-

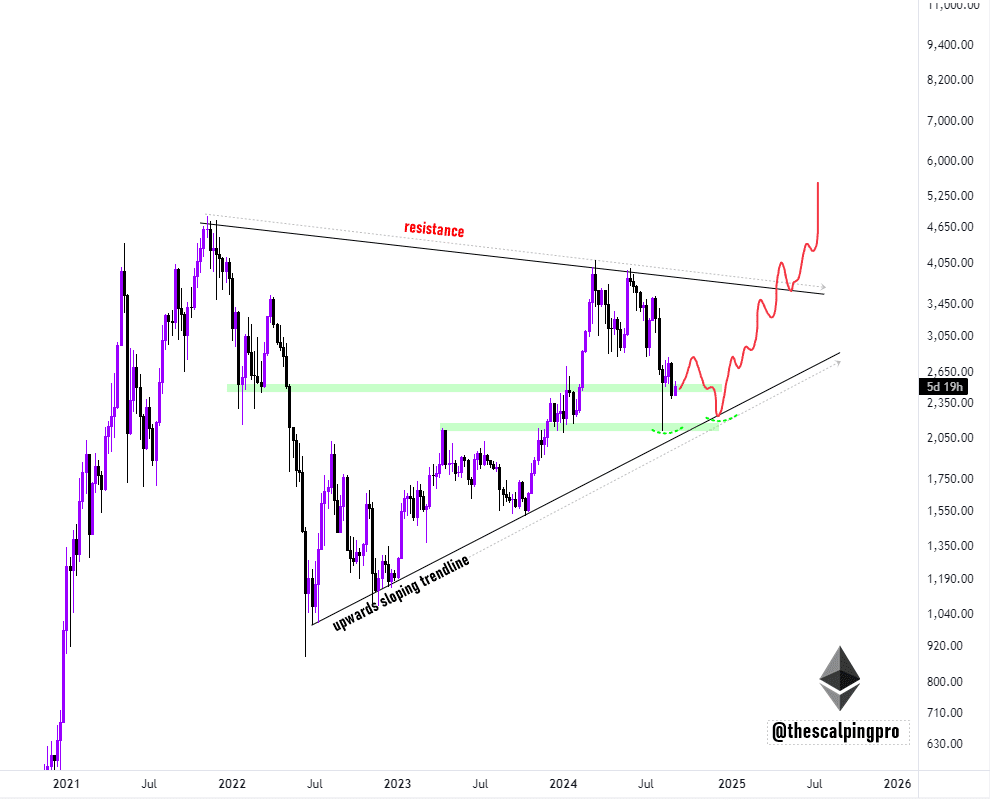

Ethereum traded in a massive triangle at press time, with analysts predicting a possible double bottom pattern.

Whale transactions and active addresses increased, signaling potential upward momentum for ETH’s price.

As a seasoned crypto investor with a knack for recognizing market trends and patterns, I find myself intrigued by the current state of Ethereum [ETH]. After weathering several storms this year, ETH’s recent dip to $2,399 has me on edge. However, the optimist in me can’t help but notice the potential bullish signals on the horizon.

In the past few weeks, Ethereum (ETH) has been facing considerable difficulties, persistently trending lower in terms of price and overall market feeling. After a steep drop in value last month, ETH has been moving according to a bearish market pattern

In the last day, the value of the asset decreased by 4.5%, which now stands at $2,399. This is also a 2.3% drop when considering the overall market trend

Despite the persistent negative outlook towards Ethereum’s price movement, certain analysts maintain a positive stance on its future performance

crypto expert Mags, on the platform previously known as Twitter, lately expressed his viewpoint about Ethereum possibly reversing its current downward trajectory

Ethereum’s possible recovery?

In his post, Mags noted,

“Currently, Ethereum’s price movement appears to be contained within a large triangular pattern. There’s a possibility that a ‘double bottom’ formation may develop close to the lower trendline, which traditionally acts as support. If this happens, we might expect Ethereum’s price to rise further.”

Based on this analysis, it seems like ETH could be nearing a significant turning point, possibly setting up for an optimistic price increase in the near future

Through technical analysis, a double bottom formation signifies a bullish turnaround, indicating that the value of an asset could be nearing its lowest point and might soon increase again

Based on my years of trading experience, I’ve noticed that when the price drops to a certain level twice and there is a slight uptick between these two low points, it often signals a potential support level. This pattern has been useful in helping me make informed decisions in the market, as it can indicate a possible reversal in the trend. However, it’s always important to remember that trading involves risk and this pattern should not be used in isolation when making investment decisions. Always do your own research and consider seeking advice from financial professionals before making any trades

According to Mags’ theory, if Ethereum’s price trend continues as expected, we could see a substantial increase in its value once the current downtrend (bear market) ends

At the moment, the technical signals for Ethereum suggest a potential recovery might be on the horizon. The cryptocurrency is currently close to crucial support points where it could find some footing in the market

If the double bottom pattern unfolds, there’s a possibility that Ethereum might break away from its extended downtrend and initiate a fresh upward movement instead

Keep in mind that while this situation is still uncertain, it’s important to exercise caution as Ethereum nears these significant price thresholds

Whale transactions and active address rebound

Surprisingly, even though Ethereum’s value is decreasing, certain essential aspects of it are starting to display encouraging indicators

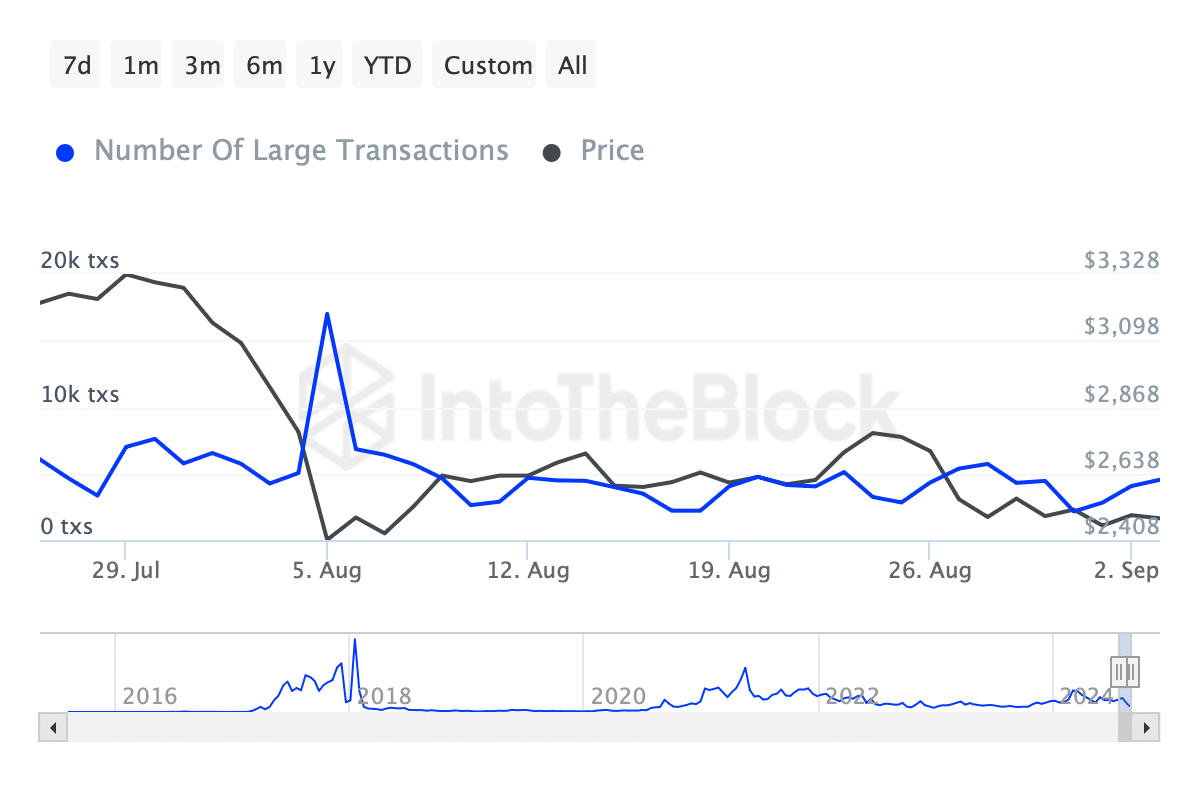

Here’s a possible way of paraphrasing the given sentence in a more natural and easy-to-read manner: For example, data from IntoTheBlock indicated that large Ethereum transactions (those exceeding $100,000) have begun to bounce back following a substantial decrease earlier in August

On the 5th of August, these transactions reached a high of over 16,000 and then dropped to around 2,210 on the 10th of August. However, the latest figures suggest a recovery as whale transactions currently stand at 4,530 as we speak

The increase in whale behavior indicates that big investors could be preparing for an anticipated rise in the value of Ethereum

An increase in whale trades is often viewed favorably since it demonstrates growing investor attention from high net worth individuals. This heightened interest might lead to a larger market upswing

Read Ethereum’s [ETH] Price Prediction 2024–2025

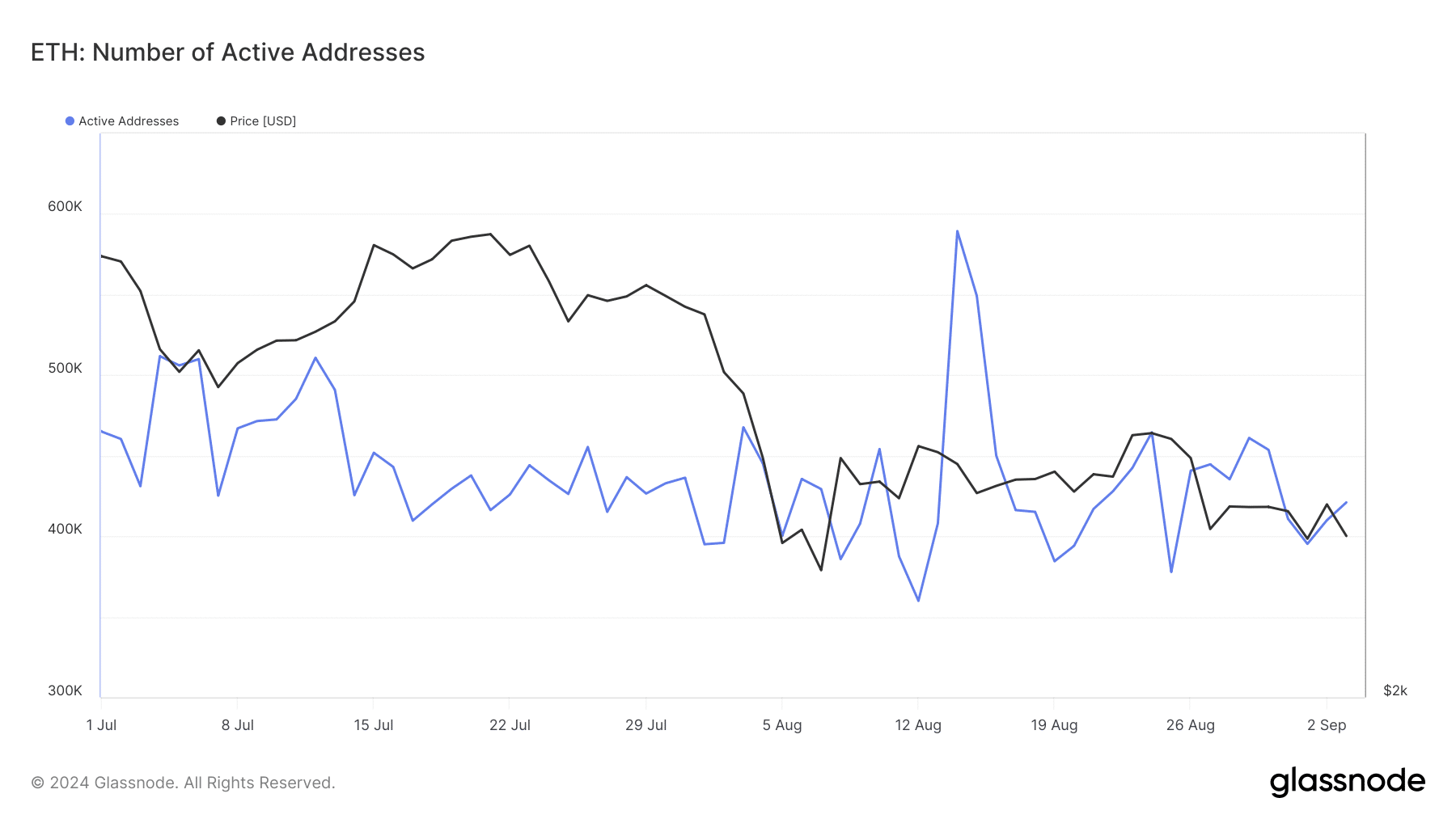

Besides whale transactions, data from Glassnode shows a resurgence in the number of active Ethereum addresses. The highest number of active addresses was recorded at 589,000 on August 14th, but it dropped below 400,000 just last week

At the time of publication, this figure has increased once more to reach 420,000. An uptick in active addresses often indicates a rise in user engagement with the network, potentially triggering a price increase as well

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-04 21:12