- Ethereum, that fickle friend, has found a cozy spot above $2,600, eyeing a potential leap to $3,200 or even $4,000. Who knew it could be so ambitious?

- With institutional interest growing like weeds in spring and network usage buzzing like a caffeinated bee, the price might just take off. 🚀

Ah, Ethereum [ETH], the ever-elusive dreamer, has nestled comfortably above $2,600, hinting at a possible ascent. As of now, it dances at $2,702.21, a modest 0.67% increase in the last 24 hours. Not too shabby, right?

But the million-dollar question remains: can ETH keep its groove long enough to break through these pesky resistance levels? 🤔

ETH technical analysis: Will the momentum last?

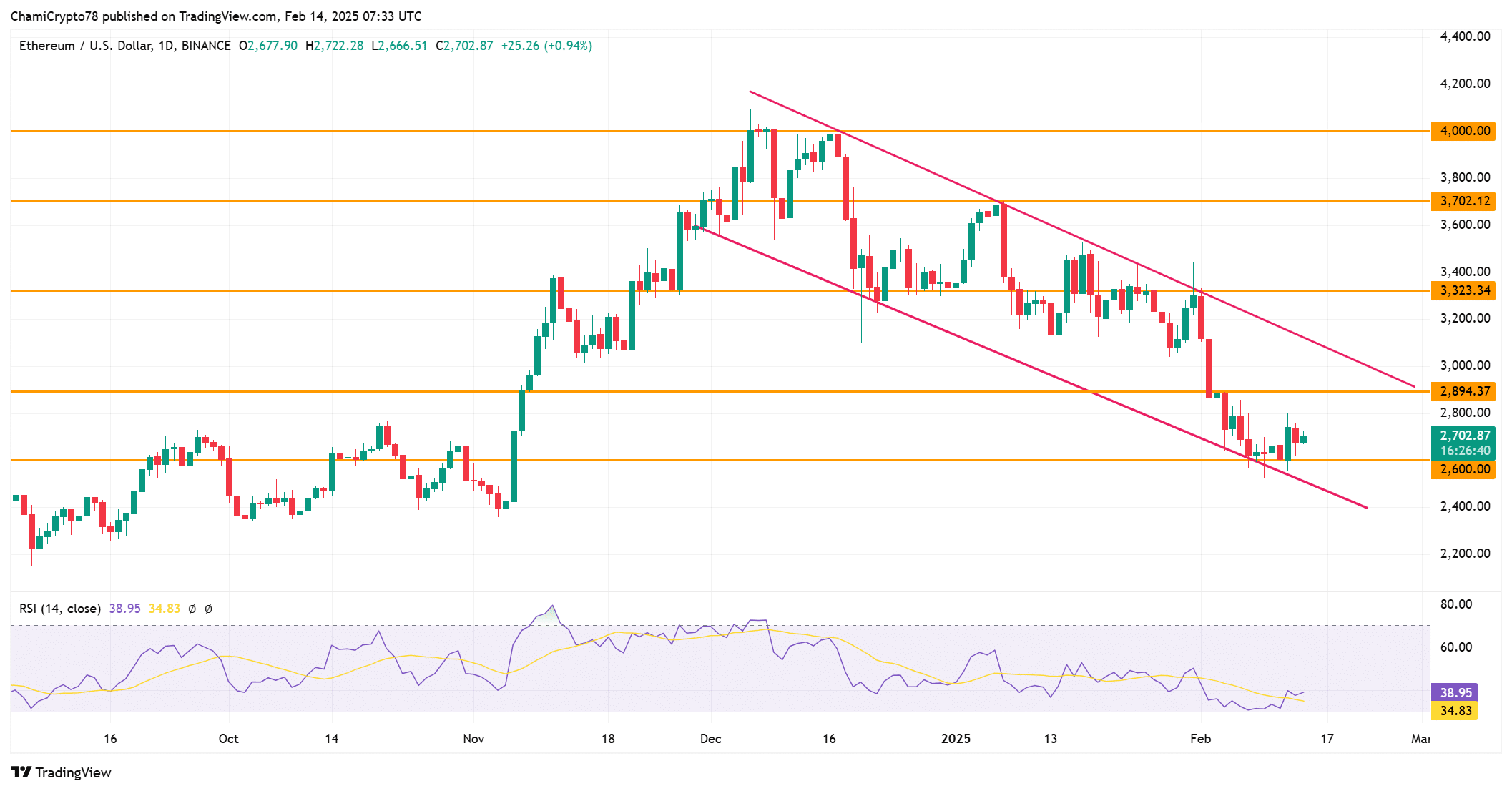

ETH’s recent price antics suggest it might be strutting into a bullish phase. The charts reveal Ethereum waltzing within a well-defined channel, with resistance levels at $2,800, $3,200, and $3,400. Talk about a high-stakes dance-off!

If ETH can shimmy past the $2,800 barrier, it could pave the way for a jubilant rally toward $3,200 or $4,000. At the time of writing, the RSI was at 38.95, indicating there’s still room for a little more upward shimmy. 💃

However, Ethereum must navigate the treacherous waters of the downward-sloping channel and cling to key support levels to keep its bullish trend alive. No pressure!

Institutional interest is booming: How will it affect the price?

Ethereum is catching the eye of institutional investors, especially with 21Shares’ bold move to file for an Ethereum staking ETF. This could mean a surge in demand as institutions rush to stake their ETH. Who knew Ethereum could be so popular? 😏

A successful approval could solidify Ethereum’s status in the institutional realm and send its price soaring. With staking potentially tightening supply, upward pressure might just become the new norm.

ETH daily active addresses: What do they tell us?

Ethereum’s network is buzzing with activity, boasting over 524,000 daily active addresses. This level of engagement is like a party that just won’t stop, crucial for long-term price appreciation. 🎉

Strong network activity signals a growing trust in Ethereum’s decentralized applications, which could lead to a higher demand for ETH. So, the more, the merrier!

ETH exchange reserves: What does it signal about the market?

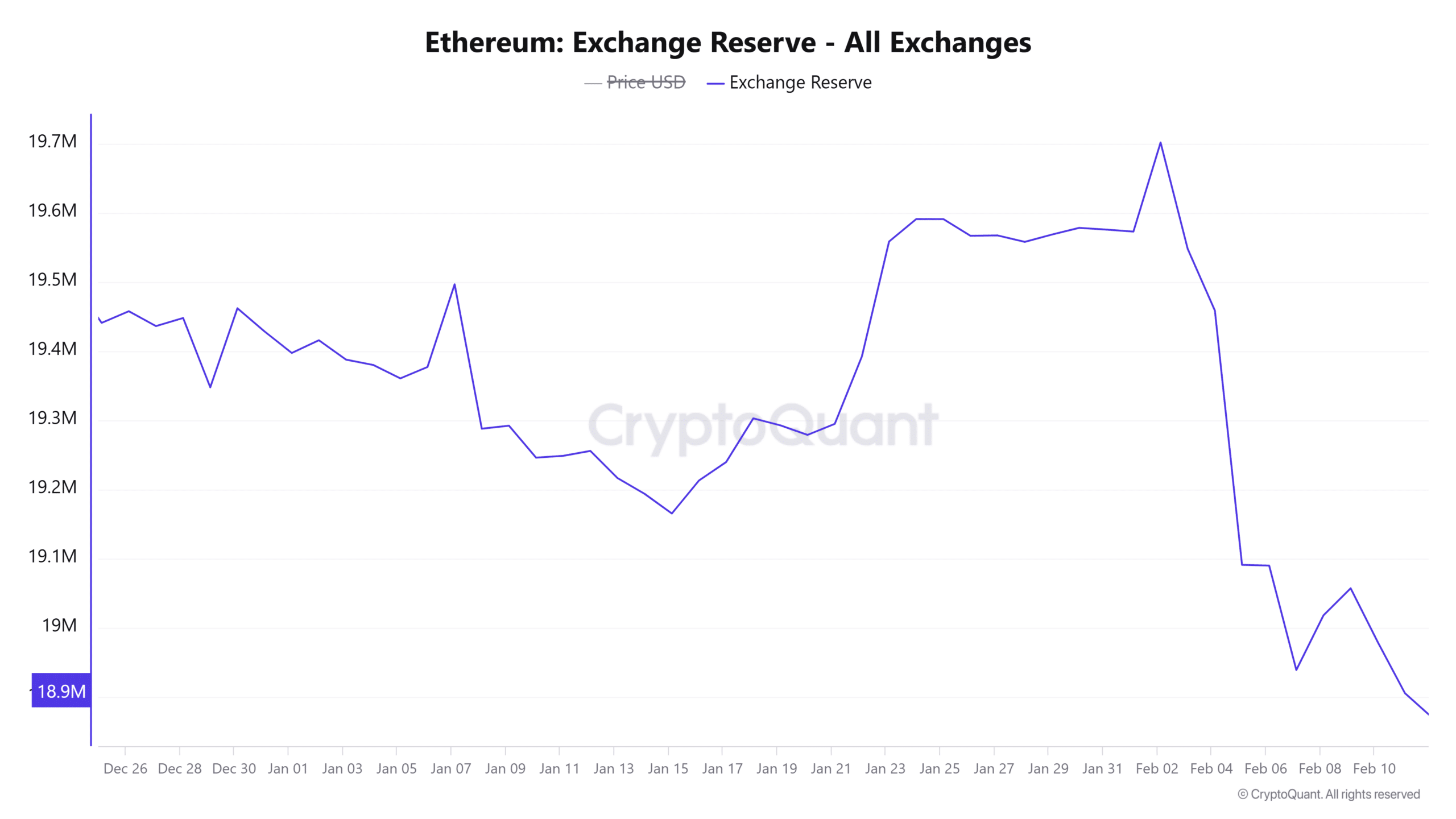

Ethereum’s Exchange Reserves, now at 18.8841 million ETH, have crept up by 0.02%. Rising reserves usually mean traders are feeling a bit jittery, depositing more ETH for potential selling. It’s like a game of musical chairs, but with more volatility!

While a growing reserve could suggest more liquidity, it also highlights the potential for increased market volatility that could impact short-term price movements. Buckle up!

Bulls and bears: Which side has the advantage?

Currently, the market sentiment for Ethereum is largely bullish, with 114 bulls compared to 105 bears. This indicates that investors are generally optimistic about ETH’s near-term prospects. Go team bull! 🐂

However, if the price stumbles and takes a nosedive, the bears might just come out to play. Ethereum needs to keep its upward momentum to keep the bulls in control and push toward higher levels.

With Ethereum

Read More

2025-02-15 03:10