- Ethereum price mirrored Bitcoin, showing volatility, with recent staking inflows leading to price declines.

- Analysts predicted a potential rally for Ethereum, targeting a $3,000 price point amid market adjustments.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of ups and downs. The recent performance of Ethereum [ETH] has been intriguing, to say the least. While the staking inflows indicate a growing commitment to the network’s security, they seem to be causing short-term price volatility, as history suggests.

In terms of cryptocurrencies, Ethereum (ETH), currently ranked second by market capitalization, has mirrored Bitcoin (BTC) in its efforts to reach new peaks but has experienced a setback instead. Over the past week, Ethereum has seen a drop of 2.1%.

Today’s downtrend seems to have continued, with Ethereum dropping by a slight 0.2%. This recent drop has caused the asset to be trading at $2,619, as I write this message.

Ethereum staking inflows soars

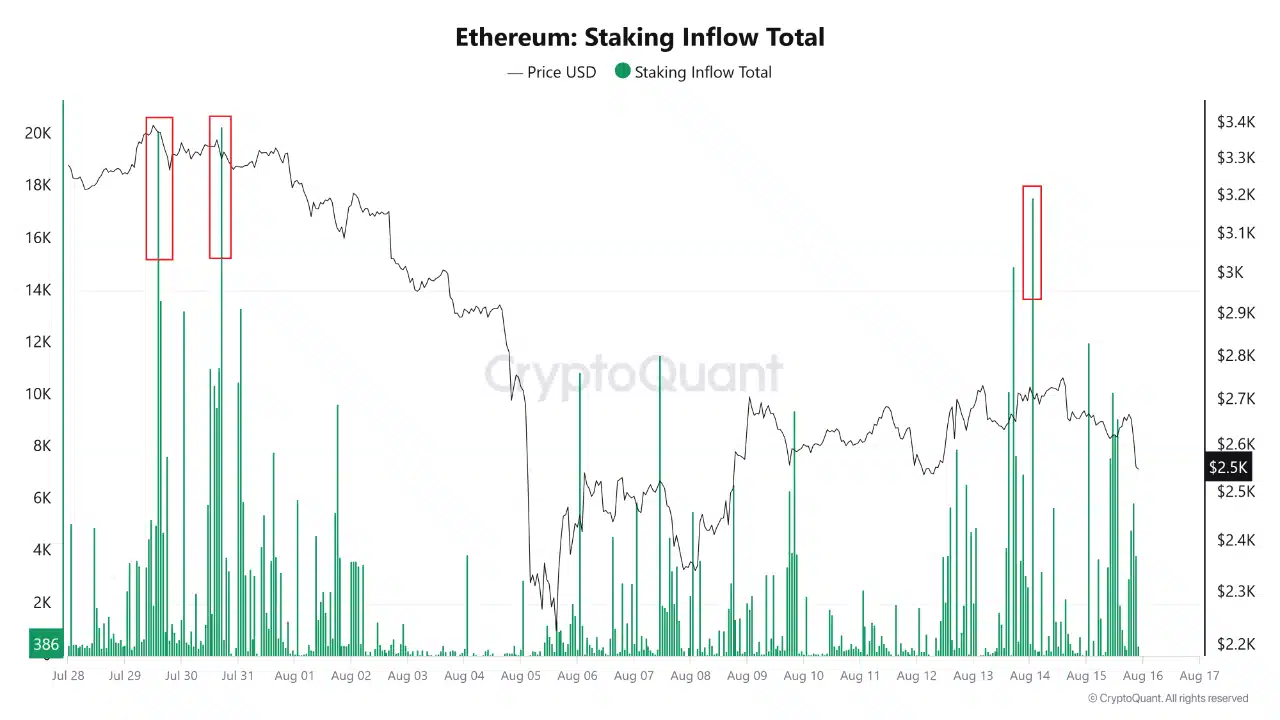

It was noted by CryptoQuant that there’s been an increase in deposits for staking on Ethereum, which suggests a rising curiosity among users to contribute to the network’s security using the Proof of Stake system.

As a crypto investor, I’ve noticed an increase that has propelled the total staking amount beyond 16,000 ETH. Interestingly, there seems to be a link between these influxes and subsequent declines in price.

Based on analysis by a CryptoQuant expert, it appears that large inflows into Ethereum staking have historically been followed by drops in the Ethereum market price, as seen in data from July and mid-August. In simpler terms, when more ETH is being staked (locked up to earn rewards), there seems to be a tendency for the Ethereum’s market price to decrease noticeably afterwards.

Based on my personal experience as a long-time investor and observer of the cryptocurrency market, I have noticed that staking mechanisms can indeed bolster network security and foster stakeholder commitment, which are crucial elements for any successful blockchain project. However, it’s essential to acknowledge that these benefits come with a trade-off: short-term price volatility caused by the locking up of liquidity.

Is a near-term surge to $3,000 still possible?

Additionally, certain analysts maintained a positive outlook regarding Ethereum’s prospects for rebound and expansion.

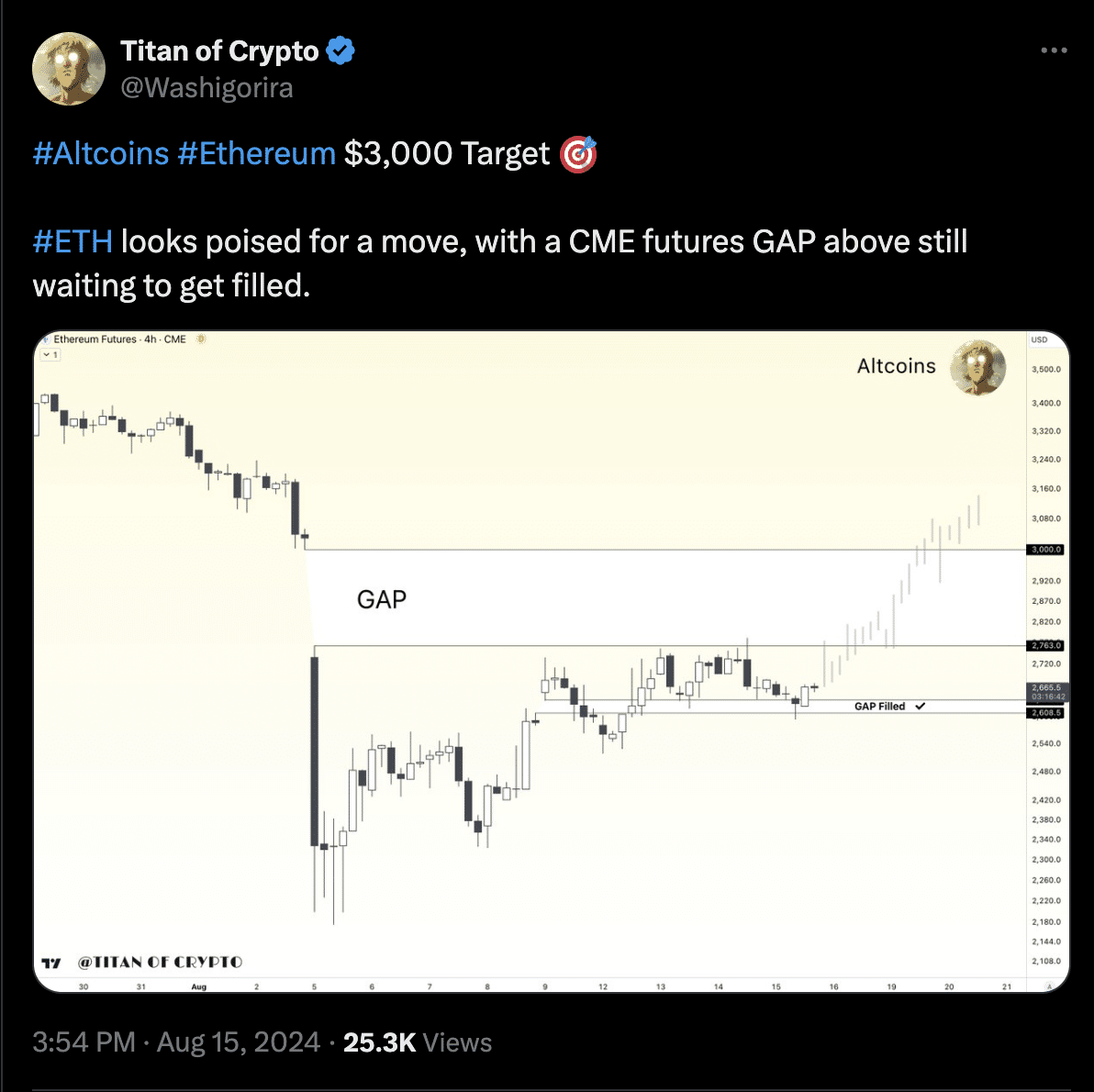

Notably, an influential cryptocurrency expert, previously recognized on Twitter as “Titan of Crypto,” has forecasted a potential value of $3,000 for Ethereum.

The forecast suggests that there might be an increase in price due to the current absence of a Comprehensive Measures Exchange (CME) future price gap, a pattern in history that has often signaled such a rise.

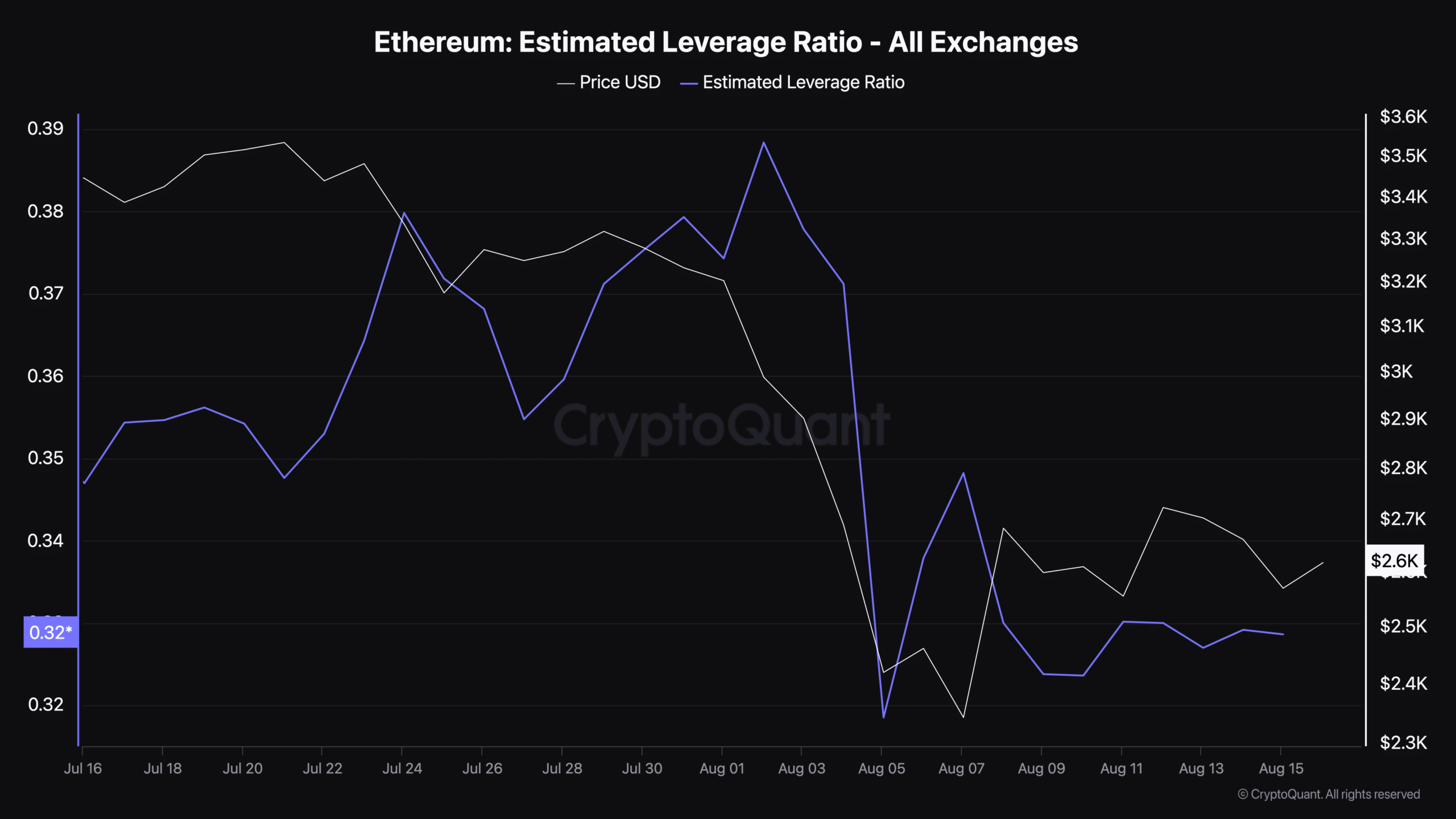

As a researcher, I find it noteworthy that the estimated leverage ratio on Ethereum currently stands at 0.328, as reported by CryptoQuant. This figure indicates a relatively conservative and steady market leverage scenario, suggesting a balanced state in the market.

Read Ethereum’s [ETH] Price Prediction 2024-25

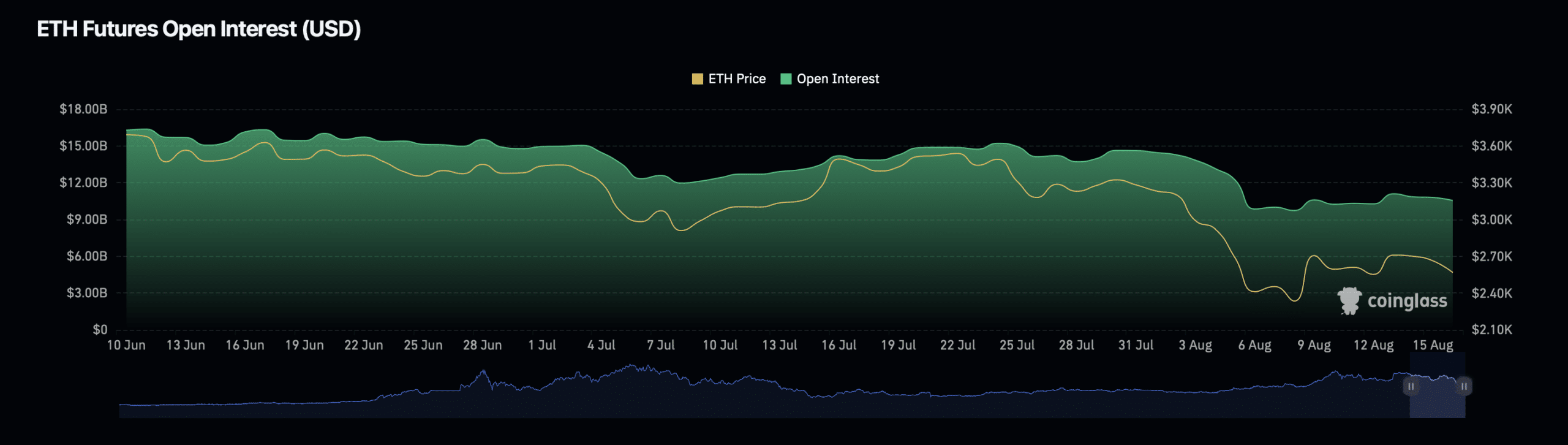

Evaluating this ratio in comparison with the recent drop in Ethereum’s Open Interest on Coinglass suggests a cautious attitude among traders.

However, it also highlighted the room for bullish momentum should market conditions improve.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-08-16 23:04