- Well, bless my soul! Ethereum’s demand side is still as strong as a mule, hinting at more growth ahead.

- ETH took a little tumble, dropping by 2.61% in the last 24 hours. Ain’t that a kick in the pants?

Now, since Ethereum hit the dizzying heights of $4.1k two moons ago, it seems to have lost its way, like a lost puppy in a cornfield. It’s been bouncing around like a rubber ball, even hitting a low of $2.1k. Talk about a wild ride!

These market shenanigans have stirred up quite the ruckus among crypto analysts. Some are as optimistic as a rooster at dawn, while others are as gloomy as a rainy day.

One fella, a bright-eyed analyst named Mac from CryptoQuant, is still waving the flag of optimism, claiming Ethereum has plenty of room to grow. Well, ain’t that peachy?

Why Ethereum Can Grow More

According to our friend Mac, despite the stormy clouds on the supply side, Ethereum’s potential for growth is as high as a kite in a windstorm.

Now, let’s break it down into four juicy reasons. First off, Ethereum’s realized price is hanging around $2.2k, which is about as undervalued as a penny in a wishing well compared to its $2.6k price tag.

That $2.2k mark is like a sturdy rock in a river, providing support. The circulating MVRV is above 1, which means ETH is as undervalued as a forgotten sandwich in a lunchbox.

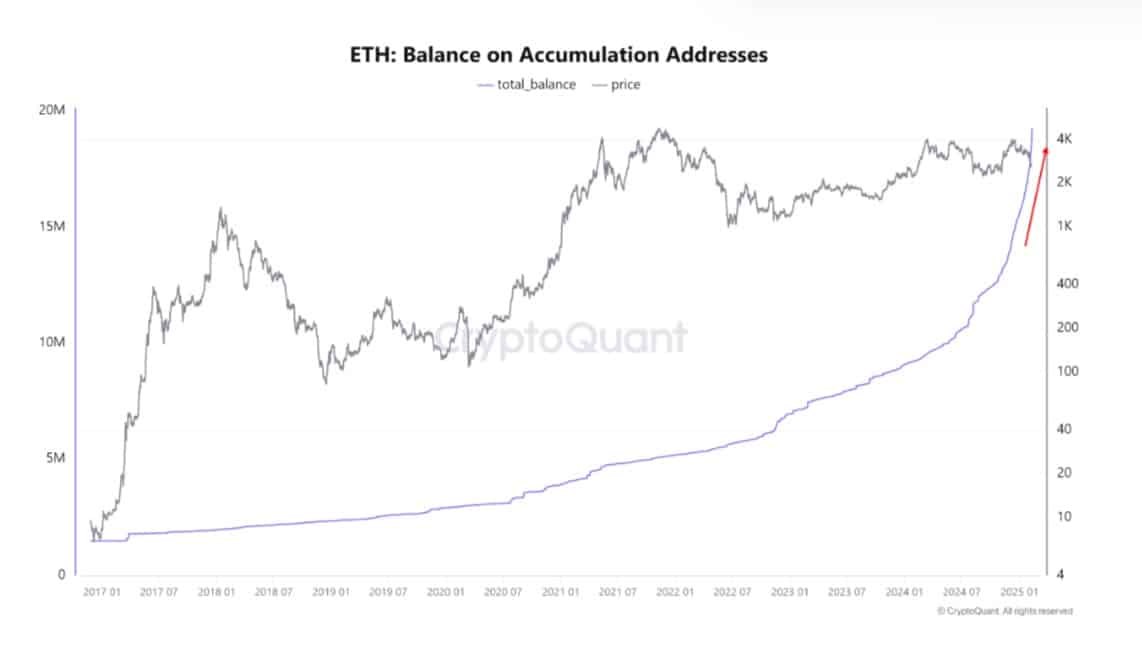

Secondly, the number of folks holding onto their Ethereum like it’s a prized possession has been on the rise. While some big fish may have sold, the little guys are holding strong, soaking up the selling pressure like a sponge.

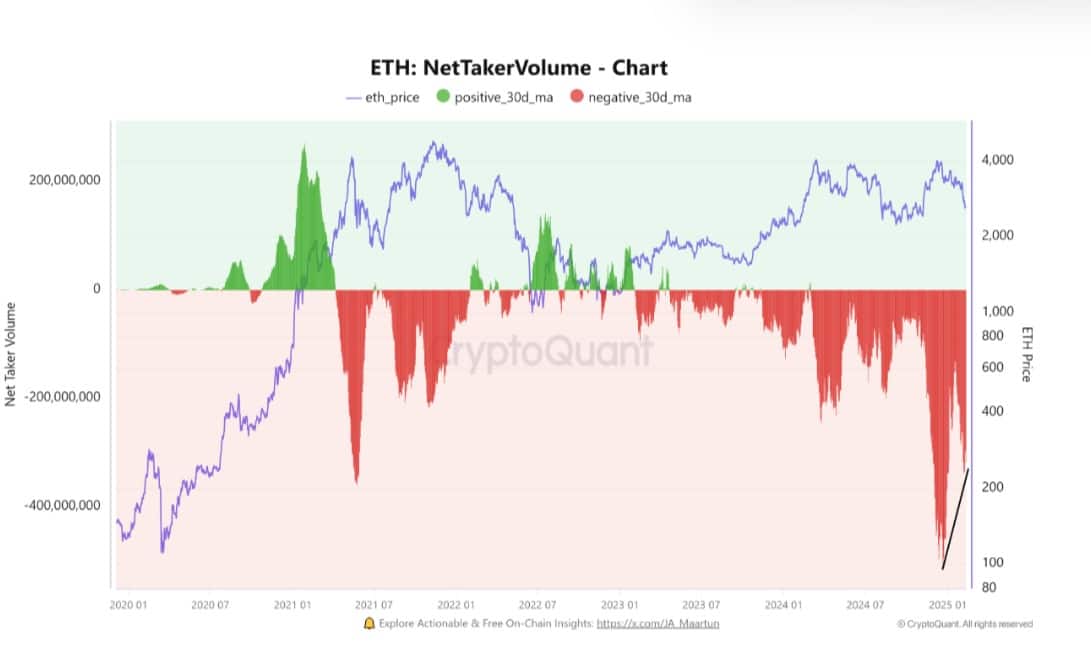

Thirdly, the selling pressure in the futures market has eased up. It’s like the storm clouds are parting, allowing a little sunshine to peek through, suggesting buyers are starting to come back to the party.

Lastly, the big boys—those institutional investors—are gobbling up Ethereum like it’s Thanksgiving dinner. When ETH’s price took a nosedive, they swooped in to buy the dip like it was the last piece of pie.

BlackRock snagged 100.5k ETH worth a whopping $276 million, and Cumberland got their hands on $174 million worth. Other institutions like WLFI are also in on the action. Talk about a buying frenzy!

This buying pressure is crucial, acting like a cushion against the downward slide.

So, while Ethereum may be struggling to keep its head above water, there are still some bright spots on the demand side.

What ETH’s Charts Say

Now, let’s take a gander at what the charts are whispering. ETH is showing some positive vibes from the demand side.

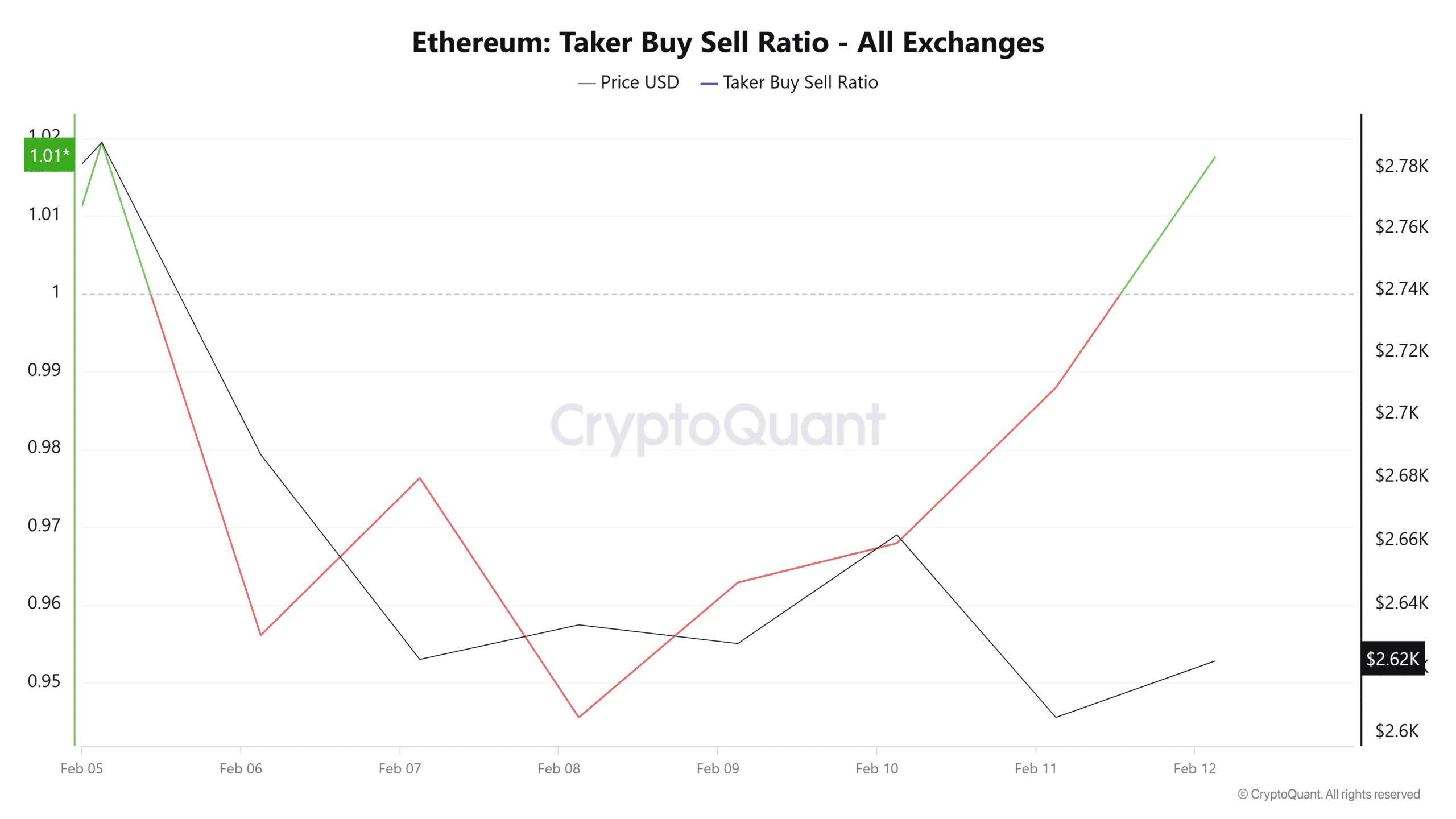

At the moment, Ethereum’s Taker buy-sell ratio has flipped positive, reaching 1.05 after being as negative as a rainy day for the past five days. This means buyers are back in town, outnumbering sellers like kids at a candy store.

Additionally, Ethereum’s Fund market premium has turned positive for the first time this week. When that happens, it’s like the investors are feeling bullish, and longs are paying shorts to hold their trades, anticipating a market rebound.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-02-13 02:35