- Ethereum’s funding rate has sharply declined since rejection at $4k

- On the price front, ETH has declined by 10.08% over the last 7 days

Over the past three weeks, I’ve noticed that my Ethereum investments have been struggling to gain traction, failing to build any significant upward momentum as depicted on the charts. To be frank, it’s been a rollercoaster ride with Ethereum experiencing drastic price fluctuations, all while trading within a narrow range rather than making any substantial progress.

Currently, Ethereum is being exchanged for approximately $3,232. This represents a decrease of 10.08% over the past week, and there’s a potential drop of an additional 1.85% in the bearish trend if we look at the daily price movements.

Amid Ethereum’s failure to maintain a steady increase, there are growing worries within the cryptocurrency community, as analysts have identified some uncertainty. For example, Cryptoquant analyst Shayan advises that for Ethereum to continue an upward trend, it must successfully defend its $3k support zone.

Ethereum’s funding rate declines

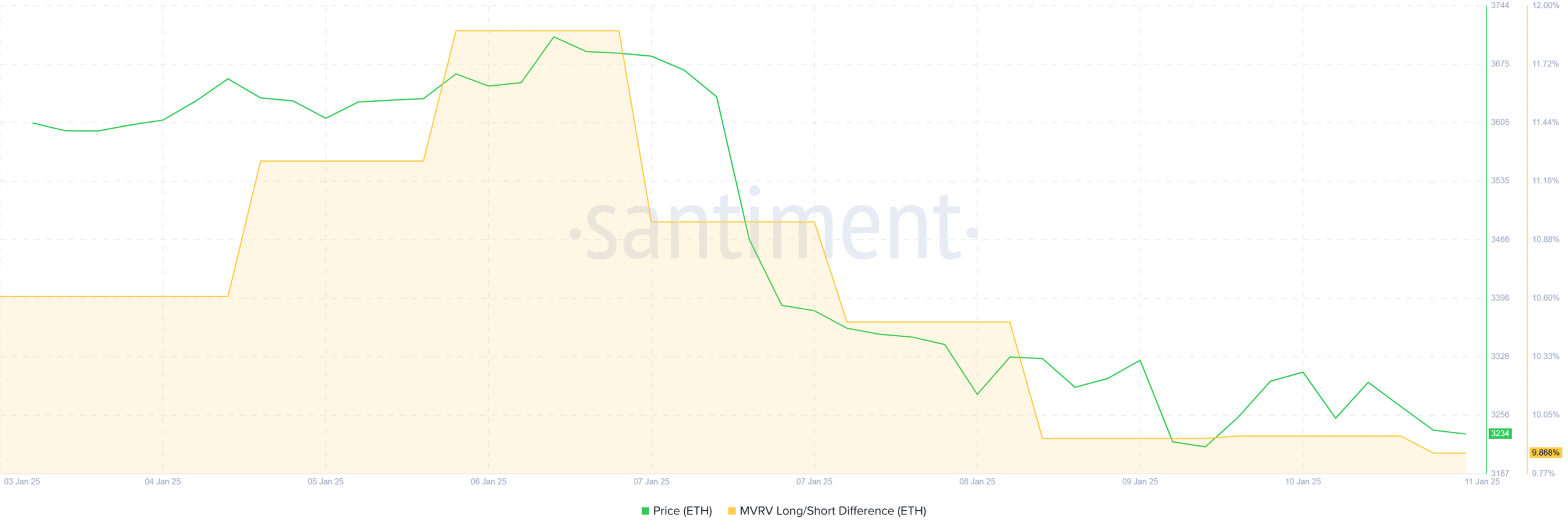

Based on insights from Shayan at Cryptoquant, I’ve observed a significant decrease in Ethereum’s funding rate following its rejection at the $4k resistance level.

The significant decrease in the funding rate indicates a dwindling interest in investing, which weakens Ethereum’s upward price trend. Consequently, unless there’s a resurgence of investor trust, it may prove challenging to maintain a bullish trend.

With a decrease in funding rate, there’s an increased risk that the price of Ethereum (ETH) could dip below $3,000. Maintaining the $3,000 support level is crucial for ETH’s stability and to spark any further price increase. However, if ETH falls below this level while the funding rate keeps declining, it may trigger more selling and a potentially larger correction.

In other words, whether Ethereum maintains an upward trajectory hinges on it recapturing a more favorable funding rate and successfully defending the $3k price point as its support. These factors will ultimately influence where Ethereum’s trend is headed next.

What it means for ETH’s charts

As an analyst, I’ve observed a significant trend: when the funding rate drops significantly, it typically indicates that investors are liquidating their long positions on Ethereum (ETH). Translated, my analysis hints at a possible change in market mood towards pessimism regarding ETH.

Over the last four days, there’s been a noticeable drop in the Relative Strength Index (RSI), indicating a significant decrease in market vigor. This downward trend suggests robust bearish pressure and a potential weakening of the upward trend.

This phenomenon can be further confirmed by a dropping +DI and rising -DI.

Examining more closely, it’s clear that there’s a change in investor attitude towards the market, as indicated by an increasing interest in taking short positions, particularly with Ethereum (ETH). According to Coinglass, about half or 52% of all traders are currently adopting this strategy.

If traders who have taken a “short” position increase, it indicates a pessimistic outlook because they anticipate the price to decrease.

In summary, Ethereum’s MVRV long-short ratio decreased by 9.86% in the past week. This decrease suggests that long-term investors are experiencing less profitability and, moreover, are becoming less confident. Historically, when long-term holders lose confidence, they often decide to sell their assets.

To summarize, the decrease in funding rates makes Ethereum vulnerable to potential decreases, with the altcoin possibly falling to around $3,160 if this downward trend persists alongside investor pessimism.

Maintaining the positive trend requires that the support at $3k remains firm. If it falls below $3,026, there’s a possibility that Ethereum might drop to around $2,800.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-12 06:15