-

Crypto speculators remain wary of profit-taking and price correction concerns

There haven’t been consecutive ETH/BTC green weekly candles since April 2024

As a seasoned crypto investor with a decade of market experience under my belt, I must say the recent price action has been quite intriguing. The bull run we’ve witnessed over the past few weeks has brought back memories of the 2017 bull market, albeit a bit slower and more measured.

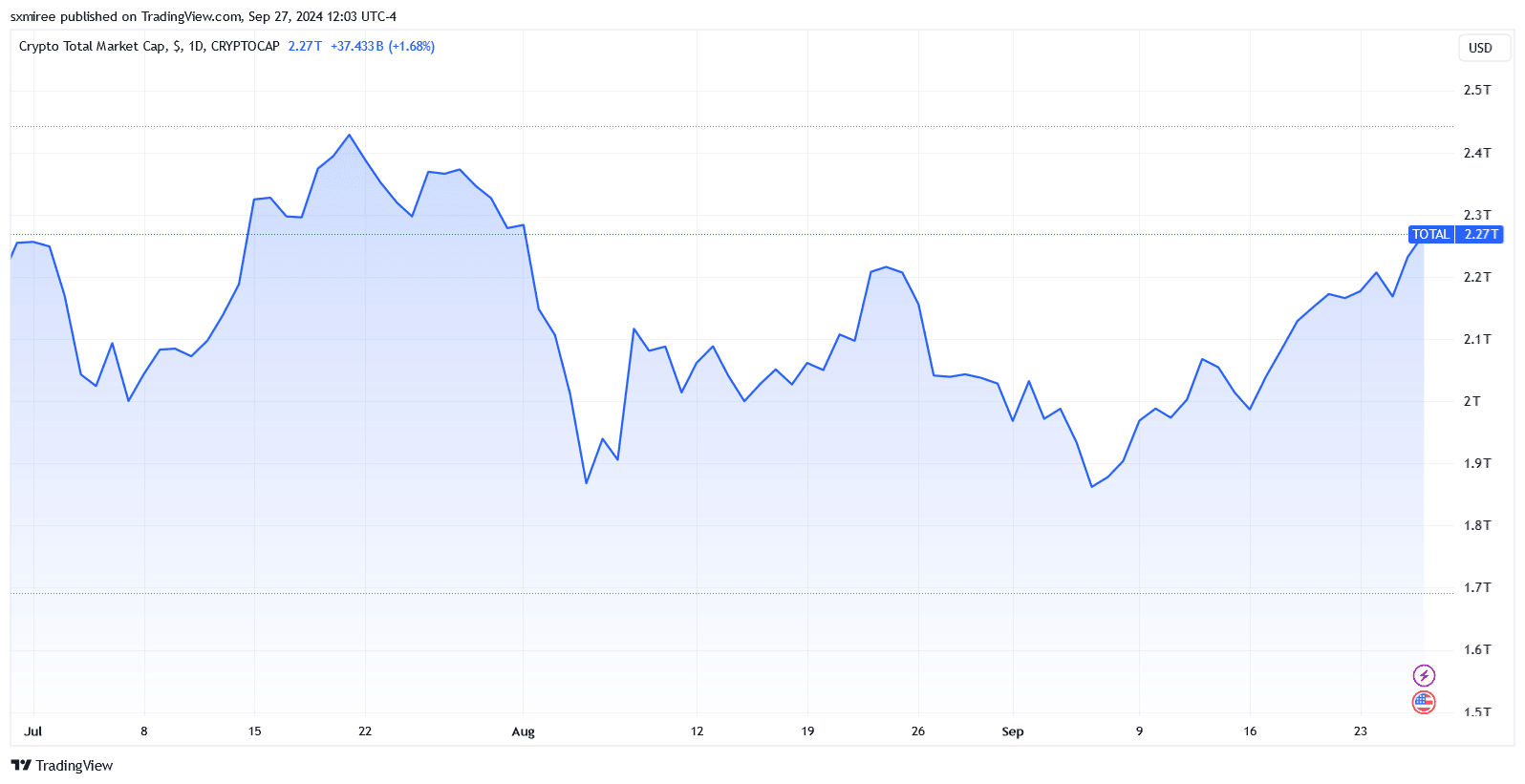

On Friday, I observed that most cryptocurrencies were experiencing upward trends following moderate growth periods between Wednesday and Thursday. Interestingly, these market-wide gains served to counterbalance an initial midweek downturn, a dip that had set in after a slow beginning to the week.

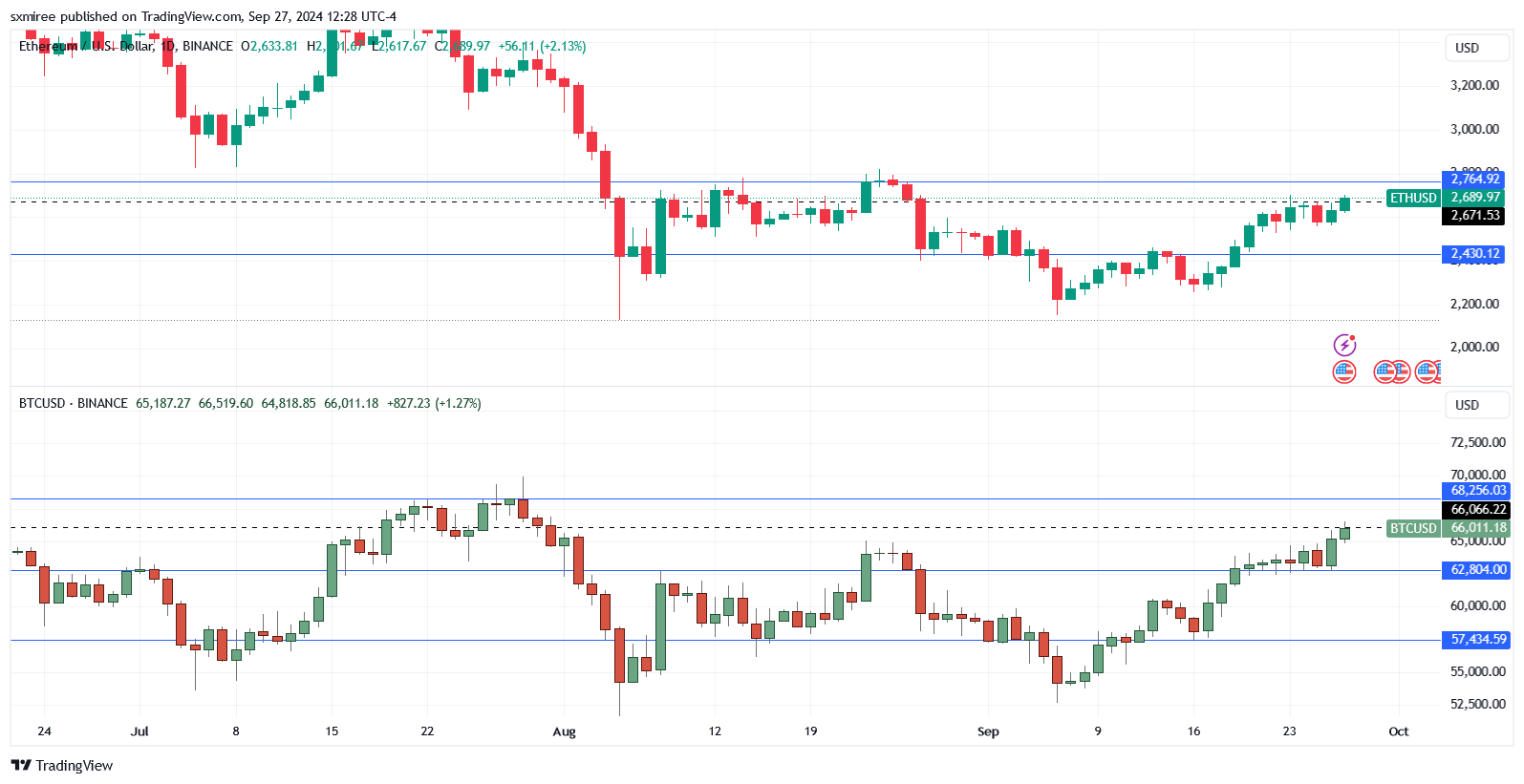

Currently, Ethereum (ETH) is being traded at $2,689, as it has regained its power in recent weeks. The optimistic investors are aiming to push the price above $2,770 for the first time since August 24th.

It’s noteworthy to mention that Ethereum (ETH) has been surpassing Bitcoin in the latter part of this month, accumulating a 16.34% increase in value since September 15.

Looking at the latest Coinglass data, it’s clear that Ethereum (ETH) and Bitcoin (BTC) experienced significant growth last week. Specifically, ETH saw a 11.26% increase in price, while BTC registered a 7.38% uptick. However, this momentum seems to have slowed down a bit this week. Interestingly, both cryptocurrencies are still on track for their third consecutive weekly gains. As an analyst, I find these trends intriguing and will be keeping a close eye on their progress.

Bitcoin bulls target double-digit monthly gains

Despite its recent revitalization, Ethereum has dropped by 20.75% over the past three months. This drop is significant when considering the anticipation of an uptrend following the July 23 launch of a U.S spot Ethereum exchange-traded fund (ETF). However, this institution-oriented offering has not met expectations, delivering mixed results thus far.

Over the next three days, Bitcoin dominates among leading cryptocurrencies with impressive monthly returns. If its value stays above $65,000, it’s set to achieve double-digit profits this month. Conversely, Ether is poised for a 5.70% growth over September, as of the current pricing.

BTC and ETH price targets ahead of Q4

Looking towards the upcoming weekend, investors are keeping a close watch on the closing values for various cryptocurrencies. Currently, Bitcoin is hovering around $66,000 in a neutral zone, with significant support found at approximately $62,800. On the other hand, Ethereum remains stable above $2,600.

Experts predict that Bitcoin (BTC) could reach between $68,000 and $70,000 in the near future, while Ethereum (ETH) might go up to $2,760 – $2,820. Yet, there’s a possibility of a temporary dip if the momentum slows down, which warrants carefulness when taking long positions. If the current pace weakens, it could open an opportunity for sellers to take control over the weekend and push prices lower, similar to what happened in July.

Bitcoin could potentially dip and aim towards levels below $62,000, with a possible drop that might reach as low as $57,400. On the other hand, Ether faced rejection at approximately $2,770 on August 24, leading to its price decrease to about $2,430 three days afterward.

The rise in ETH‘s price may be restricted due to increased Ether distribution, which could affect its immediate price trend. In other words, approximately 54,098.4 more ETH have entered the market over the last month, equating to about a 0.547% annual inflation rate according to Ultrasound Money’s data.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-28 12:07