- Ethereum loses ultrasound money status.

- Total supply has increased by over 100,000.

As an analyst with extensive experience in crypto markets, I’ve closely monitored Ethereum’s recent developments and I have some insights to share on the impact of the EIP-1559 upgrade on its supply dynamics.

As a researcher studying the cryptocurrency market, I can tell you that Ethereum [ETH], formerly known as “ultrasound money” due to its monetary policy, has undergone a significant transformation following the implementation of EIP-1559. This upgrade has introduced new deflationary features to Ethereum’s economy.

The recent update on Ethereum has resulted in a decrease in its destruction speed, implying a lessened pace at which Ether tokens are being eliminated from existence.

The amount of Ether in circulation has grown in total, with a notable uptick in the portion currently held on exchanges. What’s the relationship between this exchange ETH and the overall supply?

Ethereum total supply and fees burnt display contrasting trends

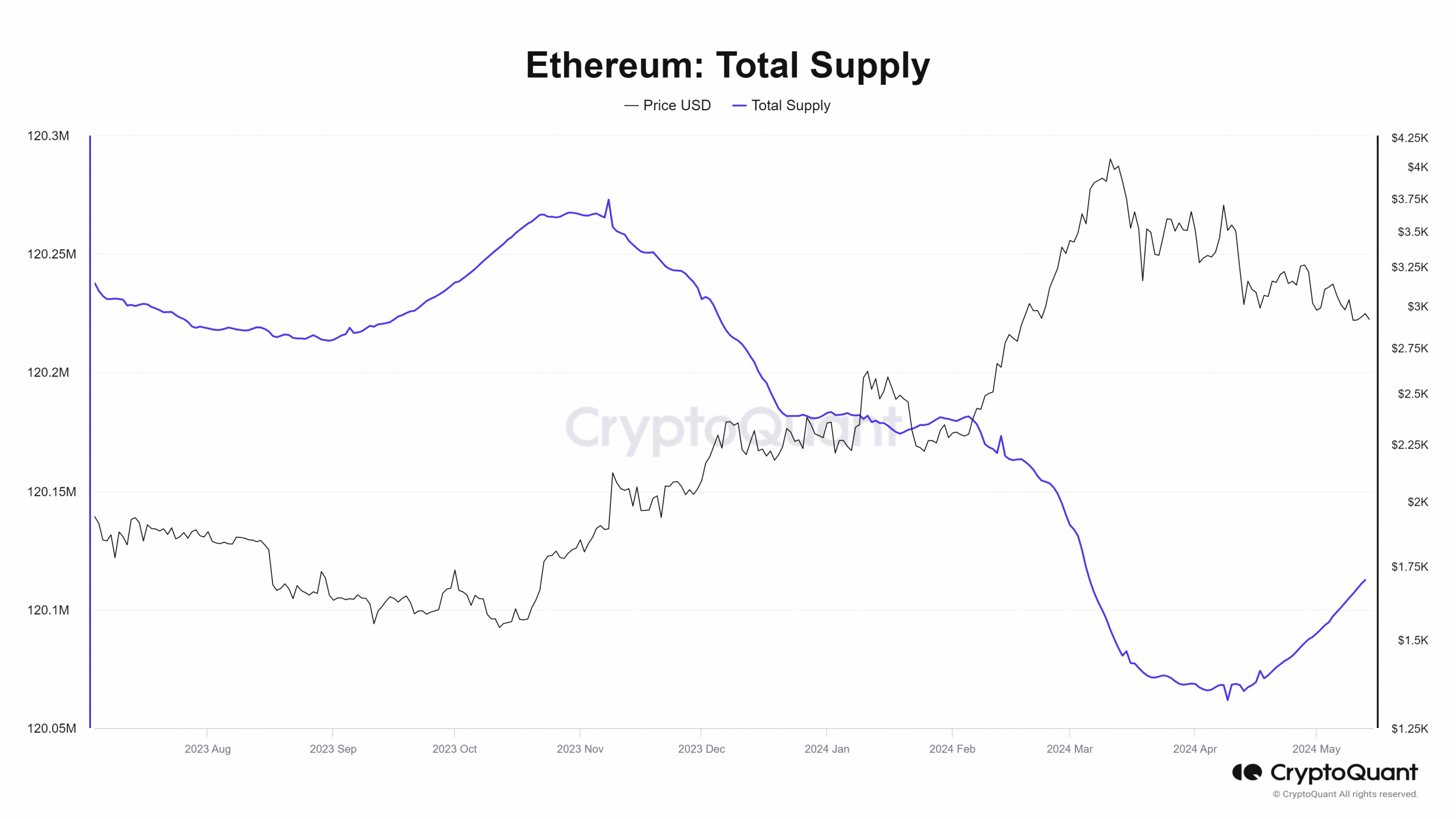

As a researcher studying Ethereum’s market trends, I’ve observed some significant shifts in its total supply behavior based on the data from CryptoQuant over the past few months.

As a crypto investor, I noticed an intriguing development between November 2023 and early April 2024. The total supply of Ethereum (ETH) saw a noticeable decrease, dropping from around 120.2 million to approximately 120.06 million. This reduction translates to over 100,000 less Ether in circulation during that period.

Starting on the 19th of April, Ethereum’s total supply underwent an increase, amounting to approximately 120.1 million coins by the time of this examination.

As an analyst, I’ve noticed that the recent surge in total supply can be explained by a decrease in the fees being burned. This trend began after the Dencum upgrade was implemented.

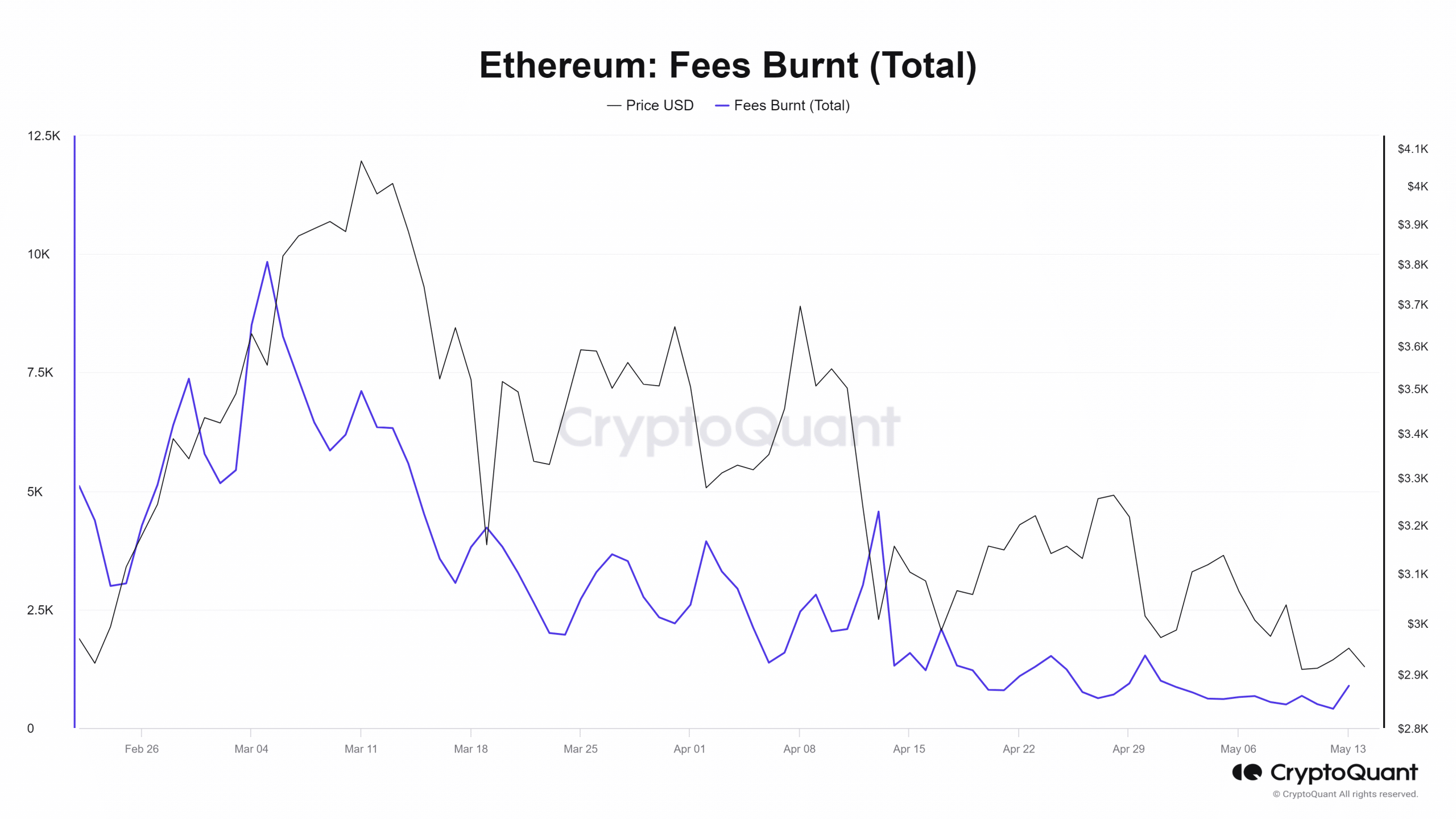

An examination of the fees burnt metric illustrates a significant decrease, starting around March.

In this timeframe, about 6,000 Ethereum tokens were spent in fees, which stood in stark contrast to the approximately 890 ETH worth of fees during the analysis.

As an analyst, I have noticed that the substantial decrease in transaction fees on Ethereum has led to an increase in its total supply. This change suggests a shift towards less deflationary dynamics for Ethereum.

Also, the decline in fees burn is due to the decline in fees on the network.

Ethereum sees a decline in overall fees

The latest Ethereum update has brought down transaction costs not only on the primary network but also on its Layer 2 platforms.

According to Coin98 Analytics’ findings, the average Ethereum transaction fee has dropped to its lowest point this year, equating to around $0.5 for each transaction based on a rate of 0.00017E.

This fees marks a significant decrease compared to levels observed around February.

An examination of the total transaction fees on the Ethereum network has shown a significant decrease in more recent periods.

At the present moment, the fees amounted to roughly $3.6 million, significantly less than the record high in March, which was approximately $7.8 million.

This downward trend in fees commenced about a month ago.

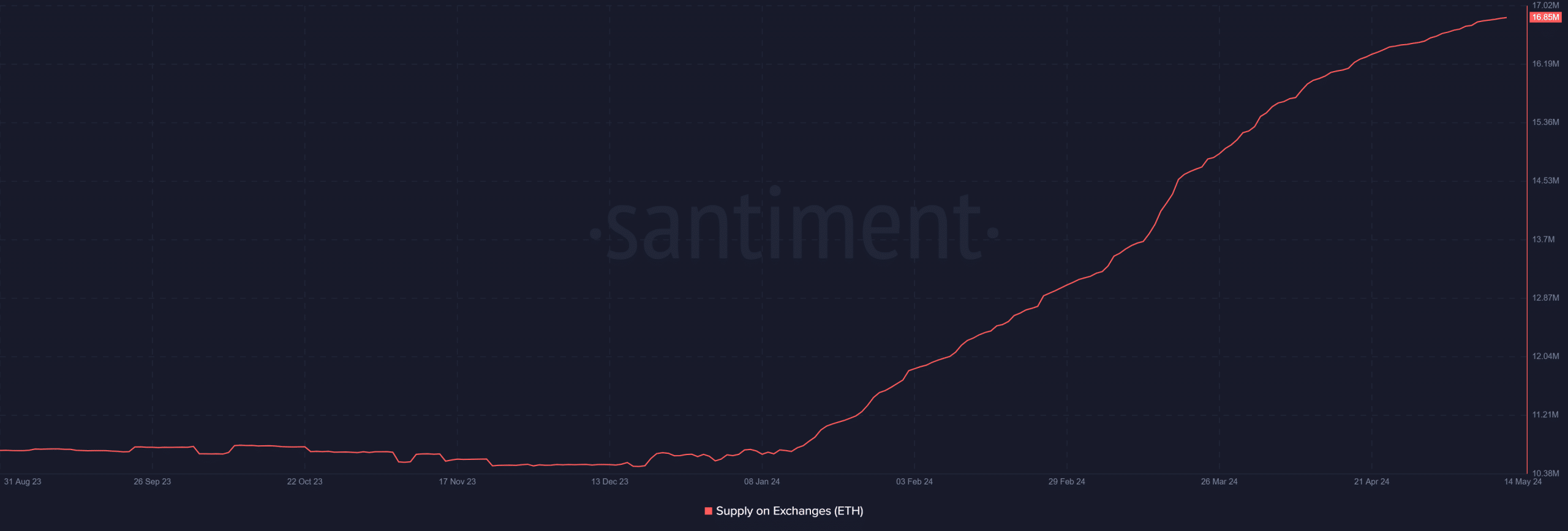

Ethereum supply on exchanges climbs

The examination of Ethereum trading volumes reveals a significant surge, displaying intriguing complexities.

Before the overall supply of Ethereum saw significant growth, there was already an uptick in the amount of Ethereum being exchanged on markets. Specifically, between March and the present moment, this exchange supply expansion surpassed the 3 million Ether mark.

As of this writing, the total exchange supply was over 16.8 million.

Although Ethereum experienced substantial expansion, its exchange supply was still modest compared to its overall Ethereum supply. This implies that Ethereum may be dealing with a controllable oversupply issue.

In simpler terms, the small increase in Ethereum being exchanged on the market suggests that its current price isn’t facing significant pressure from inflation at the moment.

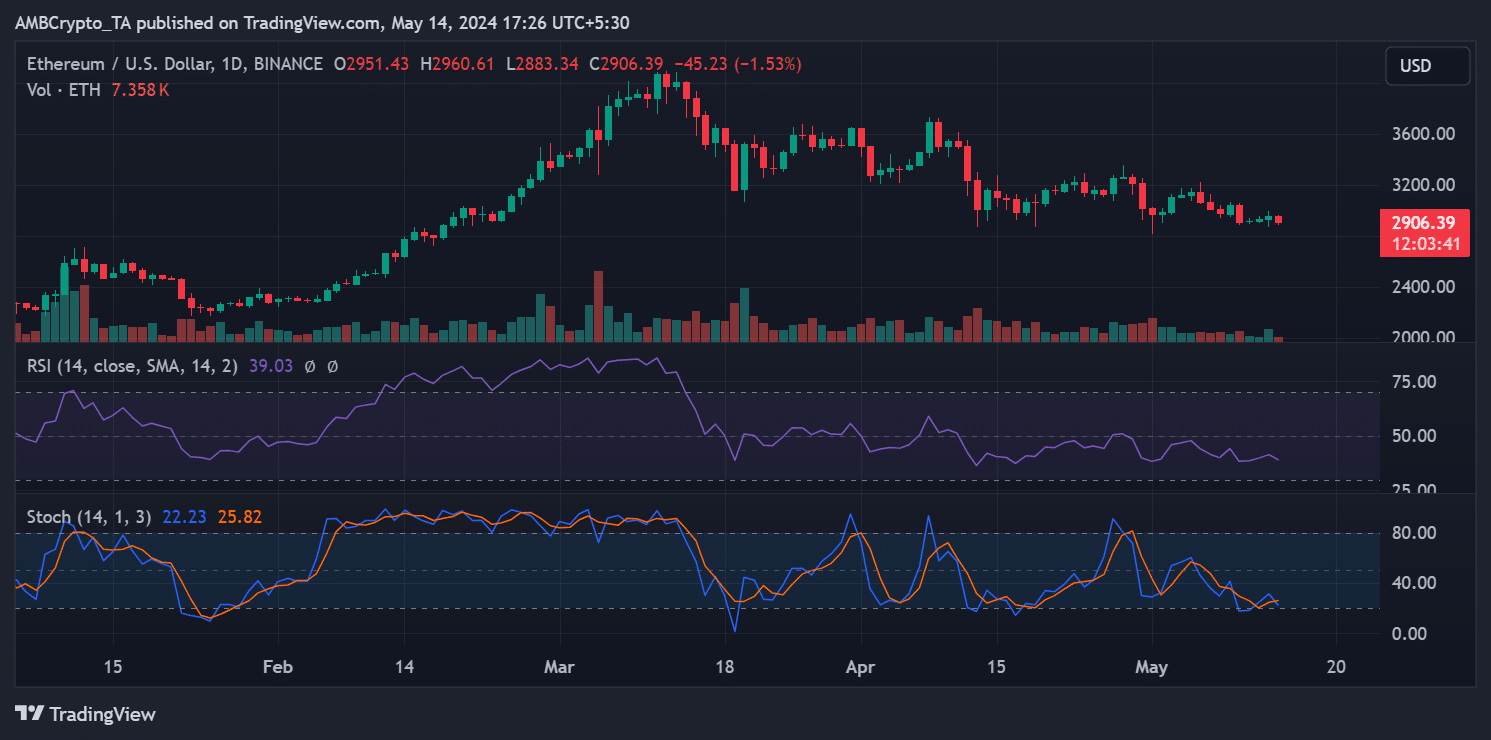

ETH continues to trend below $3,000

The current analysis of Ethereum’s price movement on a daily basis indicates a difficult phase for investors. After dipping below the $3,000 mark in the last week, Ethereum has found it tough to rebound.

As of this writing, it was trading at around $2,900, experiencing a decline of approximately 1.5%.

Read Ethereum (ETH) Price Prediction 2024-25

The stochastic oscillator and the Relative Strength Index (RSI), two different indicators, showed that the market was experiencing a downward price movement. Notably, the RSI signaled a strong bearish trend since its value stayed below the threshold of the neutral line.

Based on the present indications, there’s a sign that Ethereum might experience an upward price trend soon, indicating a potential price reversal in the imminent period.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-15 09:12