-

Ethereum saw two sizeable waves of profit-taking in the past month that projected doubts about an upcoming rally.

The ETH whales have added to their stash, with retail being keen to sell.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned that the Ethereum market is never static. The recent price action and on-chain metrics have piqued my interest, leaving me feeling cautiously optimistic.

Over the weekend, Ethereum [ETH] encountered a setback at the $3360 mark, signaling a temporary bearish trend in its short-term price action.

In other news, the latest Dencun upgrade was a success, helping L2 solutions reach low gas fees.

Developers have set their sights on the next project, named Prague. Despite some encouraging updates, the data from the blockchain indicated that investors remained uncertain.

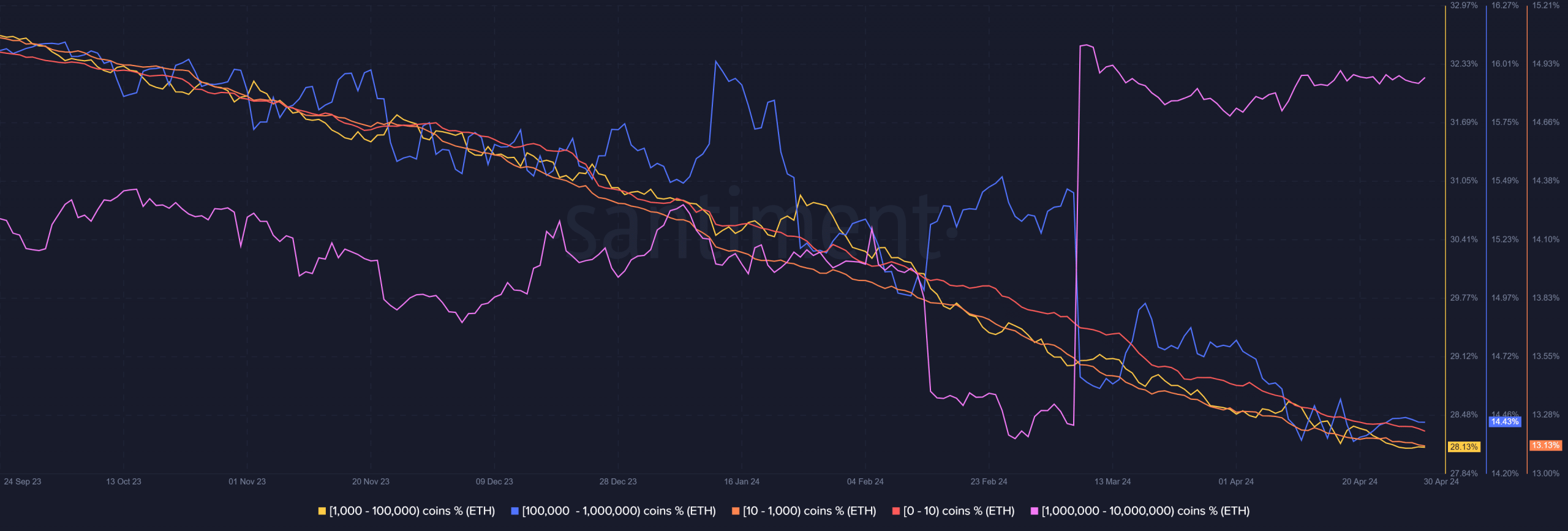

The clues from the Ethereum supply distribution

As an analyst, I’ve examined the supply distribution data provided by AMBCrypto. Notably, a significant number of wallets holding between 1 and 100 thousand Ethereum (ETH) have been offloading their tokens in recent months.

Small Ethereum wallets holding less than 0.1 Ethereum were actively purchasing, optimistic about a price surge following Bitcoin‘s [BTC] halving event.

Previously, individuals holding between 100k and 1 million tokens often acquired more during market uptrends. At times, these acquisitions occurred before significant price drops, such as the one that happened in mid-January.

The second half of April saw this cohort quiet down, neither adding to nor selling their supply.

The group of one to ten million individuals experienced a significant increase in activity around early March. After this surge, their actions have since remained subdued. Collectively, this pattern suggests that larger market participants were anticipating positive market trends in the near future.

As an analyst, I would find it beneficial to take note of a significant surge in the number of holders between the 100,000 and 1 million thresholds. Such a trend could potentially signal local market peaks and forthcoming corrections for traders to keep an eye on.

Does fear still rule the market?

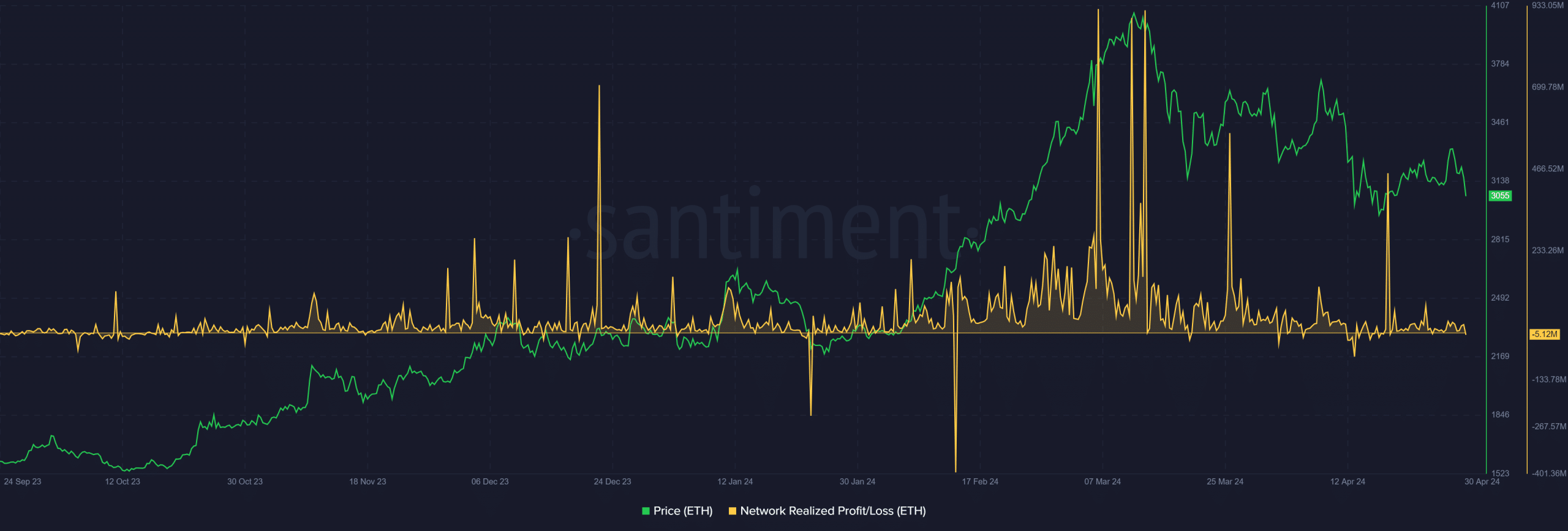

During times of rapid price increases, the network’s profit or loss (NRPL) tends to expand significantly due to accumulating gains. In the initial fortnight of March alone, both price surges and substantial NRPL peaks were observed.

This indicated profit-taking activity.

Since then, the NRPL figure has been on a general decline. There were minor upticks, for instance, towards the end of March and around mid-April, but these increases paled in comparison to previous ones.

As an analyst, I observed that the participants in the study were particularly eager to secure profits, despite the price being only slightly above the $3k support level.

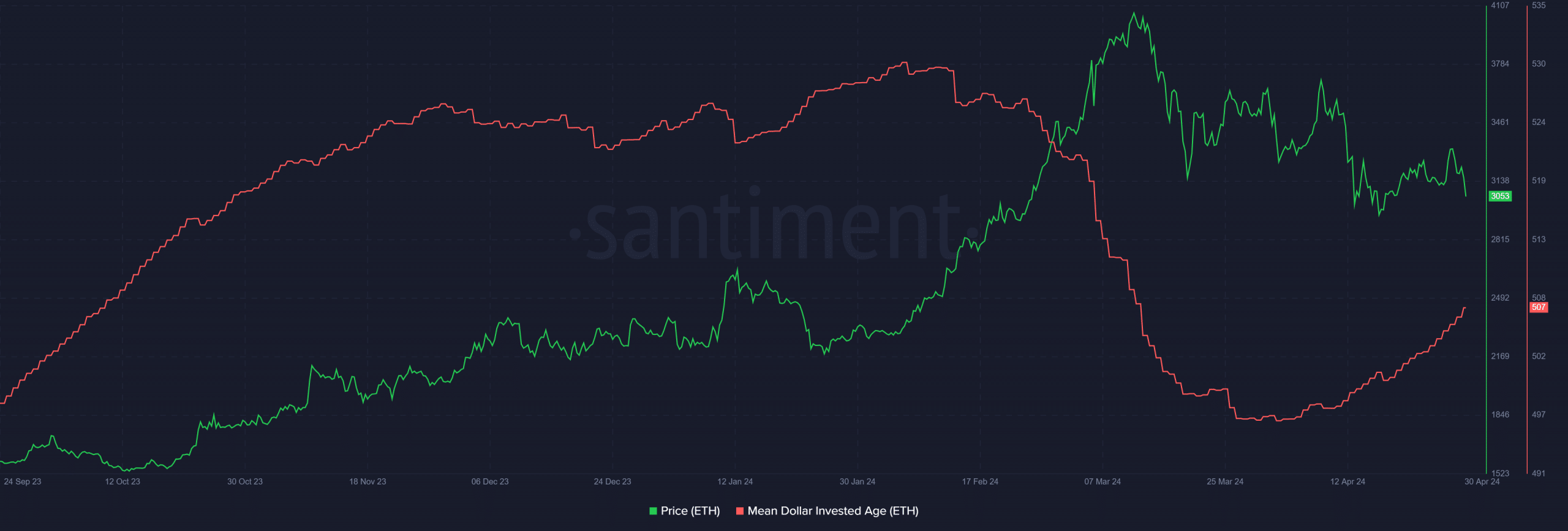

As a researcher studying the Ethereum market trends, I’ve observed that the recent price downturn over the past two months suggests a waning confidence among investors.

An alternate expression could be: Contrarily, the average investment age per dollar (MDIA) has noticeably risen over the past month. This implies that the asset is currently undergoing an accumulation stage.

It fell sharply during the rally to indicate holders were realizing profits en masse.

Read Ethereum’s [ETH] Price Prediction 2024-25

In the past month, the HOLDer sentiment has been stronger than the collective urge to book profits.

As a researcher examining the market metrics, I found an intriguing blend of fear and hope. While it’s natural for some investors to feel uneasy given the presence of fear, long-term investors possess a unique advantage: patience and faith in the market’s ability to recover over time. Therefore, holding on to their investments might be a more prudent choice than selling.

Read More

2024-05-01 05:11