-

Exchange inflow reached January highs, putting the ETH’s price at risk.

Though the reward ratio dropped, a key indicator suggested that ETH could rally above $4,700.

As a researcher with experience in cryptocurrency analysis, I find the current situation of Ethereum [ETH] intriguing. The recent surge in exchange inflows has reached January highs, which puts the ETH price at risk. However, despite the drop in reward ratio, a key indicator suggests that ETH could rally above $4,700.

As a financial analyst, I’ve noticed that Ethereum (ETH) has once again reached a peak in terms of exchange inflows, a development that occurred approximately six months ago and raised concerns about potential price drops.

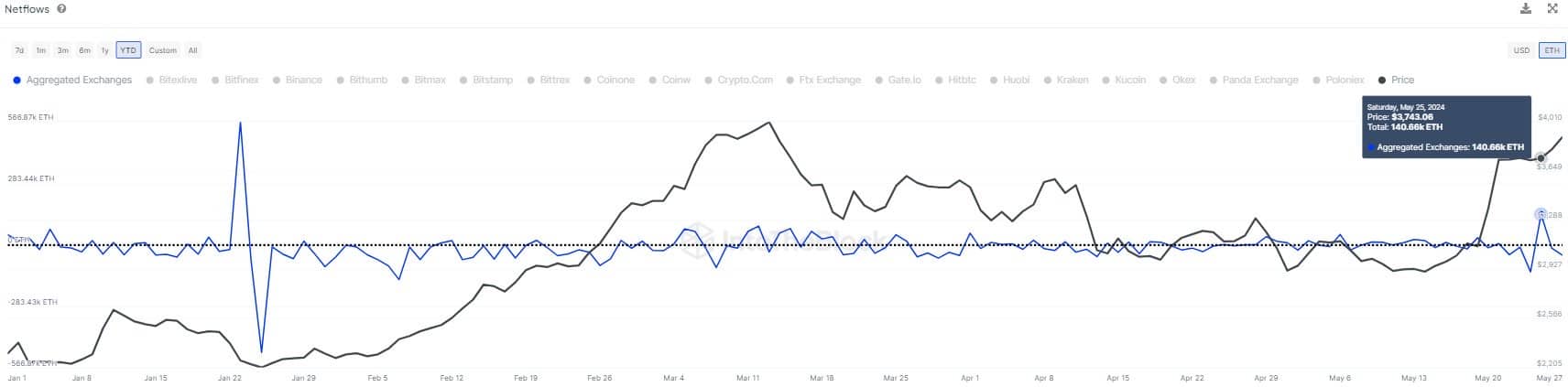

As of the deadline for this report, Ethereum’s price stood at $3,874. Based on IntoTheBlock’s data, there were approximately 140,660 transactions involving exchange inflows on May 25th.

Although the influx has been modest, AMBCrypto’s thorough analysis hinted that the bullish forecast may not materialize as swiftly as some market players anticipated.

Is a new low coming?

The heavy influx of cryptocurrencies into the exchange indicates a strong selling trend. Consequently, Ethereum may find it difficult to achieve a higher price until this selling pressure subsides.

Based on AMBCrypto’s investigation, it appears that the surge in demand and subsequent price hike for the altcoin may be related. Just a few days prior, Ethereum’s value exceeded $3,900 – marking a significant increase of approximately 16.82% over the past month.

As an analyst, I’ve observed that the approval of Ethereum spot ETFs has significantly contributed to the recent surge in its price. However, it’s important to note that Ethereum was not yet trading live at the time of this approval. Nonetheless, various market pundits have predicted that Ethereum’s price could reach new heights, potentially surpassing $4,500 or even $5,000, once these ETFs become operational.

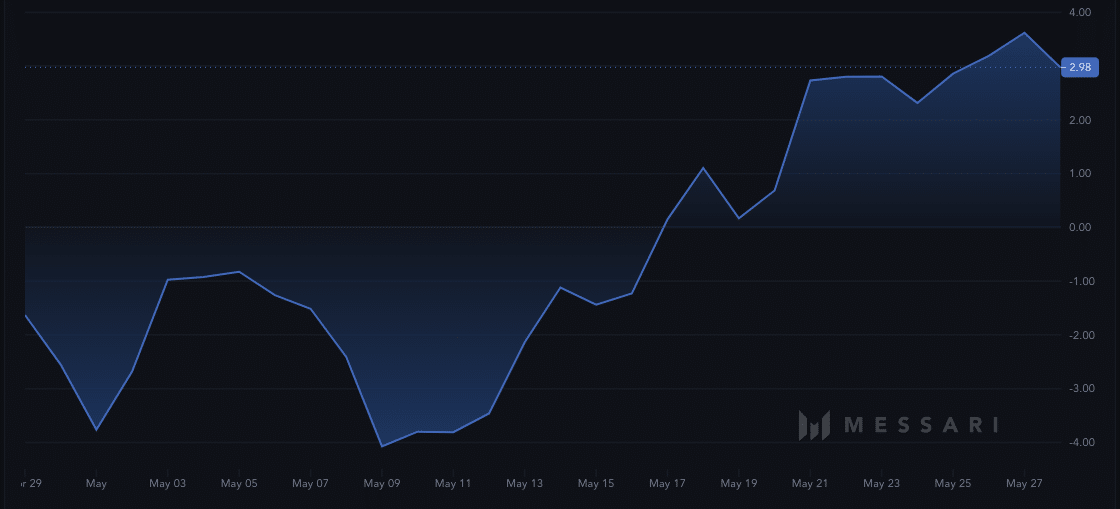

As a researcher examining the Ethereum market, I sought to evaluate whether the current trend of buying would persist and potentially impact the accuracy of my prediction if it continued past a certain point. To gauge this, I turned to analyzing Ethereum’s Sharpe Ratio.

As a crypto investor, I would interpret a negative Sharpe Ratio as meaning that the particular asset under consideration has been underperforming in relation to the risk taken to hold it. The Sharpe Ratio measures risk-adjusted return, so a negative value indicates that the returns have not justified the level of risk involved.

In simpler terms, a risk-to-reward ratio between 1 and 1.99 for a cryptocurrency is generally considered favorable. If the reading goes beyond 3, this implies that the potential rewards outweigh the risks, making it an attractive investment opportunity.

As a researcher examining the data provided by Messari, I found that the metric reached its peak of 3.62 on the 27th of May. However, at the moment I’m reporting this information, the ratio has dipped to 2.98, implying that while returns were once exceptional, they have since slowed down and are now moving at a more moderate pace.

The bull phase might start from $4,713

If the reading continues to decline, it is likely that the price of Ethereum will follow suit. Nevertheless, the long-term prospects for Ethereum as a cryptocurrency are still very optimistic.

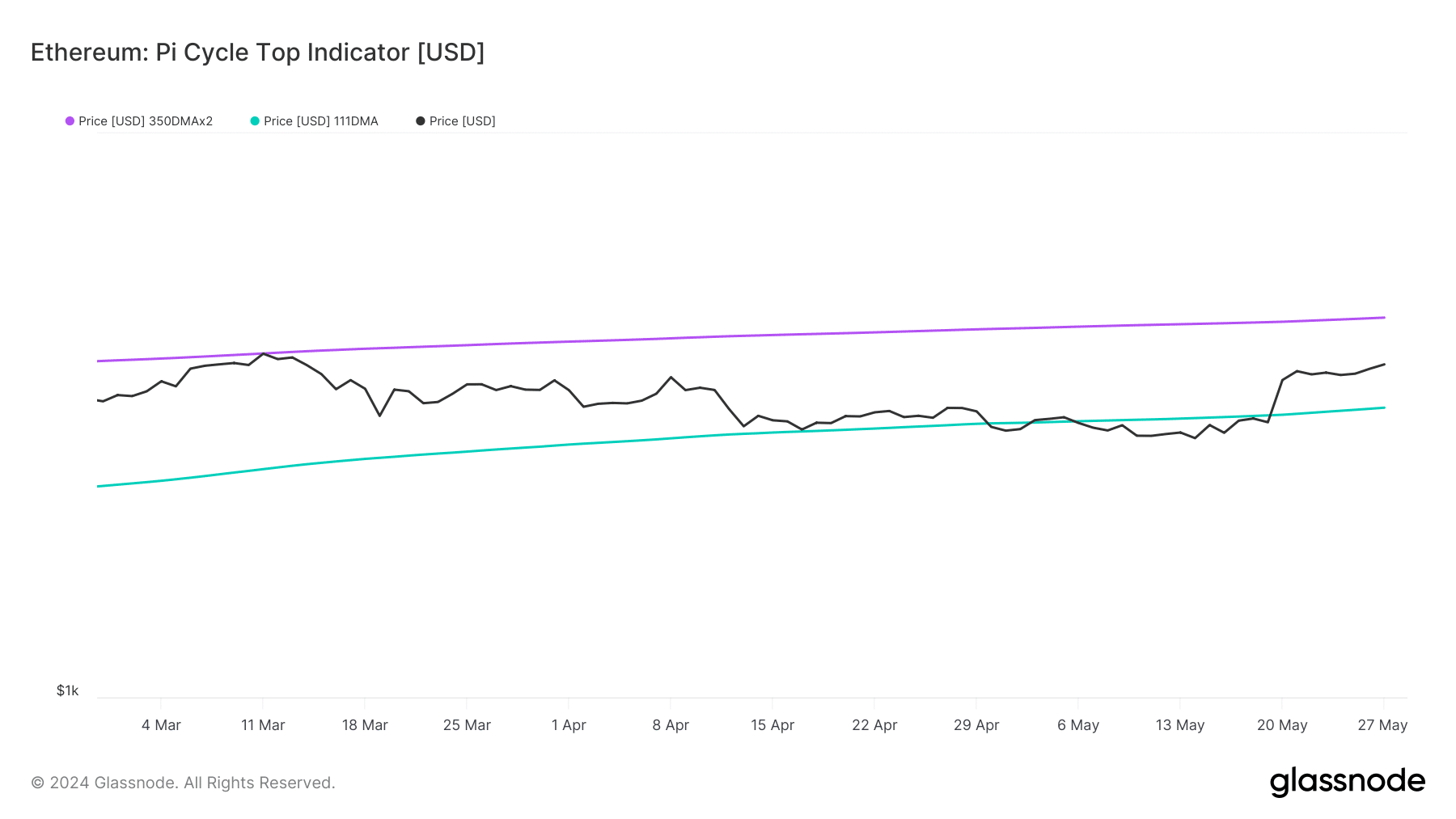

As a crypto investor, I’ve come across AMBCrypto’s analysis based on the Pi Cycle Top indicator. This indicator examines my portfolio’s price trend using two significant moving averages: the 111-day Simple Moving Average (SMA) and the 350-day SMA. By evaluating whether the prices have reached an overheated stage, it provides valuable insights into potential market conditions.

As a researcher analyzing Ethereum’s price trend using Glassnode’s data, I’ve observed that the 111 Simple Moving Average (SMA) lies below the 350 SMA. This observation implies that the price may have room to increase in value.

Is your portfolio green? Check the Ethereum Profit Calculator

If the short-term moving average (SMA) crossed below the long-term moving average (SMA) for Ethereum (ETH), this occurrence could have signaled a bearish trend.

As an analyst, I’ve observed that the indicator suggests ETH‘s price may reach $4,713 when selling pressure subsides. If this prediction materializes, the value might then strive for a test at $5,000.

Read More

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- 1923 Sets Up MASSIVE Yellowstone Crossover

- The Heartbreaking Reason Teen Mom’s Tyler and Catelynn Gave Up Their Daughter

- Discover How Brittany Mahomes Fuels Patrick’s Super Bowl Spirit!

2024-05-29 09:11