-

Ethereum showed signs of recovery after testing the $2,400 zone and surged by 4%, outpacing Bitcoin.

Does this mean the altcoin could challenge BTC’s dominance?

As an analyst with a decade of experience in the crypto market under my belt, I find myself intrigued by Ethereum’s recent surge and its potential to challenge Bitcoin’s dominance.

In the past day, Ethereum (ETH) demonstrated robustness, surpassing Bitcoin by recording a growth of more than 4%.

historically, when the price trend of Ethereum (ETH) shows an uptrend compared to Bitcoin (BTC), while their underlying indicators show a downtrend for ETH, this pattern has often signaled a potential change in direction or reversal of the price trend for Ethereum.

In simpler terms, these differences often result in substantial increases in the value of Ethereum, with Ether typically performing better than Bitcoin when the market is unstable.

So, is history repeating itself? AMBCrypto investigates.

History shows ETH outperforms in September

Source : Trading View

According to AMBCrypto’s examination of the ETH/BTC weekly graph, it was observed that Ethereum saw substantial increases in September 2016 and 2019, with peaks occurring roughly halfway through those months.

By chance, it so happens that this September marks a scheduled reduction in interest rates by the Federal Reserve, which will take place on the 18th.

Given these past patterns, the timing of the Fed’s rate cut might be more than just coincidence.

Based on past trends, ETH tends to perform favorably during this season, and a reduction in rates might further boost market dynamics, possibly pushing the price up towards the $2,800 resistance point.

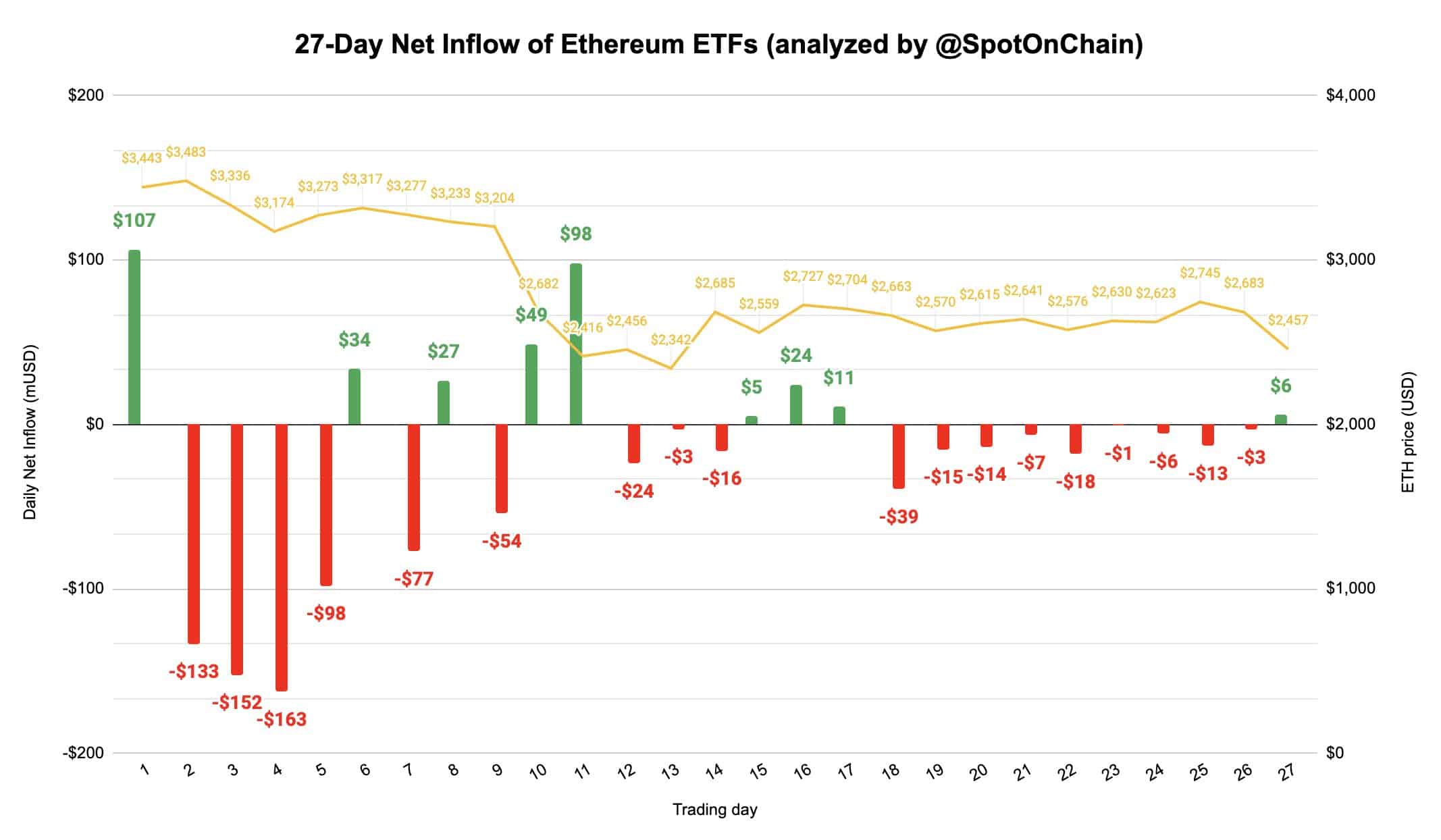

Source : SpotOnChain/X

Yesterday’s positive trend continued for ETH as it halted a nine-day run of outflows. Moreover, the institutional investment firm BlackRock’s ETHA product experienced an influx of approximately $8.4 million after five consecutive trading days without any net gains.

Compared to this, data showed that BTC’s net flow remained strongly negative for the second day.

As a researcher, I observed that there was no influx into any U.S.-based Bitcoin Exchange Traded Funds (ETFs) yesterday, and for the first time, Grayscale Mini Bitcoin (BTC) experienced an outflow.

In short, this comparison reveals a stark contrast in market sentiment between ETH and BTC.

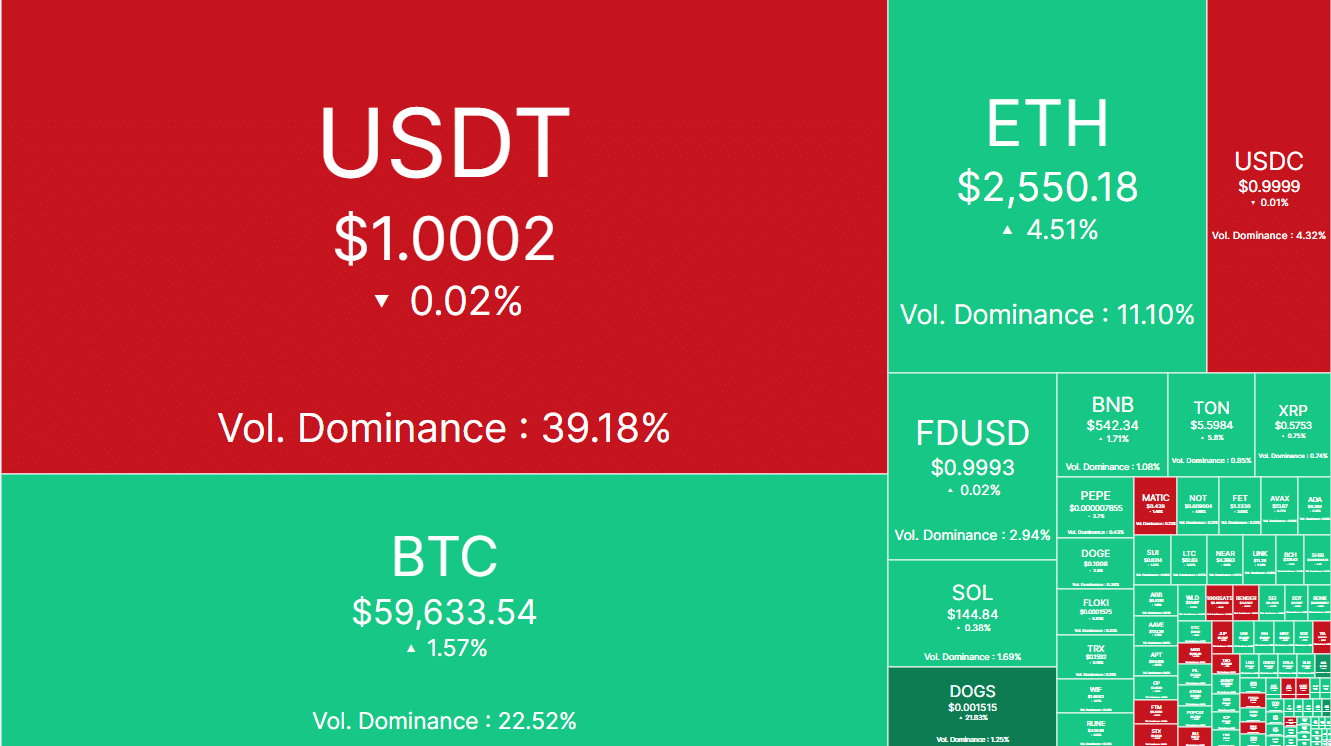

As Bitcoin grapples with the challenge of breaching the $60K barrier, Ethereum has seen a notable increase of around 4% from its previous day’s value.

Indeed, as reported by AMBCrypto, the theory needs strengthening if on-chain data supports Ethereum’s continued dominance. But let’s see if that’s the case.

Ethereum remains inferior in dominance

Currently, Ethereum is demonstrating signs of resurgence following its test at the $2,400 region. Experts predict that for a possible recovery, ETH must surmount the obstacle at the $2,600 price barrier.

As we speak, the value of the altcoin stands at approximately $2,550. However, Ethereum lags behind Bitcoin when it comes to controlling market volume.

Source : CoinMarketCap

A larger number of trades being made with Bitcoin indicates increased market activity and better liquidity. This means that, even during bear markets, Bitcoin often recovers more quickly due to its resilience.

Read Ethereum (ETH) Price Prediction 2024-25

In contrast, Ethereum’s chances of recovery are more dependent on Bitcoin’s performance.

Essentially, the mood or trend in the Ethereum market tends to mirror that of Bitcoin’s general performance. When Bitcoin decreases in value, Ethereum usually goes down as well, which strengthens Bitcoin’s position relative to Ethereum.

Read More

2024-08-29 23:04