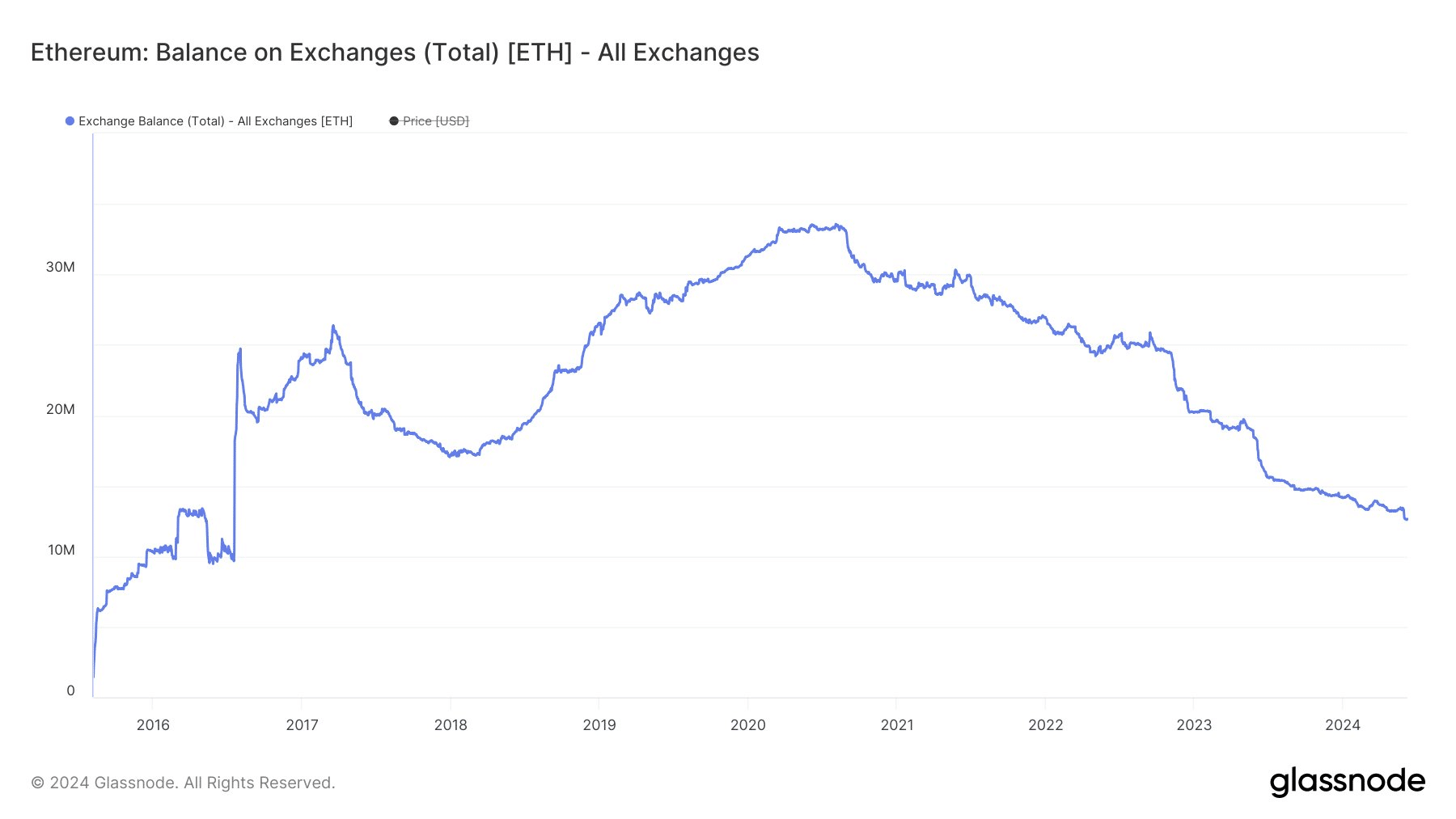

- Ethereum reserves on exchanges are at an eight-year low, setting the stage for a price surge.

- Current bearish indicators suggest there might be room for further decline before a rebound.

As a researcher with several years of experience in the cryptocurrency market, I’ve closely monitored Ethereum’s [ETH] trends and have formed an opinion based on current data. The recent drop in Ethereum reserves on exchanges to eight-year lows is an exciting development that could set the stage for a price surge. However, bearish indicators such as Ethereum being below both its 50-period and 200-period moving averages suggest there might be room for further decline before a rebound.

As a crypto investor, I’ve noticed that the quantity of Ethereum (ETH) stored on exchanges has hit a eight-year low. This is an intriguing development given the upcoming launch of spot Ethereum Exchange-Traded Funds (ETFs). The supply shock that could ensue from these launches might trigger a significant price surge for Ethereum.

But let’s check out what the data is telling us.

Ethereum ETFs to cause a stir?

if there is a significant surge in demand for ETFs based on specific spots, this could lead to a quick increase in Ether’s price due to initial buying frenzy. Subsequently, the market may experience corrections as it adapts to the new pricing dynamics brought about by the increased demand and supply.

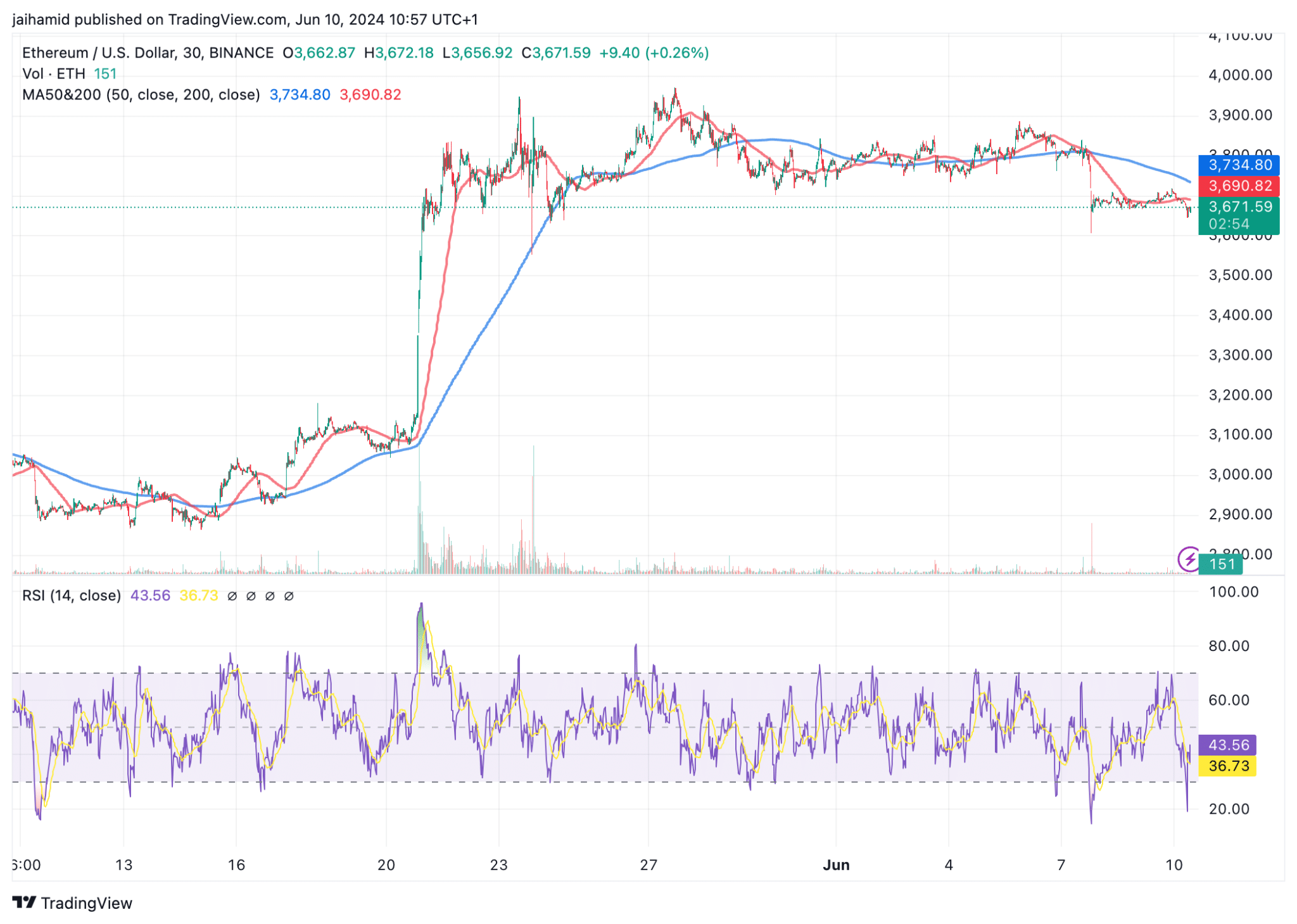

As a crypto investor, I’m observing that Ethereum’s current price sits beneath not only the 50-day moving average but also the 200-day one. The descending trend suggests a bearish outlook for the cryptocurrency.

The Relative Strength Index (RSI) currently stands at approximately 43. This figure is less than the neutral value of 50, indicating that the asset may be experiencing some weakness. However, it’s important to note that an RSI below 30 signifies oversold conditions, and we have not yet reached that threshold.

As a crypto investor, I’d interpret this as follows: The current downward trend in cryptocurrency prices might continue for a while longer, possibly causing a further small dip. However, keep in mind that oversold market conditions usually precede price rebounds.

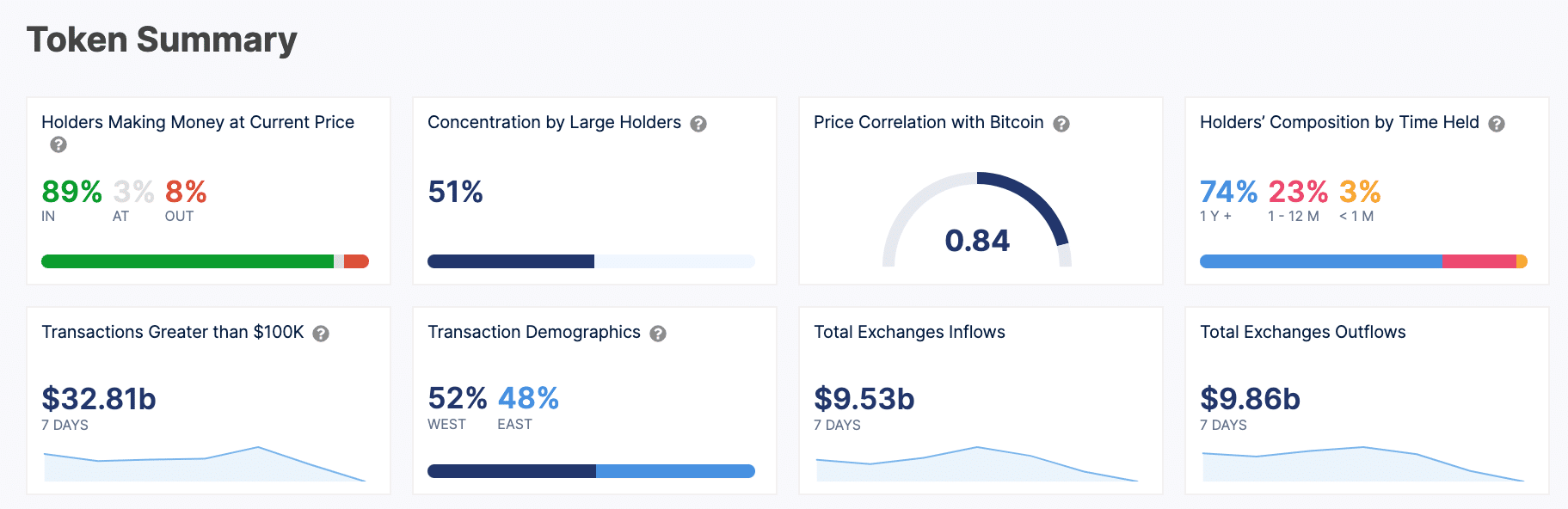

Approximately 89% of Ethereum owners currently enjoy a profit from their investment, signifying a robust and thriving market.

Approximately half of Ethereum’s total supply is controlled by a modest group of wallets, resulting in a significant accumulation of Ethereum within this segment.

Over the past week, I’ve observed a significant surge in transactions worth more than $100,000, amounting to an impressive total of $32.81 billion. This trend underscores robust institutional or large-scale investor interest in Ether. Essentially, there’s a strong bullish sentiment among investors regarding this digital asset.

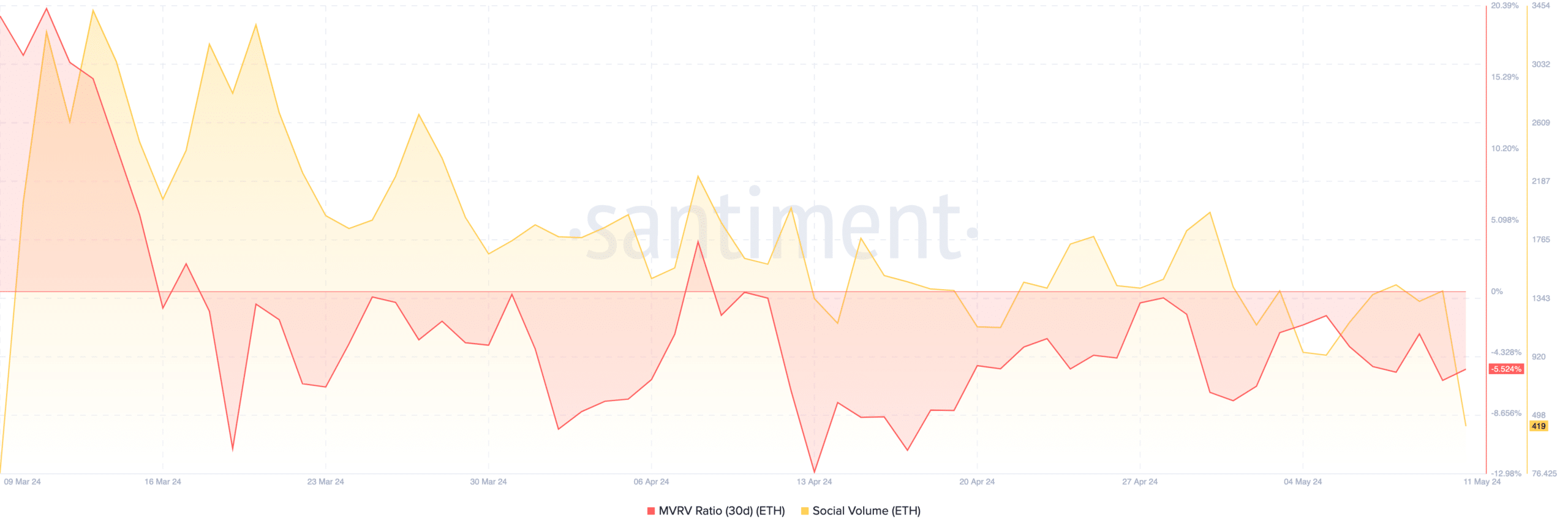

The MVRV (Market Value to Realized Value) ratio of Ethereum has been declining lately, indicating that the cryptocurrency may be becoming relatively less expensive. This could mean that Ethereum is approaching a fairer value in the market or even potentially being underpriced.

As a crypto investor, I believe this market downturn could be a much-needed correction, offering a stronger base for the upcoming bull run.

Read Ethereum’s [ETH] Price Prediction 2024-25

Should Ethereum manage to hold its ground above the current support level of $3,670, there’s a strong possibility that it will try to surpass the resistance at $3,733.

As a researcher analyzing market trends, I would express it this way: Reaching a new high above the current level could potentially trigger the next resistance point at $3,800 for the asset price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-10 18:15