-

Ethereum’s netflow from exchanges increased by over 6%.

ETH has remained below its resistance level.

As an experienced financial analyst, I’ve closely monitored Ethereum’s [ETH] recent trends and observed a significant increase in net outflows from exchanges, which accounted for over 6% month-over-month. This trend is noteworthy, as it indicates that investors are shifting their ETH holdings away from trading platforms and potentially engaging in long-term holding or staking activities.

During the last thirty days, there has been a significant increase in the withdrawal of Ethereum [ETH] from exchanges. This observation suggests that investors have been transferring their assets off trading platforms.

In spite of a decrease in available exchange reserves, the amount of Ethereum being staked for validation has persistently increased. Ethereum has been making efforts to maintain its value in the face of changing investor attitudes and heightened network engagement.

Ethereum increase monthly outflow

According to AMBCrypto’s examination of Ethereum’s transaction records, approximately one million ETH were withdrawn from cryptocurrency exchanges during the month of June.

The $3.8 billion worthoutflow signified a notable 6.4% decrease from the previous month’s figure. This significant change suggested that a large amount of Ethereum had been taken off exchanges.

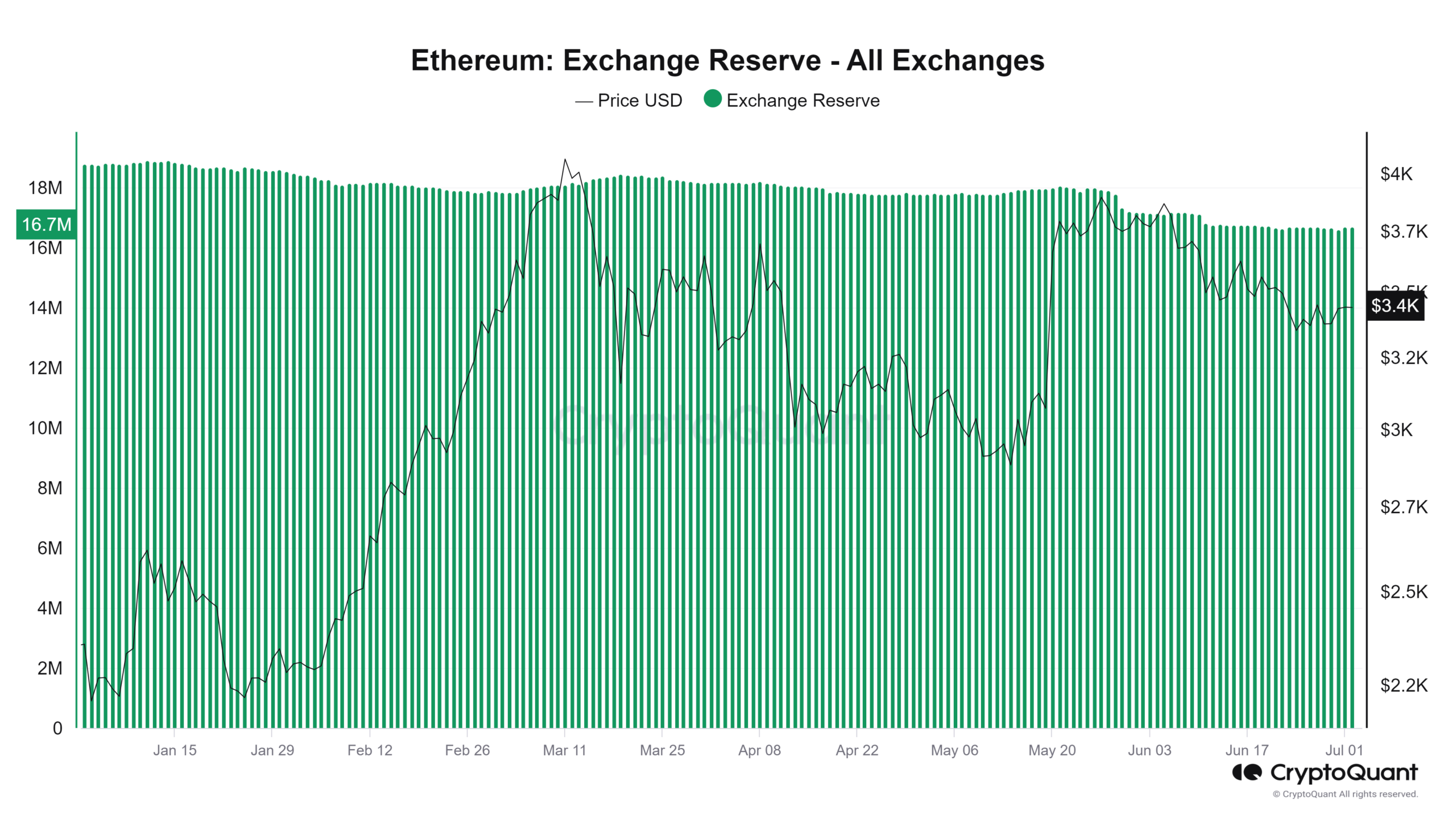

An in-depth look at the cryptocurrency reserve figures from CryptoQuant revealed a significant change. Initially in June, the amount of Ethereum stored in exchanges exceeded 17 million.

By the month-end, the Ethereum reserve had dropped to approximately 16 million units. At present, the figure stands at roughly 16.6 million ETH.

This decline in exchange reserves typically suggests a couple of strategic movements by investors.

Investors are either choosing to hold onto their Ethereum for longer periods or becoming more involved in Ethereum staking by transferring their ETH.

The ongoing advancement towards Ethereum 2.0 significantly reinforces this belief, as both situations suggest a optimistic outlook amongst Ethereum owners.

Total Ethereum staked increases

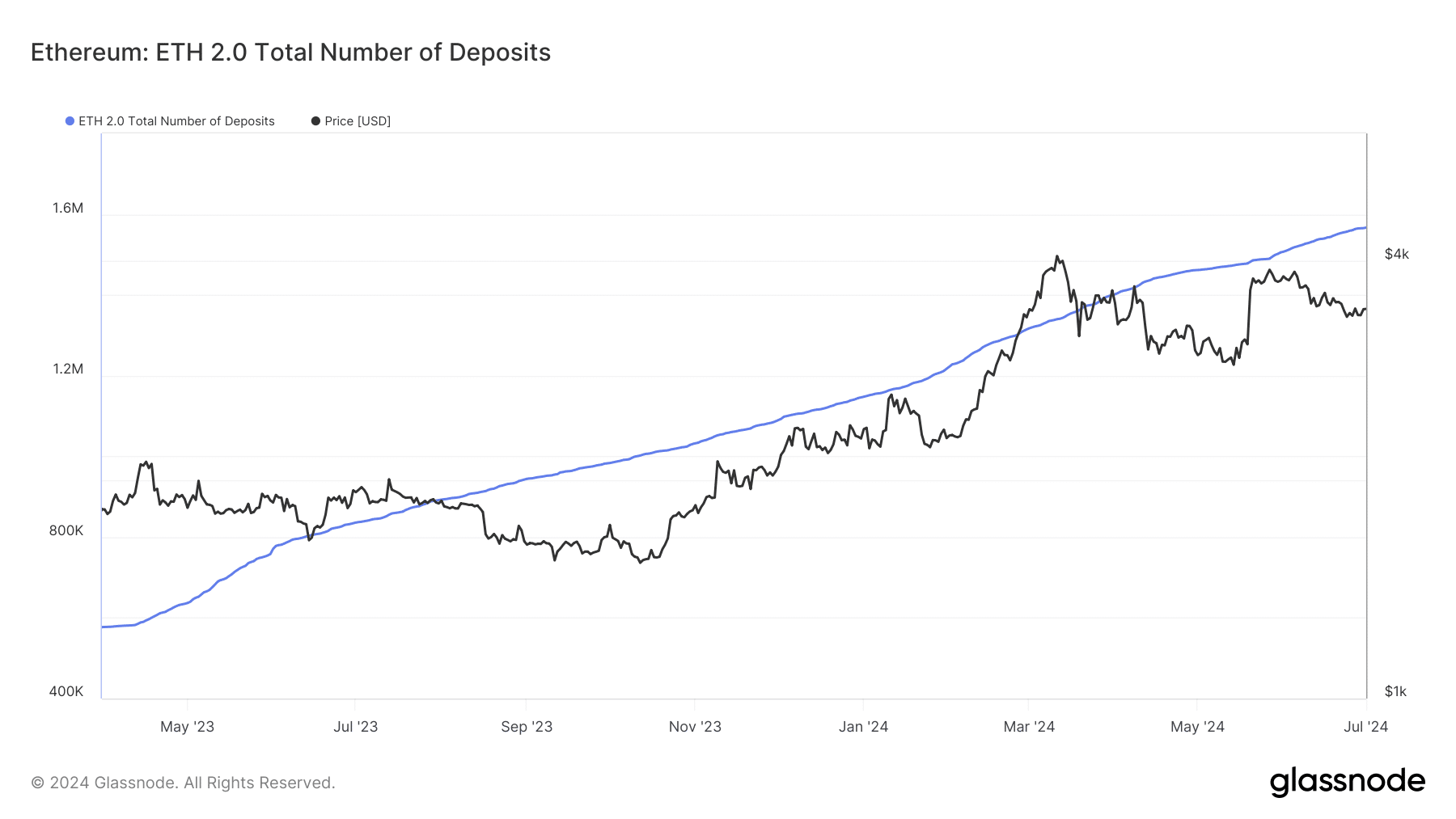

As an analyst, I’ve found that studying Ethereum’s staking patterns provides valuable insights into the actions of its investors. Notably, there’s a trend toward decreasing balances held on exchanges, suggesting that more and more holders are choosing to stake their Ether rather than keep it in exchange wallets.

Based on Glassnode’s statistics, there has been a persistent rise in the quantity of Ethereum deposits. This trend implies that an increasing number of Ethereum holders are choosing to stake their ETH.

As an analyst, I’ve noticed an intriguing development in the Ethereum market: the surge in the number of deposits for staking contracts, which now exceeds 1.5 million. This trend implies a growing preference among investors and traders to secure their Ethereum holdings through staking instead of merely trading or keeping it on exchanges.

As a data analyst, I’ve uncovered some intriguing insights. According to Dune Analytics, an astounding 33.2 million Ethereum tokens have been staked. This substantial amount represents nearly a quarter of the entire Ethereum supply (approximately 28%).

In simpler terms, the rise in Ethereum being staked and the decrease in Ethereum held on exchanges signify that investors are moving towards longer-term investment strategies.

ETH finding resistance

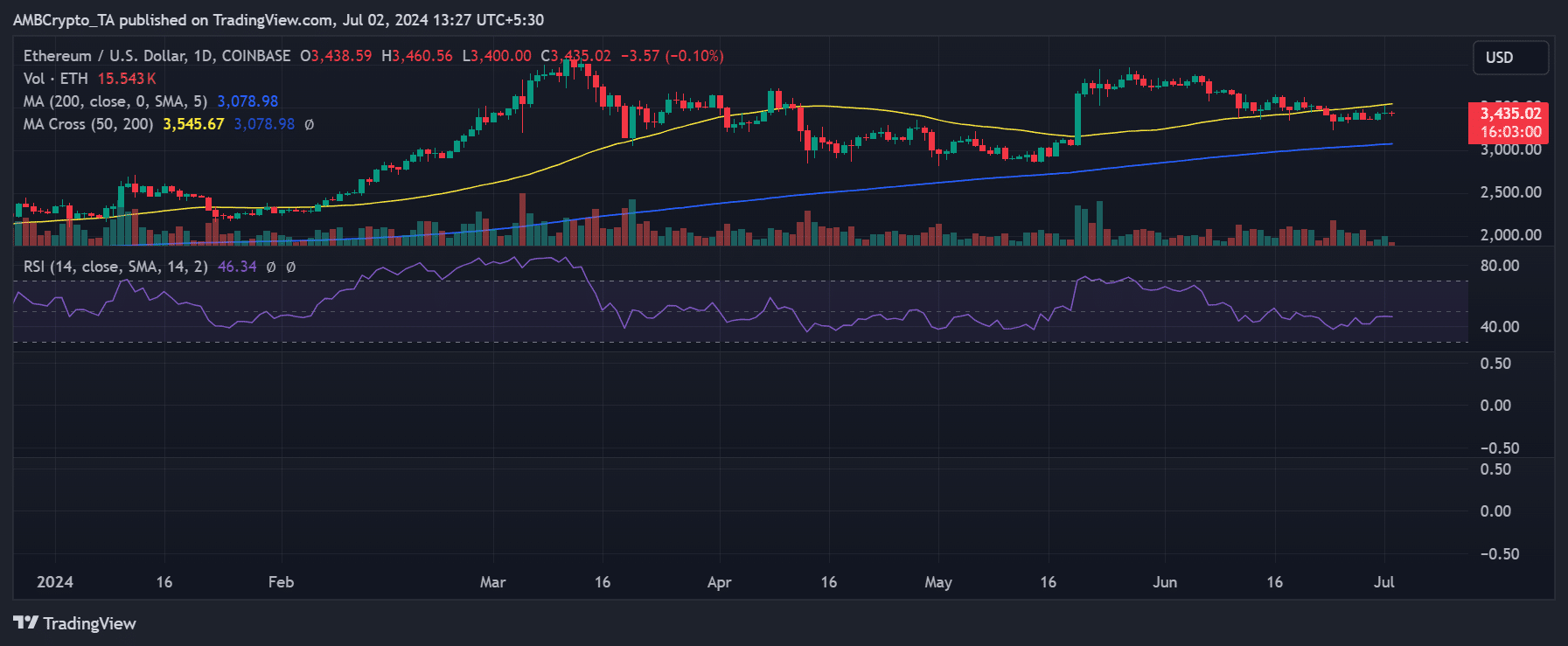

As a researcher studying the Ethereum market, I’ve noticed an intriguing development when examining the daily time frame chart provided by AMBCrypto. The price of Ethereum has dipped beneath its short-term moving average (represented by the yellow line) recently.

As an analyst, I’ve observed that the moving average, which used to act as a floor for the asset’s price, has now transformed into a barrier preventing further upward movement due to the recent downward trend.

A frequent technical occurrence in the markets is when the role of a price level shifts from being a source of buying incentives to a hindrance for further advancements, signaling a shift in investor sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

At the current moment, Ethereum is priced approximately at $3,430 on the markets, showing a minimal decrease of almost 1%.

As a market analyst, I would describe the current situation as follows: The short-term moving average is acting as a barrier to price movement, with the resistance level lying between $3,500 and $3,600.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-02 20:08