Amid the cacophony of the financial markets, Ethereum has finally broken free from its chains, surging past the $3,000 mark with a triumphant roar. After weeks of being trapped in a tight consolidation, the second-largest cryptocurrency has found its voice, rising over 20% since Tuesday. This decisive move has not only rekindled the spirits of the bulls but has also set the stage for a potential altcoin renaissance. The broader market, which had been in a state of muted anticipation, is now buzzing with renewed vigor, as if the air itself is charged with the electricity of possibility.

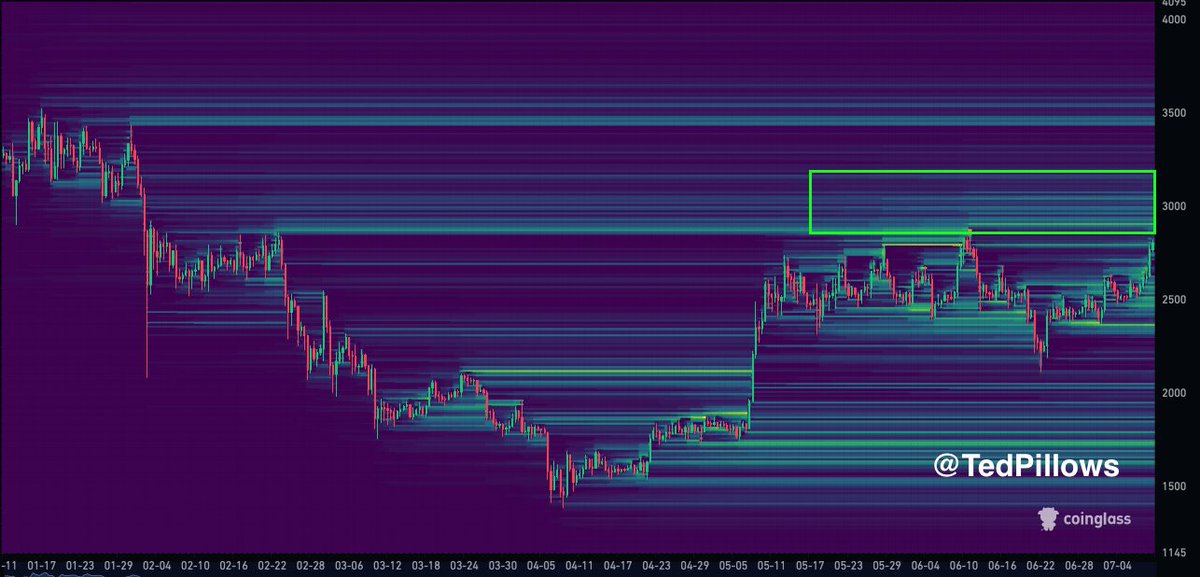

Top analyst Ted Pillows, with a twinkle in his eye, points to the large concentration of liquidity just above the $3,000 mark as the key to Ethereum’s ascent. “Liquidity is a magnet,” he quips, “and once Ethereum cleared the $2,850 resistance, it was like a dam bursting, sending the price surging through the $3,000 level and into a new realm of opportunity.” The market, it seems, has found its new north star, and the bulls are not about to let it go without a fight.

As Bitcoin continues to set record highs, Ethereum and its altcoin brethren are poised to catch up, or so the story goes. The big question on everyone’s lips is whether ETH can maintain this newfound momentum and lead the charge into a full altcoin season, or if this is just a fleeting moment of glory before another round of consolidation. The market, as always, is a fickle mistress, and only time will tell if the bulls can keep the party going.

Ethereum has spent the last several weeks in a state of limbo, hovering between support around $2,800 and resistance just below $3,000. The altcoin’s attempts to break free had been met with stubborn resistance, but yesterday, the tide finally turned. ETH closed above the key resistance level, signaling a potential breakout and the start of a new bullish phase. The breakout is not just a technical achievement; it is a symbol of renewed confidence in Ethereum’s value proposition, a beacon of hope in a market that has seen its fair share of turbulence.

The broader macroeconomic conditions have also played a role in this resurgence. Strong labor market data in the US and signs of de-escalation in global conflicts have helped reduce uncertainty and reignite risk appetite across financial markets. With Bitcoin reaching new highs and the risk-on sentiment returning, Ethereum’s breakout may be the harbinger of a new wave of upside for altcoins.

Top analyst Ted Pillows, ever the optimist, highlights the technical factors at play: “ETH liquidity is lying above $3,000, and liquidity is a magnet.” This means that large clusters of buy and stop orders are concentrated above this level, drawing the price toward these zones. Now that Ethereum has broken past resistance, the presence of high liquidity could accelerate its move upward, as traders chase the momentum like moths to a flame.

The breakout also holds symbolic weight. It shows that investors are regaining confidence in Ethereum’s value proposition, particularly with the broader altcoin market showing signs of life. If ETH can hold this breakout and establish $3,000 as new support, the next leg higher could materialize quickly, opening the door to targets in the $3,400–$3,600 range. The bulls, it seems, are not just laughing; they’re cackling all the way to the bank.

Ethereum (ETH) has decisively broken above the psychological and technical resistance at $3,000, closing its most recent candle at $3,008.97. This breakout follows a strong 15% daily surge, as seen in the chart, marking a powerful move backed by growing bullish momentum. Volume has expanded significantly, confirming trader conviction and institutional participation in this move.

The breakout puts an end to nearly two months of sideways action, with ETH previously locked between the $2,500–$2,850 range. The 200-day simple moving average (SMA), currently near $2,796, was breached with strength, acting as a springboard for price acceleration. The reclaim of this moving average adds technical validation to the breakout and signals the beginning of a new bullish leg.

ETH is now in a key zone for potential continuation. As long as bulls defend the $2,850–$2,900 level as support, Ethereum has room to rally toward $3,400 and beyond. With Bitcoin trading at all-time highs and macro conditions turning favorable for risk assets, ETH could lead the next wave of altcoin expansion. The bulls, it seems, are not just in the market; they’re in it to win it.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Borderlands 4 Players Get a New Look at Exo-Soldier Vault Hunter

2025-07-11 23:47