- Metrics suggested that Ethereum was undervalued.

- Market indicators gave ambiguous signals regarding an upcoming bull rally.

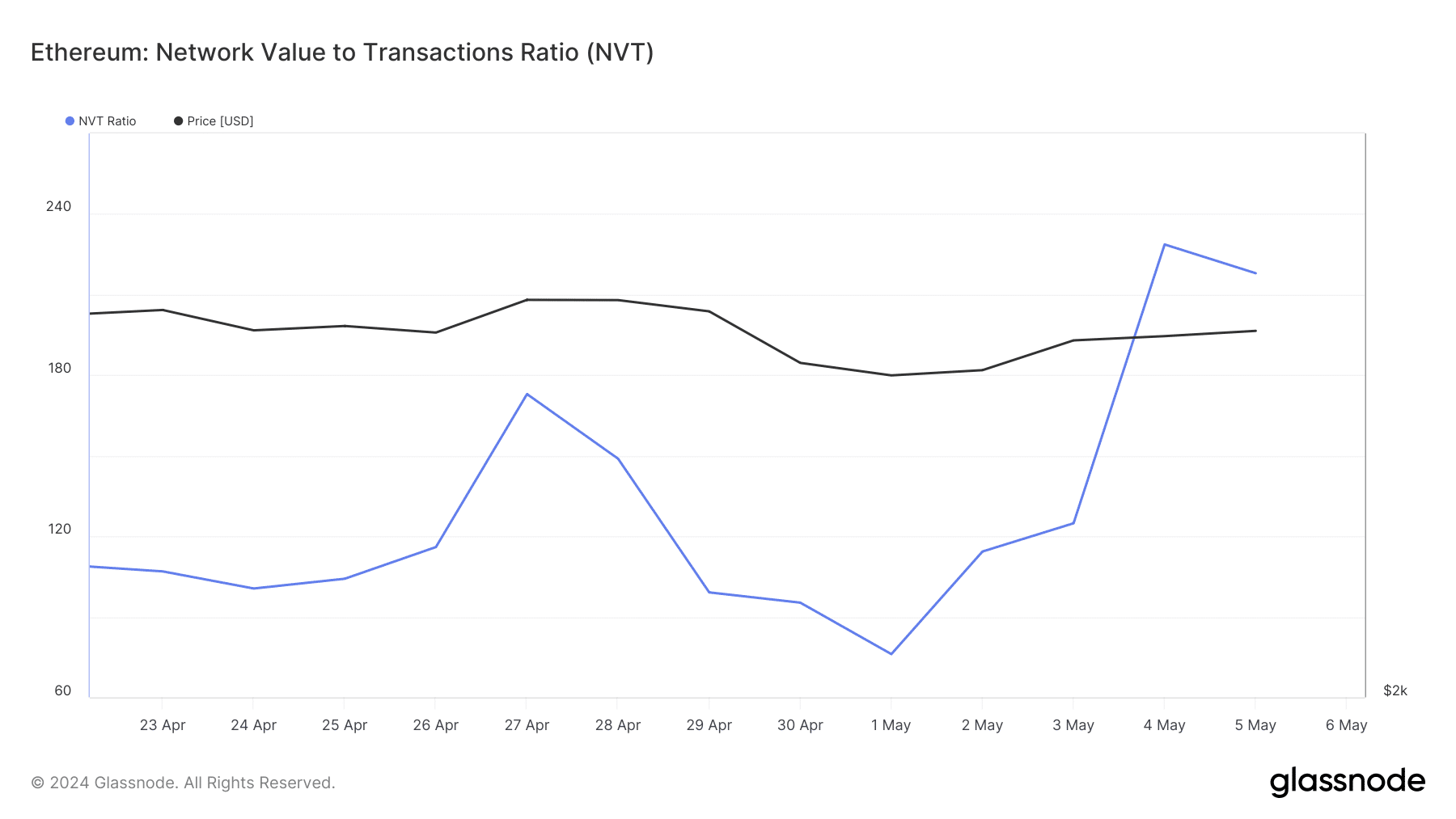

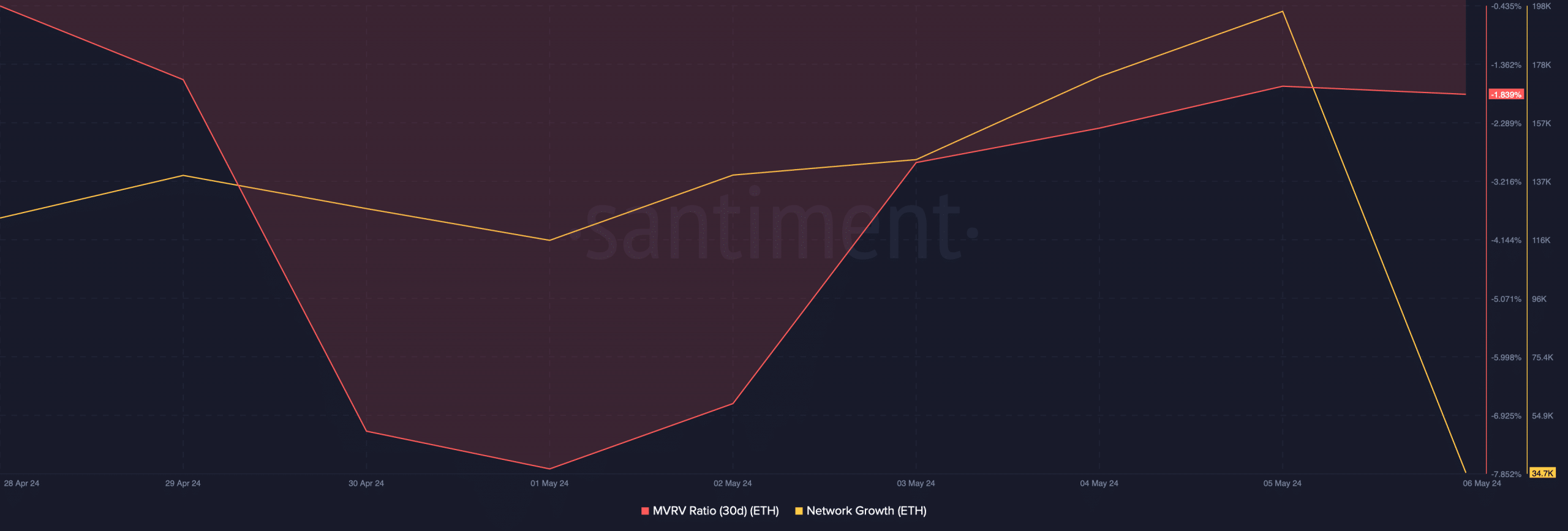

As an experienced analyst, I’ve closely watched Ethereum’s price action and studied its metrics carefully. The metrics suggested that Ethereum was undervalued based on its Network To Value (NVT) ratio, which had taken a downtick after a sharp increase. Furthermore, other bullish indicators like the MVRV ratio improvement and high network growth were visible.

On May 6th, Ethereum [ETH] regained its footing and surpassed the $3,100 mark once more. As the price tag hit this significant level, it also strengthened its position within a bullish trend.

A breakout above the pattern could allow ETH to reach new highs in the coming weeks.

Ethereum price prediction

last week brought disappointment for investors as the price of the leading altcoin dropped significantly to hit a low of $2.8k. But starting from May 1st, the token’s price began to surge upward, regaining bullish momentum.

Based on data from CoinMarketCap, Ethereum’s price has risen by more than 1.55% within the past 24 hours. At this moment, Ethereum is being bought and sold at approximately $3,144.11. Its total market value exceeds $377 billion.

Recently, the well-known crypto analyst, World of Charts, drew attention to a descending triangle formation on Ethereum’s price chart in a recent tweet.

I’ve noticed that the token has been trading within a specific range or pattern since early March. According to recent analysis and a tweet I came across, the corrective phase for Ethereum (ETH) has ended. Now, ETH is moving upwards towards the upper trendline of this falling wedge pattern.

If Ethereum manages to make a strong escape from the falling wedge pattern, we could witness a substantial price increase of around 45% to 50% in the upcoming weeks. This upward trend could potentially propel Ethereum beyond its previous March high.

Is Ethereum ready for a rally?

An in-depth examination of Ethereum’s on-chain statistics by AMBCrypto was conducted to determine if they indicated the potential for a price surge.

Significantly, the Network Value to Transactions (NVT) ratio of Ethereum experienced a decline following a notable rise. A decrease in this measure implies that the asset may be underpriced.

In examining Santiment’s data, we identified several positive indicators for Ethereum. Specifically, its MVRV (Market Value to Realized Value) ratio enhanced during the past week. Additionally, there was a notable increase in its Network Growth.

This meant that more new addresses were created to transfer the token, reflecting high activity.

According to a recent tweet from Lookonchain, a significant sale of Ethereum (ETH) occurred, with a single entity unloading approximately 7,000 ETH. This transaction equated to more than $22 million at the current market price, as reported by AMBCrypto Converter.

This seemed bearish, as it hinted that the whale was expecting a price drop.

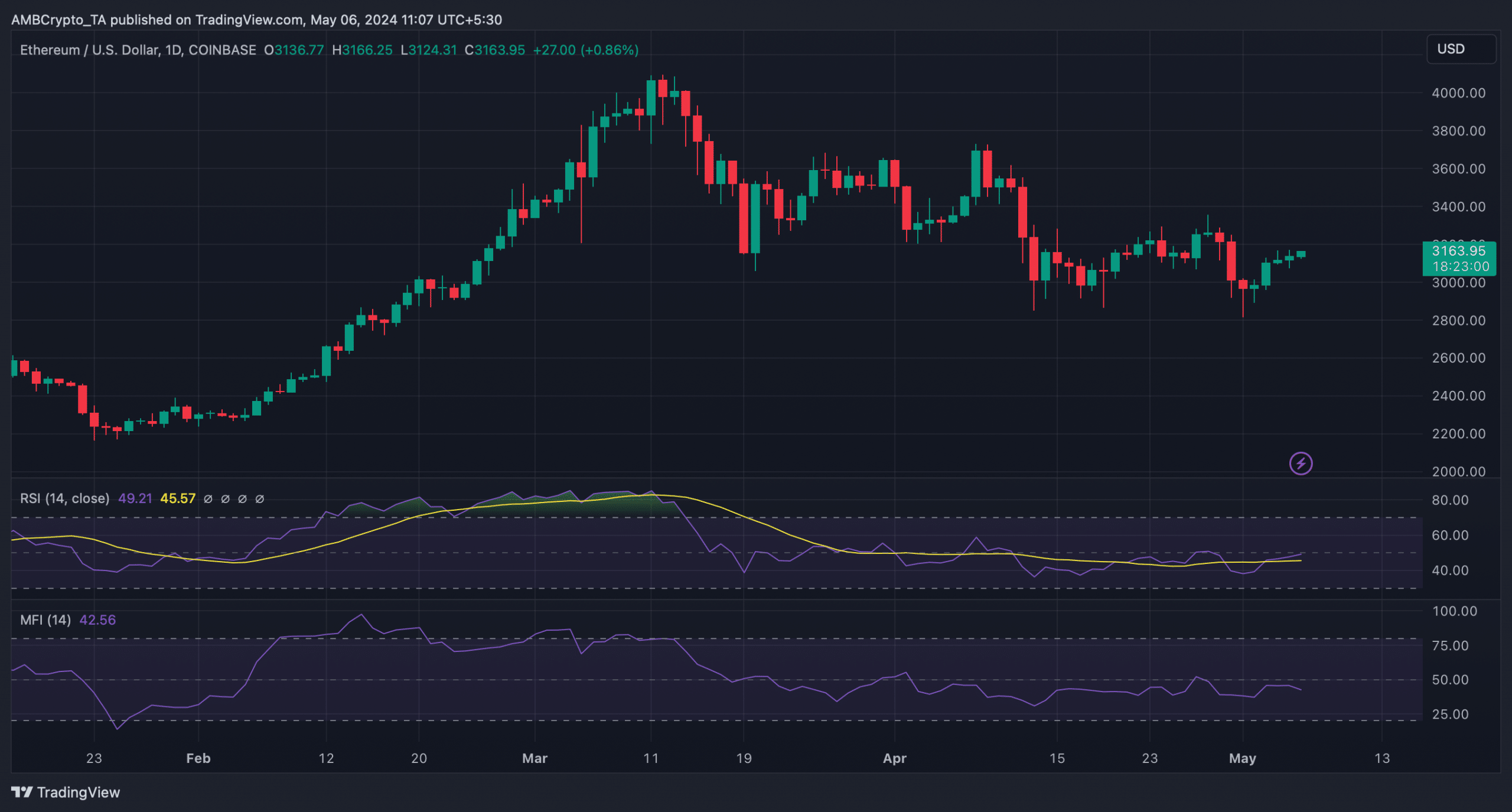

To gain a clearer perspective on if Ethereum’s price could surge past its falling wedge formation, AMBCrypto examined its daily chart in detail.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on our examination, Ethereum’s Relative Strength Index (RSI) showed an increase to 49.7, implying a strong likelihood for a price rise.

As a crypto investor, I’ve noticed that the Money Flow Index (MFI) hasn’t been on the side of the bulls lately. In fact, it’s been hanging out beneath the neutral threshold of 50, indicating that the sellers have had the upper hand in the market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

2024-05-06 17:12