- Institutions sold ETH worth $105 million during the latest correction

On-chain data suggested the decline could be an opportunity to buy before another rally starts

Four institutional investors, among them well-known whales in the Ethereum market, sold off some of their Ethereum holdings. As a result, the price of Ethereum dropped by more than 7% within a day.

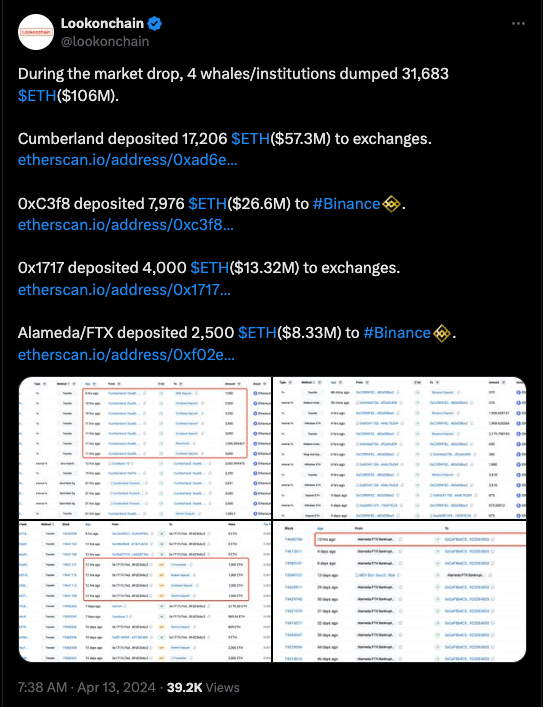

Based on Lookonchain’s report, Cumberland transferred a sum of 17,206 Ether coins to various exchanges, with these coins having a value of approximately $57.3 million at the time of transaction. Additionally, FTX deposited around $8.33 million worth of ETH into Binance. Lastly, two other institutions collectively offloaded roughly $39.92 million in ETH value from their holdings.

Only the short-sighted may be affected

Whales may dispose of their assets for various motivations. Some might be making routine profits, while others could be offloading losses from underperforming cryptocurrencies. Nevertheless, it appears that this altcoin isn’t typically involved in such scenarios.

When I penned down this text, AMBCrypto hadn’t managed to ascertain the reason behind the sell-offs. Yet, one fact remained undeniable— these sell-offs significantly contributed to Ethereum’s price drop to $3,169. At present, ETH was priced at $3,262, suggesting a slight rebound. Nevertheless, it’s crucial to assess if Ethereum can maintain this minor upward trend.

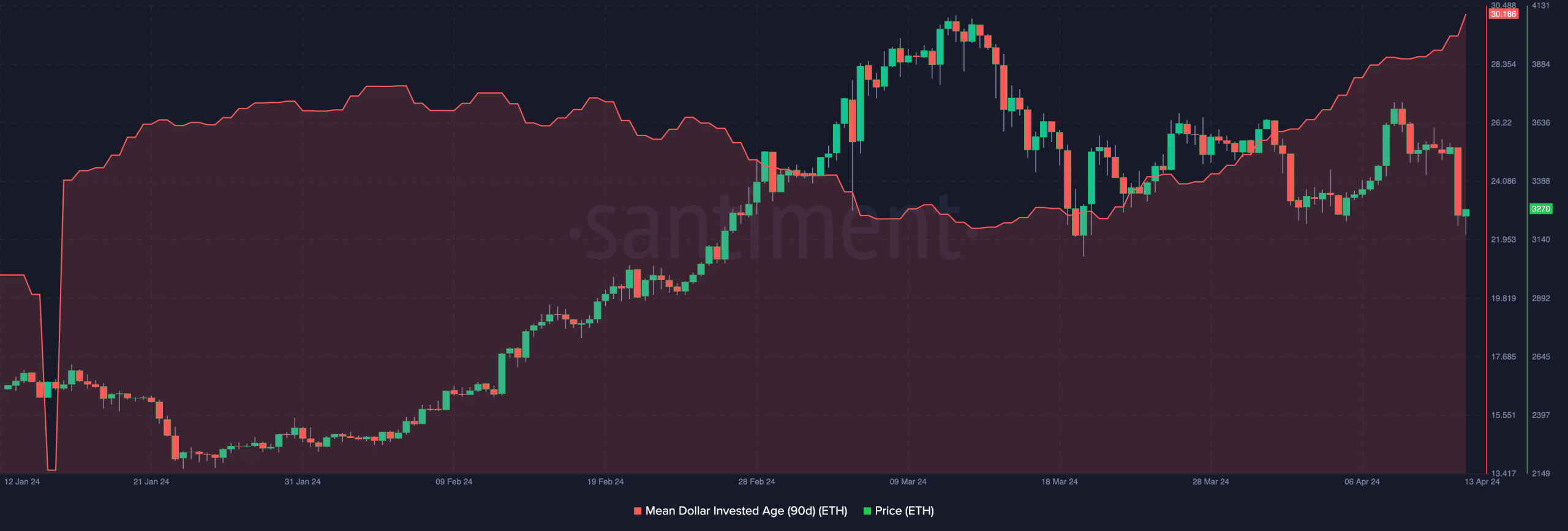

AMBCrypto analyzed certain factors that might influence the value. The Mean Dollar Investment Age (MDIA) was among the initial metrics they considered.

The Mean Dollar Age in Crypto (MDIA) represents the typical age of coins kept in a single wallet. A rising MDIA indicates that fewer coins are being used actively and have stayed put for an extended period. Conversely, a decreasing MDIA suggests that older coins are being transferred or spent more frequently. According to Santiment’s on-chain analysis for Ethereum, the 90-day MDIA experienced a notable surge.

Previously, a large drop in Ethereum’s metric was followed by a peak in specific locations. Consequently, the current rise indicates that Ethereum might be underpriced, making the recent price decrease an opportunity to purchase at reduced costs before its anticipated surge.

Is the next path great?

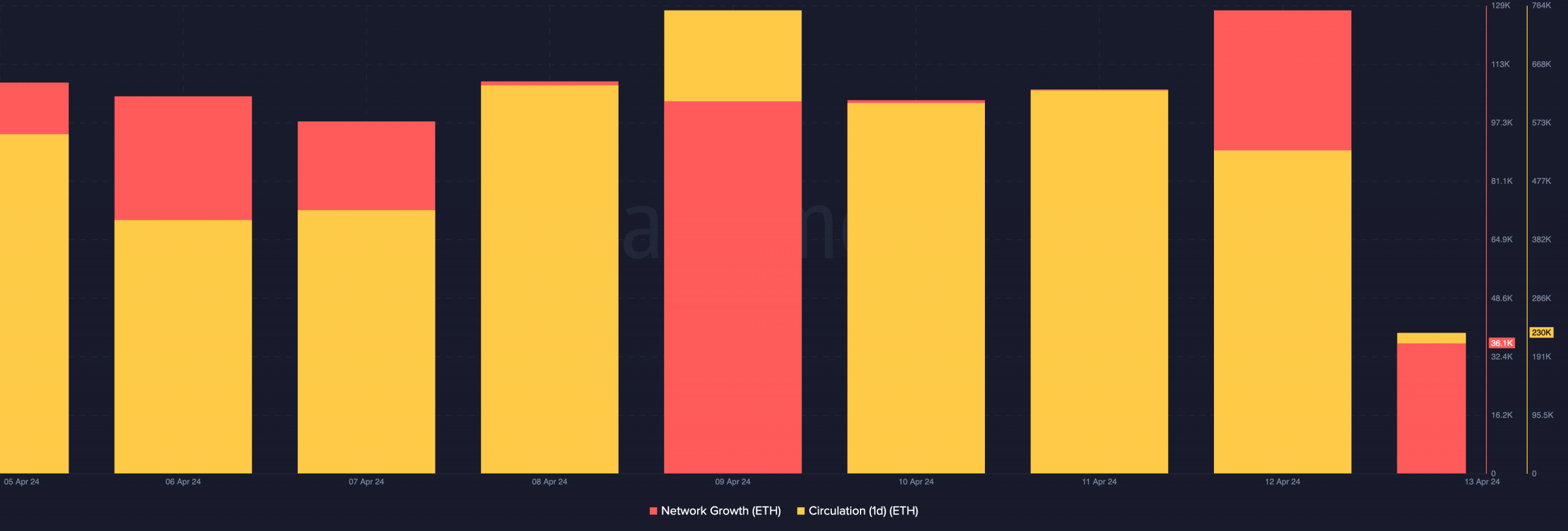

AMBCrypto assessed network expansion as an additional indicator. This measure signifies the level of user engagement growing or declining over a period. A rising figure suggests the project is gaining popularity, while a decreasing one may indicate a loss of interest.

On the 12th of April, there were approximately 128,000 new interactions on Ethereum’s network, signifying a significant number of new addresses engaging with the project.

The price decrease led to a drop in the number, down to 36,100. Should network expansion enhance, Ethereum’s demand could spur a price surge.

On the other hand, a decrease in the metric might lead to a standstill for its value. Moreover, the daily circulation fell to 230,000, serving as evidence of reduced engagement.

Is your portfolio green? Check the ETH Profit Calculator

In other words, even though a decrease in Ethereum circulation may seem unfavorable at first, it could actually be beneficial by reducing selling pressure. If this trend continues and fewer coins are in circulation, Ethereum’s price might recover from its recent slump.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-14 02:15