Ah, Ethereum! A cheeky little blockchain darling that has recently enjoyed an explosive price rally over the past week, gallivanting up by a splendid 22% to touch the dizzy heights of $3,856. However, in the last 24 hours, it has taken a rather dramatic dip of 4.18%, prompting one to question if the momentum has all the tenacity of a damp sponge. With the specter of regulatory uncertainty and ETF outflows casting a shadow, it seems the ETH aficionados are rather jittery. Yet, if we peer through the fog, its fundamentals and onchain data hint at a healthy cooldown rather than a full-on trend reversal. Curious about the next milestone for dear old ETH? Well, gather ’round for a bit of whimsical short-term price analysis!

Strategic Holding Amid Sell Pressure

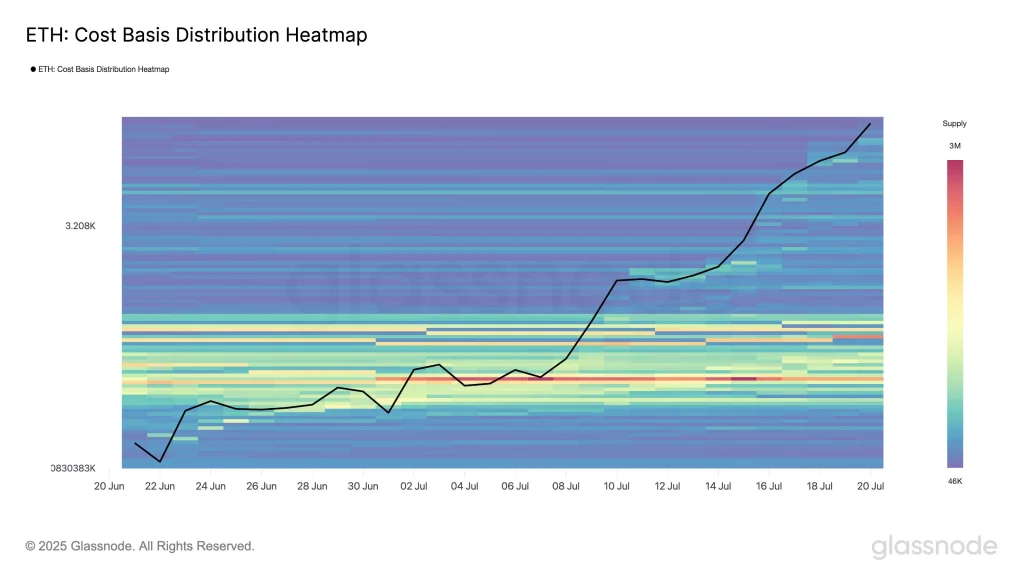

Well, according to the renowned seers at Glassnode and their Cost Basis Distribution Heatmap (which, by the way, sounds like something out of a wizarding school for crypto), a significant clan of ETH investors who hoarded their coins around the vibrant $2,520 mark have begun to book their profits. This is evident from the fading red bands reminiscent of the dreaded early July—how they make the heart flutter! Despite this, an astonishing count of nearly 2 million ETH remains as unmoved as a cat in a sunbeam. Their findings daintily reveal three crisp insights:

- Holders are nibbling on partial gains rather than making a hasty retreat.

- The remaining positions suggest unwavering faith in a bullish future.

- New buyers are courageously stepping in, absorbing the sell pressure like a sponge soaked in optimism.

This curious distribution behavior highlights a maturing investor base who are using market rallies to rebalance their portfolios, all while keeping their faith in ETH’s medium-term prospects as if it were a family pet that promises to bring home the bacon.

Ethereum Price Analysis

Currently, Ethereum is playing coy at $3,635, sporting a -4.18% pullback in the last 24 hours. The RSI has taken a stroll from the overbought zone of 70 to a rather pedestrian 51, suggesting that the momentum is, shall we say, dwindling. Additionally, the price has crept below the 20-period EMA on the 4-hour chart, which is akin to a slight sneeze on an otherwise bright day—a sign of short-term bearish pressure.

Key support, my friends, is lurking at $3,550—an admirable bounce zone. Should it fail here, we might very well see ETH bring out its sad face and tumble down toward $3,525. Conversely, for any glimpses of a revival, our dear Ethereum must muster its courage and reclaim the resistance at $3,870, with hope lingering for a retest of the coveted $4,096. Ah, the drama of it all!

FAQs

Why is Ethereum price down today?

Ah! The dastardly trio of Bitcoin ETF outflows, a bout of profit-taking after a sharp ETH rally, and a sprinkling of regulatory uncertainty have conspired to send the price down today. Such a mischievous lot!

Is Ethereum still bullish in the medium term?

Indeed! Onchain data indicates that large holders are leisurely retaining their positions, giving us hope that despite the recent hiccups, a long-term upside remains plausible.

W

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Get the Bloodfeather Set in Enshrouded

- How to Build a Waterfall in Enshrouded

- Fatal Fury PS5, PS4 Will Return with a Second Season of DLC Fighters

- The Simpsons Cast Lindsay Lohan To Voice Future Maggie

- Mormon Wives’ Demi Responds to Jessi’s NSFW Claim About Husband

2025-07-22 13:51