- The on-chain metrics showed bulls were eager to go long.

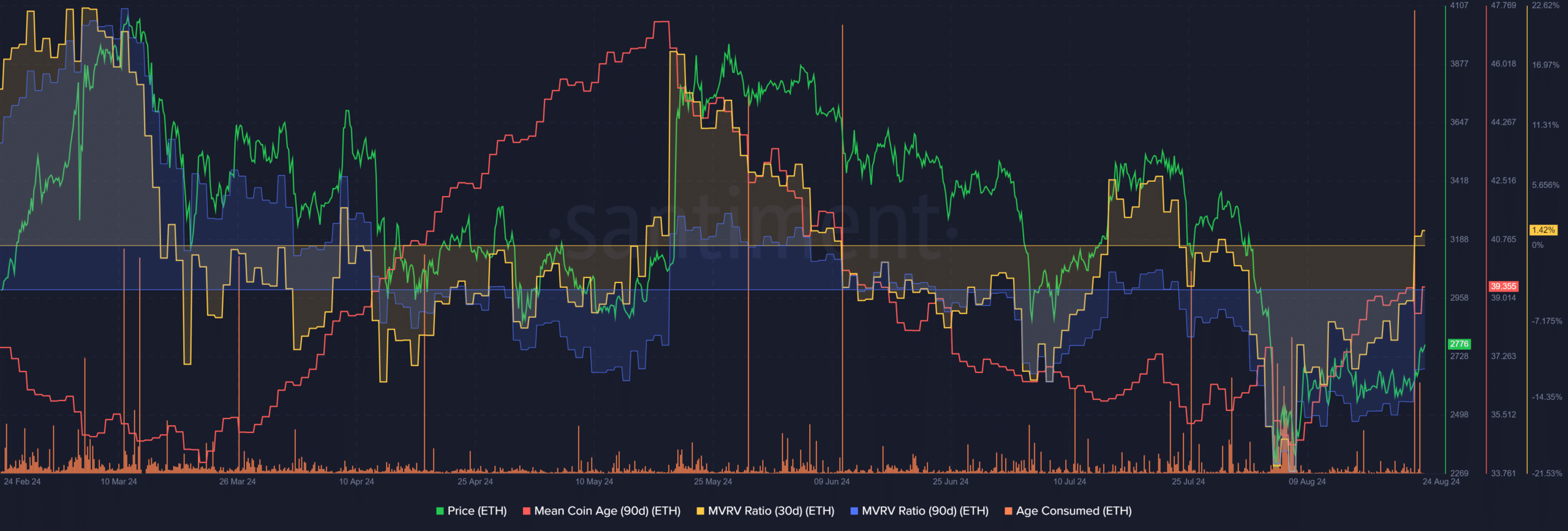

- The age consumed metric signaled caution while other metrics showed.

As a seasoned researcher with years of experience in the crypto market, I find myself intrigued by the recent developments in Ethereum [ETH]. The soaring taker buy/sell ratio indicates a surge in bullish sentiment, which could potentially signal a recovery for ETH. However, I’ve learned from past experiences that such metrics can sometimes be misleading.

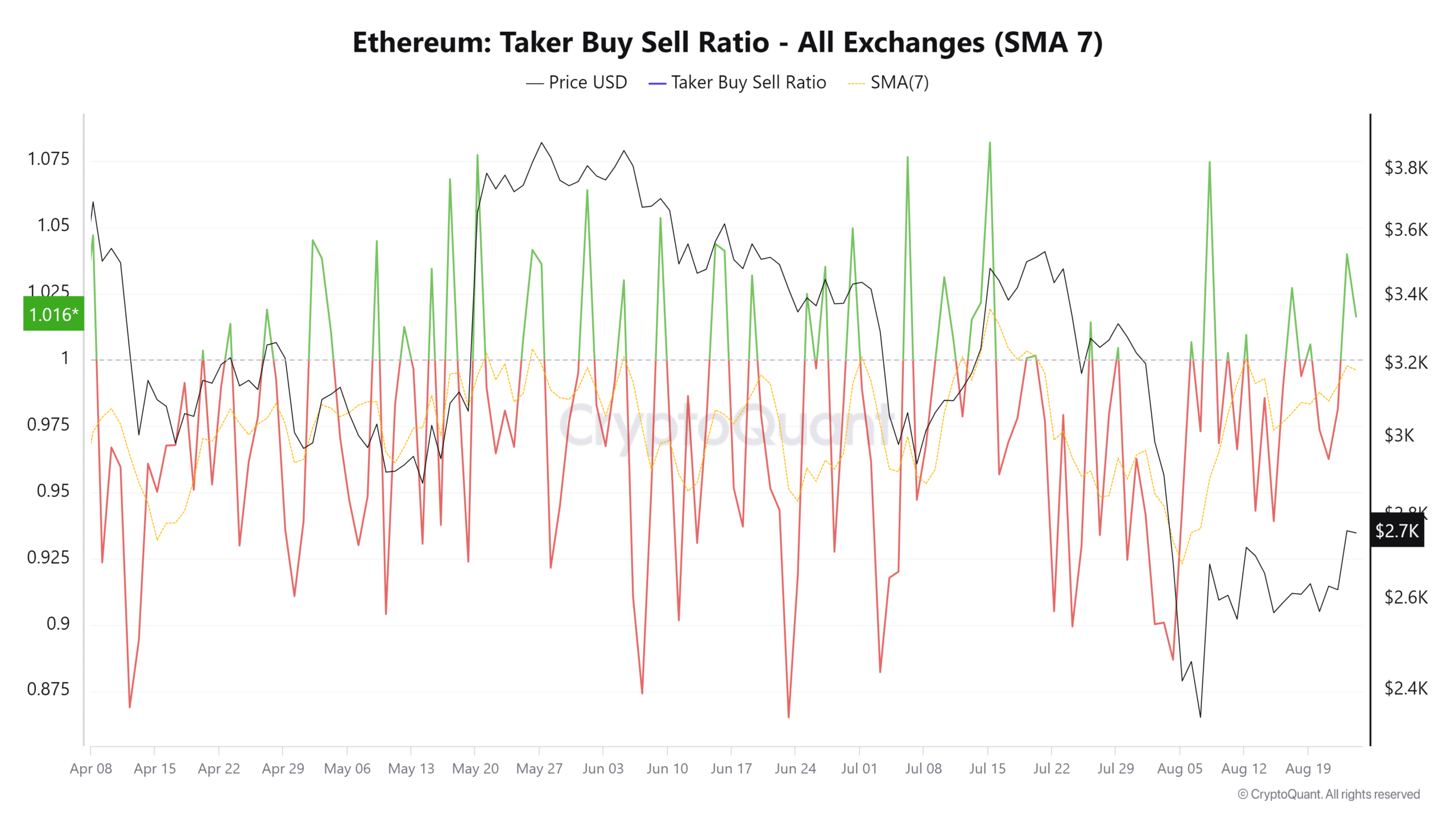

Over the last few days, the buying and selling activity for Ethereum [ETH] has significantly increased, as evidenced by the steep rise in the taker buy-to-sell ratio. This indicator measures the ratio of taker buy volume to taker sell volume. A value less than 1 suggests a bearish outlook.

A “taker” refers to the type of order made, which is typically a market order instead of a limit order. This indicates that such traders are ready to pay a slightly higher price to complete their trades immediately based on current market rates. Consequently, this ratio can serve as an indicator of overall sentiment.

Ethereum on the way to recovery

On the 31st of July, Ethereum was valued at approximately $3,200 in trading. Since the 20th of July, there has been a higher number of sellers compared to buyers, indicating a predominant bearish attitude. After the price drop on the 5th of August, the market’s rebound sparked interest in long positions.

On the 8th and 23rd of August, although the spikes suggest a bullish trend, they may not necessarily point to a continuous or long-term recovery.

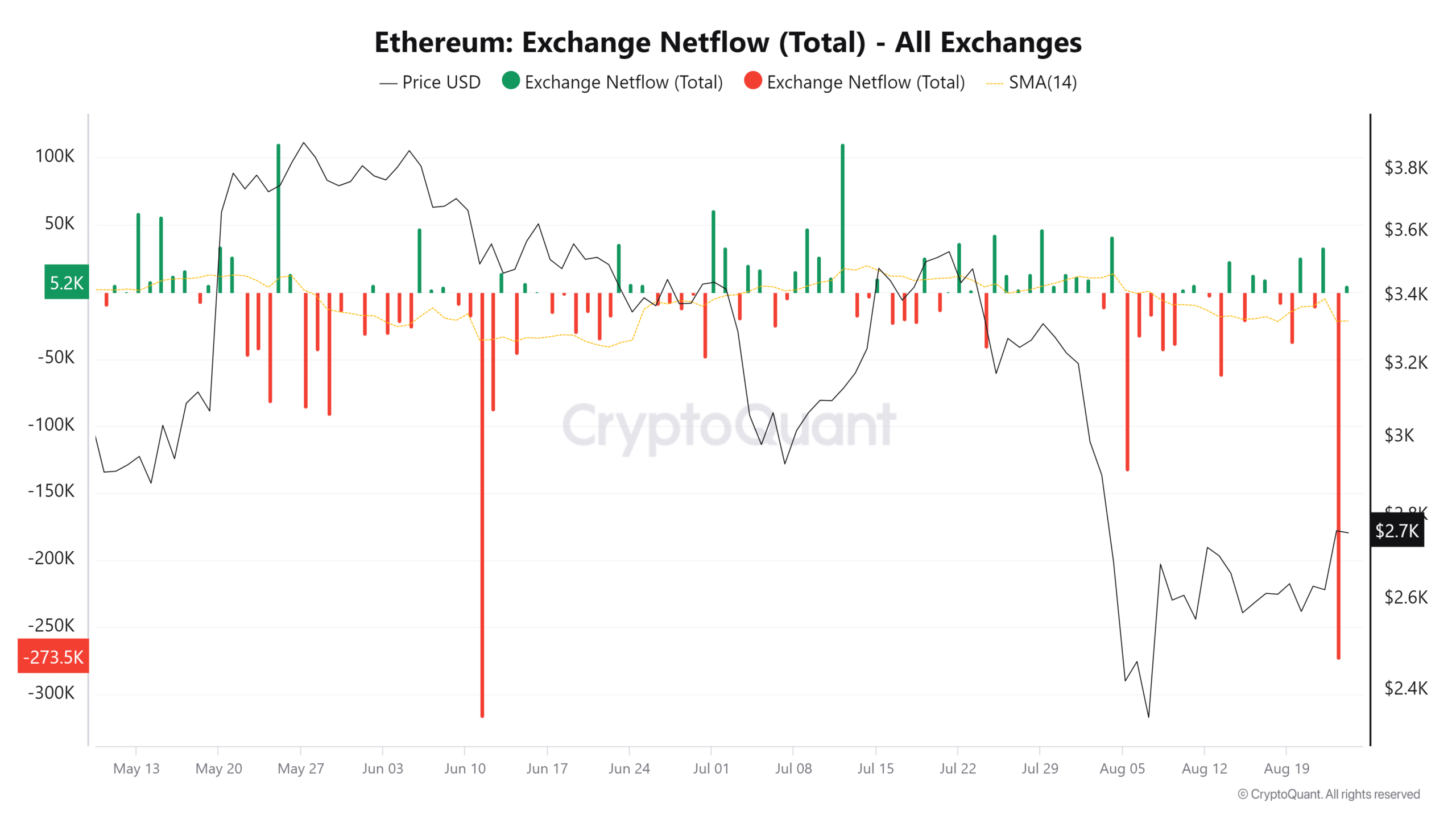

As a crypto investor, I’ve noticed that the recent outflow of Ethereum from exchanges could provide some insight into the market trend. On the 23rd, there was a massive withdrawal of ETH, suggesting that investors might be hoarding it, signaling accumulation. However, after the price drop in early August, the 14-day simple moving average has once again started to slide downwards, indicating a resumption of its downtrend.

This was an encouraging sign and could push prices toward the $3k resistance zone.

Should traders anticipate a breakout past $3k?

30-day MVRV recently moved into positive range, showing short-term investors are currently in profit. However, the 90-day MVRV remains negatively positioned. Over the last three weeks, the average age of coins has been steadily increasing.

As someone who has been closely monitoring the cryptocurrency market for quite some time now, I find it fascinating to observe the intricate patterns that unfold within this dynamic ecosystem. In my personal experience, a network-wide accumulation, as signaled by the recent data, often reinforces a bullish sentiment from the netflows metric. This means that a significant number of tokens are being bought and held, which can indicate a growing confidence in the market’s potential future growth.

Is your portfolio green? Check the Ethereum Profit Calculator

A decrease in network gas fees might make Ethereum’s supply grow over time, which could potentially have a detrimental effect on Ethereum in the long run.

Movements like these often indicate a surge of sell-offs. Investors should keep an eye out for potential selling pressure throughout the weekend, and approach Monday’s market activity with care.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-08-25 12:07