- ETH hit a roadblock near $2700 after the October recovery.

- Options market priced lower odds of ETH hitting $3K before US elections.

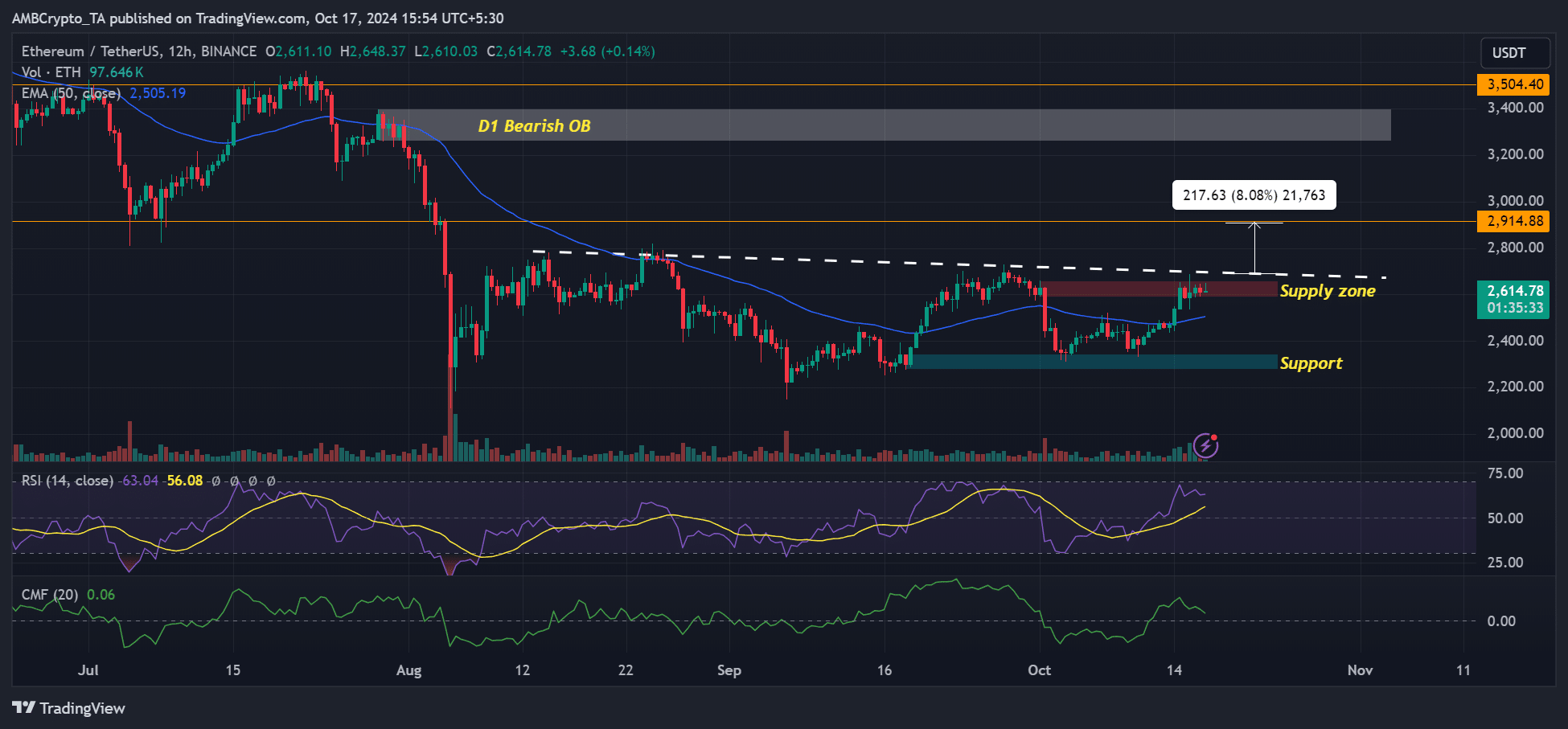

As a seasoned analyst with years of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The latest surge in Ethereum [ETH] prices has been quite intriguing, but it seems we have hit a roadblock near $2700.

After initially experiencing losses in the first part of October, Ethereum [ETH] rebounded and reached approximately $2.6K, marking a 12% increase from its previous level at around $2.3K.

At press time, ETH was valued at $2,614 but hit a key roadblock below $2700.

Ethereum price prediction

Over the last ten days, I’ve observed a surge in capital flowing into Ethereum, evident from the upward trend of the Chaikin Money Flow. Lately, though, this indicator has started to dip slightly over the past two days, hinting that the inflow rate might be slowing down just a bit.

This potential development might disrupt ETH’s advance beyond the identified obstacle, which serves as both a resistance area (marked in red) and a concentration of bearish orders. Additionally, this resistance area aligns with a trendline resistance (represented by a dotted white line).

This situation suggested that the roadblock might lead to a price drop near the 50-day Exponential Moving Average, which is around $2.5K (as indicated by the blue line).

If Bitcoin (BTC) continues to surge past $68,000, Ethereum (ETH) could potentially overcome its obstacles and rise by approximately 8% to reach around $2,900.

Options data suggests…

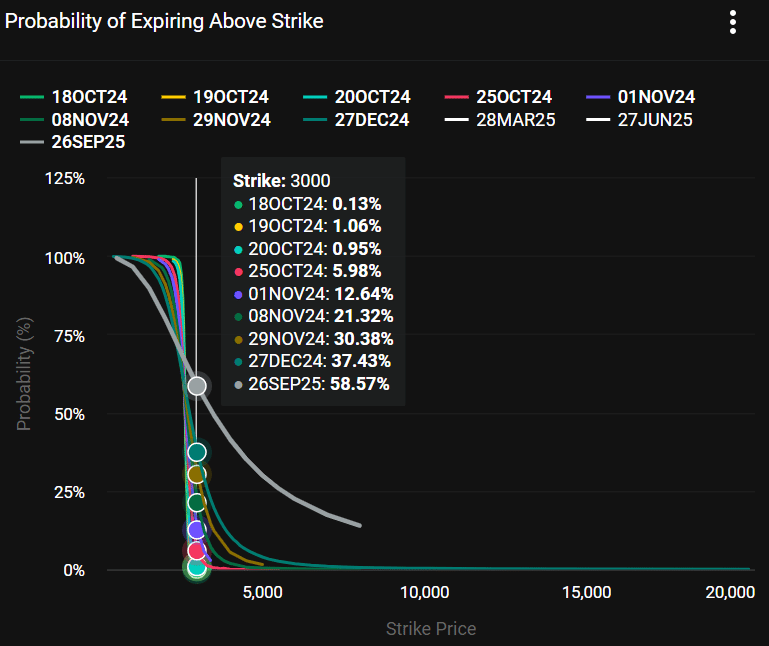

Based on data from Deribit regarding options, it seems unlikely that Ethereum (ETH) will experience a significant surge above $3K by the end of October, as suggested by a relatively pessimistic 6% probability in the options market.

Contrarily, by the 8th of November, following the US elections, the chances stood at approximately 21% that one Ethereum (ETH) would be worth around $3,000.

In other words, a significant increase in ETH’s price beyond $3K could potentially occur post-U.S. elections, as the incoming administration will play a decisive role in shaping DeFi regulations.

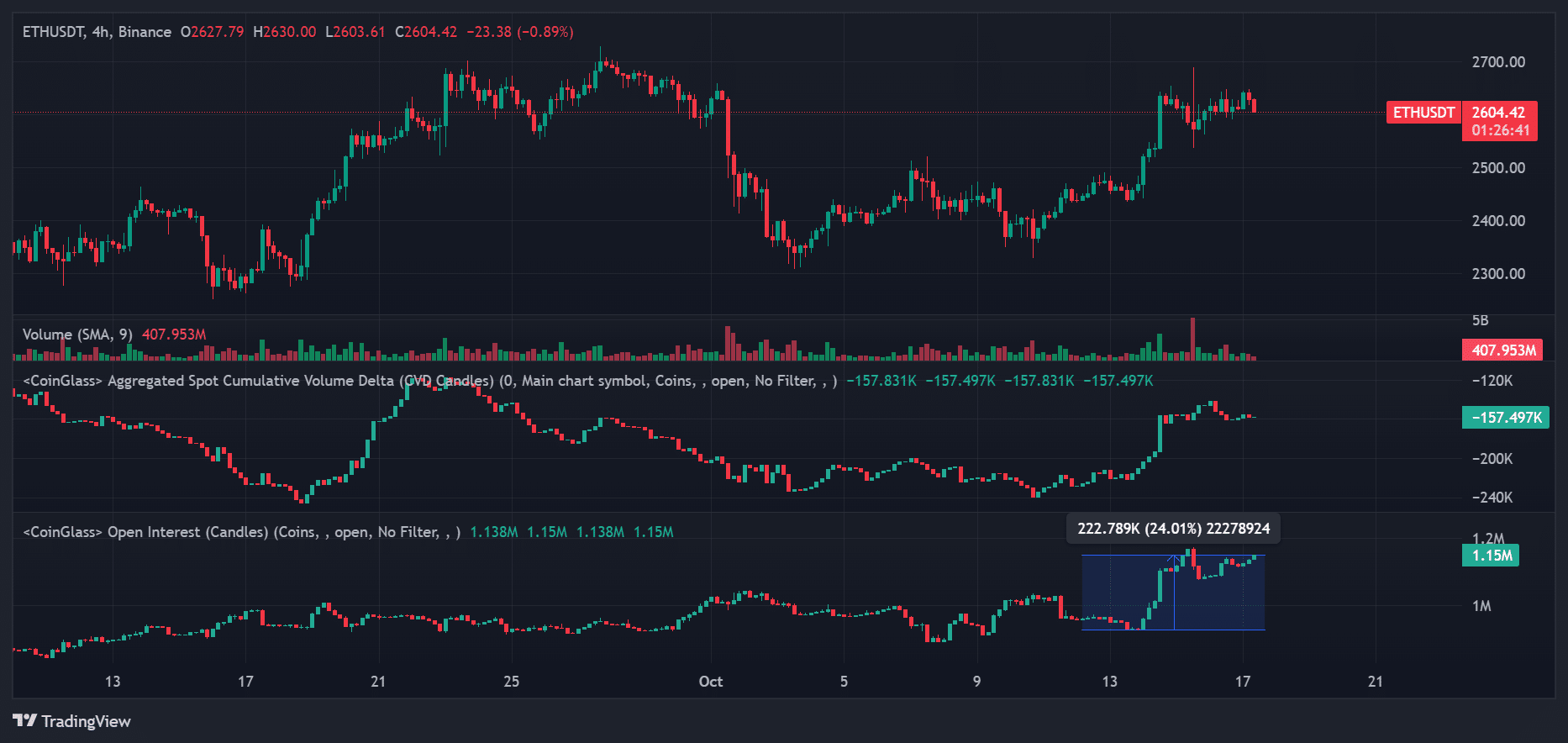

During that timeframe, there was an increase of approximately 8% in price, which led to a new addition of more than 220,000 Ether in open interest on the Binance platform this week.

Although this indicated bullish bets, given the uptick in price and rising spot demand (CVD), it doesn’t paint any price direction for ETH in the future.

Read Ethereum [ETH] Price Prediction 2024-2025

However, since we had a high level of leverage, there was a significant risk of being forced to sell our positions (liquidated) if the price of Ether dropped sharply or fell significantly.

In the near future, potential areas of interest might include the price level of around $2300, the 50-day Exponential Moving Average (EMA), and a possible obstacle that traders may find significant.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-18 02:15