-

ETH exchange balance has hit a new low, signaling an upcoming supply crunch.

ETH could target the previous range-low if improved market sentiment persists.

As a seasoned analyst with over two decades of experience in the cryptosphere, I’ve witnessed countless bull and bear cycles, and this latest Ethereum (ETH) phenomenon is intriguing. The record-low exchange balances suggest an impending supply crunch, which historically has been a strong bullish signal for altcoins like ETH.

1. The balance of Ethereum [ETH] held in exchanges has reached a record low, creating a potential shortage for the leading alternative coin worldwide. Interestingly, large Ethereum holders, often referred to as ‘whales,’ have been actively increasing their stockpile, despite the recent market downturn, as pointed out by on-chain analyst Leon Waidmann.

‘Despite the dip, whales keep stacking #Ethereum! The #ETH Exchange Balance just hit a new LOW’

As a researcher, I’ve observed a significant shift in Ethereum’s distribution. By August 10th, approximately 10% of the total Ethereum balance had moved to exchanges, equating to roughly 12 million Ether. This trend suggests a dwindling supply, which could theoretically pave the way for an upward momentum in Ethereum prices.

The scarcity of Ethereum (ETH) available on centralized exchanges reached an all-time low, indicating that investors are transferring their ETH holdings from these platforms either for long-term holding or personal custody purposes.

In most cases, this can be viewed as a bullish cue for ETH.

ETH network effects surged

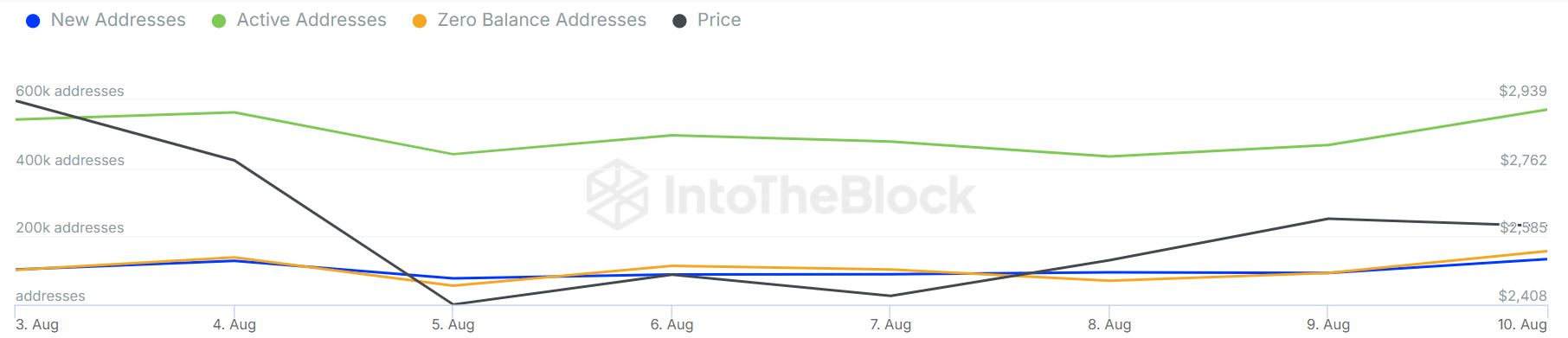

As a crypto investor, I’ve been witnessing an uplift in Ethereum (ETH) activity following the dip to $2.1k on 5th August. Interestingly, the number of active addresses skyrocketed, rising from approximately 440K to an impressive 571K by 10th August – marking a significant increase of over 130K.

During the same timeframe, more than 60,000 new addresses were added, highlighting robust expansion within the Ethereum network.

As an analyst, I observed a fluctuating trend in weekly ETH demand from U.S investors, particularly through ETH ETFs. Notably, these products recorded significant inflows of $48.7 million and $98 million on Monday and Tuesday respectively, suggesting that investors were capitalizing on the market dip to increase their holdings.

However, ETFs saw a negative streak from Wednesday to Friday, totaling $42 million in outflows.

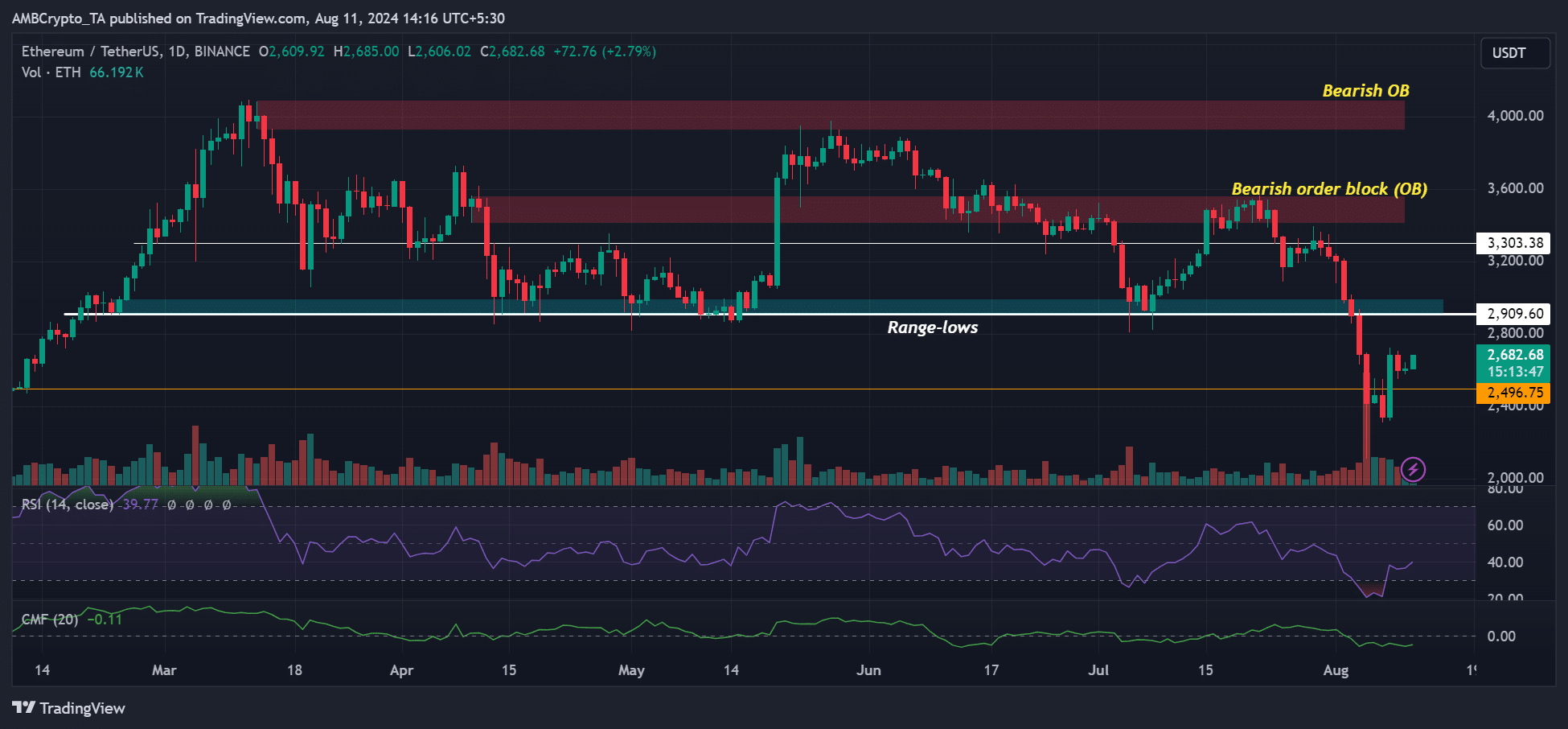

ETH price action

Ethereum’s overall price surge has reached approximately 30%, taking it from around $2.1K to over $2.6K as of the latest update. It regained the significant $2.5K level, but so far, the previous low points at $2.9K have not been revisited or recaptured.

In my analysis, should the market recovery continue into the coming week, a crucial point to keep an eye on would be the range lows. If, however, we see a pullback from the recovery’s progress, the bulls will find themselves in a position where they need to defend the $2.5k level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-08-11 18:15