-

ETH’s performance against Bitcoin was less than ideal, leading to a weekly bearish structure.

Until the $2.8k and $3k levels are breached, the outlook will remain bearish.

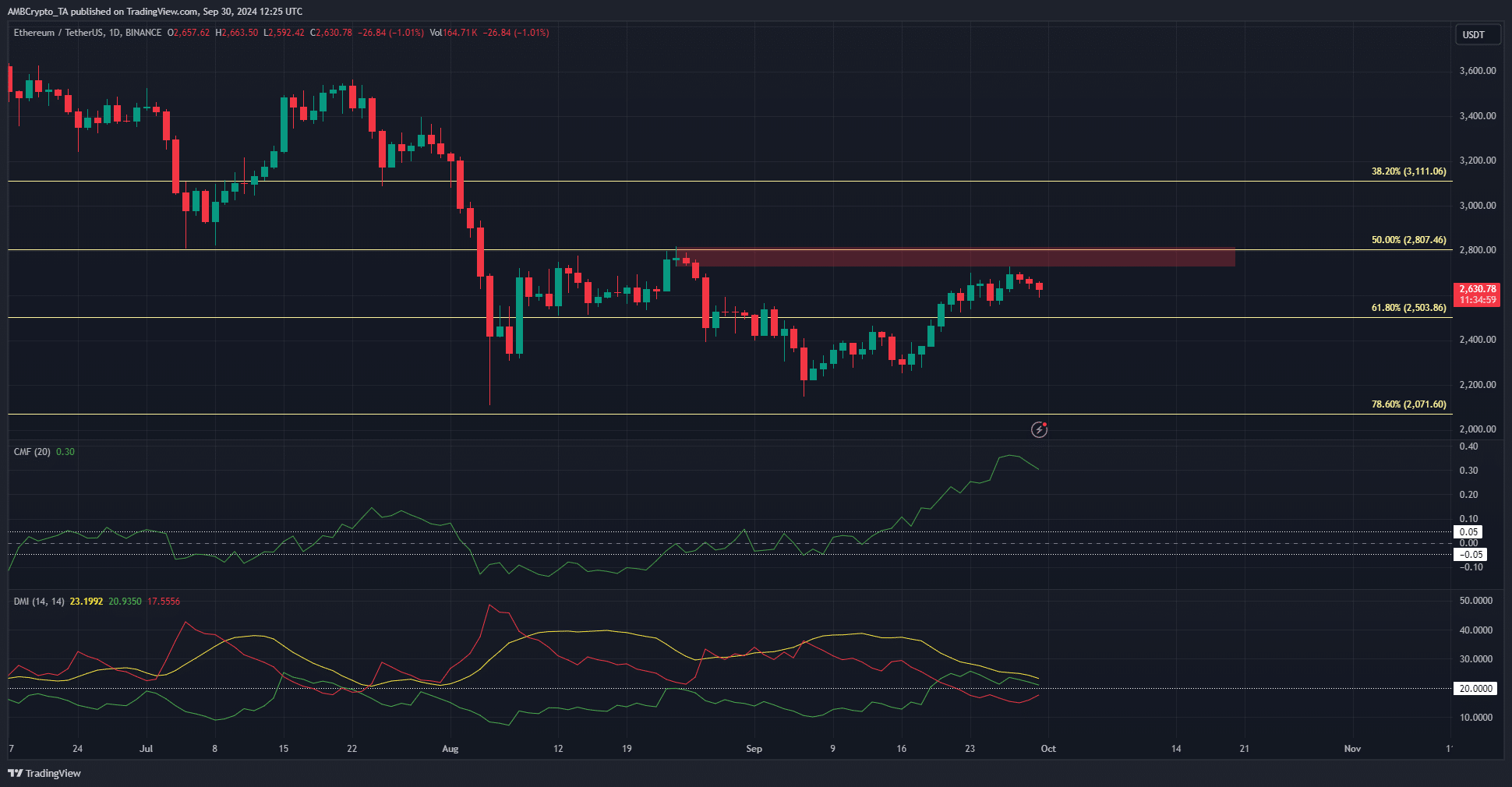

As a seasoned researcher with years of experience analyzing digital asset markets, I find myself constantly amazed by the unpredictable nature of cryptocurrencies. Looking at Ethereum [ETH], its performance against Bitcoin [BTC] has been less than ideal, leading to a weekly bearish structure. Despite the bullish momentum and buying pressure on the daily chart, key resistance levels overhead need to be breached for the outlook to change.

As an analyst, I’ve observed a persistent escalation in gas fees within the Ethereum [ETH] network, coinciding with a surge in overall network activity. This upward trend in gas fees can be partially explained by the growing adoption of Decentralized Finance (DeFi) platforms on the network and the increasing volume of ETH transfers.

From a technical perspective, the overall trend and momentum seem favorable for a bullish move on a daily basis. However, it’s crucial to surpass certain resistance levels that currently stand as obstacles.

Ethereum has lost much ground during the consolidation

Over the past few weeks, Bitcoin [BTC] has dropped only 13.4% compared to its peak in March. In contrast, Ethereum [ETH] has seen a more significant decrease of 35.8%. This relatively poor showing next to Bitcoin suggests a bearish forecast for Ethereum until it surpasses the $3k resistance level.

Here’s a possible way of paraphrasing it:

On the daily chart, the Crowd Momentum Factor (CMF) climbed to 0.3, marking a level last reached in March. This significant increase in buying pressure has fueled a 16.7% rise in the asset’s value over the past fortnight.

In simpler terms, when the ADX (yellow) and the +DI (green) on the DMI exceeded 20, it suggested a robust trend and a positive (bullish) direction. However, even with this strong signal, the halfway point or Fibonacci retracement level persistently prevented the bulls from advancing further.

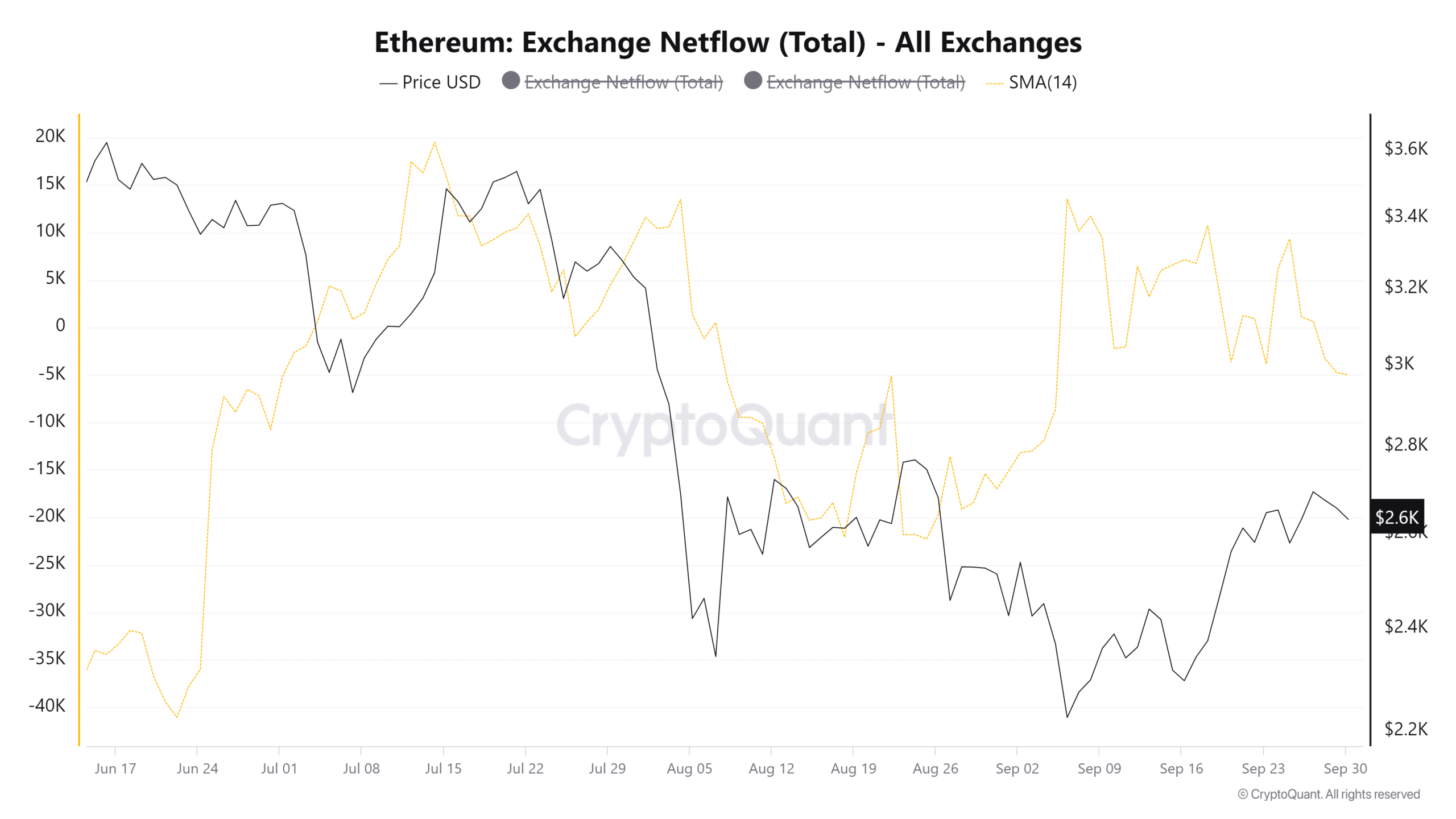

Netflows give clues on trend strength

Starting from late July, there’s been a predominant movement of Ethereum away from centralized exchanges, indicating a trend towards accumulation. Yet, this outflow wasn’t as substantial as the ones seen in February and November of 2023.

Is your portfolio green? Check the Ethereum Profit Calculator

Over the last fortnight, there have been numerous days with inflows. While this wasn’t a mass selling event (exodus), it did suggest that some investors were content to cash out their gains. This might be connected to the strong performance of Ethereum since March.

Currently, the Netflows chart does not indicate a highly optimistic Ethereum price forecast for the upcoming 4-8 weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-01 08:39