- The $2.6k support zone was decisively broken over the past two weeks

- Ethereum sellers’ consistent dominance has investors worried

As a seasoned researcher with years of experience tracking the crypto market, I can confidently say that the current state of Ethereum [ETH] has me concerned. The decisive break below the $2.6k support zone over the past fortnight and the consistent dominance of sellers have left investors feeling uneasy.

As an analyst, I’ve noticed that Ethereum (ETH) has formed an ascending triangle pattern on the higher timeframes, which typically indicates a bullish outlook. Despite the 16.6% drop from Tuesday to Friday, this decline falls within the boundaries of this optimistic pattern, suggesting that long-term investors might find reasons for optimism and anticipate recovery.

Ethereum hasn’t outperformed Bitcoin, which usually sets the pace in the cryptocurrency market, and this lack of comparable success has been a source of disappointment for investors. Furthermore, the recent sale of 1000 ETH by the Ethereum Foundation didn’t help to improve investor confidence.

Daily wick from early August has been filled

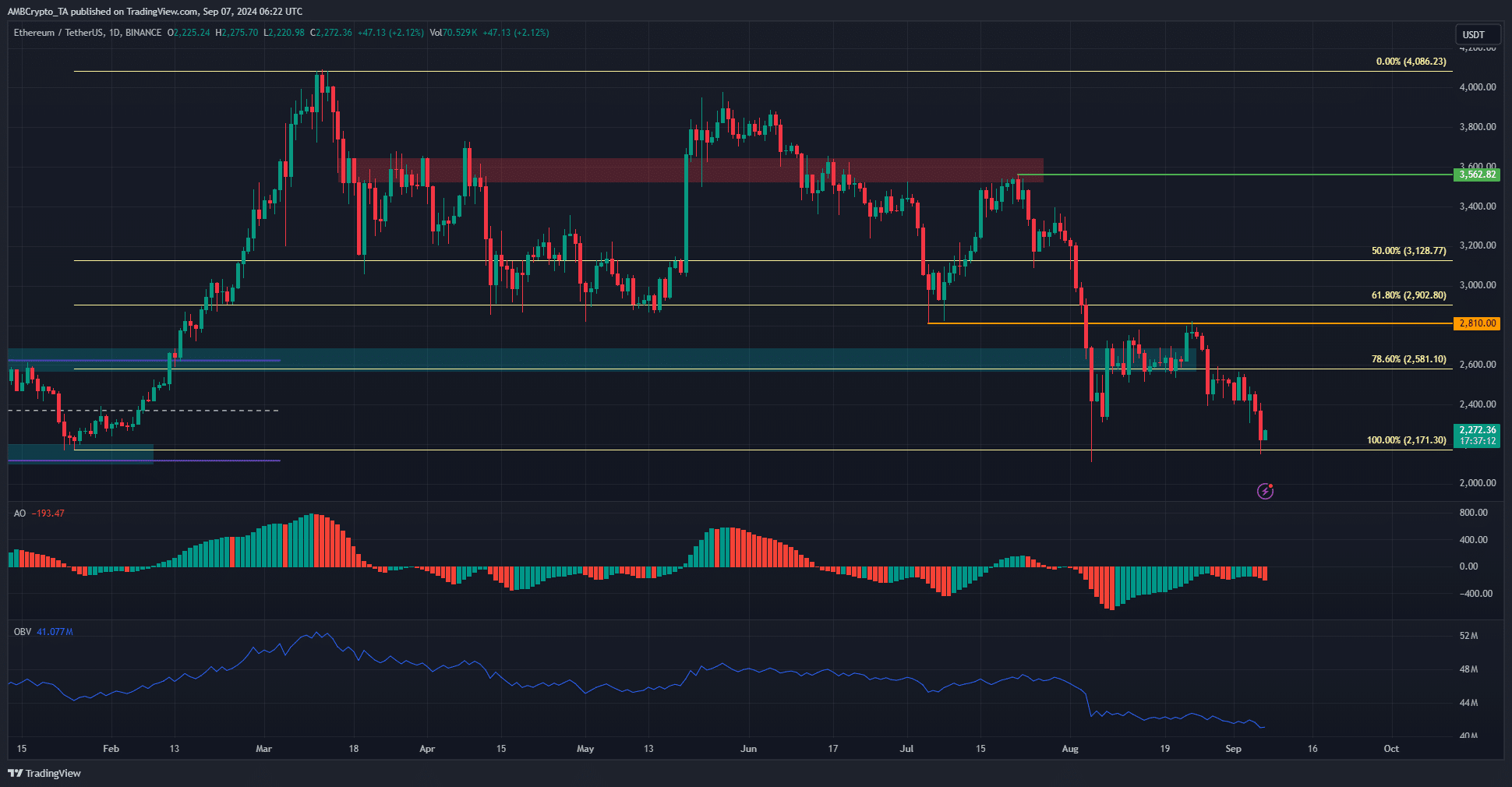

The advance made in February has completely reversed. In the latter part of July, losses were encountered which led to a test of the $2171 area; this area was revisited on September 6th as well.

As a crypto investor, I’ve noticed that the Awesome Oscillator’s histogram has been displaying red bars beneath zero, indicating a strong surge in bearish momentum. Since early August, this bearish trend has maintained its control without letting go.

Two weeks ago, Ethereum’s price hovered above $2.6k, suggesting a potential recovery. However, the OBV (On-Balance Volume) has been on a decline, indicating sustained selling pressure.

Since that time, I’ve noticed a significant breakthrough in the resistance level, which served as the high range in early 2024. This development suggests a potential for further declines, considering the clear upper hand held by the sellers at present.

Ethereum vs Bitcoin also reflected weakness

Since early 2023, the weekly chart of Ethereum versus Bitcoin has shown a persistent decline. This downtrend broke through the 2022 low of 0.056 in the year 2024, and since then, the value of Ethereum relative to Bitcoin has consistently dropped on these charts.

Read Ethereum’s [ETH] Price Prediction 2024-25

Concerns arose about the resilience of the altcoin market, given Ethereum’s sluggish performance. As for the older coins, they may find it challenging to attract the fresh capital pouring into the market, especially during a potential bull market.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-09-07 16:07