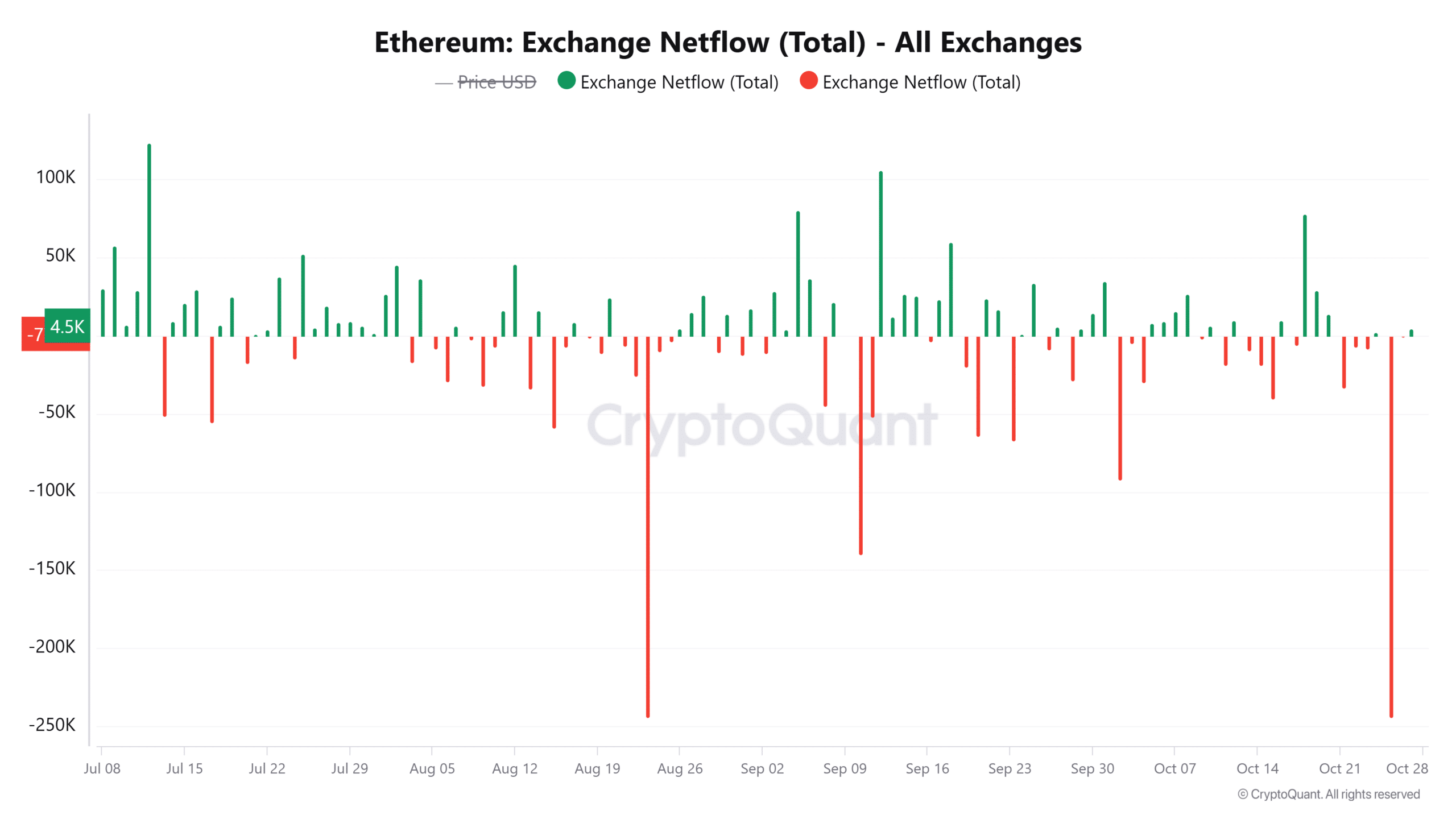

Major outflows from exchanges: A sign of bullish sentiment?

Over the past 24 hours, I’ve noticed an interesting trend with Ethereum – around 4,500 ETH has been moving out of exchanges, representing a 3.03% reduction in readily available liquidity. This could suggest that a substantial amount is being withdrawn for long-term holding or perhaps used elsewhere, leaving less ETH on the trading platforms.

As a researcher studying Ethereum dynamics, I’ve noticed an interesting pattern: When substantial quantities of ETH leave exchanges, it typically indicates that investors are opting for long-term holding or staking their assets elsewhere. This shift decreases the immediate urge to sell, contributing to a more stable market environment.

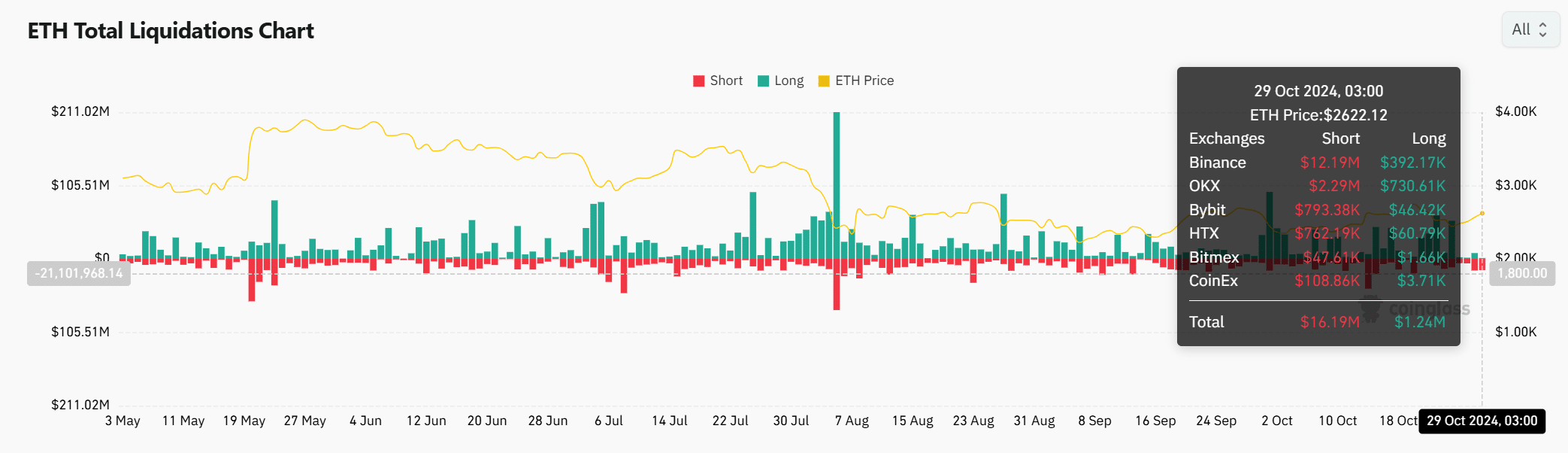

ETH liquidation data highlights dominance of longs

Data on Ethereum’s liquidation suggests a positive outlook, with most liquidations occurring from short positions rather than long ones. This pattern implies that traders are optimistic about Ethereum rising further, as they hold more long positions in expectation of future growth.

As a result, this confidence from long-term investors might increase upward momentum, offering the necessary foundation for a prolonged market rise.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The significant amount of Ethereum leaving exchanges, combined with its favorable technical signs, suggests it might continue its upward trend, potentially leading to a bullish market.

Reaching crucial thresholds might spark a significant upward trend. Ethereum seems primed to soar, considering that liquidity is being concentrated, implying the next few days could be decisive in determining Ethereum’s price movement.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-29 22:16