-

Ethereum saw around $2.3 billion inflows.

The ETH price rise triggered a notable short liquidation volume.

As a seasoned crypto investor, I’ve witnessed the intricacies of the Ethereum market for quite some time now. The recent price surge in ETH was nothing short of remarkable, with over $2.3 billion inflowing into exchanges on May 21st alone. This influx led to a notable Netflow and sparked significant short liquidations.

Recently, there was a notable price shift for Ethereum [ETH], resulting in a massive wave of short positions being closed and an unprecedented surge in buying activity.

In light of recent advancements, there are rumors that certain organizations could be gearing up for the possible acceptance of a financial instrument based on Ethereum.

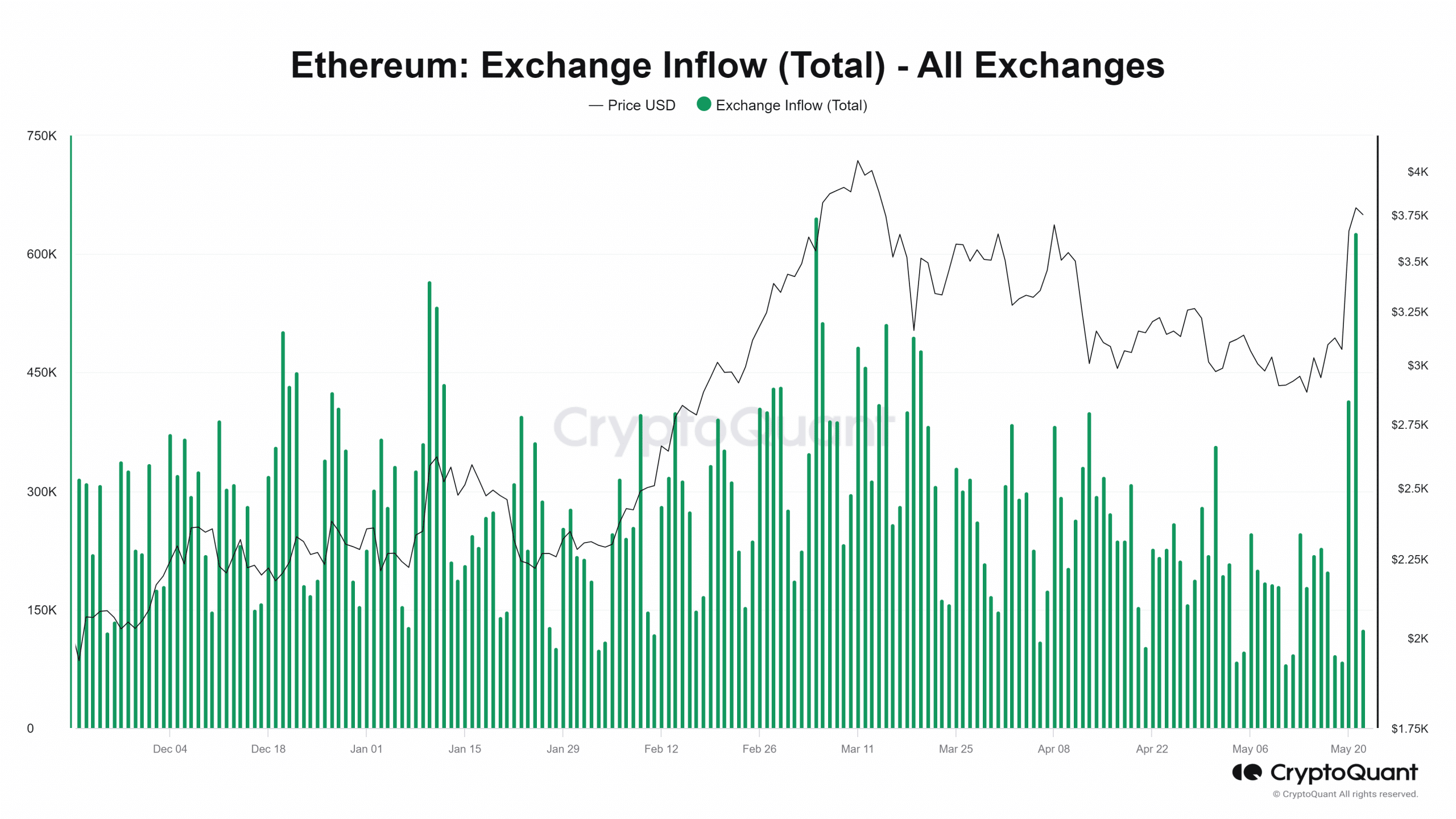

Ethereum sees significant flow into exchanges

As a crypto investor, I’ve been keeping an eye on Ethereum’s inflow trend as analyzed by AMBCrypto using CryptoQuant. It appears that savvy traders have jumped on the bandwagon and transferred significant amounts of Ether into exchanges to capitalize on the recent price surge.

On the 21st of May, approximately 627,770 Ethereum tokens, worth more than 2.3 billion dollars at an average price of around $3,789 per ETH, were transferred to cryptocurrency exchanges. This represented the second-largest exchange inflow in over a year.

In March, the biggest transfer of Ethereum (ETH) took place, amounting to 648,000 ETH or roughly $2.3 billion. At the current moment, more than 100,000 ETH have already been moved.

Over the last several days, a significant amount of Ethereum has been flowing into exchanges, resulting in a net positive flow for Ethereum. This flow suggests that more Ethereum is being deposited onto exchanges than withdrawn.

I observed a Netflow of approximately 49,000 ETH on the 21st of May. This flow has persisted, and as I speak now, it exceeds 55,600 ETH.

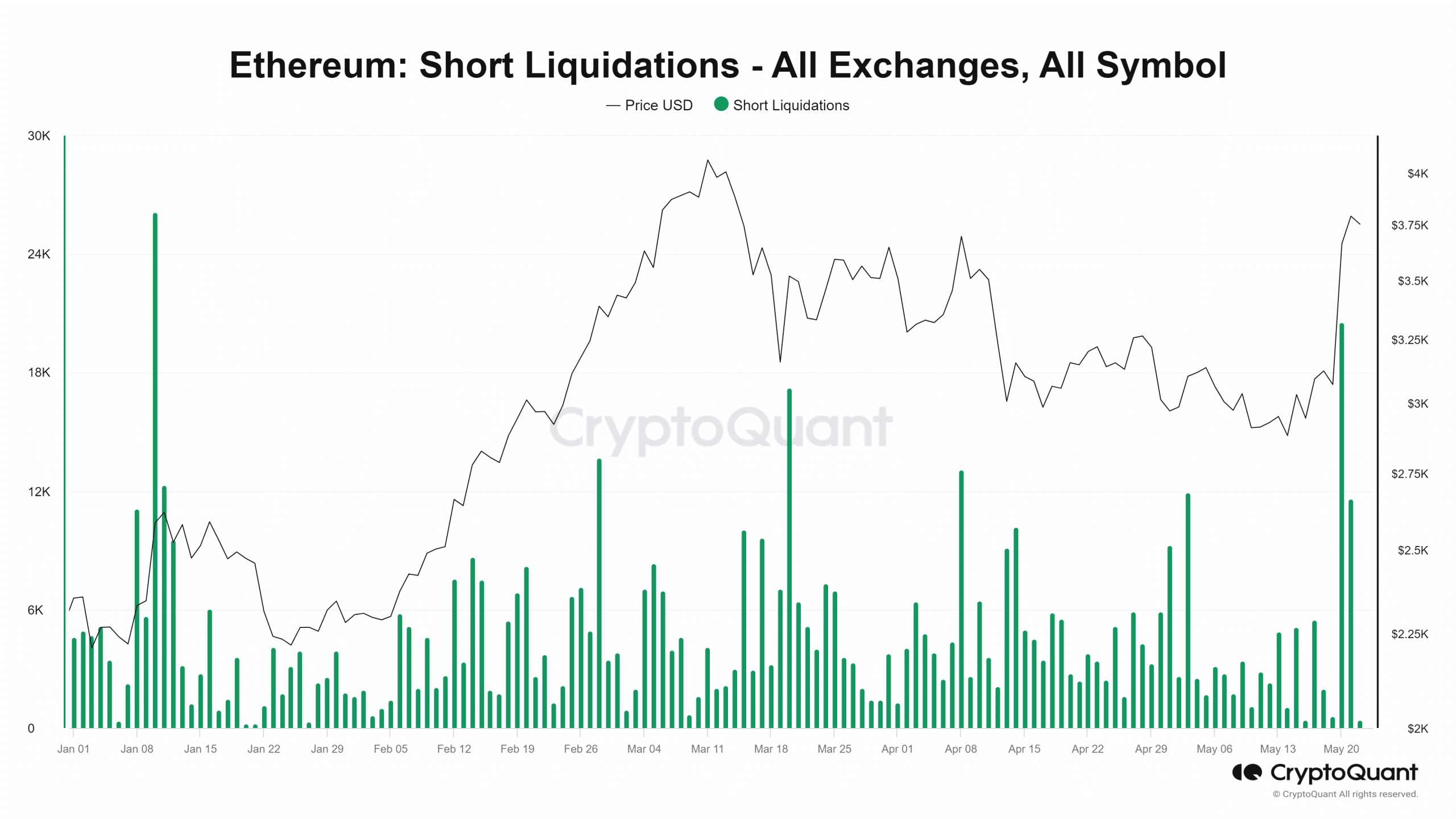

Ethereum shorts see more liquidation

Another effect of the recent Ethereum price increase has been a surge in liquidation volume.

Based on AMBCrypto’s examination of the liquidation data, I’ve noticed that a considerable number of short positions have been forcedly closed in the recent past.

On May 20th, around 20,558 Ethereum tokens, worth more than $75.2 million, were forcibly sold due to being underwater positions, representing the second largest short liquidation event in over a year.

On May 21st, more than $44 million worth of Ethereum (ETH), equal to over 11,600 ETH, was liquidated as the trend persisted.

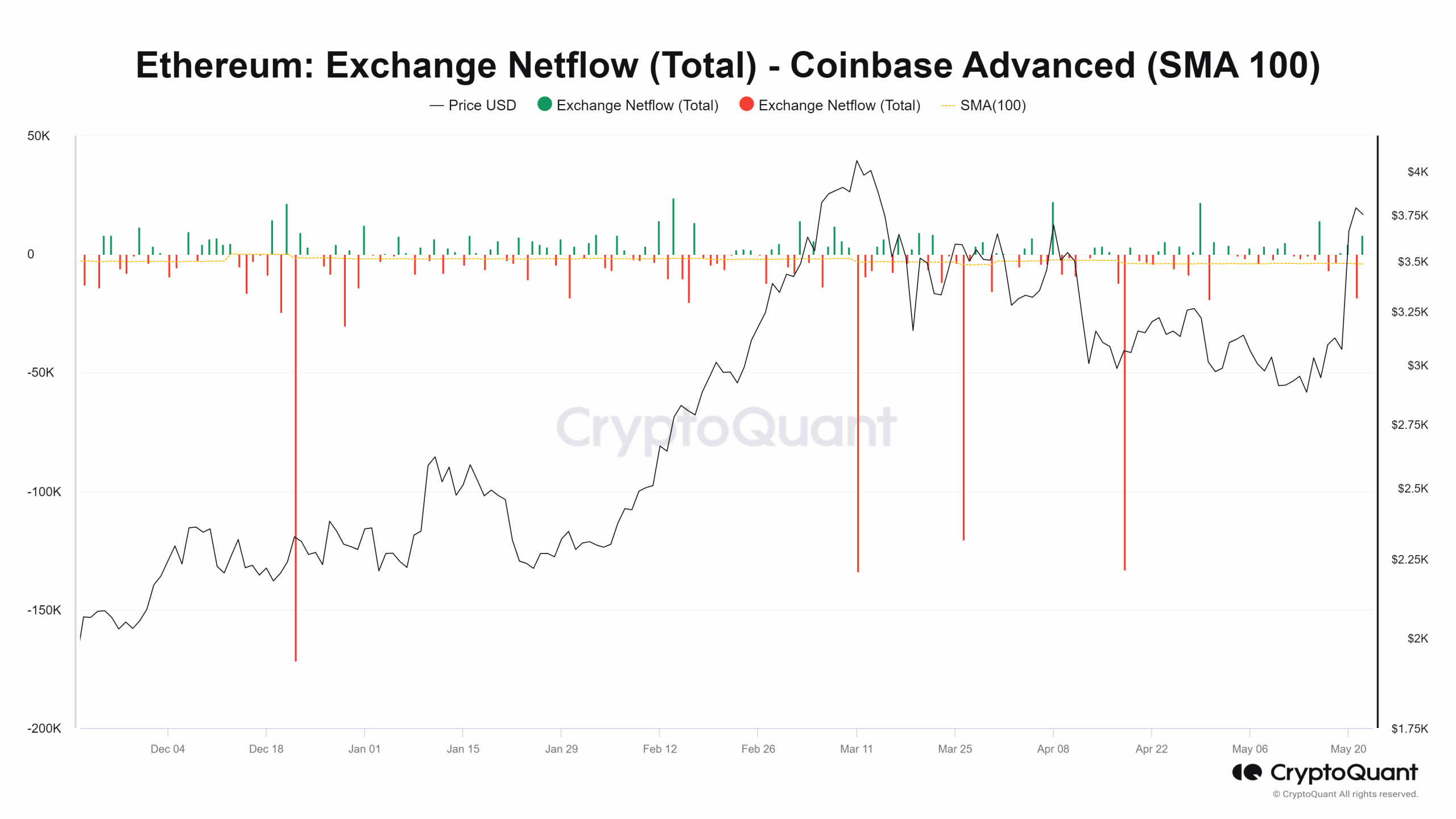

Institutions preparing for ETF approval?

With Ethereum’s prices on the rise recently, there’s been increased chatter about the potential upcoming approval of an Ethereum Exchange-Traded Fund (ETF).

Some commentators express optimism regarding the upcoming approval, while certain analysts posit that relevant institutions may have already begun their preparations.

On the 11th, 27th of March, and 18th of April, significant amounts of Ethereum were taken out of Coinbase as indicated by a CryptoQuant chart. The quantities of Ethereum transferred were approximately 134,000, 120,454, and 133,000 ETH respectively.

Observing similar patterns of outflows on Coinbase prior to the Bitcoin ETF approval announcement in January indicates that institutional investors could be preparing for a possible approval at this time as well.

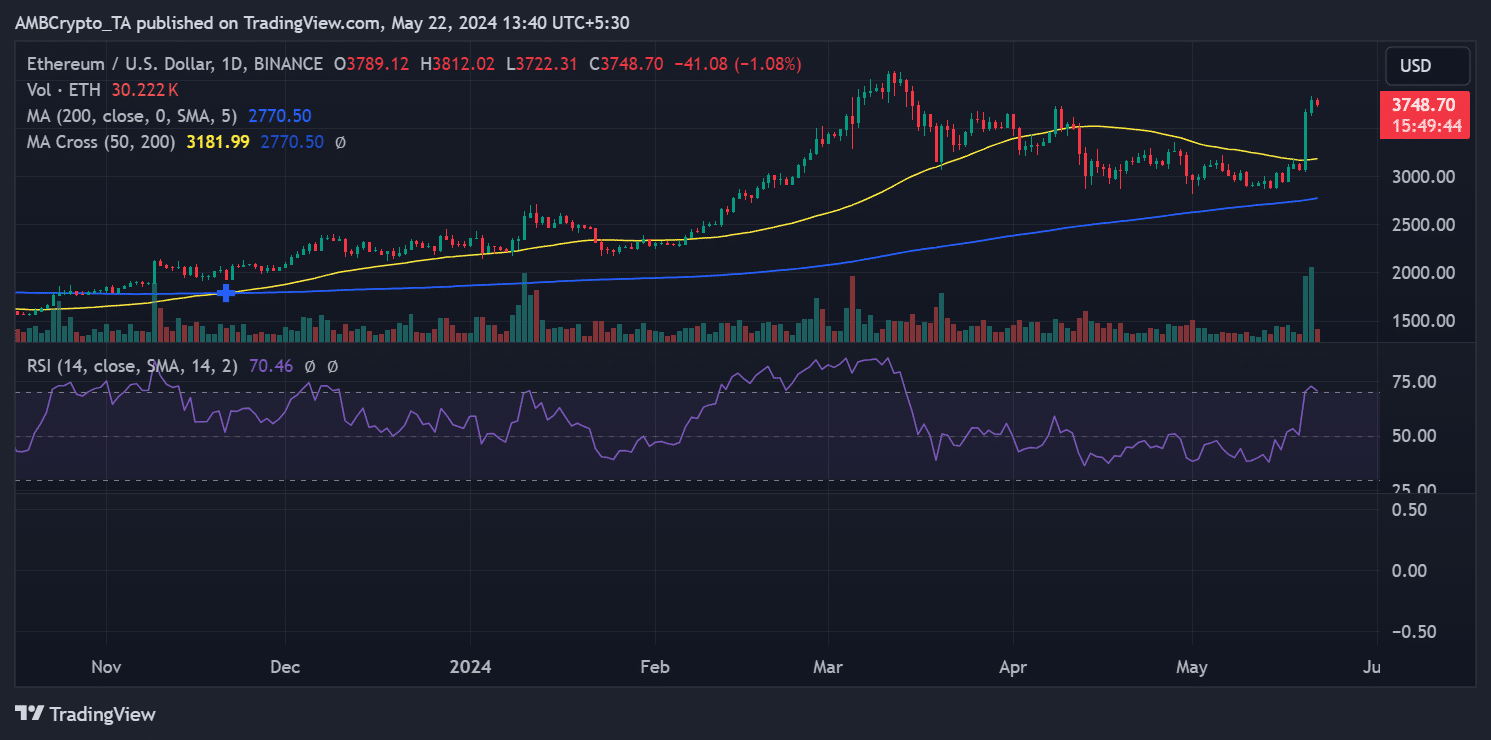

ETH sees a slight drop

Ethereum surged to approximately $3,661 following a 19% increase on the 20th of May.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on AMBCrypto’s evaluation of the daily chart, Ethereum’s uptrend persisted on May 21st, resulting in a approximately $3,789 value, representing a 3.50% gain, and revisiting a price level last observed in March.

As of this writing, Ethereum was trading at about $3,749, reflecting a decline of just over 1%.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-22 23:03