-

Investments worth $30 million were allocated to Ethereum products.

Bitcoin registered outflows, but ETH’s price might drop.

As a crypto investor with experience in the market, I’m keeping a close eye on the recent developments in the digital asset investment products space. The fact that Ethereum [ETH] registered inflows worth $30 million for the first time in seven weeks is a positive sign. However, I’m also aware of the potential risks, as Bitcoin [BTC] recorded significant outflows during the same period.

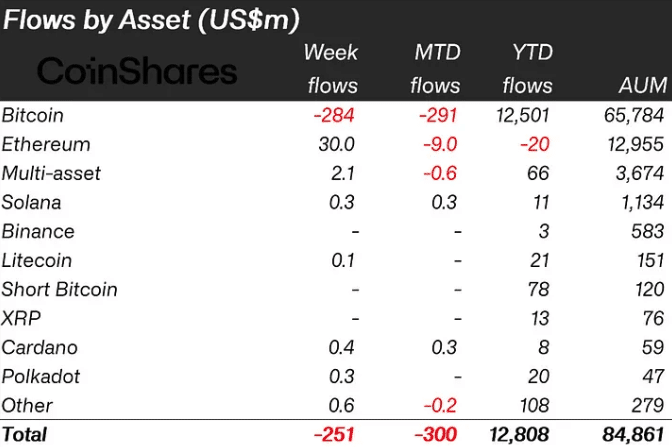

Digital asset investment products experienced withdrawals rather than inflows for the fourth week in a row, according to a May 7th announcement by Coinshares, the foremost asset management firm in this sector.

The total value of outflows amounted to $251 million, of which Bitcoin (BTC) represented a significant portion at $284 million. Notably, Ethereum (ETH) managed to lessen this figure by bringing in inflows worth $30 million.

ETH comes out from the shadows

Seven-week streak broke for Ethereum as it experienced inflows for the first time. Notably, this development followed the recent introduction of Bitcoin and Ethereum spot Exchange Traded Funds (ETFs) in Hong Kong.

CoinShares also agreed, highlighting that,

Last week brought a noteworthy development as spot Bitcoin and Ethereum ETFs were successfully introduced in Hong Kong markets. These new funds attracted substantial investment during their inaugural week of trading, with a total inflow of approximately US$307 million.

An alternative explanation may hinge on the upcoming U.S. decision regarding the approval of Ethereum ETF proposals.

Previously on AMBCrypto, there were reports voicing doubts from certain industry experts regarding the given approvals.

Despite some expressing cautious optimism, a number of individuals believed that the filing would be approved. In the penultimate week, it was noted that Litecoin (LTC) and Chainlink (LINK) were at the forefront of the influxes.

Last week, investors showed no interest in these alternative coins. A positive development for Ethereum could help pull it out of its slump.

An alternate perspective is that a rejection at the current price level could lead to further adjustments for Ethereum. Currently, Ethereum is trading at $3,067.

The coast is not clear

As a researcher studying the current trends in the market, I’ve noticed some forecasts suggesting a potential drop in price. Should these predictions hold true, we might see the value slide down to around $2,800, much like it did a few weeks prior.

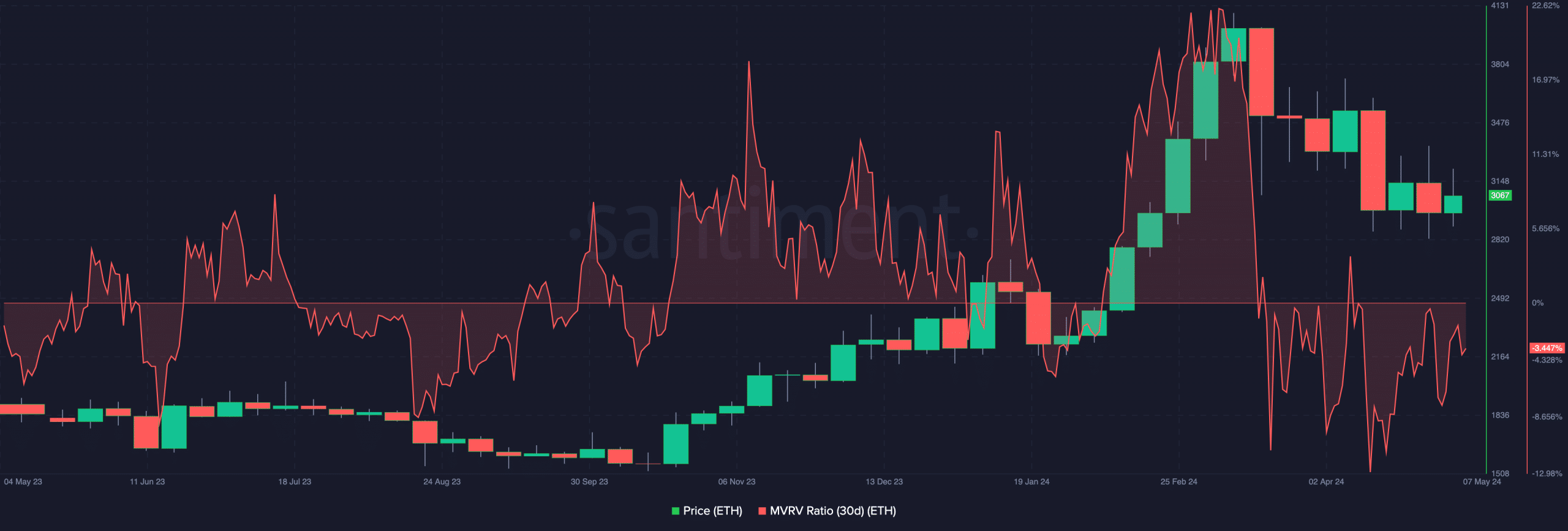

As a researcher studying the trading strategies of certain individuals, I examined the potential of their forecasts aiming for returns exceeding $4,000. To assess the merit of these predictions, I analyzed the Market Value to Realized Value (MVRV) ratio.

One way to rephrase this in clear and conversational language is: The MVRV ratio serves as a gauge for assessing the profitability situation of crypto investors. By using this indicator, you can determine if a particular cryptocurrency is considered underpriced, fairly priced, or overpriced in the current market.

Currently, the average Ethereum holder would incur a loss of approximately 3% if they were to sell their coins based on the market value over the past thirty days, as indicated by a MVRV ratio of negative 3.447%.

Few people would adopt this approach, but it may not represent a wise accumulation point based on historical trends. Notably, significant purchasing chances have emerged in the past when the metric fell between -7% and -18%.

As an analyst, I would advise those monitoring Ethereum (ETH) and anticipating favorable entry points to exercise patience and potentially hold off for a while longer.

No matter where ETH enters the market, it will require significant buying power for prices to rise and benefit holders.

Currently, it’s undetermined when Ethereum may reach its moment in the spotlight. Nevertheless, there’s optimism among market players that Ethereum’s time to flourish could be just around the corner.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-05-08 11:04