- Trading at a support level defined by the Fibonacci retracement line at press time, ETH is likely to breach this level soon.

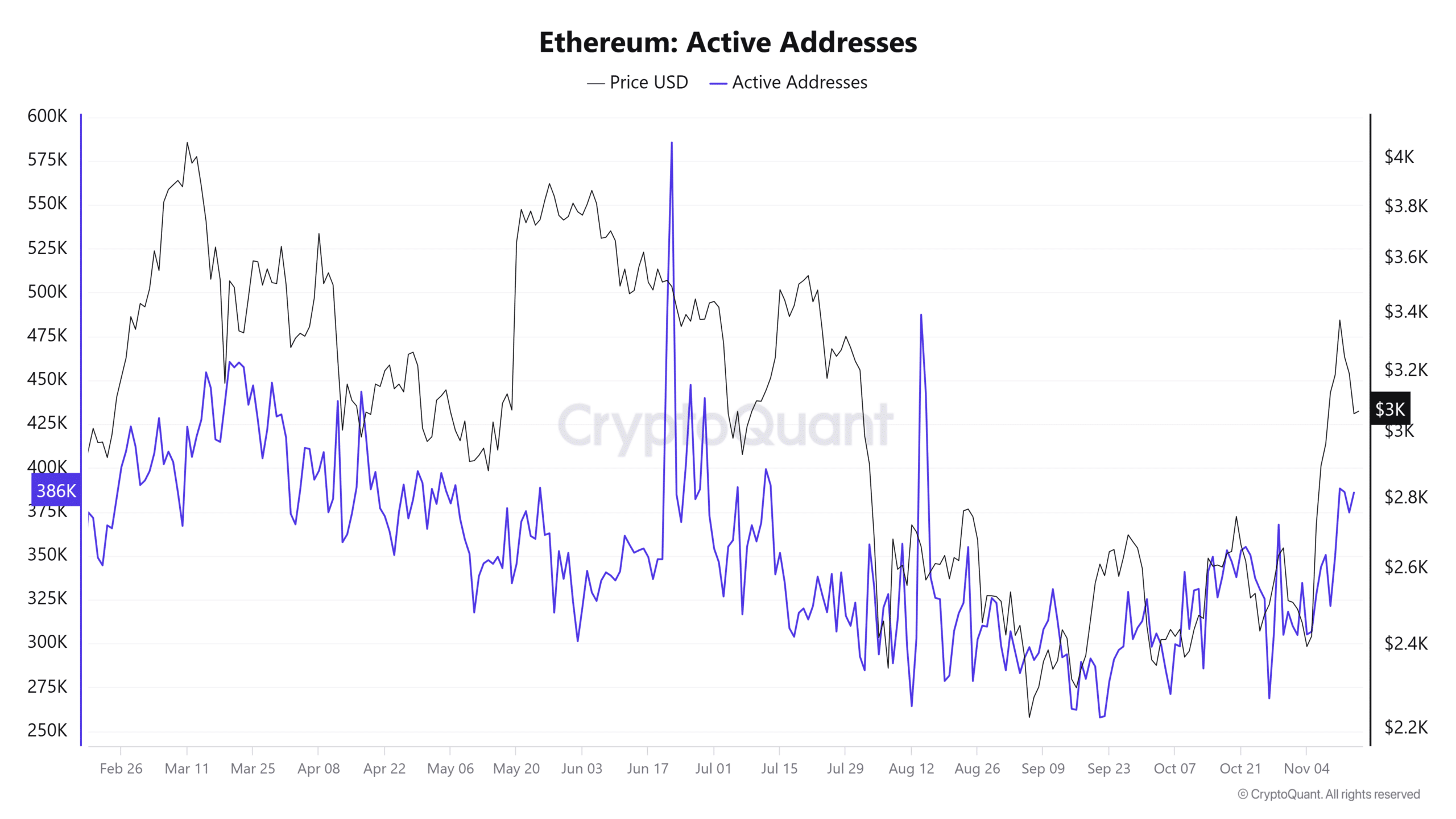

- Positive netflows and an increase in active addresses suggest strong investor activity, despite the short-term bearish pressure.

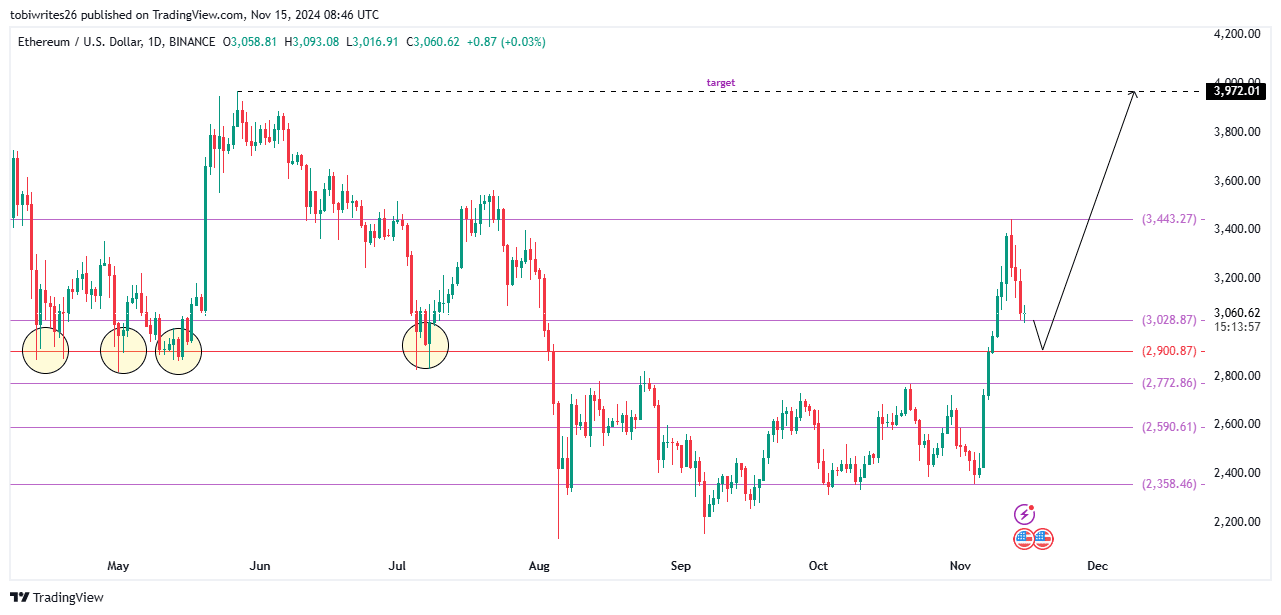

As a seasoned crypto investor with a knack for technical analysis and a keen eye for market sentiment, I find myself both cautiously optimistic and bracing for short-term turbulence regarding Ethereum [ETH]. The current dip, which has touched the Fibonacci retracement line at $3,028.87, may be a sign of things to come as ETH is poised to break this support level.

Over the last four weeks, there’s been a significant 18.56% surge in Ethereum [ETH], demonstrating strong positive trends. Yet, it’s worth noting that a slight drop of 3.63% has started recently, and this downward trend might temporarily intensify before Ethereum recovers.

In simpler terms, it seems likely that we’ll see a rise in the market after this period of stability ends, based on current investor feelings and technical signals. This means the overall long-term perspective remains optimistic.

Slight decline could propel ETH to new highs

Right now, when I’m typing this, Ethereum (ETH) was seen moving lower, momentarily hitting a Fibonacci retracement level that is serving as its current support.

The Fibonacci retracement indicator, commonly employed for locating potential support and resistance points, indicates that a tentative support might be found at the price point of $3,028.87. Nevertheless, it’s important to note that this level may only offer a short-term respite from possible future price decreases.

As a researcher studying the trends of ETH, I’ve noticed that if ETH dips below its current level, it might trigger a minor drop towards $2,900.87 – a 50% retracement from its overall rally. This level has historically played a crucial role in ETH’s recovery, having spurred four previous occasions of ETH’s upward momentum, including two significant rallies.

Source Trading View

If this backing holds strong once more, the bullish trend for Ethereum might reemerge, potentially propelling its price towards a goal of around $3,971.02.

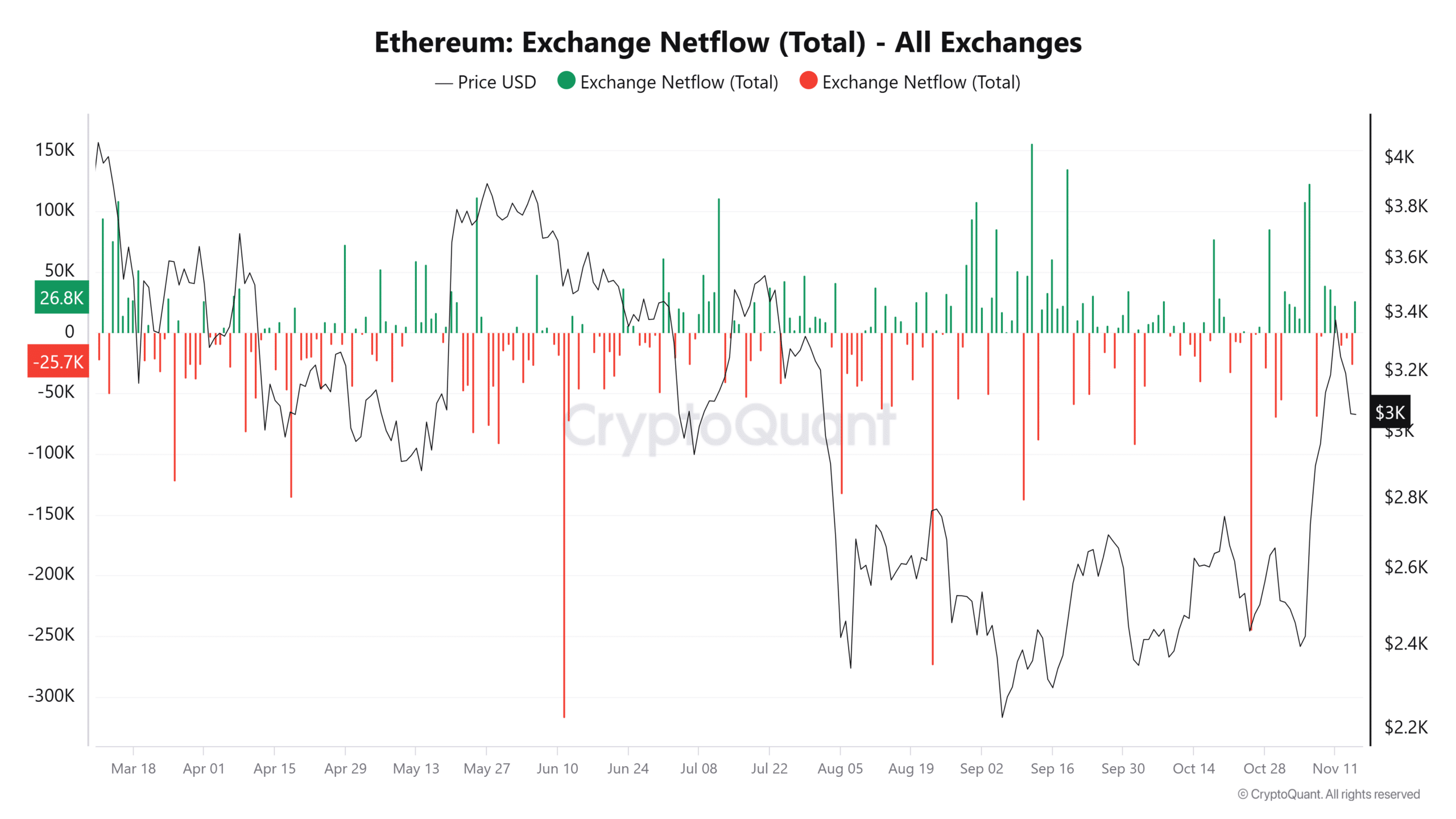

Key metrics point to selling pressure

It seems like Ether (ETH) might experience a possible price decrease since several significant factors suggest higher selling activity. Currently, the support level is at approximately $3,028.87, and it looks like a drop could happen soon due to the increasing downward pressure.

A major factor here is the increase in Ethereum (ETH) being transferred to exchanges, amounting to more than 32,600 ETH. This movement suggests that these ETH might be sold off for liquidation purposes. Such an influx often indicates increased selling pressure, which can hinder the asset from experiencing additional rallies.

One key aspect to consider is the significant increase in active wallets. Previously, instances where activity surges coincide with falling prices often indicate that many of these wallets are more inclined towards selling rather than purchasing.

Based on these merged indicators, it appears that Ethereum could potentially drop below its current support level, leading to a temporary decrease in its value.

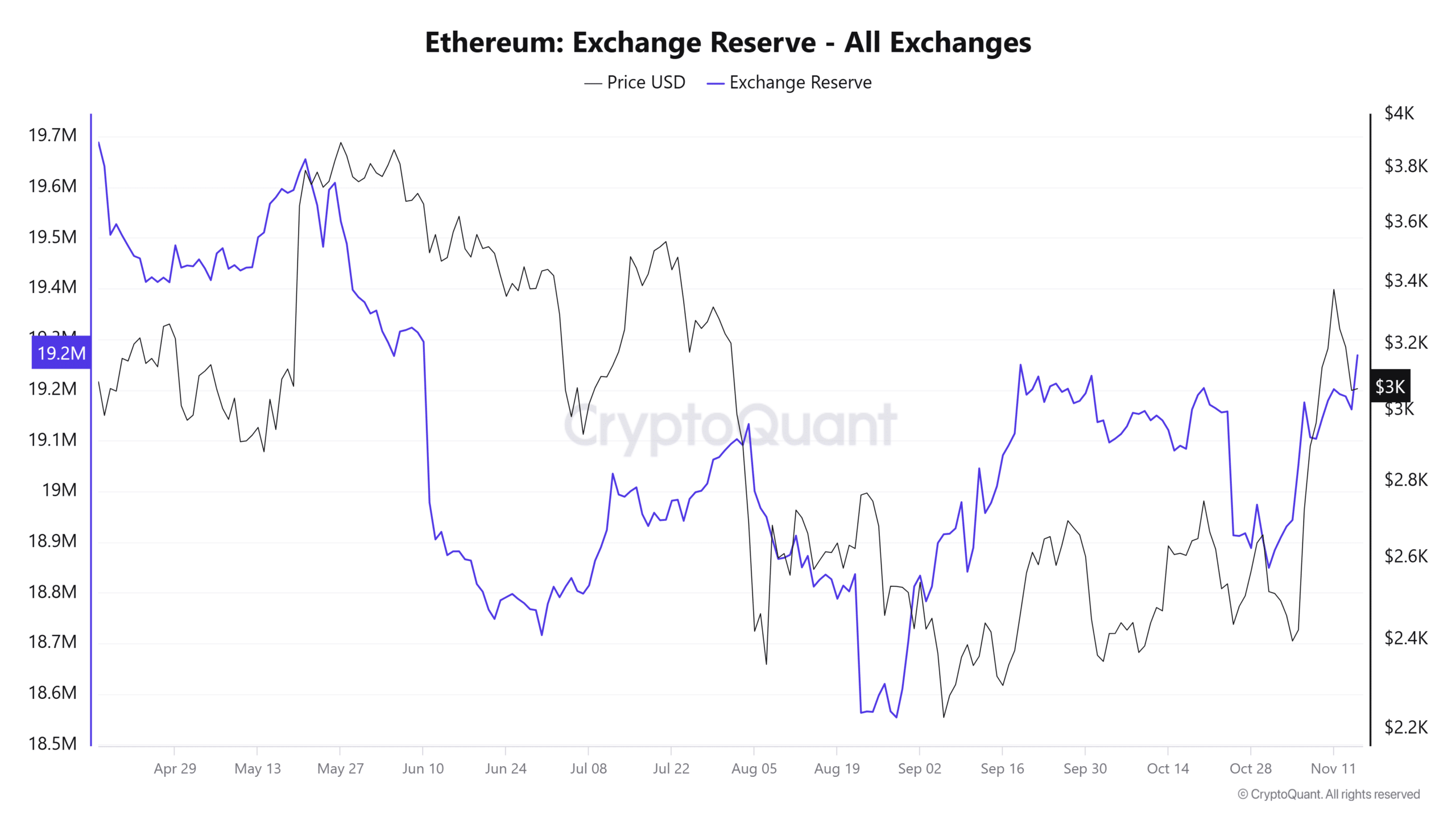

Ethereum decline expected to be temporary

Based on the latest figures from the Exchange Reserve, it appears that Ethereum’s decrease in value might be caused by a rise in the amount of Ethereum being held on exchanges for trading purposes, which generally results in more sellers and downward price pressure.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Nevertheless, although a decrease seems unavoidable, it might only be temporary. Notably, the daily and weekly growth in the Exchange Reserve has been insignificant, standing at 0.03% and 0.32%.

Should this trend continue, the $2,900.87 mark could become a significant focal point, drawing in potential buyers not only as a goal during the ongoing downward trend but also as a starting point for the forthcoming uptrend.

Read More

2024-11-16 07:03