🚨💸 Ethereum on the Brink of Disaster? 🚨💸

Oh, dear reader, the woes of Ethereum continue to unfold like a tragic Russian novel. The price hovers around key demand zones, as listless as a Sunday morning in a sleepy provincial town. The bulls, those stalwart champions of optimism, seem to have abandoned ship, leaving the bears to revel in their misery.

Technical Analysis

By Edris Derakhshi, our resident cryptic seer

The Daily Chart: A Tale of Woe

On the daily timeframe, ETH has failed to recover above the previous support turned resistance near $2,000. Ah, the cruel whims of fate! The daily structure remains bearish, a bleak landscape of despair, while the rejection from the $2,200-$2,000 supply zone has intensified selling pressure, like a relentless rain pouring down on the parched earth.

The 200-day moving average, currently positioned above $2,800, serves as a haunting reminder of the broader bearish bias, a specter that haunts the dreams of ETH enthusiasts. And the RSI, that trusty indicator, lingers in oversold territory, a faint glimmer of hope in a sea of despair. But will it be enough to stem the tide of selling pressure? Only time will tell.

The 4-Hour Chart: A Dance of Despair

Zooming into the 4-hour chart, ETH has formed a horizontal consolidating pattern, a stagnant pool of mediocrity. The asset recently retested the $1,900 zone but was quickly rejected, a cruel joke played on the hopes of those who dared to dream of a bullish breakout. The RSI has also pulled back from its previous bounce, a faint whisper of weakening momentum, a reminder that even in the darkest of times, there is always hope… or is there?

Sentiment Analysis: A Study in Futility

By Edris Derakhshi (TradingRage), our resident prophet of doom

Exchange Reserve: A Sea of Uncertainty

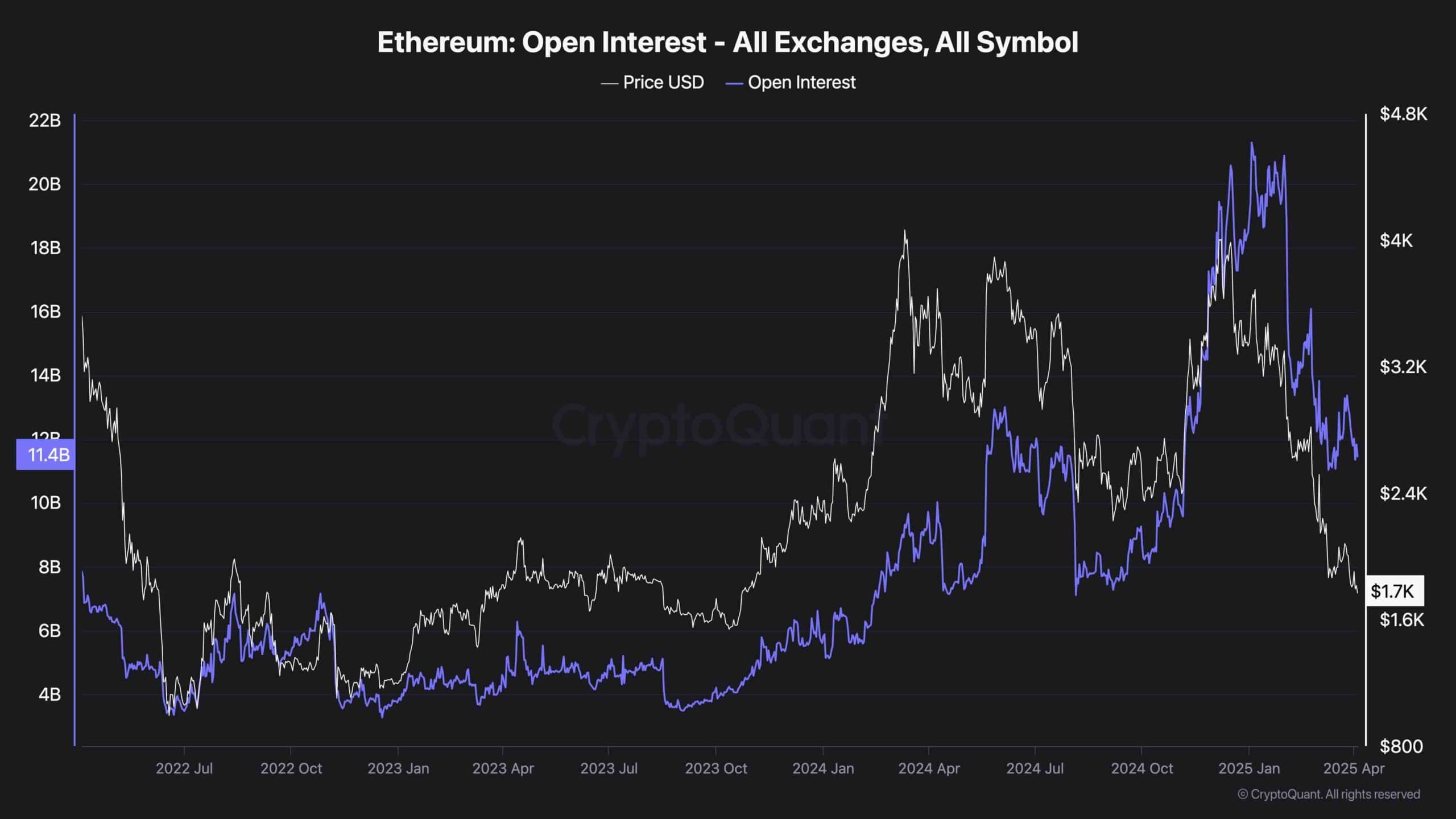

From a sentiment and open interest perspective, Ethereum’s open interest has remained elevated compared to historical values in recent years, even as the price continues to slide. Ah, the cruel irony! This suggests an influx of aggressive short positioning or late leverage entering the market, a ticking time bomb waiting to unleash its fury on the unsuspecting masses. If this open interest unwinds rapidly, it could trigger short squeezes on any upside volatility, a fleeting glimpse of hope in a world gone mad. But until then, it adds pressure and risk of continued liquidations, especially near key support zones.

Read More

2025-04-04 16:40