-

ETH traded at $3k at press time.

The cumulative short liquidation of Ethereum rose to over $800 million.

As a researcher with experience in cryptocurrency markets, I’ve been closely monitoring Ethereum’s [ETH] price movements and liquidation trends. Based on the data available at press time, it appears that Ethereum traders are increasingly betting on a further decline in the price of ETH.

Following a drop in price on May 7th, the number of Ethereum [ETH] contracts with open long positions being liquidated increased. As a result, there was an uptick in the creation of new short positions among traders.

Due to heightened selling pressure, the cost of Ethereum dipped beneath the $3,000 threshold during trading on May 8th.

Ethereum traders bet on price decline

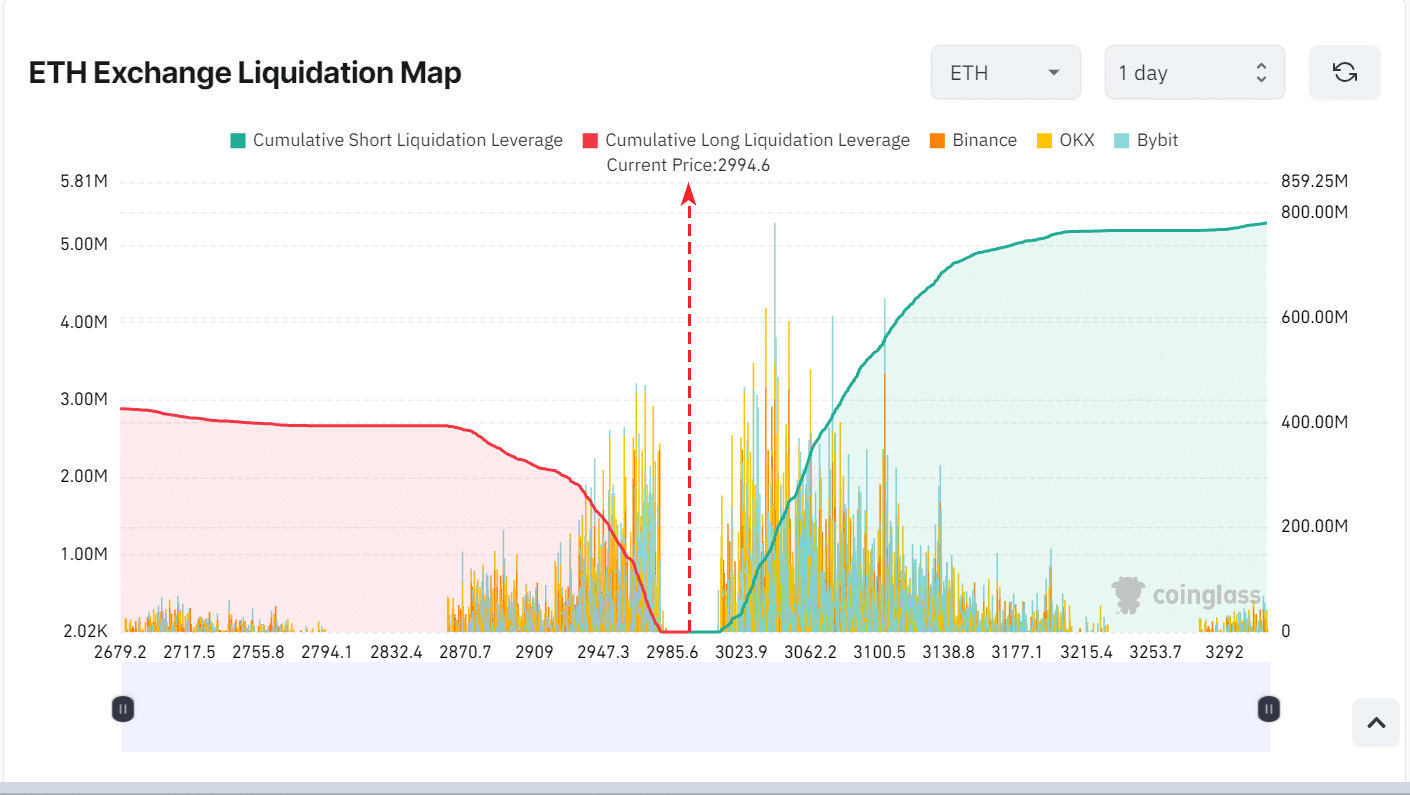

At the current moment, according to AMBCrypto’s examination of Ethereum’s liquidation map on Coinglass, there is a significant prevalence of short positions.

The cumulative short liquidation leverage for the 24-hour period has risen to over $800 million.

Traders are growing more frequent in taking a bearish stance towards Ethereum’s price, implying they anticipate further drops in the near future.

As I delved deeper into the analysis of the map, I discovered that the total amount of leverage used over the past week had surpassed a staggering $1.7 billion.

Based on the market behavior in the last trading day, it’s no surprise that traders have taken this stance now.

Ethereum long positions feeling the heat

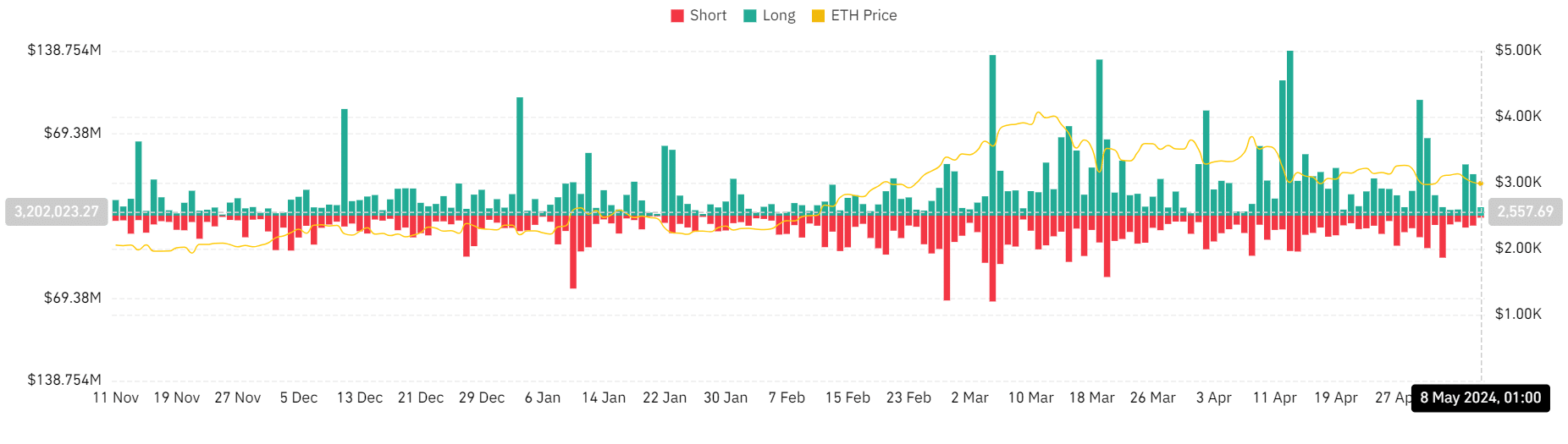

Over the past three days, there have been more Ethereum long positions liquidated than short ones.

According to AMBCrypto’s analysis of Coinglass’ liquidation data, the long positions surpassed $78 million during the time frame from the 6th to the 7th of May.

Conversely, short liquidations, during the same period, amounted to approximately $18.3 million.

At the time of publication, this trend continued with over $7 million worth of long liquidations taking place, compared to approximately $1.6 million in short liquidation volumes.

ETH to fall deeper?

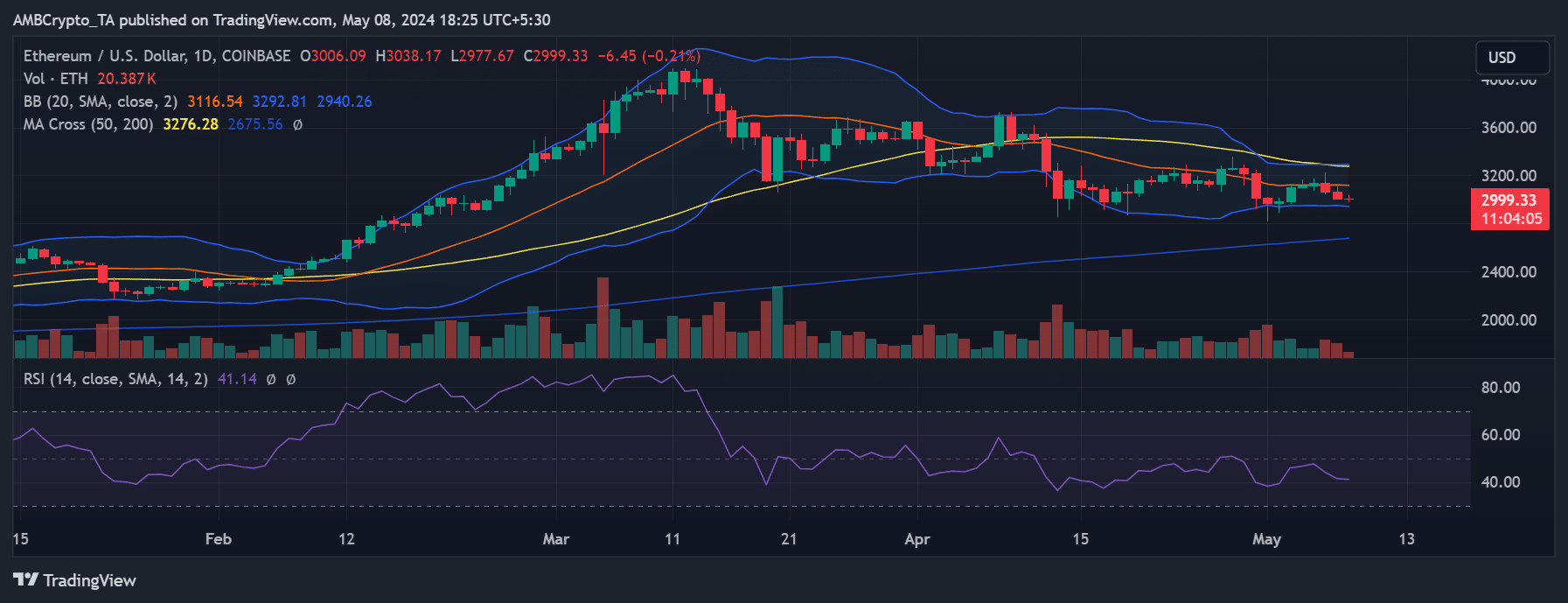

AMBCrypto’s look at Ethereum’s daily timeframe price trend revealed a notable three-day decline.

Read Ethereum’s [ETH] Price Prediction 2024-25

At approximately $3,000 when this text was composed, the price showed only minor decreases below 1%. The Bollinger Bands’ expansion suggested that some price instability or volatility was present.

The downward trend of Ethereum (ETH) has become more pronounced, as indicated by an RSI reading of 40. This figure reflects a significant bearish outlook among investors.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-08 17:12