- Spot Ethereum ETFs recorded $11.4M in inflows for the first time in nearly three weeks.

- This comes as outflows from exchanges increased significantly, relieving the near-term selling pressure.

As a seasoned analyst with years of experience in the cryptocurrency market, I find it intriguing to see the recent trends in Ethereum [ETH]. The $11.4 million inflows into ETH ETFs on 10th September are a positive sign, albeit minor compared to the cumulative net outflows since launch.

On September 10th, there was a $11.4 million increase in investments in Ethereum-based exchange-traded funds (ETFs), according to SoSoValue’s data. This marked the first instance of inflows in almost three weeks.

Leading financial institutions BlackRock and Fidelity saw significant investments totaling approximately $4.31 million and $7.13 million, respectively, during the data collection period.

Although there’s a change in public opinion, Ethereum ETFs (Exchange Traded Funds) have not kept pace with Bitcoin ETFs, experiencing a total of $562 million in withdrawals since their introduction.

Based on Glassnode’s analysis, the performance of Ethereum ETFs has been relatively subdued due to withdrawals from the Grayscale product. However, it’s worth noting that these financial products exert a lesser influence on the trading activity in the Ethereum spot market.

Ethereum exchange outflows reach multi-week peak

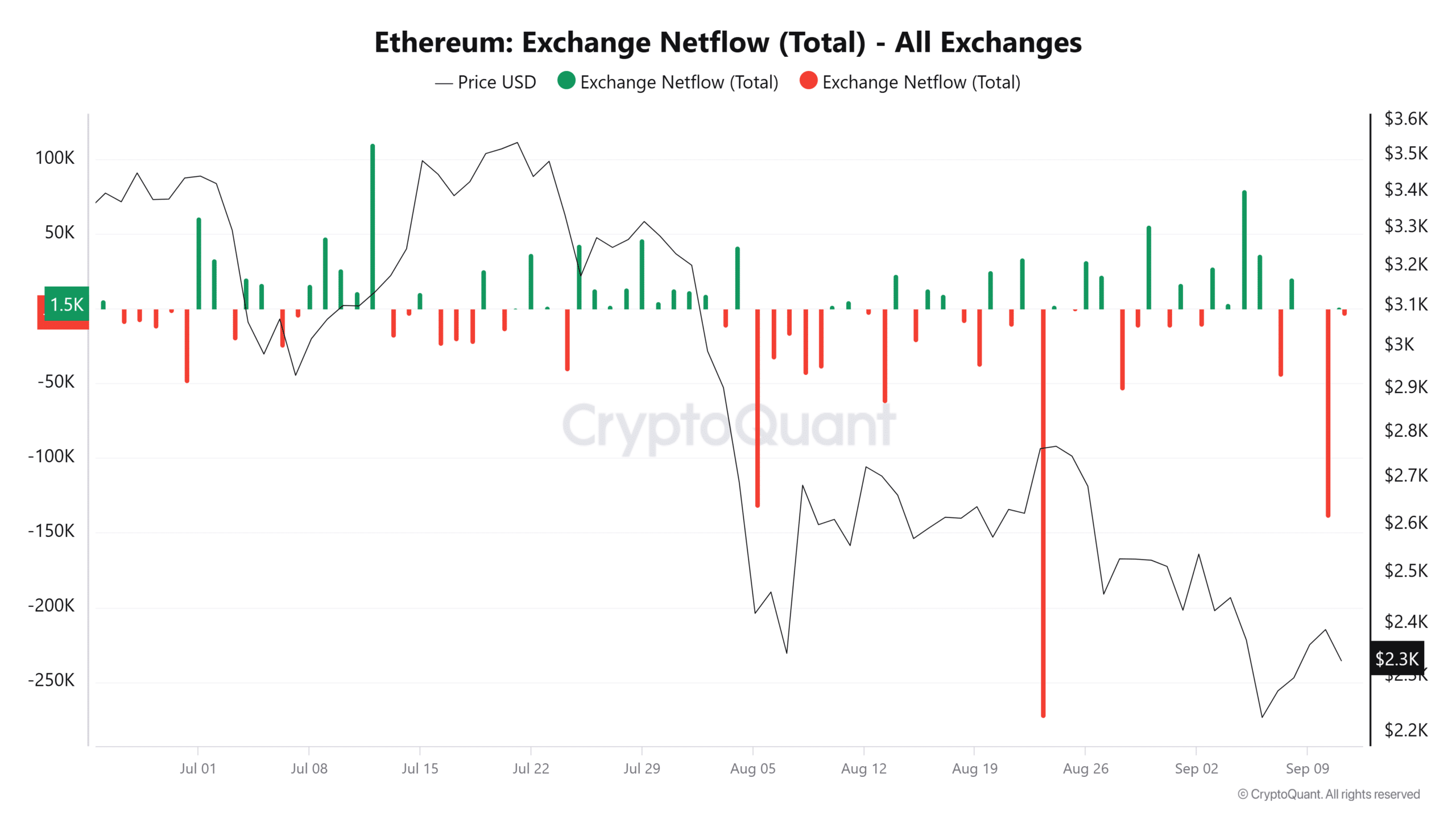

Information from CryptoQuant indicates an increase in Ethereum transfers off of exchanges. The net flow of ETH on exchanges peaked at 139,548 on September 10th, marking the highest level seen in several weeks.

A rise in Ethereum being taken off the market by traders suggests that not many people are planning to sell ETH soon. This reduction in supply pressure for the cryptocurrency could lead to an uptick in interest, potentially causing prices to go up if demand rises.

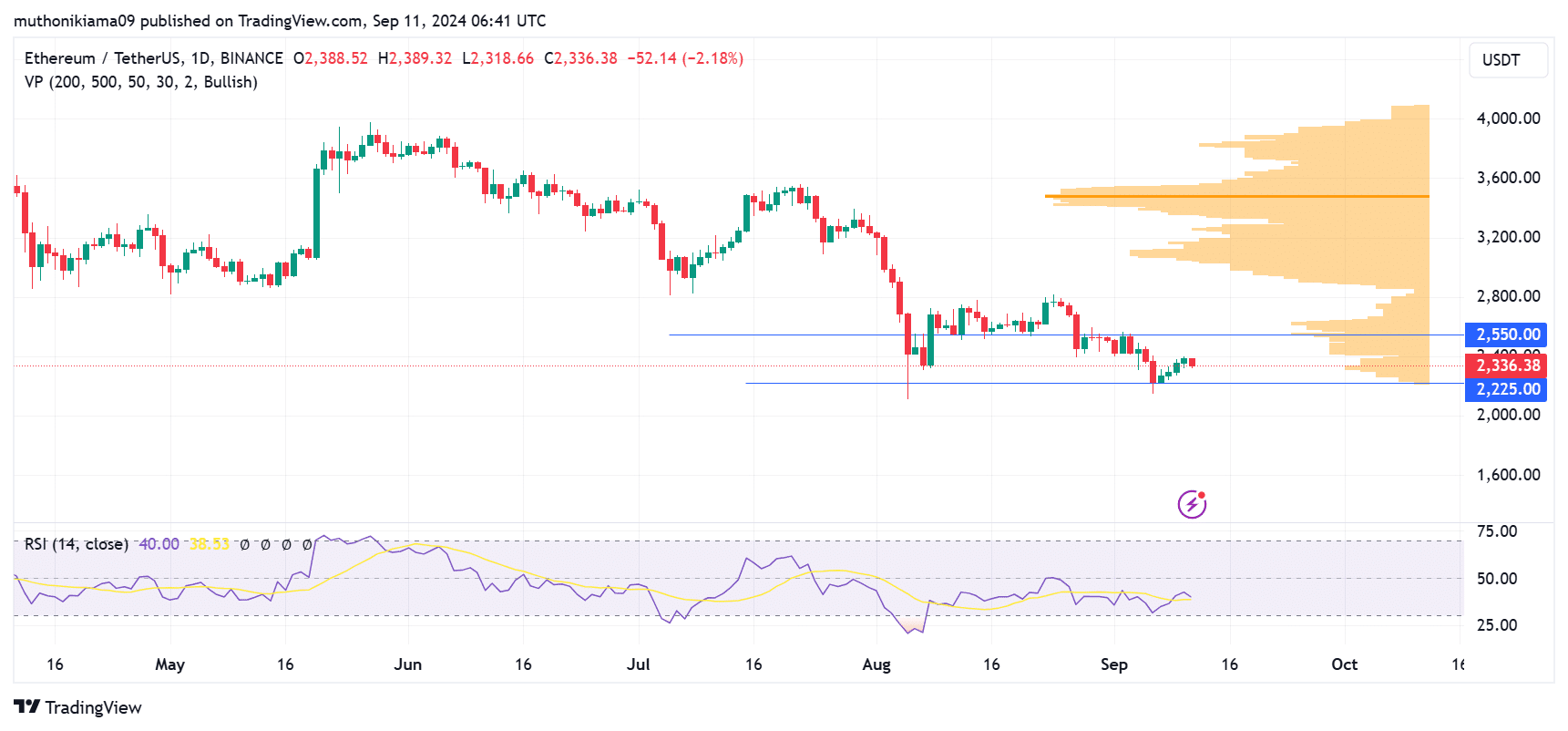

Despite the rise in demand, it’s not as robust as expected. The Relative Strength Index currently stands at 40, indicating that selling pressure is unusually strong. Furthermore, the RSI is trending downward, with a possibility of falling below the signal line. Such a move could generate a sell signal and potentially lead to additional price drops.

As a researcher, I’ve observed from the volume profile data that there seems to be a predominance of bearish activity in the Ethereum market. The current price level appears to have remarkably low selling volumes, suggesting that Ethereum might hold its ground here for a while due to consolidation.

If the selling trend persists, there’s a likelihood that the altcoin might dip to retest its support level at $2,225, after which it could make a significant price shift.

It seems that buyers are finding the price of $2,550 difficult to surpass, creating a significant barrier. Traders are on alert, hoping for a breakthrough beyond this level to signal the commencement of an upward trend.

ETH’s rally is also contingent on the performance of the Ethereum network if support from the broader market fails.

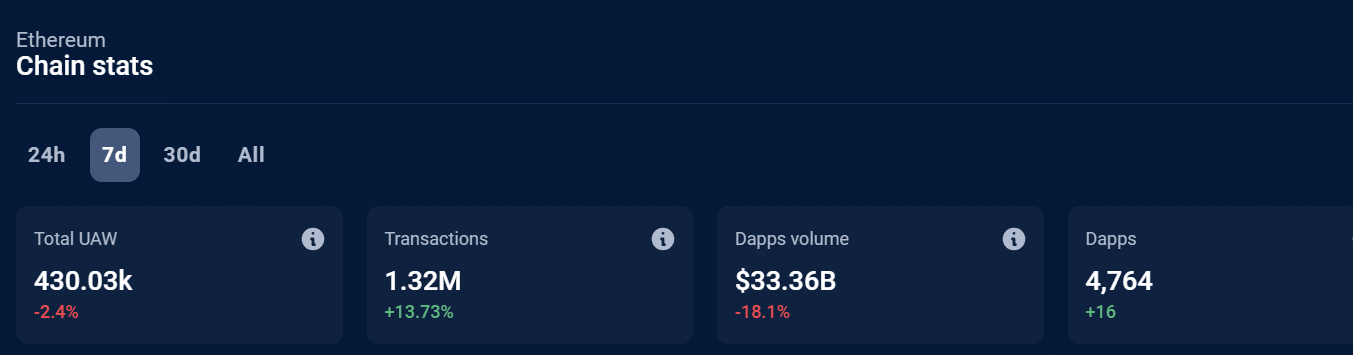

As an analyst, I’ve noticed a decrease in volumes on the Ethereum network, according to data from DappRadar. Specifically, over the past seven days, the volume for decentralized applications (DApps) built on Ethereum has dropped by approximately 18%, bringing the total to about $33 billion.

During the given timeframe, transactions within the blockchain rose by 13%. This suggests an upsurge in trading activities, yet the number of overall interactions on the network appears to be decreasing.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-11 21:11