- Sellers have taken over Ethereum price direction, suggesting that price might fall below $3,000.

- The one-day Realized Cap dropped, indicating that the market might lose confidence if the trend persists.

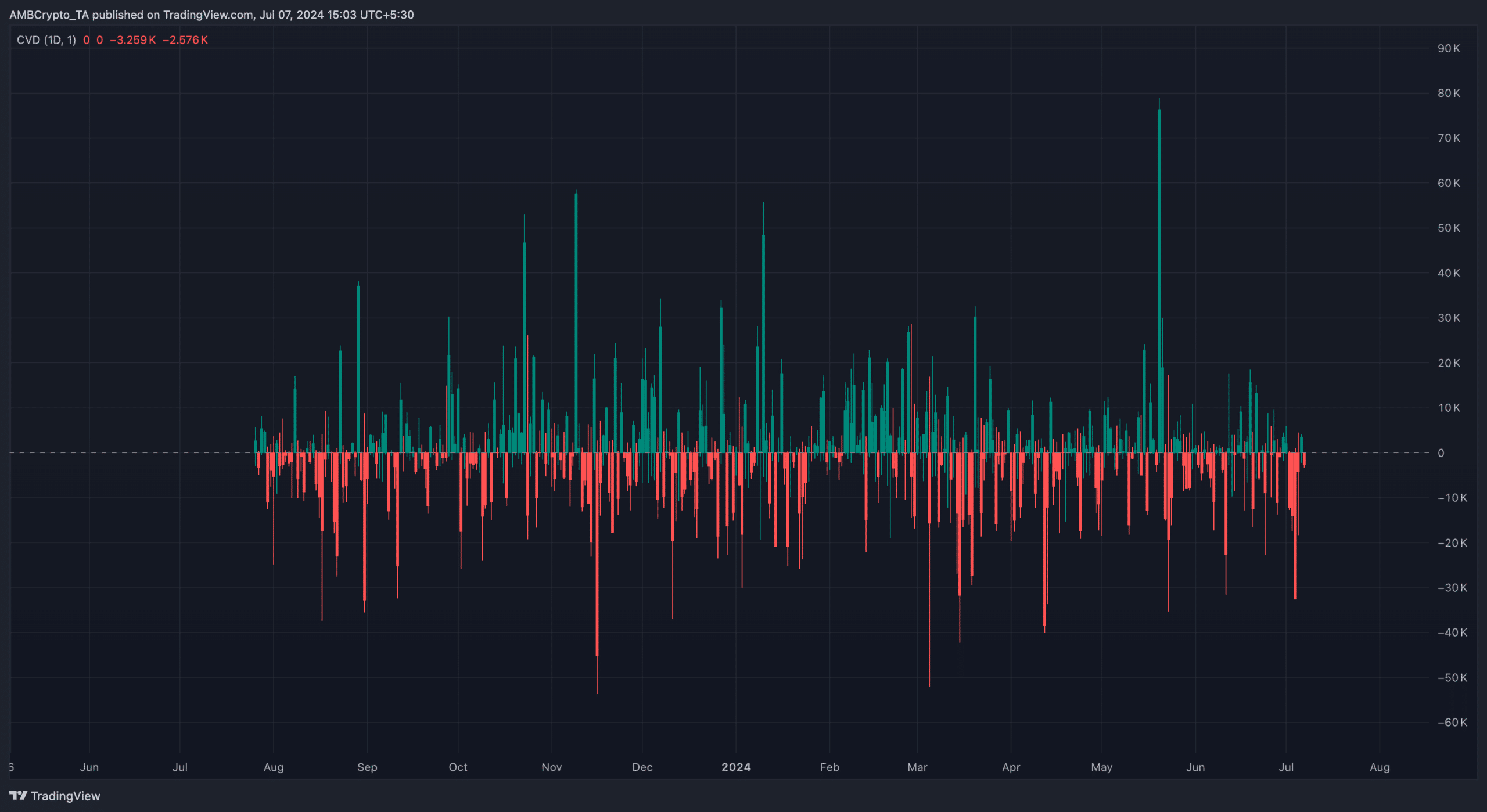

As a researcher with experience in analyzing cryptocurrency markets, I find the current trend in Ethereum [ETH] concerning. The Cumulative Volume Delta (CVD) data suggests that sellers have taken over the price direction, increasing the likelihood of ETH falling below $3,000 again.

As an analyst examining Ethereum’s [ETH] price trends, I have observed some concerning data based on the Cumulative Volume Delta (CVD) metric. According to this indicator, there is a high risk that the price could dip below the $3,000 mark for a second time in a short period.

In the ETH/USD daily chart, the volume difference between buyers and sellers (CVD) has shifted into the negative territory. This indicator reflects the variance in trading activity between purchases and disposals over a specified period.

Buyers struggle to sustain the pressure

When the value is positive, there are more buyers than sellers in the market for the cryptocurrency. This situation can lead to an uptick in price in the near future. Conversely, if the value is negative, then sellers outnumber buyers, indicating a possible downward trend for the cryptocurrency’s price.

When conditions are similar to the present, it can be challenging for prices to rise. The value of the altcoin stood at $3,012 as of the reporting time. Previously, Ethereum had tried to surpass the $3,100 mark, but the bears successfully thwarted its advance.

Although the CVD (Cardano Venture Day) setback is a significant concern, further indicators suggest that the cryptocurrency’s full recovery may take some time yet.

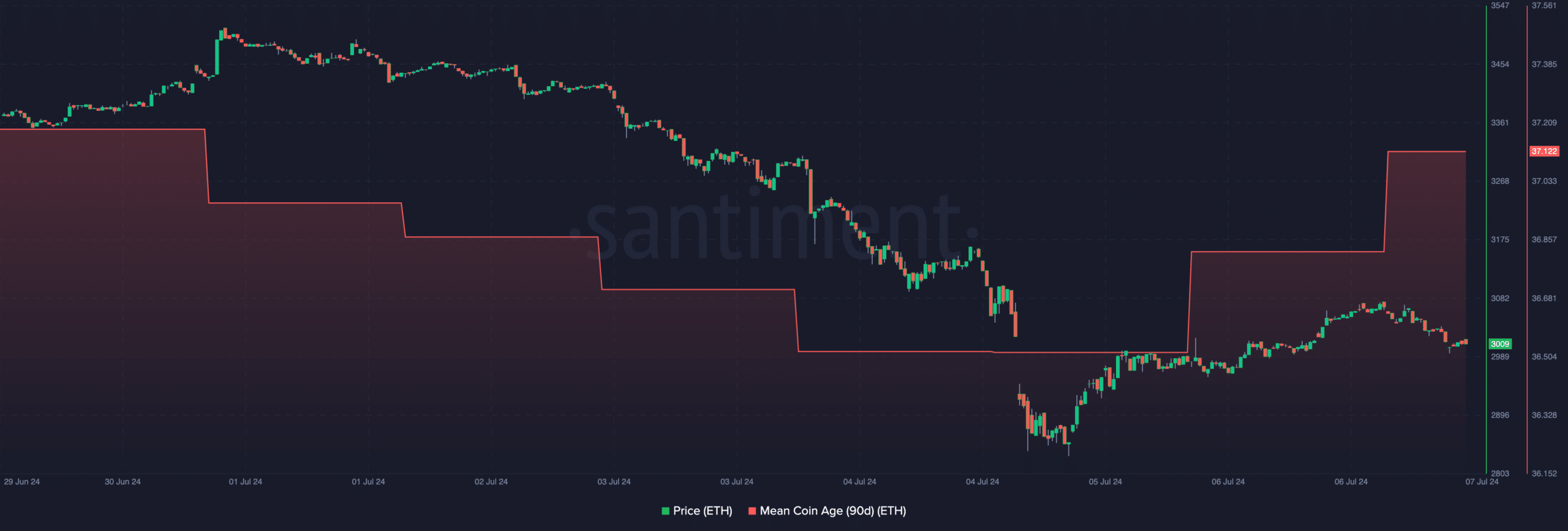

As a researcher studying blockchain data, I came across one particular dataset that piqued my interest: the Mean Coin Age (MCA). This value represents the average age of the coins circulating on a given blockchain. When the MCA rises, it signifies that older coins are being reintroduced into circulation. Consequently, there’s an enhanced possibility of a sell-off event occurring.

As a researcher studying cryptocurrency trends, I’ve observed that a decline in the average age of coins in circulation suggests that holders are choosing not to sell. Instead, they prefer to store their digital assets in personal, non-custodial wallets.

More old coins, more problem

At present, the moving average price for Ethereum over the past 90 days has risen from $36.50 to $37.12. Such an uptick indicates heightened trading activity surrounding this cryptocurrency.

The price decrease from its 6th of July value is an indication that the majority of the transaction was completed as sales.

As a crypto investor, I’m closely monitoring the trend of Ethereum’s price. If current market conditions persist, I fear that ETH may dip below the $3,000 mark. Furthermore, if buying pressure doesn’t pick up to meet the increasing supply, we could see another drop, potentially down to $2,881 – a level we touched on the 5th.

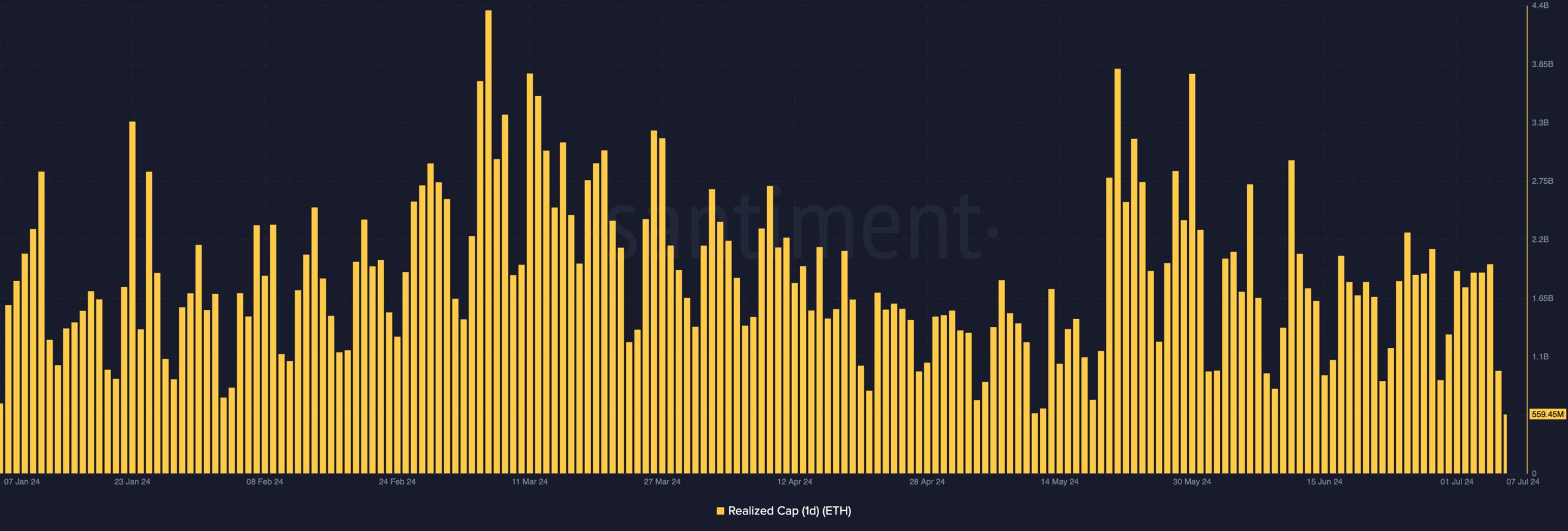

Furthermore, the Realized Capitalization matched the projection. The term “Realized Capitalization” refers to the value of a coin when it was last transacted, in contrast to its current market value.

From a research perspective, I’ve found that the total cost basis for all market participants, represented by the Realized Cap, fell to $559.45 million in a single day. This decline indicates that some Ethereum (ETH) holders have suffered unrealized losses due to the price drop.

As a researcher observing the Ethereum market, if this trend continues, there’s a risk that the broader market may begin to lose faith in Ethereum. Consequently, the demand for Ethereum could decrease significantly. In such a scenario, it’s reasonable to expect that the price of Ethereum might experience a downturn as previously discussed.

Is your portfolio green? Check the Ethereum Profit Calculator

As a crypto investor, I find it intriguing that the price of Ethereum is currently decreasing. However, this trend could actually present an opportunity for me to buy more Ethereum at a lower price, especially if the overall market remains in a bull run.

As a crypto investor, I can tell you that the shift taking place may not show immediate results within the next few days or even weeks. However, from my perspective, Ethereum’s value is poised for significant growth in the long term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-08 00:07