- The bullish triangle pattern could see ETH breakout toward $3,350

- Unenthusiastic demand could hurt the chances of a breakout

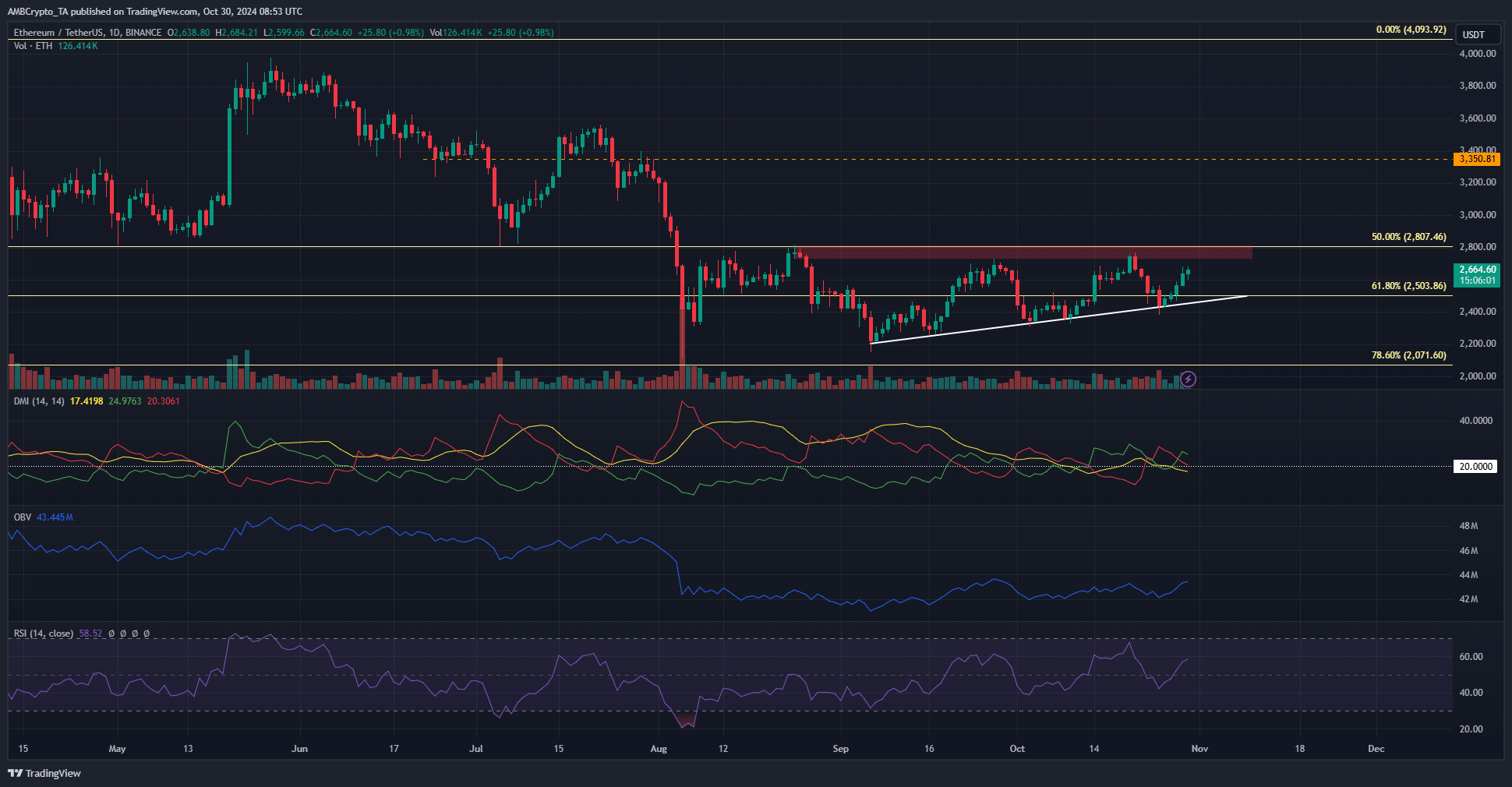

As a seasoned researcher with over a decade of experience in the crypto market, I’ve seen my fair share of price patterns and trends. The current ascending triangle pattern forming around Ethereum [ETH] has me cautiously optimistic about its potential breakout towards $3,350. However, the lukewarm demand and the OBV that’s still below its June and July levels have me a bit worried.

Ethereum (ETH) was previously trading below a resistance level at around $2,800, a barrier that hadn’t been surpassed since August. However, the subsequent price increase has been gradual and somewhat subdued in terms of explosive power. Yet, this upward trend has been steadily gaining traction since September.

It appeared that assets were being accumulated, as indicated by negative exchange netflows, yet it remained uncertain whether this accumulation would be sufficient to surpass the recently achieved three-month price peaks.

Ascending triangle pattern promises $3.3k for ETH

Over the past three months, starting from September, Ethereum has been creating a succession of lower highs followed by rising lows. Despite this progression, it hasn’t managed to surpass the $2,800 resistance level, resulting in an ascending triangle formation. Meanwhile, the On-Balance Volume (OBV) has gradually climbed upwards over the last two months, but it remains significantly below the levels it held in June and July.

A moderate interest might lessen the scale of the surge, and if the day’s closing price exceeds $2,800, it could potentially push the price up to around $3,350.

The potential surge might not occur immediately but could happen within the next few days. A drop to around $2.5k is also a possibility. Although the Relative Strength Index (RSI) suggests a bullish trend, it’s not yet clear which direction the market will take in October. Similarly, the DMI aligns with this ambiguity, and at the moment, the Average Directional Movement Index (ADX or yellow line) is dipping below 20.

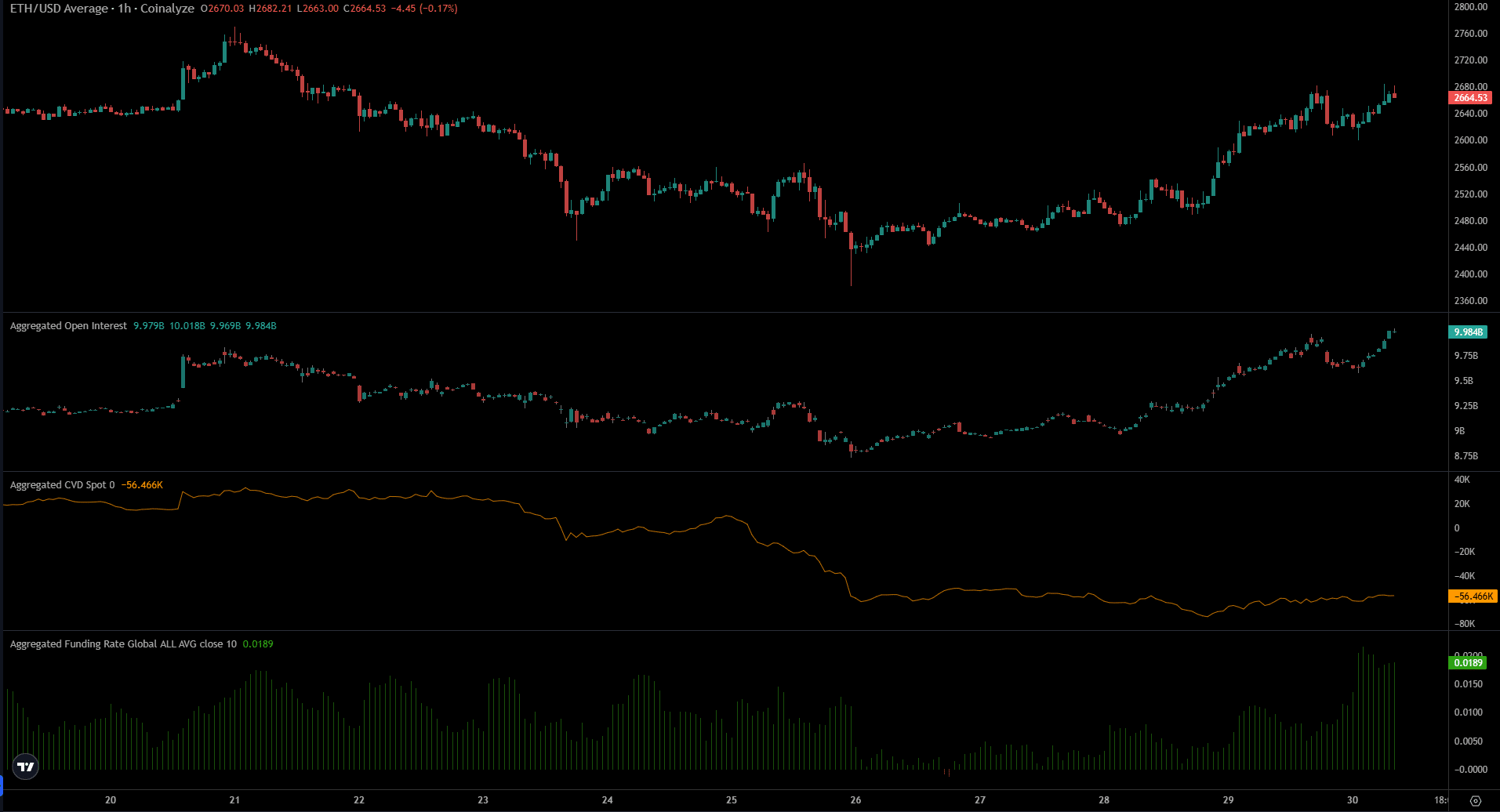

More volume concerns on the lower timeframes

Over the last three days, Open Interest and prices have noticeably climbed significantly. Similarly, the funding rate experienced a sharp increase during the previous 24 hours. This suggests a robust bullish sentiment in shorter trading periods.

Is your portfolio green? Check the Ethereum Profit Calculator

Despite Ethereum’s 9.4% increase since October 26th, the spot CVD didn’t detect any activity. This lack of demand for the spot and the waning strength indicated by the OBV has sparked doubts about the bulls’ power.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-31 06:15