- Ethereum’s price fell while network growth and velocity plummeted

- On a macro level, Ethereum’s network continues to see growth

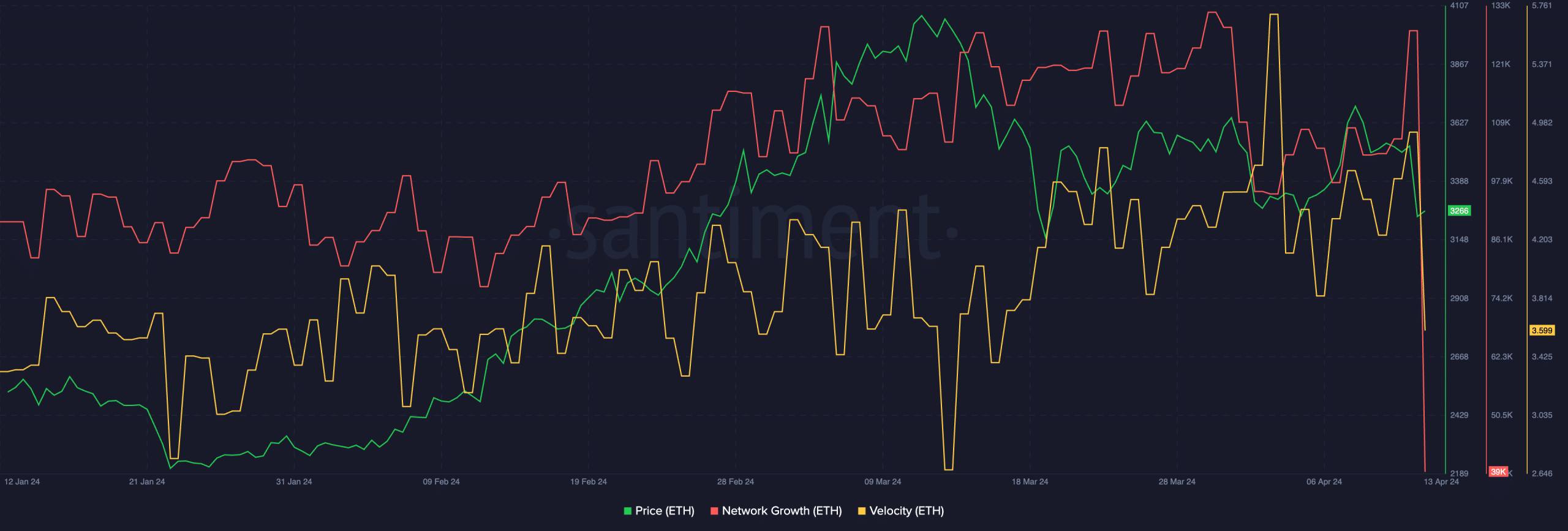

Over the past 24 hours, Ethereum [ETH] experienced a significant drop in price, following a similar trend in the broader cryptocurrency market. The coin was priced at $3,267.60 at the time of reporting, representing a 7.22% decrease in value.

Ethereum takes a hit

During this timeframe, Ethereum’s network expansion noticeably decreased. This hinted that the appeal of ETH for new users was waning, and the number of fresh addresses eager to purchase ETH at its current rate was scant. Furthermore, the transaction speed of ETH dropped, implying a decrease in the regularity with which ETH was being exchanged.

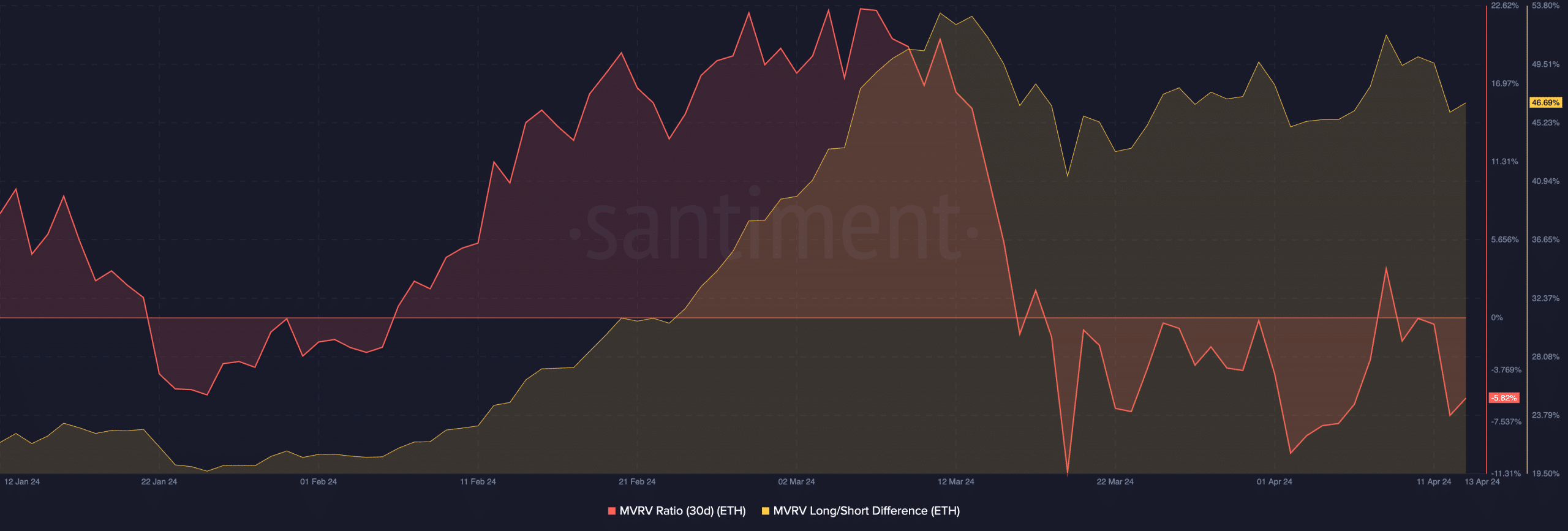

Additionally, the MVRV ratio of Ethereum decreased, signifying a decline in the number of profitable addresses. Furthermore, there was an uptick in the long-term investor versus short-term investor gap for Ethereum, suggesting more long-term holders have amassed the cryptocurrency.

Looking at the larger picture

Despite appearing challenging for Ethereum in the immediate future, the long-term perspective holds great promise. Notably, Ethereum’s network has made significant strides since last year.

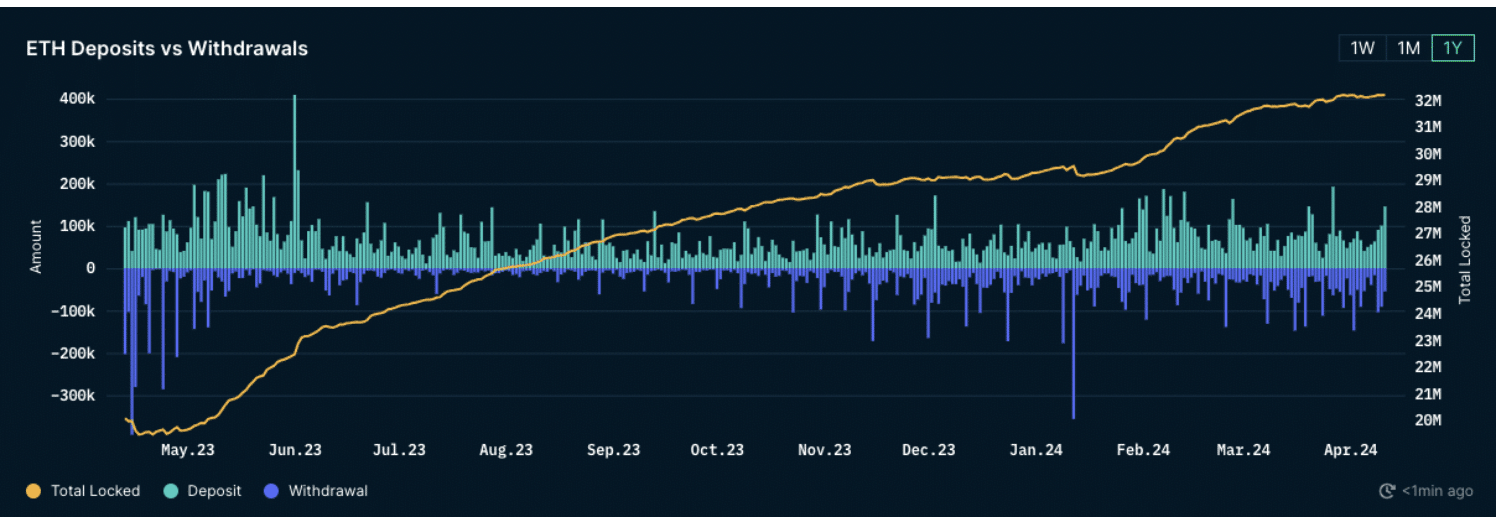

According to Nansen’s data, the amount of Ether staked has experienced substantial increase over the past year, rising from 20 million to 32.2 million Ethereum. Although there was a slight decrease in staked Ether following centralized exchanges’ withdrawals during Shapella’s launch, there has been a noteworthy rise of approximately 61% in staked Ether.

Approximately $42 billion has flowed into Ethereum’s staking system recently, which is an enormous investment according to current values.

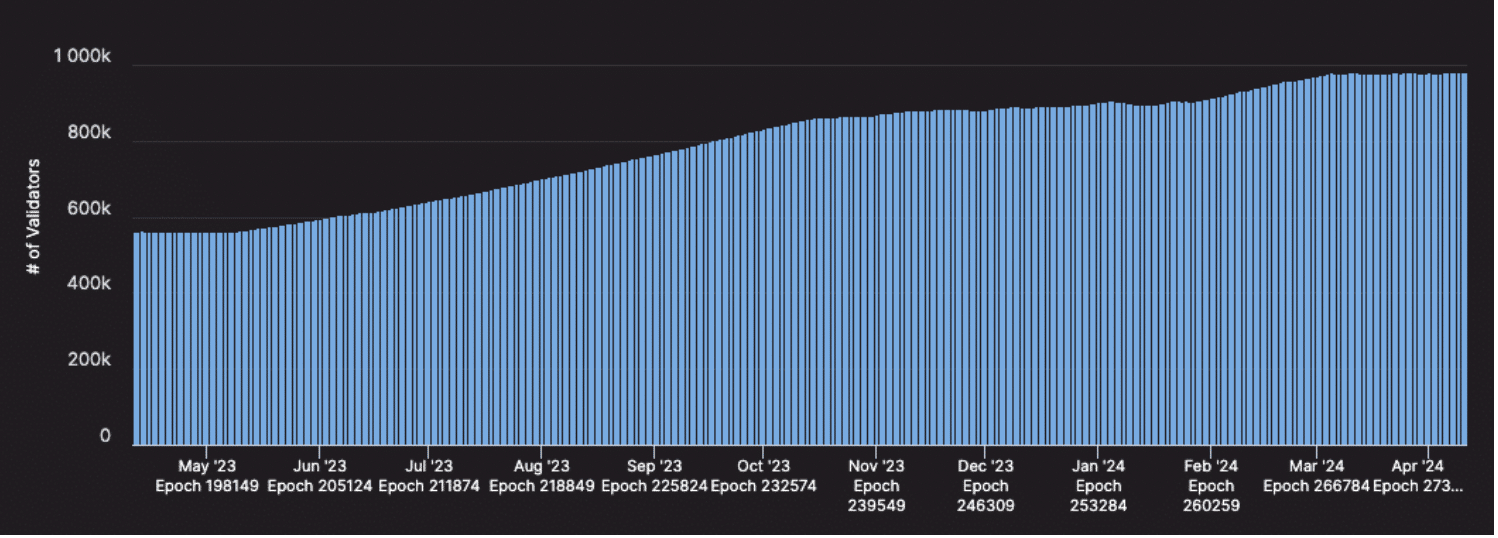

The number of validators in the Ethereum network has experienced notable expansion following Shapella, bringing relief to the community who had worried about a possible large-scale departure of validators. As per Austin Blackerby, EVM Analytics Manager at Flipside Crypto, this expansion has helped quell numerous concerns.

Last year around this period, roughly 563,000 Ethereum validators were actively securing the network. Now, that number has grown by more than 74%, reaching an estimated 981,000 validators.

In the report published in September 2023, concerns were brought up by developers and researchers regarding the continuous expansion of the number of validators. This growth puts pressure on the peer-to-peer network and messaging system, increasing the likelihood of node failures due to heavy computational demands and bandwidth usage.

Read Ethereum’s [ETH] Price Prediction 2024-25

An extensive group of validators also increases the difficulty and potential risks for implementing future upgrades. The approaching upgrade, named “Electra,” aims to tackle the issues arising from the growing number of validators.

In simpler terms, the outlook for the largest cryptocurrency other than Bitcoin appears more stable and hopeful in the long run compared to the short term.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-13 18:15