- Ethereum made recent gains that were likely not on the back of organic demand.

- The liquidity hunt in the coming days could see prices reach $2.9k.

As a seasoned crypto investor with a keen eye for market trends, I must admit that Ethereum’s recent gains have left me somewhat skeptical. While institutional interest and whale accumulation are certainly positive signs, the rapid surge seems to be more fueled by liquidity from late short-sellers rather than organic demand.

A few days back, Ethereum (ETH) seemed appealing to investors as institutional interest surged and large-scale investors (whales) increased their holdings of the token.

Some gains were made over the past two days, bringing prices up to $2672 at press time.

To share some fresh updates, Ethereum co-founder Vitalik Buterin has endorsed an idea for numerous block proposition contributors within the system. The aim is to mitigate potential issues related to centralization and manipulation.

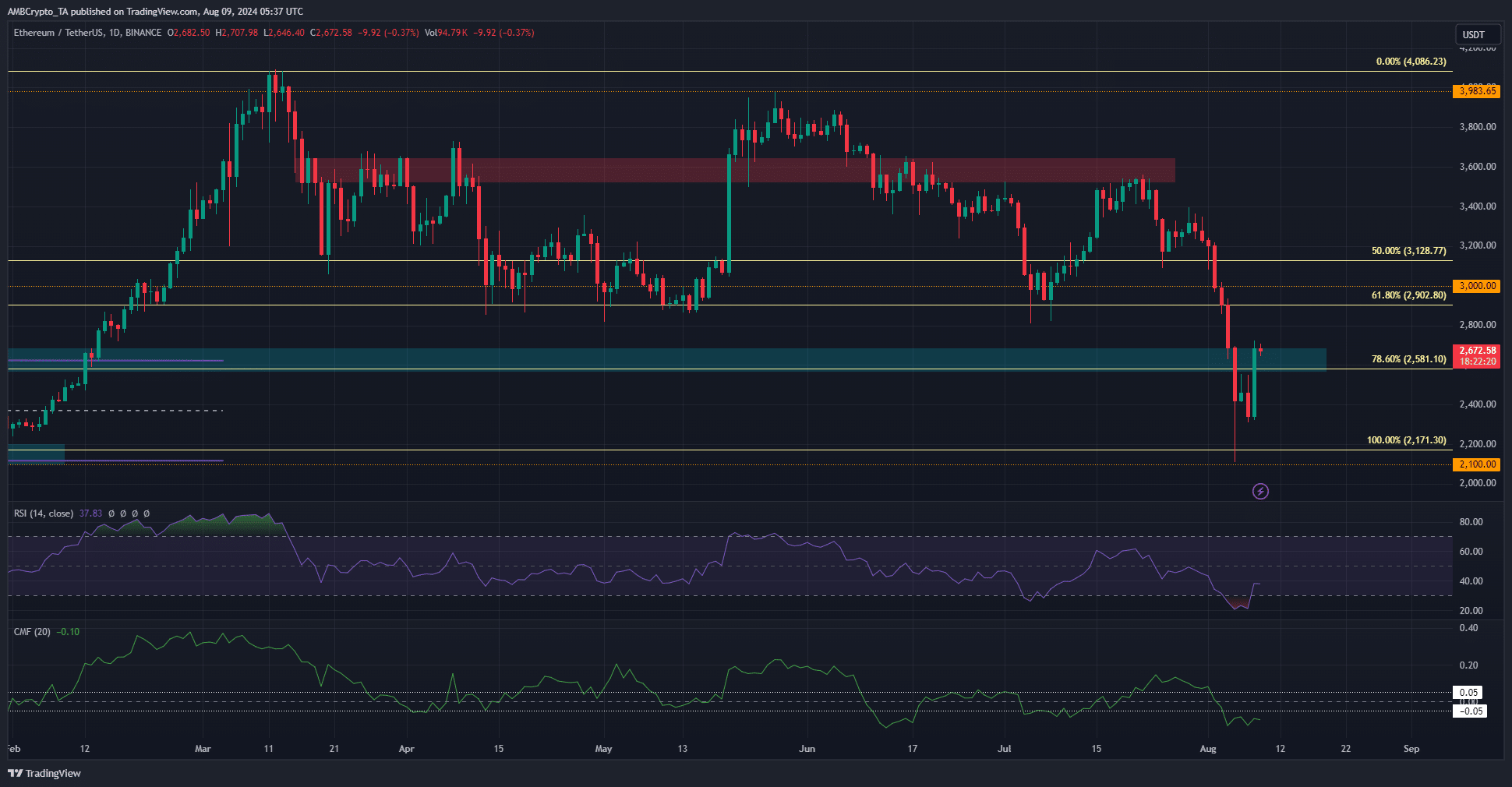

Resistance overhead appeared ominous for Ethereum buyers

In January and February of this year, a price range between $2580 and $2680 acted as a barrier preventing the bulls from advancing. To continue their momentum, it’s crucial for the bulls to transform this resistance zone into a support zone in the upcoming days.

Based on the analysis of various technical indicators, the situation appears less promising. Specifically, the Relative Strength Index (RSI) stands at 37, indicating a strong downward trend. Similarly, the Chaikin Money Flow (CMF) is currently -0.1, suggesting significant outflow of capital from the market, which has contributed to reversing recent price increases.

It appears that the increase in price, starting from the $2.1k bottom, may have been primarily fueled by the desperate buying from those who had previously sold short, rather than a surge in genuine demand. Consequently, there’s a possibility of another downturn following this liquidation process.

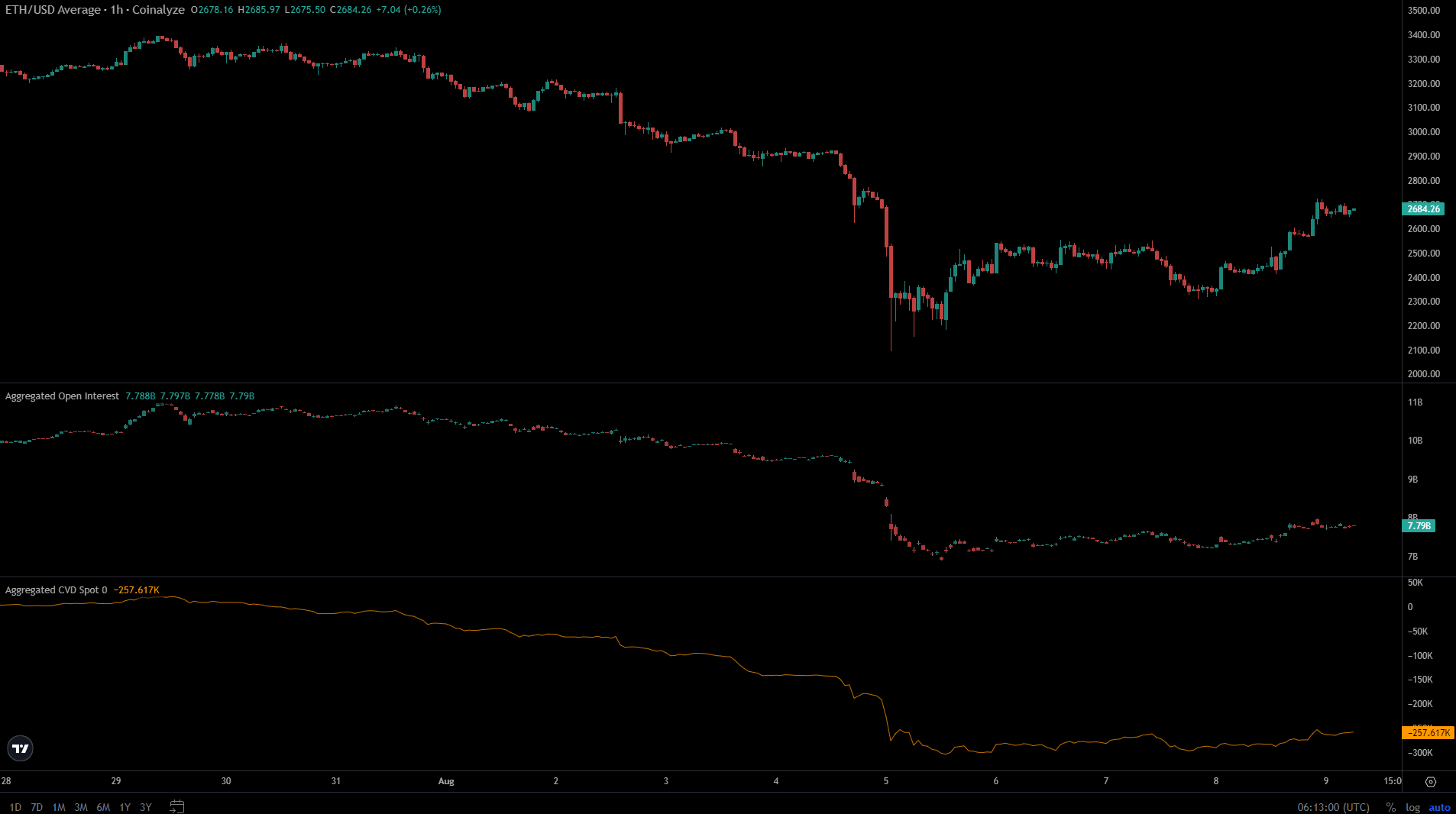

Lack of conviction from speculators

Over the past few days, since hitting its lowest point on Monday, Ethereum (ETH) has surged by an impressive 27%. However, it’s worth noting that while the price has seen substantial growth, the Open Interest has only marginally increased from $7.07 billion to $7.79 billion. This increment is relatively modest when compared to the substantial price gains observed. As a researcher studying this market, I find this disparity intriguing and worthy of further investigation.

This showed that speculators lacked bullish conviction.

Still, the spot CVD saw a slow uptrend initiated, which was a piece of good news for the bulls.

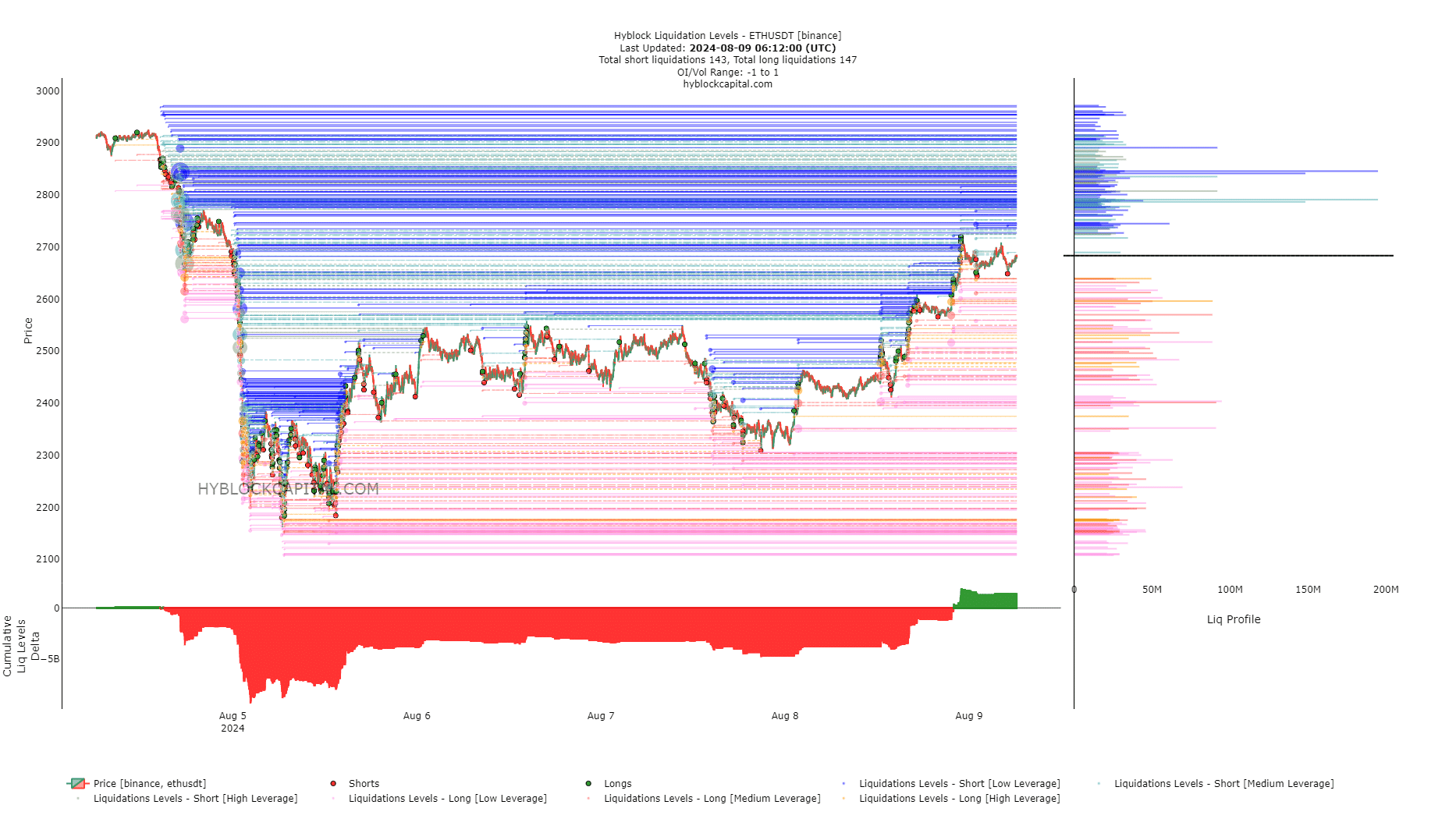

Upon my examination of the liquidation levels chart provided by AMBCrypto, I observed a notable shift towards long positions gaining prominence. Specifically, the cumulative liquidation levels delta was progressively showing more positivity, suggesting that the balance might be tilting in favor of long positions.

Read Ethereum’s [ETH] Price Prediction 2024-25

To the north, the $2791 and $2845 are the biggest liquidation levels.

In other words, because the increase (delta) wasn’t exceptionally large, it’s likely that further price growth in the short term will continue. Above $2845-$2900, bulls might face difficulties, and prices may start to drop after reaching that point.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-08-09 14:15