-

Ethereum forms a parallel upward channel as price breaks the 52 week moving average.

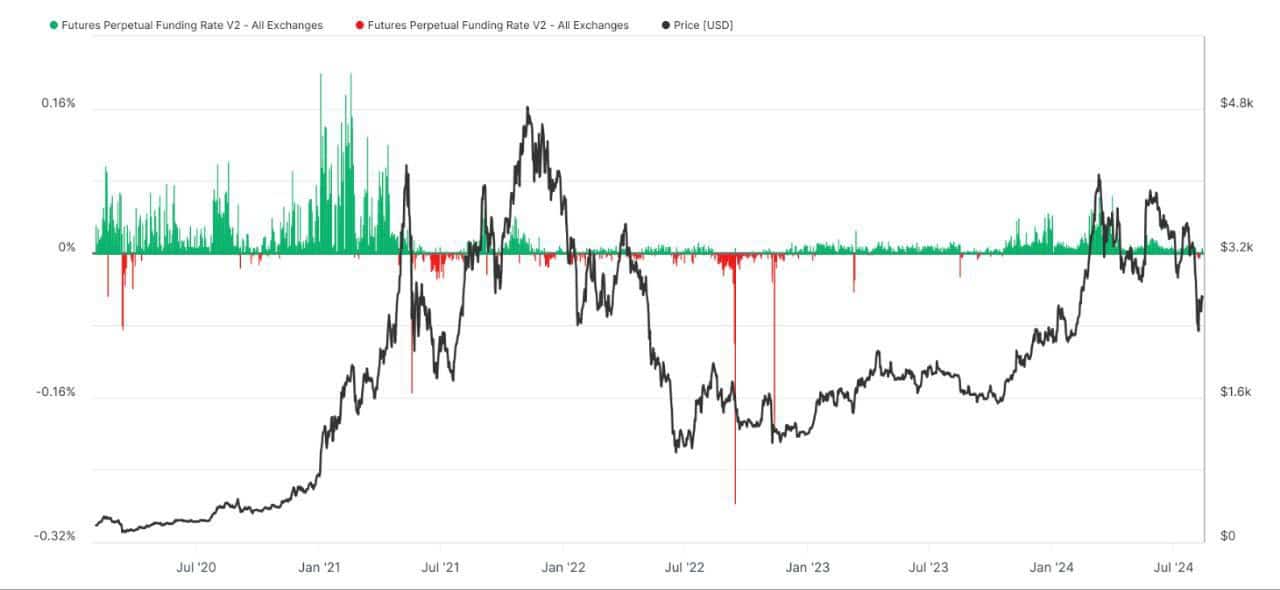

the RSI of ETH/USD is oversold as funding rates become generally positive.

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen bull markets and bear markets come and go. The current trend of Ethereum [ETH] is reminding me of the late 90s dot-com boom, where every coin seemed to be the next big thing.

It appears that the cost of Ethereum (ETH) is gradually exhibiting a noticeable pattern, suggesting that traders are gearing up for a possible bull run sometime towards the end of 2024 or beginning of 2025.

According to the 4-hour chart analysis, the Ethereum to Tether pair (ETH/USDT) appears to be forming a bear flag pattern inside an uptrend channel, and it’s projected to approach the $2900 mark.

It appears quite probable that the Ethereum price will hit the specified supply area, aligning with the 200 Exponential Moving Average (EMA) band on the 4-hour graph.

To strengthen its upward trajectory, Ethereum (ETH) must surpass and maintain itself above the 200 Exponential Moving Average (EMA). Although the general perspective remains optimistic, it’s essential to exercise caution if the price lingers below $2900 for a prolonged duration.

Furthermore, the price of Ethereum (ETH) on the weekly graph appears to be moving within a two-year ascending trend line, frequently brushing against the bottom line, suggesting a possible increase towards the $2900 mark.

Currently, the price is below the annual average, highlighting $2900 as a key resistance point.

The graph additionally demonstrates that ETH/USDT has surpassed its 52-week exponentially weighted moving average lately, yet it’s left an extended wick on the weekly candle, suggesting substantial purchasing demand.

Given my extensive background in trading and market analysis, I believe that while the current price is lower, there seems to be a strong interest and potential for a surge towards the $2900 mark. Based on previous trends and market movements, I have learned that prices can fluctuate wildly before settling into a stable pattern. However, the consistent positive sentiment and increased demand for this asset make me optimistic about its future growth. I would advise careful observation and strategic planning for those considering investment in this area.

Altcoins at levels they bottomed

One indication that Ethereum (ETH) could increase is the current situation of other cryptocurrencies, often referred to as altcoins. Right now, their values are comparable to those observed in 2020 and 2023 – years when the lowest points for altcoins were reached.

As a researcher, I’m observing a pattern that hints at Ethereum potentially reaching its bottom. The general sentiment among market participants is fear, and the current trading prices of altcoins are reminiscent of historic lows. This situation seems to present a promising opportunity for those who are keen on investing.

As an analyst, I often find myself advocating a bolder approach during periods of market fear, recognizing these moments as ripe opportunities for savvy investors like ourselves. While many retail investors are maintaining their cautious stance, seasoned traders view such circumstances as inviting chances to expand our investment portfolios.

RSI of ETH is oversold with positive funding rates

Examining the trends in ETH/USDT pricing, the Relative Strength Index (RSI) has dipped down to the overbought region and has rebounded vigorously from the 30% threshold.

Based on my years of trading experience, I find that identifying and following support trendlines can be a valuable strategy for predicting potential rebound points. In this specific case of ETH/USD, it appears we are currently at such a point where the price seems poised to bounce back. If this happens, I believe Ethereum’s price could reach new highs, given the overall positive trend in the market. However, as always, it’s essential to exercise caution and consider various factors before making any investment decisions, as the market can be unpredictable at times.

In the end, when funding rates are negative, it signifies that traders who have placed short positions on Ethereum (betting against its growth) are compensating those with long positions (who believe in its growth). This suggests a pessimistic or bearish outlook towards Ethereum.

Indeed, according to Glassnode data, it appears that the majority of Ethereum’s funding rates throughout 2024 have indicated a bullish sentiment, suggesting optimism among investors.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The current decrease in Ethereum’s value to around $2,100, along with decreasing funding fees, seems to indicate a change in investor attitudes.

Although there’s been a recent drop, the consistently high funding rates during 2024 suggest that a price surge might be imminent in the coming period.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-08-20 11:04