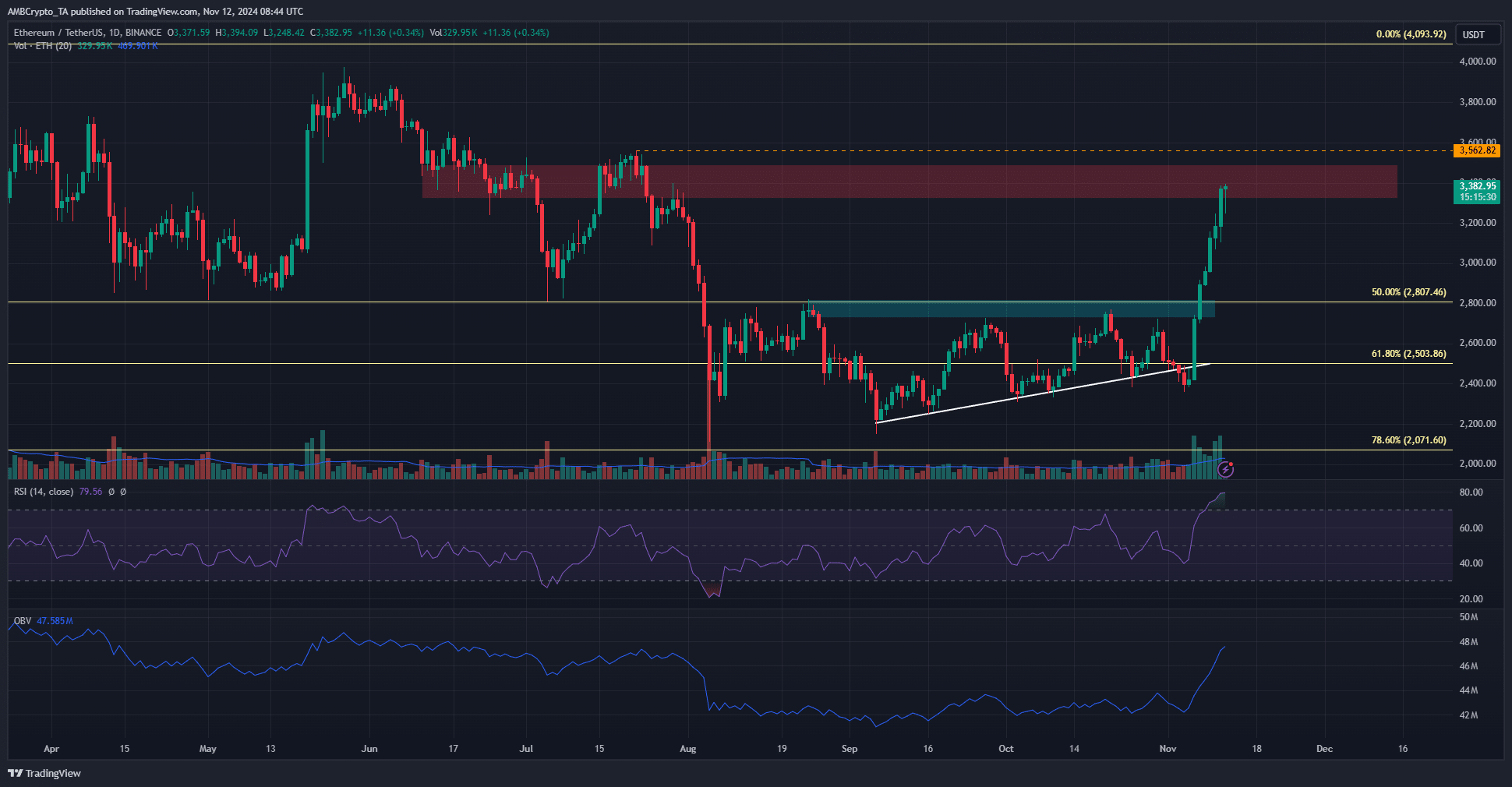

- Ethereum rocketed past the $2.8k resistance to reach $3.4k within a week

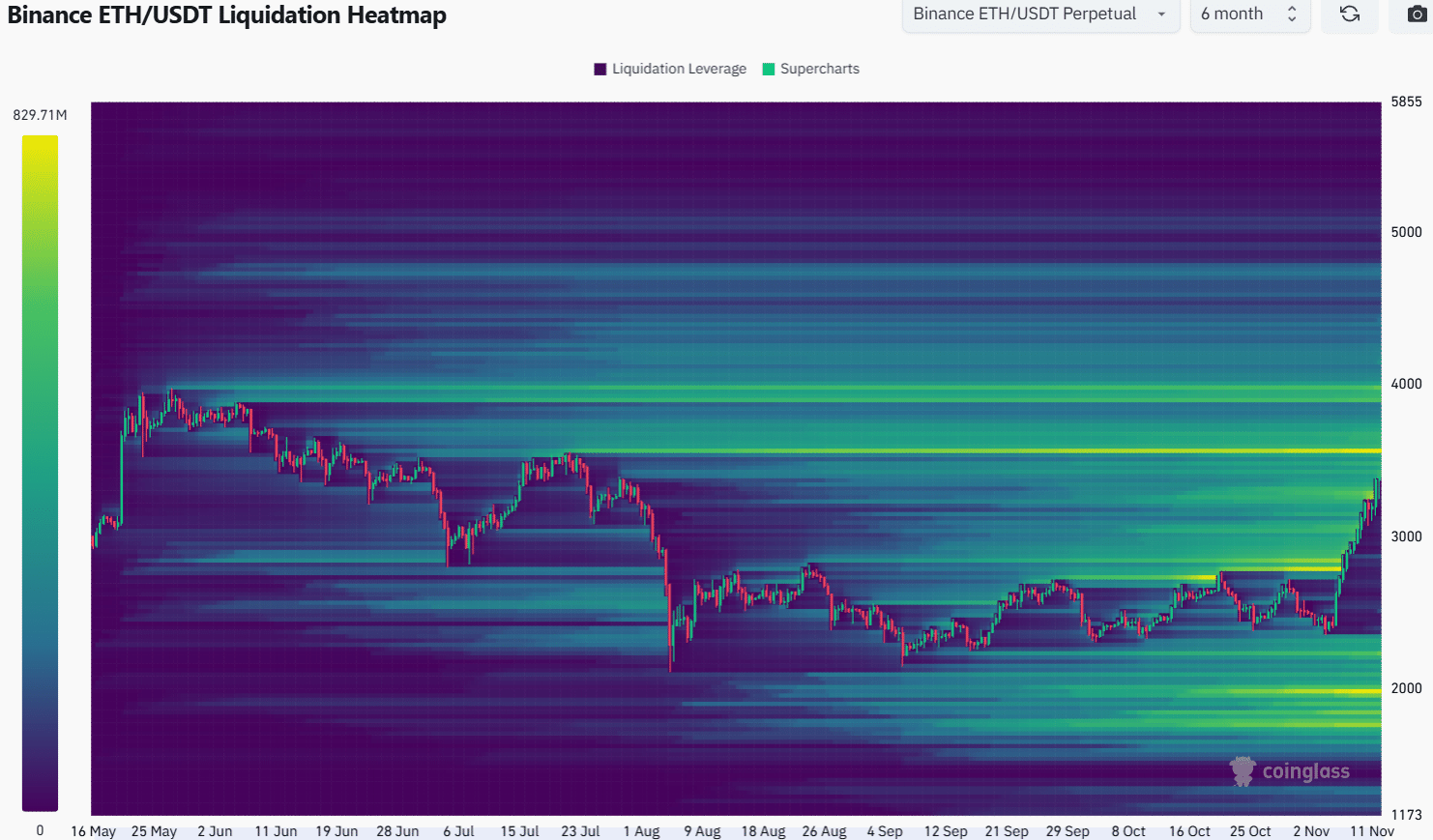

- The liquidation levels building up at and below $4k were reasonable targets for ETH prices

As a seasoned analyst with over two decades of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The recent surge in Ethereum [ETH] prices has been nothing short of breathtaking, and it’s clear that we are currently in the midst of a significant bull run.

In simpler terms, the price of Ethereum [ETH] has successfully surpassed the $3,200 barrier and is now aiming towards the $3,500 and $4,000 price points, which are considered significant psychological thresholds. AMBCrypto’s technical analysis suggests that the $3,562 region could play a crucial role in the next strong upward trend.

As network activity grew and transactions spiked, it became evident that the network was in high demand. Looking ahead, Ethereum’s price forecast shows a very optimistic outlook on longer time scales following the recent surge.

The importance of $3,562 on the higher timeframes

A week ago, Ethereum appeared to break down beneath the ascending triangle pattern. This was a bearish sign, but the price was quick to reverse, and has had 43.1% gains since last Tuesday.

It became clear that the “breakdown” was actually a deceptive maneuver. A more precise assessment over the last two months would have identified it as a range formation instead.

1) In simpler terms, the OBV exceeded its peak from the last three months and nearly reached the June levels. This indicates a strong bullish trend, as suggested by the Relative Strength Index (RSI) of 79.5.

ETH might need a couple of days to gather strength, considering it has faced resistance since June and July.

As a researcher analyzing Ethereum’s price movement on a weekly basis, I noticed that the previous high of $3,562 in late July marked the beginning of a downtrend. If we surpass this level in future analysis, $4,000 could potentially be the next target for Ethereum’s price.

Further gains highly likely for Ethereum

By examining a six-month historical perspective, AMBCrypto discovered zones of liquidity extending as high as $4,000 on their liquidation heatmap.

Read Ethereum’s [ETH] Price Prediction 2024-25

Noteworthy were the peak prices recorded in July, specifically $3,562. This level holds significance not only on the weekly graph but also because it serves as a densely populated liquidity pool.

The scarcity of Ethereum selling prices towards the south indicates a higher likelihood of Ethereum moving northwards in the upcoming days and weeks. Keep an eye out for market fluctuations on shorter time periods, as they may indicate increased volatility.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-11-13 12:07